Is gold still the best hedge against inflation for investors?

Gold has historically been considered the best investment and hedge against inflation because it has retained its purchasing power over time. However, whether gold can still be treated as such is a matter of debate, and the answer depends on various factors.

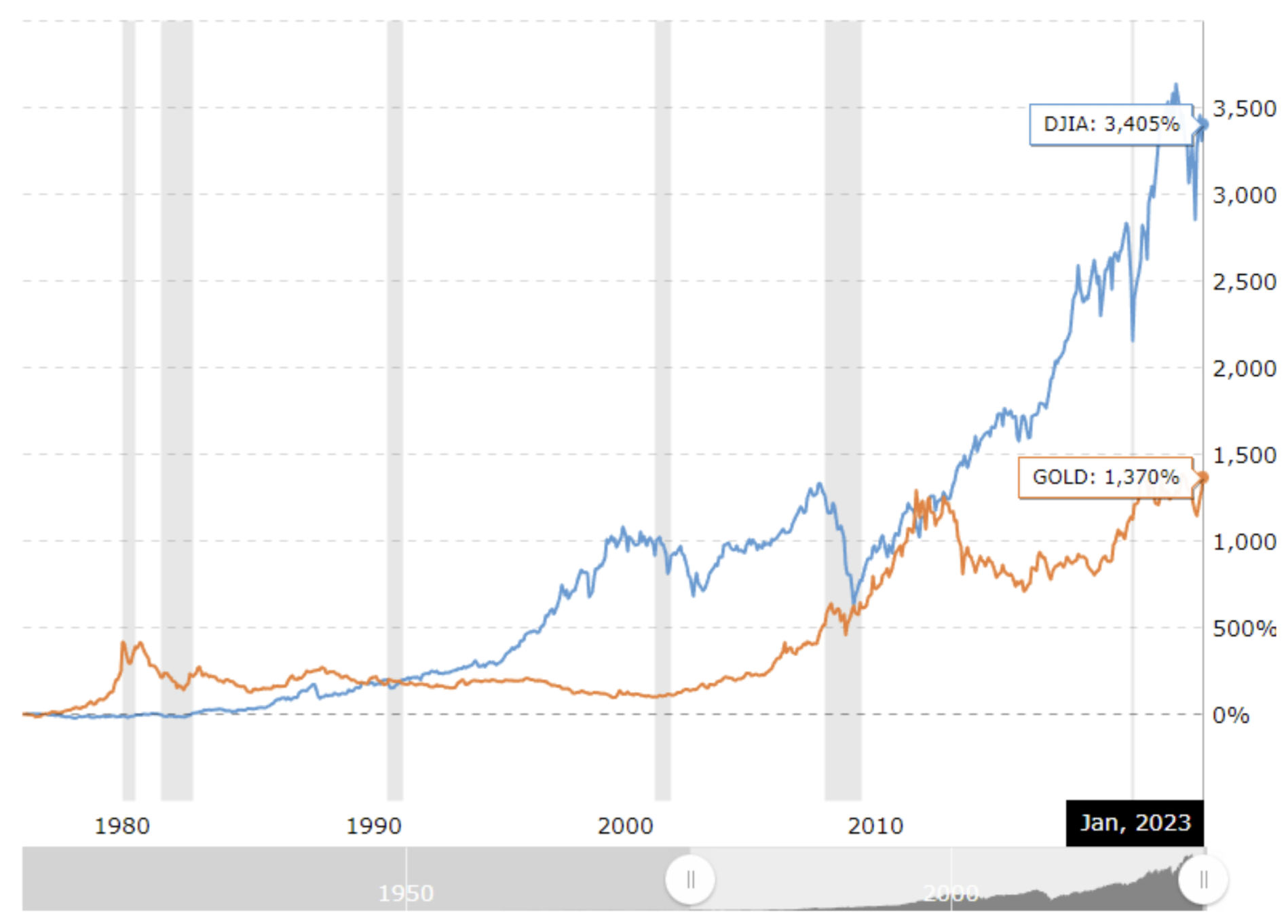

Gold results

Gold can be a good hedge against inflation, because its value tends to increase when inflation increases. This is because gold is an asset that central banks cannot print or manipulate its value. During periods of high inflation, investors may resort to gold as a safe haven, which typically drives up its price.

