What will the stock markets live now?

The beginning of 2022 on the financial markets is marked by the stabilization of prices EUR / USD almost USD 1,13, strengthening of the currencies of our region in anticipation of further increases interest rates by the central banks of Poland, the Czech Republic and Hungary, soaring yields of US bonds and declines on Wall Street, which ended yesterday with a classic "Hole buying".

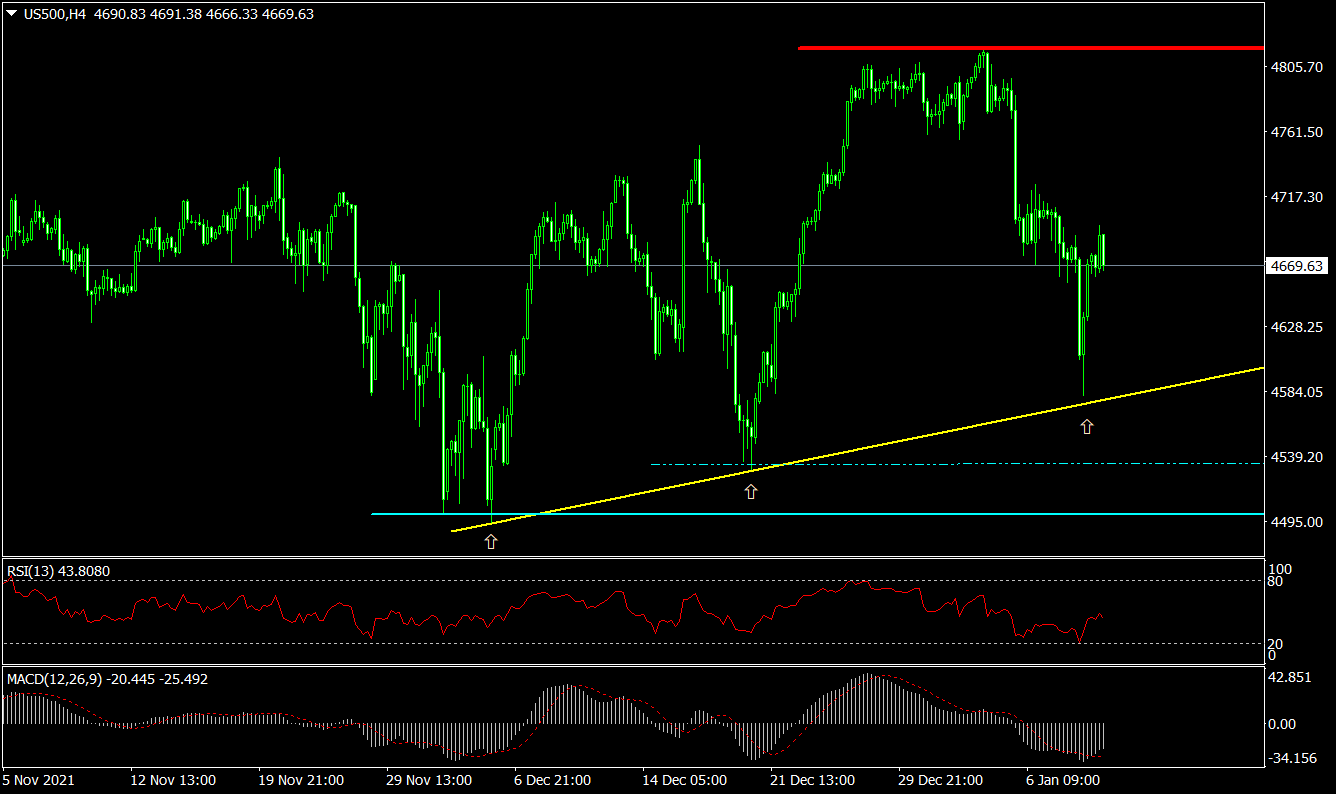

US500 chart (S&P 500 CFD), H4. Source: Tickmill

What will the financial markets live with

The US inflation data will go first. These will be published on Wednesday, January 12th. It is estimated that consumer inflation in the United States will accelerate to 7% in December. from 6,8 percent in November, which would be the highest reading in 4 decades. A day later, data on producer inflation will be released. She is also set to rise. Up to 9,8 percent December from 9,6% y / y in January.

A further rise in inflation in the US, which is not only an economic problem, but also a social and political problem, may raise expectations for faster monetary tightening by the Fed, thus becoming an impulse for the dollar to strengthen and the decline in Wall Street.

Growing inflation, however, will not be able to push the US indices down strongly, as the season of publication of results by local companies starts already on Friday. The market will therefore focus on this topic for some time, which may support stock prices. It is worth remembering, however, that investors will look at the generated results as well as the expectations of companies regarding the functioning in times of high inflation and rising interest rates.

The last chord of January will be the Fed's meeting on interest rates on January 26. It will not bring about a change in monetary policy, but it should bring a definite answer to the question of when such a change will finally take place. And that's in two dimensions. Both in terms of interest rate increases and the reduction of the balance sheet Fed.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)