Will inflation in the US go down? The Fed will stop raising interest rates?

Inflation in the US turned out to be sustained. Until a few months ago, the Fed claimed that this was a temporary phenomenon. The annual rate of change in the consumer price index peaked in June at 9,1%, and by September it had dropped only slightly to 8,2%. In turn, the base rate has not yet decreased, and has recently risen to a new annual level of 6,6 percent Today's publication is scheduled for 14:30.

The inflation picture deteriorated significantly during the year. The Fed sees it. At the press conference after the last meeting FOMC President Powell pointed out that the monetary policy bias will have to become more restrictive, which will reduce the chances of a "soft landing" of the economy.

What steps will the Fed take?

A key question for the Fed and for the financial market outlook is how quickly inflation will drop back towards 2%. from unacceptably high levels achieved. A quick reduction of the price pressure would be a prerequisite for this The Federal Reserve soon stopped raising rates. If inflation does not fall quickly enough, the Fed is likely to have to continue tightening monetary conditions, despite mounting political resistance to further interest rate movements. The next publication CPI it will surely be the highlight of the week.

High inflation in the US (but not only) it is in part a consequence of a pandemic and the measures taken to combat it. In spring 2020, the supply of many services was limited due to the lokcdown. So consumers shifted some of their spending on goods, which led to increased demand. The supply was unable to keep up, and consequently prices rose dynamically.

Lower increase in commodity prices

The growth rate of consumption of (nominal) goods was significantly higher than consumption of services until spring 2022, which was an unusual phenomenon. However, the situation has normalized in recent months. Commodity price increases (excluding energy and food) have moderated accordingly.

For some commodities (such as used cars where additional demand has met supply constraints and therefore prices have risen sharply) the year-on-year ratio has decreased significantly. Compared to the previous month, the prices of used cars have even dropped recently.

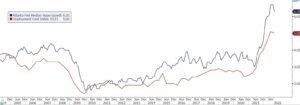

The rise in service prices has been steadily accelerating in recent times. However, in this case, the summit may soon be reached. On the one hand, wage growth, which has increased significantly in recent years and thus increased the prices of many services, does not appear to be increasing any further recently. For example, the median of wage growth calculated by the Atlanta Fed eased in September, and labor costs in the second quarter also rose at a slower pace.

Additionally, US rents, which are largely responsible for the strong rise in service prices, should lose momentum next year. They make up one-third of the headline consumer price index, or around 40%. the core basket, which does not include energy and food, making it by far the most important sub-component.

Inflation pressure

Until recently, official data pointed to a steady rise in rental inflation. However, private data (such as Zillow) on new lease rentals, the segment with the strongest rental movement, point to a slowdown. With some delay, this should be reflected in the official data covering all residential premises.

Therefore inflationary pressure is likely to ease in 2023. In the case of energy and food, the price shock should not recur. As for the baseline index, normalization is visible and thus reassurance should continue. On the other hand, the decline in service prices will continue, but at a very slow pace. Inflation in the US it is likely to stay above the 2% target in the longer term. due to structural factors - the costs of climate policy, reduced labor supply due to demographic reasons and increasing protectionism.

The Fed quickly raised its key interest rates to a range it already considers restrictive. This and the delayed effects of interest rate hikes now speak in favor of slowing down the pace of further action, as Chairman Powell said quite clearly. The American institution still believes that excessive inflation is a greater risk than a possible "hard landing" of the economy.

Therefore, further tightening is almost certain. We expect the Fed to complete the cycle around 5%, hitting this level in three steps. Let us recall that the median of FOMC members, which resulted from the dot plot after the September meeting, was 4,6%.

According to Powell, the historical development of the situation "strongly warns against a sharp loosening of politics." The Fed will therefore remain on "until the job is done" course.

Source: Łukasz Zembik, OANDA TMS Brokers

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Where to look for investment opportunities? Forecasts for the XNUMXth quarter [Download Ebook] forecasts for the fourth quarter](https://forexclub.pl/wp-content/uploads/2023/10/prognozy-na-iv-kwartal-300x200.jpg?v=1697785512)