However, there are some downsides to investing in gold. First, gold does not generate any income, and its value depends solely on market demand, which can be unpredictable. In addition, the price of gold can be influenced by factors other than inflation, such as geopolitical tensions or changes in the demand for jewelry. Gold has also been unable to outperform the Dow Jones for 40 years, except for a few periods.

Source: macrotrends

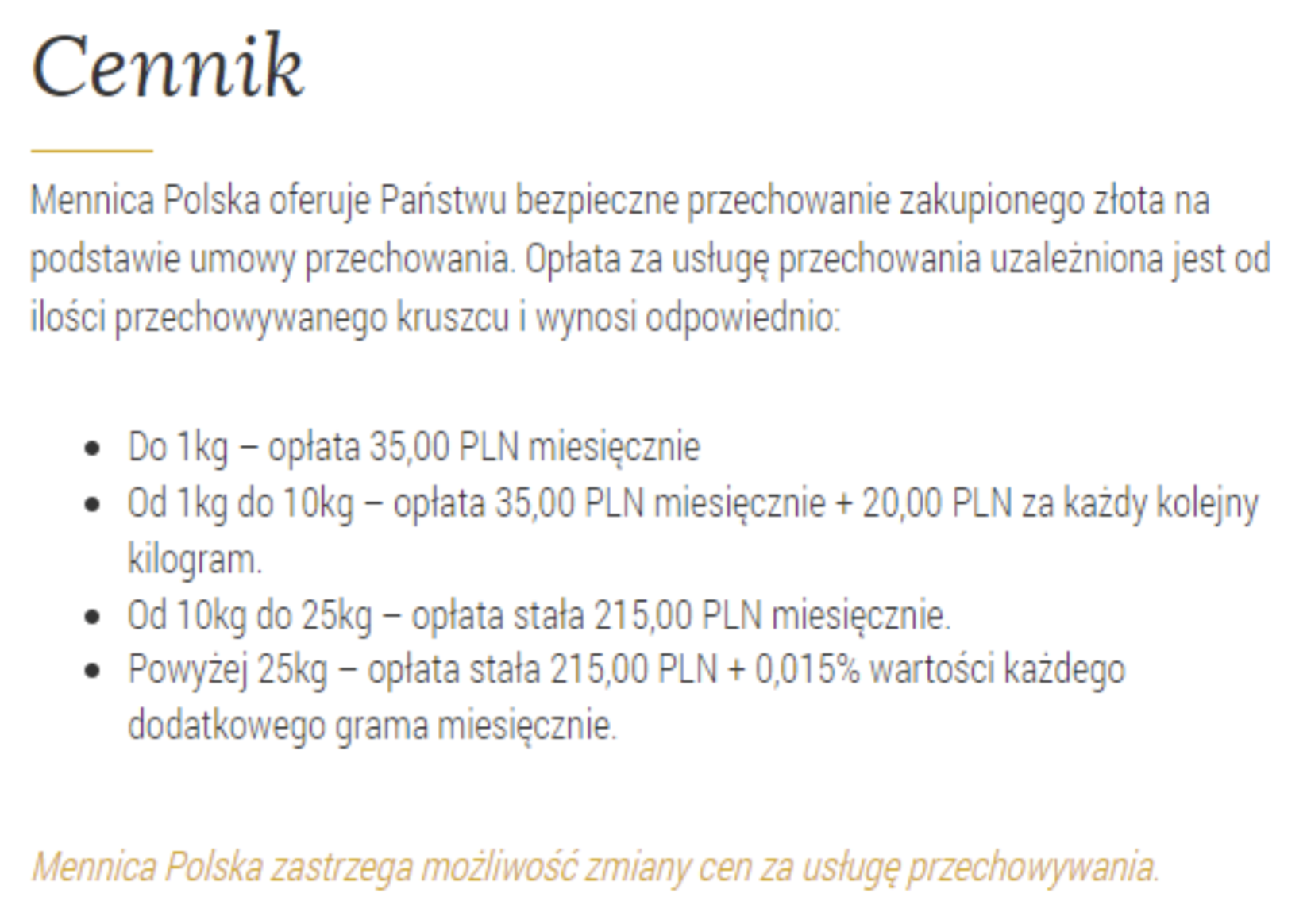

Right or nie, gold is widely perceived as a reliable means of protection against the risk associated with the declining purchasing power of money. However, some investors do not take into account its additional costs related to storage and other logistical complications.

Source: Mint of Poland

Fortunately, this problem is solved if we decide on Mutual Funds or exchange-traded funds (ETFs) that invest in gold: These funds allow you to invest in a diversified portfolio of gold-related assets, such as gold mine shares or gold futures, without having to own physical gold directly.

Maxim Manturov, Head of Investment Advisory at Freedom Finance Europe, stated:

“For many years, gold has been perceived as a capital investment. As a physical commodity, it cannot be printed like money, and its value is unaffected by government interest rate decisions. Because gold has historically retained its value over time, it serves as a form of insurance against adverse economic events. When an adverse event occurs, investors invest their money in gold, which raises its price due to increased demand. The devaluation of the US dollar and real returns are positive for gold and miners. The strong dollar made the price of gold fall. After peaking in September and October, the US dollar has recently started to weaken, which is likely to trigger an increase in gold prices driven by increased demand. In turn, lowering Treasuries' yields is also positive for the price of gold, as real interest rates fall. Lower real interest rates will increase the effectiveness of investing in gold. In the longer term, gold sector valuations look very attractive again.”

