Will GDP data give a kick to the zloty?

In the morning the zloty strengthens awaiting the publication of Polish GDP data for the first quarter of 2022. This is the main dish event in the markets today.

Today they can help the zloty

The highlight of Tuesday on the domestic currency market will be the publication of preliminary estimates of the Polish dynamics Gross Domestic Product (GDP) for the first quarter of this year. While awaiting these data, the zloty is strengthening. Additionally, it is supported by good sentiment in global markets and the related increase in risk appetite.

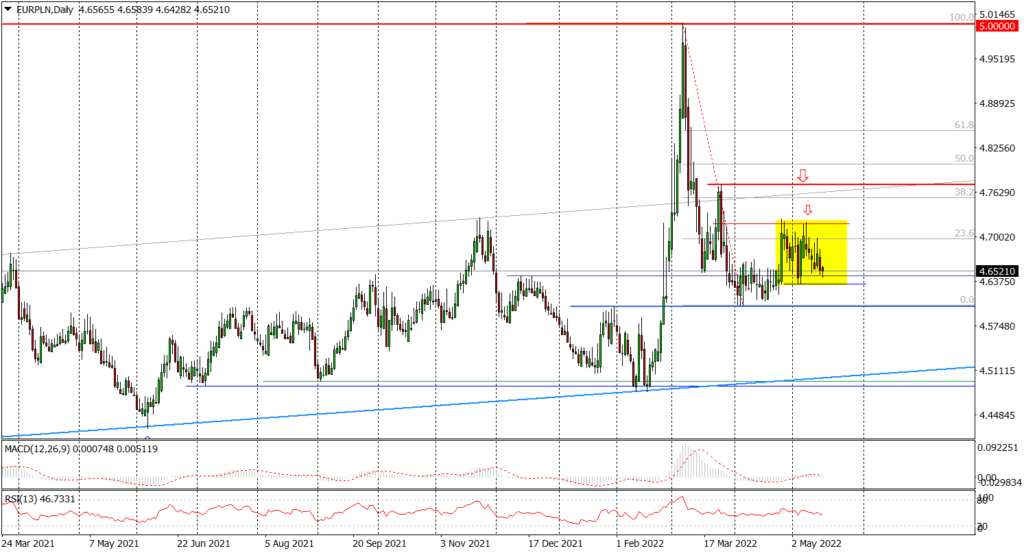

In the morning the zloty slightly appreciated against most major currencies. At 09:22 the EUR / PLN exchange rate was at the level of PLN 4,6521, which means a decline in the euro by 0,7 groszy as compared to Monday's closing levels, when the single currency fell against the zloty by 3,2 groszy.

EUR / PLN daily chart. Source: Tickmill

On the second consecutive day, the dollar was also depreciating. In the morning the USD / PLN exchange rate fell by PLN 1,8 to PLN 4,4465. The CHF / PLN quotations fell back by 0,7 groszy to PLN 4,4480 and remained close to the three-month lows. The only exception was the pound, which rose by 1,3 groszy to PLN 5,5140 today, in response to the optimistic data on the situation in the British labor market released in the morning.

At 10:00, the Central Statistical Office (GUS) will publish preliminary estimates of the dynamics of Poland's GDP for the first three months of 2022. Economists forecast that economic growth accelerated to 8 percent. year on year from 7,3 percent. in the fourth quarter of 2021. However, it is possible that this acceleration will be even higher. The morning appreciation of the zloty is precisely the positioning for such better than expected data.

The slowdown is practically certain

At this point it should be emphasized that the first quarter will be the last period with such a rapid economic growth. In the following quarters, one must take into account a significant slowdown in GDP growth. It is possible that there will be recessionary readings of this data.

The data from Poland described above do not end the emotions on the domestic currency market. In the afternoon, the market's attention should shift to the US data and they will finally decide at what levels Polish currency pairs will end the day. At 14:30 CET the April retail sales data will be released, and at 15:15 the industrial production report. Paradoxically, the weaker the data (but not much disappointing), the better for the markets and the better for the zloty. Weaker readings mean less pressure on the interest rate hike by the US Fed, which will indirectly translate into a strengthening of the zloty.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)