Why did the Federal Reserve love high inflation?

Today I would like to present you some solid conclusions on the topic of price increases. Nevertheless, the statement about loving may of course be too controversial. Much has been said recently about how fiscal stimulus pushed inflation up and how Federal Reserve got rid of pressure to raise interest rates. Today, however, we will focus on the effectiveness of these activities in the long term. It is worth saying at the outset that high inflation (remaining above the target for a long time) is not “as bad” as it is drawn. Obviously, from the perspective of the consumer, who is directly shifted with the burden of rising prices, inflation is the most severe and felt. However, have we considered the harmfulness of price increases below the assumed threshold? Does what happened to the economy back then receive its bonus right now? I invite you to a short, analytical summary.

Indebted to the resistance?

It is not revealing that high inflation (within reason, of course) is helpful in reducing debt. It is at least inappropriate to ignore this fact as a factor neutral to price growth in the economy. The increase in indebtedness of budgets is observed evenly all over the world. Its greatest "generator" is, of course, the United States. It was there that the Federal Reserve came up with the idea of averaging inflation to get rid of the pressure to raise interest rates. Of course, we will not be able to measure the effectiveness of this action until some time. Returning, however, to the strictly credit mechanism, higher inflation means paying off the debt with cheaper money. Debt service becomes cheaper, budget revenues increase and the nominal GDP level increases.

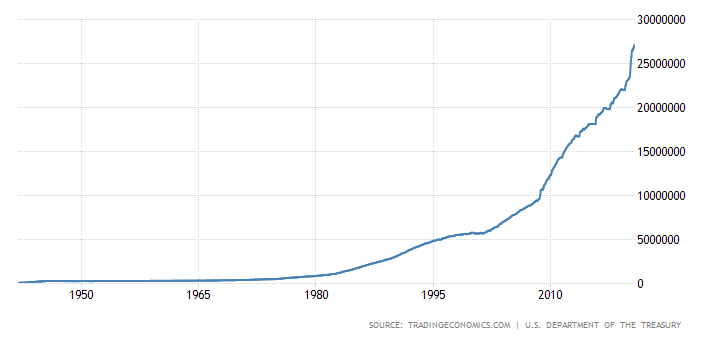

Source: Trading Economics

The chart above shows the debt of the United States. Its growth in recent years has been absurdly high. It should come as no surprise, therefore, that the FED will, as far as possible, delay the interest rate hike as a form of fight against the rise in prices. Inflation is a kind of hidden tax. It increases the nominal value of GDP without increasing the nominal debt. The United States can afford "extra" debt due to the fact that the USD is the reserve currency of the world. Therefore, the debt generated in the dollar is perceived much milder by the global economic situation.

"This is not the time to worry about debt"

When quoting Powell's words at the end of April, it is worth bearing in mind the moment when he uttered them. During the first wave of the virus, the Reserve eagerly declared the possibility of buying an unlimited number of debt securities from the market. Obviously, these actions were meant to blow you up in terms of maintaining the liquidity of the market. This declaration has expired a bit. Compared to the pre-war years, the supporters of such a level of budget debt are maintained by the fact of a constant, weakening change in the purchasing power of the American currency. It is worth adding that in 1913, for example, our USD 1 was worth USD 26.

Source: Stooq.pl

The dollar index shown above covers a range similar to the debt shown at the top of the text. Despite its imperfections, this index is one of the best USD strength barometers in the broad market.

A paradise for debtors

The environment of low interest rates eats away capital investments in favor of debtors (including, of course, government budgets). In the short term, no factor overshooted out of bounds (be it inflation or debt-to-GDP ratio) is a problem. However, it arises in the long term, when it becomes necessary to roll over the current debt at higher interest rates.

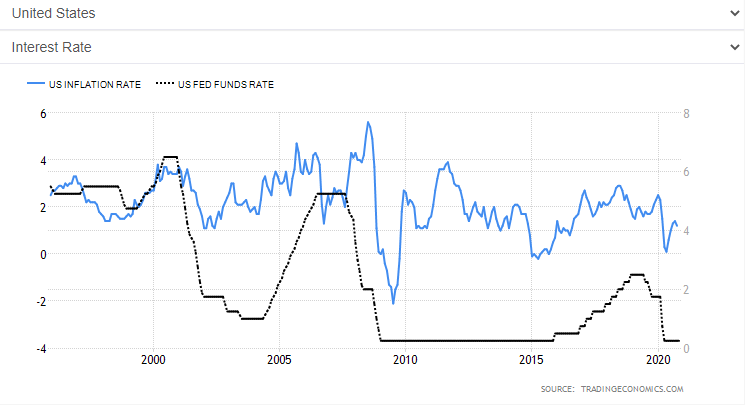

Inflation and interest rates. Source: Trading Economics

The graph shows the relationship between inflation and interest rates. Of course, apart from the change in interest rates, there will be many more factors influencing growth, but this is the most crucial one. The chart shows some lags in inflation's response to changes in interest rates. Nothing happens right away and it's a completely natural process. In this case, however, it is about something completely different. Namely: the effectiveness of monetary policy. It can be seen that the recent monetary policy was particularly satisfactory (with the expected effects) with a relatively high level of the price increase index. At this point, the US also moved beyond a certain balance. Usually, the more expansionary monetary policy (on the part of the Fed) was balanced by a more restrictive fiscal policy (government actions). Currently, however, both policies are moving in the same loose direction.

Summation

Taking into account only the banking sector (central and commercial) and leaving the private sector (enterprises and consumers) aside, the risk of high inflation in the short term remains relatively high. For now, the index of price increases is so useful for servicing the debt that it will not be dragged to lower levels. The key moment for raising interest rates (de facto lowering inflation) there will be a real risk of it going up. What must happen to make it so? The answer is obvious - credit. Mainly the one drawn by consumers. If the situation with the virus actually stabilizes, which will lead to an increase in employment and a better economic situation of households, the demand for credit will relatively increase. We will still have an environment of low interest rates, still a good degree of savings, a better situation on the labor market and… greater demand for "investment goods".

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)