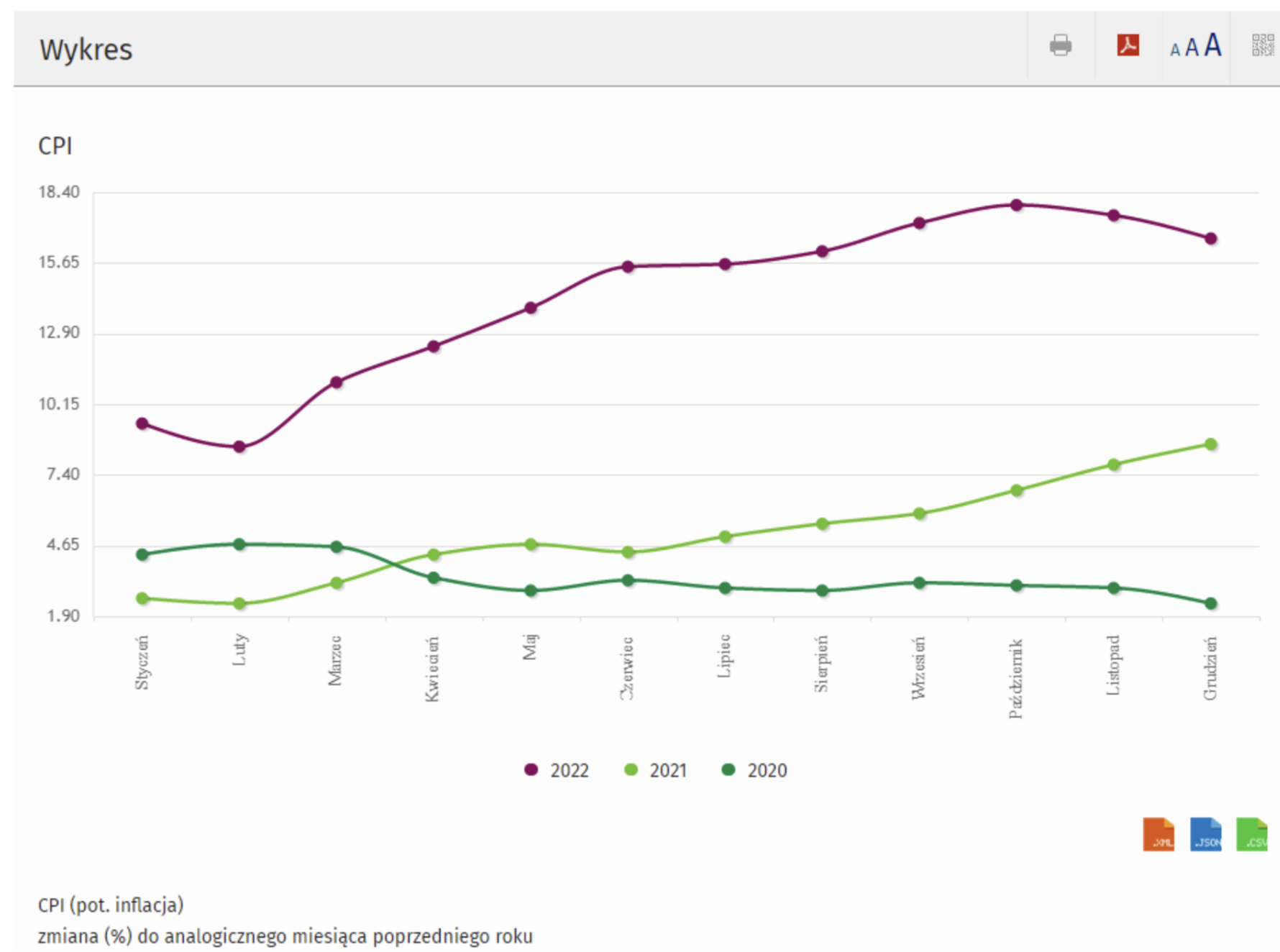

Inflation in Poland

The annual inflation rate in Poland accelerated to 17,2 percent. in January 2023 from 16,6% in December 12.2023 and slightly below expectations: 17,6%. The latest reading remained well above the central bank's inflation target of 2,5%. The prices of electricity, gas and other fuels grew faster (34% against 31,2% in December), transport (16% against 13,3%) and fuels for personal transport (18,7% against 13,5%) .2,4 percent). On a monthly basis, consumer prices rose 2022 percent, the largest increase since March XNUMX.

Source: GUS

As inflation rates in Poland continue to rise, investors are looking for ways to protect their wealth. And while gold continues to be a safe haven, many alternative investment options have emerged, such as US Treasuries, cryptocurrencies and commodities.

US Treasuries are backed by the US government and tend to rise in price as inflation increases. Unfortunately, during the recent surge in inflation and declining bond prices, they proved to be insufficient hedges. As of September 13, 2022, the US inflation rate was over 8%, while the 10-year Treasury rate was 3,42%, meaning that the real (inflation-adjusted) interest rate was negative and will remain so until inflation will quickly fall back to 2%.

Source: macrotrends

However, one of the features that make cryptocurrencies — especially Bitcoin — so attractive to investors is the belief that they are more resistant to inflation than fiat currencies such as the zloty or dollar.

Bitcoin, like gold, is a finite resource and cannot be printed indefinitely. It appreciated much faster than the US dollar lost - from virtually worthless in 2010 to a valuation of over $20 by the end of 000. trend over time was increasing). This has made Bitcoin and other cryptocurrencies an increasingly popular hedge against fiat inflation.

