Dark Pools, i.e. anonymous exchanges of large investors

Cryptocurrencies were originally intended to serve anonymous money transfers. Before them, the financial markets already knew the concept of an anonymous asset exchange in the form of Dark Pools exchanges. Only a few have access to them. Every average Kowalski and Nowak (at least in legal interpretation) has the same access to public information, i.e. news about companies, information about the price and its changes during the session. However, there are places that function far from Wall Street. Today we will talk about Dark Pools - what they are and how they work.

Dark Pools = private exchange?

Let's start from the beginning. Dark Pools are private exchanges for a few investorswho have large wallets. It is there that the largest institutional investors can buy and sell their shares without influencing market prices by exchanging huge packages. They have access to the Dark Pools, among other things banks, investment funds or hedge funds. Offers that are added there are not only anonymous, but are not displayed as in a standard order book. The system adjusts the opposing buy / sell offers. Only when the transaction is completed, information about its execution is disclosed to the public. Why is this happening? So that no one could use such a movement to manipulate the price. The exchange operator is the only person who has information about the transactions.

So what is the role of Dark Pools? First of all, this place is used for trading large blocks of shares. Thanks to such exchanges, high transaction costs related to issuing such orders and excessive price manipulation are eliminated. Imagine such a situation. JP Morgan wants to acquire 20% of shares Tesla. Such information reaches the stock market. What's happening? There is a wave of purchases (so the price increases significantly). To prevent this from happening, Dark Pools were created. Anonymity applies not only to the transaction volume. You can also hide the priceat which we want to buy or sell the instrument.

Where are the Dark Pools exchanges operating?

The first private exchanges of the Dark Pools type date back to the 80s. Therefore, it is quite a fresh “creation”. The regulator then allowed the exchange of assets between clients of investment banks and brokers. Currently, the activities of these exchanges are spread all over the world. In general, Dark Pools may raise some doubts among private investors regarding the legality of such activities. He settled this issue SECwhich allowed investment banks to establish such exchanges. They operate as an alternative trading system.

How can I join Dark Pools? Where do you have to register and what conditions to meet to be able to participate in them? The situation is not as simple as in the case of regular accounts, where we must have a brokerage account in a given institution. Here we need to tell ourselves what the types of Dark Pools are. Therefore, we distinguish the following:

- "Brokerage" - they are created by brokers who enable their clients to trade securities completely anonymously, e.g. Citi (Citi-Match, Citi-Corss), JP Morgan (JPMX)

- specific companies that create alternative, anonymous trading systems. Among them there will be mainly: Chi-X Global, NYFIX Millennium

- the last type of Dark Pools are those created by exchanges. The best example here will be the ISE (International Securities Exchange).

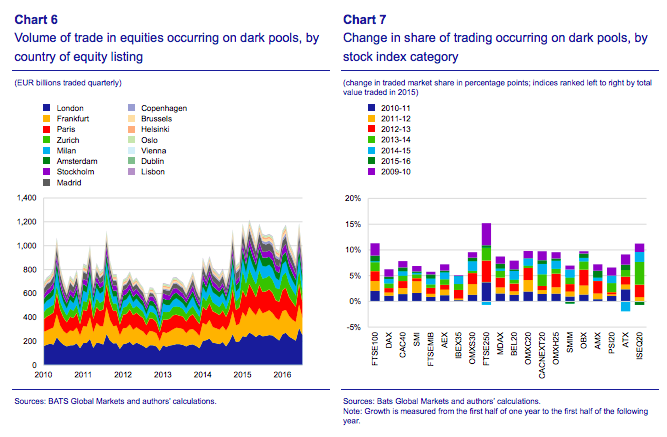

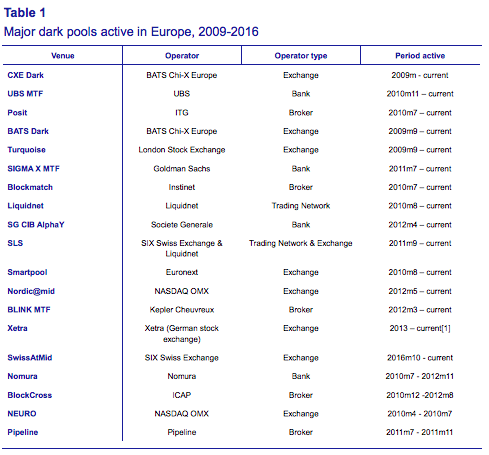

How is it in Europe? On the Old Continent, we also have this type of alternative trading systems. MIFID has changed a lot in these matters. It was she who made creation possible ASO (abbreviation of alternative trading system), which also include Dark Pools. The vast majority of anonymous DPs are owned by exchanges, followed by brokerage firms and banks. The least Dark Pools have various types of trading networks in their hands. The graphic below shows their status as of 2016.

Source: https://www.ecb.europa.eu/

According to the report, Dark Pools are mainly located next to entities that have a strong base of clients trading in stocks. The operators are as mentioned above MTF, banks or brokers. Brokers and banks use dark pools as a way to internalize their clients' own trades and transactions.

The trade leaders in Dark Pools in Europe are primarily London, Paris, Amsterdam and Frankfurt. The report also shows an increase in interest in trading in this type of ASO over the years 2010-2016, as shown in the chart above in this report. It illustrates the increase in Dark Pools participation for stocks in various indices during the years mentioned above. This increase is shown as the difference between the two years in the total share of equity trading in each index that took place via Dark Pools.

Manipulations in Dark Pools

In conclusion, since it is not possible to view orders and manipulate the price in Dark Pools whether there are any possible manipulations with it. It is true that the crowd effect is not possible due to the lack of access to the order book preview. However, there is still a "normal" exchange where the price can be inflated, which will translate into a price structure also in dark pools.

Another advantage is Dark Pools the possibility of excluding a specific (suspicious) investor from trading. It is hard for us to imagine such a situation on the public stock exchange - for example the WSE, where its management board prohibits Kowalski from buying or selling shares. The opposite is true in Dark Pools. The DP administrator has the option to exclude such an investor from trading if any manipulations or other undesirable actions are detected.

Cheaper and better

Often, Dark Pools are accused of not being transparent. So, in fact, their greatest feature turns into a disadvantage. Dark pools, as mentioned above, “obscure” the book of supply and demand. Until the regulations on DP (ATS) came into force, individual investors often looked at them quite crookedly. The disclosure transaction is only made after its conclusion. At this point, one can contemplate whether or not the volume and price are kept secret. The undoubted advantage, however, is the transaction costs associated with trading in dark pools. Larger blocks of shares can primarily negotiate prices. Certainly, someone will say in a moment that big players can also do it in brokerage houses. Dark Pools are also not bound by the NMS regulations, which significantly reduces costs.

Dark Pools can be talked about as exchanges for the chosen ones, where transactions take place away from the hustle and bustle of Wall Street. Nobody knows (except the operator) the volume and prices of the orders. Most individual investors may consider these places to be unfair to the public stock exchange, and the entire Alternative Trading system as a detached and distinguished element. Opinions about Dark Pools (as about everything) are divided. Undoubtedly, they have many advantages, which are also their greatest disadvantages for part of the market. What is important, however, is that they are regulated, which makes them also part of the stock market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)