Why can the Fed never catch up and what is the reason for the depreciation of the USD?

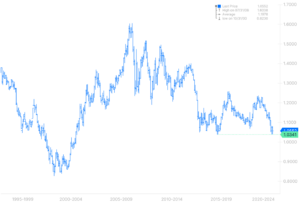

At the meeting of the Federal Open Market Committee (FOMC) on June 15, the US Federal Reserve raised rates by 1994 basis points (bp) for the first time since 75. The Fed aims to tighten monetary policy at the fastest pace since Volcker's presidency in the early 80s, while reducing the balance sheet - a factor that played no role at the time. The US dollar strengthened dynamically in line with the regular reassessment of the Fed's increasing tightening. The US currency is likely to peak and begin a significant retreat only when the economy plunges into a disinflationary demand-driven recession or the market realizes that the Fed will never catch up with the curve because, if it did, it would jeopardize the stability of the US government bond market.

Will the USD peak only after the speeding train of inflation has crashed?

The almost unprecedented pace of Fed tightening this year made it Federal Reserve it raised rates by 150 basis points in three meetings and the market has priced in a further 200 basis point tighter in calendar year 2022. If tightening continues as expected, it will total 350 basis points in just a few months. Keep in mind that it took Yellen and Powell three years to raise rates by 225 basis points, and it took Greenspan and Bernanke almost two years to raise rates by 425 basis points - not including quantitative tightening (QT). in the period following the global financial crisis. In short, the Fed last operated at this pace in the early 80s.

READ ALSO: Inflation won't come back to moderate levels, it's a speeding train

And yet the Fed continues to try to resist its exorbitant expectations of a tightening, even after a delayed start of the rate hike cycle. At the FOMC meeting on May 4, Fed chairman Jerome Powell in particular rejected the idea of a rate hike of more than 50 basis points in order to carry out a rate hike of just this scale on June 15 after what many believe was an example of Fed steering the market with a comment at WSJ. Then - at a press conference on June 15 - Powell tried to convince the public that the July rate hike could be 50 basis points instead of 75.

Apparently, the Fed has fervent hope that the current high levels of inflation will eventually prove to be temporary. This is also evidenced by the latest Fed economic projections, which were refreshed at the June meeting FOMC the forecast of core inflation measured by the level of consumer spending (PCE) in 2024 amounted to 2,3%. This is not a change from March, although the Fed has de facto lowered its forecast core inflation for 2023 and headline inflation for 2024 by -0,1%. As we emphasize in this forecast, the risk is that inflation is a speeding train and the Fed is still lagging behind the curve, unable to catch up with it, as I justify below.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

One argument that the US dollar may peak and begin to depreciate despite the Fed tightening is that many other central banks will eventually overtake the Fed in raising rates and as a result their real interest rates will rise above than the level reached by the Fed. It is precisely this situation that has led several emerging-market currencies such as the BRL and the MXN to show a resilience this year that could not be expected amid rapidly rising US yields and a stronger dollar. However, in the context of the G10 basket currencies, with the notable exception of USD / JPY, most dollar pairs do not particularly correlate with changes in yield spreads shaped by central bank policy expectations at the front end of the curve or at the long end of the yield curve.

Let's take an example the AUD / USD pair, where expectations for an interest rate hike by the Reserve Bank of Australia have caught up and exceeded expectations for the Fed for the next nine months, and the ten-year Australian government bond yield (end-June) was more than 80 basis points higher than the US Treasury bond yield compared to the 0 range -50 basis points in the first months of this year. This prompts us to believe that the dominant factor behind the dollar's appreciation in the current cycle is the status of the US dollar as the world's reserve currency and the simple fact that US inflationary pressures require the Fed to tighten its policy further.

This has a negative impact on the mood and global financial conditions. In such a case, the USD will only begin to depreciate when economic reality finally collapses, sufficiently reversing inflation through a demand-driven recession. Only then will the US dollar finally decline after a period of exceptional appreciation to its highest level in more than 20 years.

Why will the Fed not be able to catch up?

With the enormous fiscal spending on fighting the pandemic in the United States in 2020 and 2021 - totaling around $ 5 trillion - there are new strong concerns about the fiscal sustainability of the US government. In 2022, it emerged that the boom in asset markets in 2020, and in 2021 in particular, as well as record increases in personal income due to the pandemic's heavy inflow of cash generated exceptionally large tax revenues, helping to alleviate these budgetary concerns at least temporarily. While things do not look too disturbing in the current calendar year, the situation may be completely different in the coming years. This is due to the fact that since the 90s tax revenues have been increasingly correlated with returns from the asset market, and these promise to be at least modest this year.

The brief recession and the slump in 1990 saw nominal tax revenues increase by 1991% in 2, but compared to 9-10% in the previous two years, this was not an impressive figure. Compare this to the effects of the 2000-2002 technological crisis, when nominal tax receipts for three years in a row, from 2001 to 2003, fell by 12,3% in total, even though the nominal economy continued to grow. As of 2008, nominal tax receipts in the United States did not reach a new maximum until 2013.

Pressure on the market

In 2022, the US budget deficit is projected to be just -4,5% CBAor maybe even less, compared to the -6% forecast at the beginning of the year. The fiscal return is so large that the U.S. Treasury may even scale down some of this year's sovereign bond auctions, which will help offset some of the pressure on the market to absorb Treasury issues as the Fed is actively reducing its balance sheet at an increasingly faster pace until it reaches 95 USD billion / month in September.