Source: Coinmarketcap

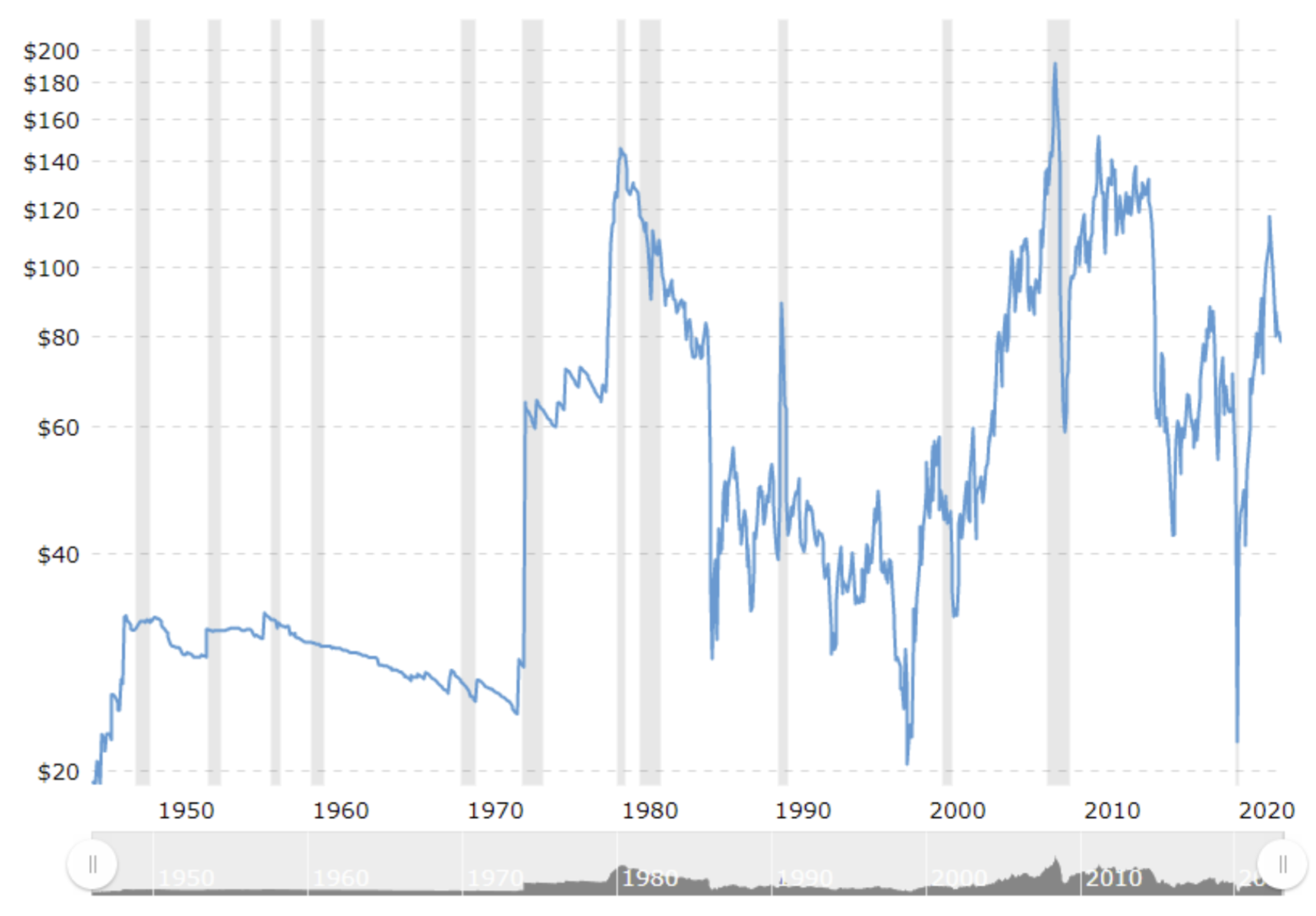

Prices of commodities such as oil, metals and agricultural products tend to rise with inflation, so they can be a good hedge against it. However, investors should be aware that commodities can also be extremely risky. Commodity prices depend heavily on supply and demand, which can be highly unpredictable. This makes them a risky investment: the chance of profit is high, but so is the risk of loss.

Below, the price of a barrel of oil over the last 70 years:

Source: macrotrends

Summation

What does all this mean for investors in Poland? While gold remains a viable option for investors looking to protect their wealth from inflation, it is important to consider other options as well. US Treasuries, cryptocurrencies and commodities can also be inflation hedges, and their historical performance should also be considered when making investment decisions.

Sponsored article

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)