However, the gains in the asset market during the pandemic, driven by the maximum support from monetary and fiscal policy, were of a one-off nature and will not repeat themselves soon as both the Fed and the treasury tighten their belts to contain inflation. Even without a recession, assuming at best that US asset markets are on a sideways or slightly upward trend by the end of this year, next year's fiscal balance will deteriorate significantly as capital gains tax receipts decline and the cost of servicing existing debt increases exponentially due to all the redeemed and new treasury bonds currently generating much higher yields. Add to that the final recession next year and the treasury will have trouble financing its spending priorities.

Loosening monetary policy?

In all likelihood, due to a lack of investment in improving the supply side, inflation will not fall too far by then, and will not allow the Fed to relax as much as it has in recent cycles since 2000. Perhaps the concern is exaggerated, but we will have to consider a political response to the next recession. And in such an environment, the Federal Reserve could be sidelined as the US Treasury uses stronger resources.

Examples include the introduction of capital controls to contain domestic savings and / or financial repression by forcing a certain percentage of private savings to be allocated to US Treasury bonds offering negative real yields to savers due to the constraint on nominal government bond yields. In other words, monetary policy is rapidly losing importance because it cannot balance the risk of inflation. If it were possible, it would endanger the stability of state finances. Watching the Fed is like looking in your rearview mirror.

G10 currency basket

In Q2020 this year, exchange rate volatility reached its highest level since early 10, with the GXNUMX currencies experiencing unusual performance discrepancies. The main change was the rise in the value of the US dollar as a result of the sharp overestimation of the pace of the Fed's tightening and the weakening of the Japanese yen as Bank of Japan refuses to compromise on its yield-curve control policy, shifting all the pressure that would normally be on Japanese government bonds (JGBs) onto the yen itself (see Charu's excellent article in this forecast analyzing the increasing pressure on the Japanese yen and Bank of Japan policy) .

Another noteworthy thread is the weakening strength of the Australian dollar towards the end of this quarter despite a significant increase in planned interest rate hikes by the Australian central bank as the market fears a decline in industrial metals prices and China's intentions for the coming winter due to a zero Covid policy and the risk of more downtime in the country. Even commodity currencies underperformed at the end of Q110 due to possibly premature fears of an eventual recession and / or a tightening in financial conditions negatively affecting currencies such as the CAD, even though the rate of rate hikes implemented by the Bank of Canada is expected to be will match the pace of Fed's hikes. Oil has surpassed $ XNUMX per barrel, and Canada is on track to recover its current account surplus after the global financial crisis has pushed it into external deficit mode for more than a decade.

The euro will have difficulty rebounding

Last quarter, we tried far too early to predict a recovery in the euro, reflecting premature hopes that the war in Ukraine would end soon, relieving the additional pressure from the EU from rising electricity and gas prices. Moreover, while European Central Bank The (ECB) tried to be careful to tighten monetary policy, it was amazing how quickly the bank announced the need to reduce peripheral bond spreads by shifting its balance sheet assets at a time when it was about to end the era of negative interest rates. The ECB will lag behind everyone except the Bank of Japan. The euro will struggle to rebound if Chinese export demand from Europe remains minimal, the war in Ukraine continues and the United States continues to constrain global liquidity.

The pound sterling is in the same position and it is still difficult to envision a growth scenario for the currency, given the UK's extreme supply-side constraints and the enormous external deficit exacerbated by high energy import prices. At least the Bank of England is upholding its tough stance and is able to raise rates much more easily than the ECB. In GBP / USD pair an impressive 1,2000 level should be observed as it attempts to break it in June.

In addition, there was a shocking 50bp rate hike by the Swiss National Bank at its June meeting that changed the Swiss franc narrative by suggesting that the central bank is now less interested in lagging behind the ECB in its policy moves as well as easing concerns over the Swiss franc. exchange rate, at least against EUR. Ultimately, the strong franc is one of the tools that may help ease inflationary pressures after the basic Swiss Consumer Price Index (CPI) rose to 1,7% in May, its highest level in several decades, excluding one month in 2008. .

EUR / CHF pair it returned to levels below 1,0200 after it had moved in the range of 1,04-1,05 before the meeting of the Swiss central bank. The parity in this pair will test the Swiss National Bank's tolerance towards the stronger franc.

CNH, and the CNH / JPY pair in particular, will most likely get our attention before the end of the year

In our Q2015 forecast, we noticed that the seemingly steered USD / CNH exchange rate, in which China allowed its currency to closely follow the US dollar, even as the latter appreciated sharply against the Japanese yen, pushed the CNH / JPY pair up to the highest level since 20,00. This creates enormous tension in the region as Japan's exports become much more competitive (as Charu reasonably points out in his article on the Bank of Japan and JPY, this argument has its limitations as much of Japanese production now comes from all of Asia, including China). It was around the time the CNH / JPY pair hit the 2015 level back in 20,00 that China carried out a major overhaul of its exchange rate system. It is probably no coincidence that it was on the day it hit XNUMX this year that China increased volatility in the USD / CNH pair, allowing its currency to surpass its very narrow range so far.

At the time of writing, the Bank of Japan at its meeting on June 17th reiterated its decision to continue to control the yield curve, with the CNH / JPY pair just above their March daily high of 20,17. Earlier, we predicted that China would decide to weaken its currency only if the inflation risk disappeared, which would require a significant drop in commodity prices. Regardless, the CNH could prove to be the most important currency to watch as a potential new source of market volatility should China move towards weakening this quarter or the next - which could also put an end to the US dollar era.

All Saxo Bank forecasts available here.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response