The US dollar can make life difficult for bears

Overall, the currencies in the third quarter behaved calmly - the most important of them in particular - but there were also interesting individual phenomena such as the weakening of the AUD and the strengthening of the NZD and the NOK. It may be easy to suggest a future increase in volatility, but if it does, it will be the first increase in volatility since the quarter preceding last year's US presidential election. Due to the uncertainty surrounding the US fiscal outlook, the Fed's withdrawal from accommodative policy, political uncertainties in the EU, soaring commodity prices and a tectonic shift in Chinese policy, energy levels should allow for strong acceleration in the coming quarter.

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

USD: The last quarter showed that the US dollar is a hard currency to weaken

It should be emphasized immediately that this forecast, despite the publication after the FOMC meeting on 22 September, was prepared even before this meeting. Given the scale of the reaction to the June FOMC meeting, which significantly shook the USD, some of the expected dollar moves may prove to be the most dynamic early on (even in retrospect to the release date!) Or at the very end, depending on whether the Fed it will surprise us with more aggressive rhetoric at the September meeting (which is in line with my expectations), or it will wait until November with tightening the policy based on the trajectory of market expectations in QXNUMX.

In QXNUMX, the US dollar may not follow the current "tik-tok" pattern - strengthening in QXNUMX, weakening in QXNUMX, strengthening in QXNUMX, etc. Spectacularly comfortable conditions regarding liquidity and risk appetite in QXNUMX did not result in a depreciation of the USD, partly due to the very mild rhetoric of the Fed after the one-off half-shock after the June meeting FOMC. If the near-ideal conditions for a weakening of the USD proved insufficient to depreciate the dollar in the last quarter, apart from a modest decline after the upward break, how could we forecast a much weaker dollar if the environment in QXNUMX turns out to be much less favorable?

In QXNUMX, the Fed's most lenient policy compared to the rest of the world was initiated by President Powell's speech at the Jackson Hole symposium at the end of August, at which the president strongly defended the Fed's thesis that inflation would be temporary and that further progress would be needed on the mandate employment side Fed before Federal Reserve will take into account the possibility of a rate hike at all. Interestingly, the reports on the Jackson Hole conference almost completely omitted the presentation of an intriguing study arguing that the main factor of the very low rate r-star (neutral level interest rate policy) is inequality, not demographic trends. Naturally, forcing the Federal Reserve to admit that its policies are contributing significantly to the worsening of inequality has so far proved to be an overwhelming task, but this may be the first sign of a shift in approach.

In the context of QXNUMX, we predict that the market will read the Fed's rhetoric in a different way as Powell and the company are set to continue the changes towards the withdrawal from the accommodative policy, which was confirmed - albeit in a subtle way - at the June FOMC meeting. Wages are expected to rise significantly as a result of the enormous demand for labor and record-high number of job offers following the end of the pandemic aid package for millions of people in early September. We sincerely hope that the Delta variant, which clearly impacted sentiment in QXNUMX, will also lose relevance, but it should be noted that each successive wave of coronavirus-related infections and surprises has undermined our confidence in how long the effects of the pandemic will last.

Other factors may also contribute to the appreciation of the USD in the fourth quarter compared to the situation in the previous two quarters. In the first three quarters of this year, the US Department of the Treasury cut its impressive overall account from over $ 1,5 trillion to nearly $ 200 billion. At the same time, the Federal Reserve provided additional liquidity of more than $ XNUMX trillion in QXNUMX and QXNUMX, which even overshadowed the Fed's quantitative easing program and was forced to get rid of the surplus through an extensive conditional sale mechanism (reverse repos), which at the time of writing this forecast corresponded to the "stored quantitative easing" of 8-9 months. After the New Year, the US will face problems after the pandemic response fiscal impulse has expired completely, which will not be fully replaced next year, even if somehow miraculously implements a $ 3,5 trillion social spending program requiring the unambiguous approval of a democratic majority. Next year will show that the Fed is unable to realistically limit asset purchases and that the forecast for the US economy will be lowered even at the end of this year. At the same time, the life of the dollar bears may be significantly hampered by one-off factors such as rising yields on an increasing number of government bonds after the debt ceiling is resolved, reduced liquidity as a result of the Fed's constraint on asset purchases, and greater volatility in asset markets. In Q2022, however, the US dollar may reach a significant cyclical low, in preparation for a weak XNUMX and beyond.

EUR: Accumulation of strengthening in the fourth quarter?

In the forecast for the euro for the third quarter, I asked a rhetorical question whether we could "move to the fourth quarter". It seemed that the next potentially critical turning point for Europe and the euro would be the result of the elections in Germany and the shape of the final coalition. Non-volatility traders naturally supported the notion that Q5 was simply waiting out as EUR / USD price action was largely within the range and the three-month implied volatility of EUR / USD had dropped to extremely low levels below 2007%. Volatility briefly declined in these regions in 2014 and 2019, ignoring the longer period of projected low volatility in late 2020 and early 26, just before the pandemic caused price action to explode beyond a narrow range. At the beginning of the fourth quarter, volatility may go up around the elections in Germany on September XNUMX and the inevitable formation of a center-left coalition of SPD / Greens and ... who else? Apparently, one should expect a “traffic light” coalition embracing the growing liberal power of the FDP. This is an intriguing possibility that means numerous pre-pledged commitments from the FDP should the party become part of the ruling coalition, including greater emphasis on the supply side in terms of lowering taxes to stimulate the economy. If these parties manage to form a coalition, it could provide a significant positive impetus to the German and EU forecasts by increasing stimuli on both the supply and fiscal side. This may mean that the euro will gain more grip from the middle to the end of QXNUMX. The development of the situation should be monitored carefully, as the fourth quarter may be an important breakout point from local lows, laying the foundations for a significant rally in a pair EUR / USD.

We see potential for a solid acceleration in volatility in the EUR / USD pair in Q1,1500, which could initially drop before a sustained rally begins before QXNUMX ends. With implied volatilities near historical lows, value can be found in long-term options strategies defining the path in QXNUMX - potentially in the area of XNUMX or lower if a change in US yields causes a solid appreciation of the USD. In the longer term, we expect a significant strengthening of the euro. Source: Bloomberg)

JPY and CHF: Decline due to the expected increase in US yields

Here the situation is very simple. In the fourth quarter there will be early elections in Japan with an emphasis on "doing something" on the fiscal side. Candidates from the ruling LDP are outdoing each other in promises of maximum fiscal stimulus, and Bank of Japan it is even ready to throw new logs into the monetary policy furnace in the form of quantitative easing. Moreover, given our positive outlook for commodities, it can be assumed that JPY will face further pressure as the Japanese current account is moving in the wrong direction. The Swiss franc will also lose due to higher yields and the projected fiscal stimulus in the EU in 2022.

GBP: The increase in stability over the post-Brexit situation helps here, but only to some extent

British politicians seem to agree that the most important task is to reliably tighten the fiscal belt while avoiding a collapse of the economy, bearing in mind that it was the austerity measures under Osbourne's tenure, combined with the 2015 immigration crisis, that contributed to the victory of the exit supporters. Of the Union in 2016 Simultaneously Bank of Englandaware of the risk of inflation, he provided sterling with some support; the central bank assumes that it will manage to raise rates by mid-2022, anticipating the expected Fed hike. In addition, a rapid stabilization of the EU trade easing could help, where the necessary investment inflow would offset a headache of trade deficit, which keeps the ceiling on potential GBP appreciation relatively low.

AUD and NZD: Will we hit the point of maximum divergence in QXNUMX?

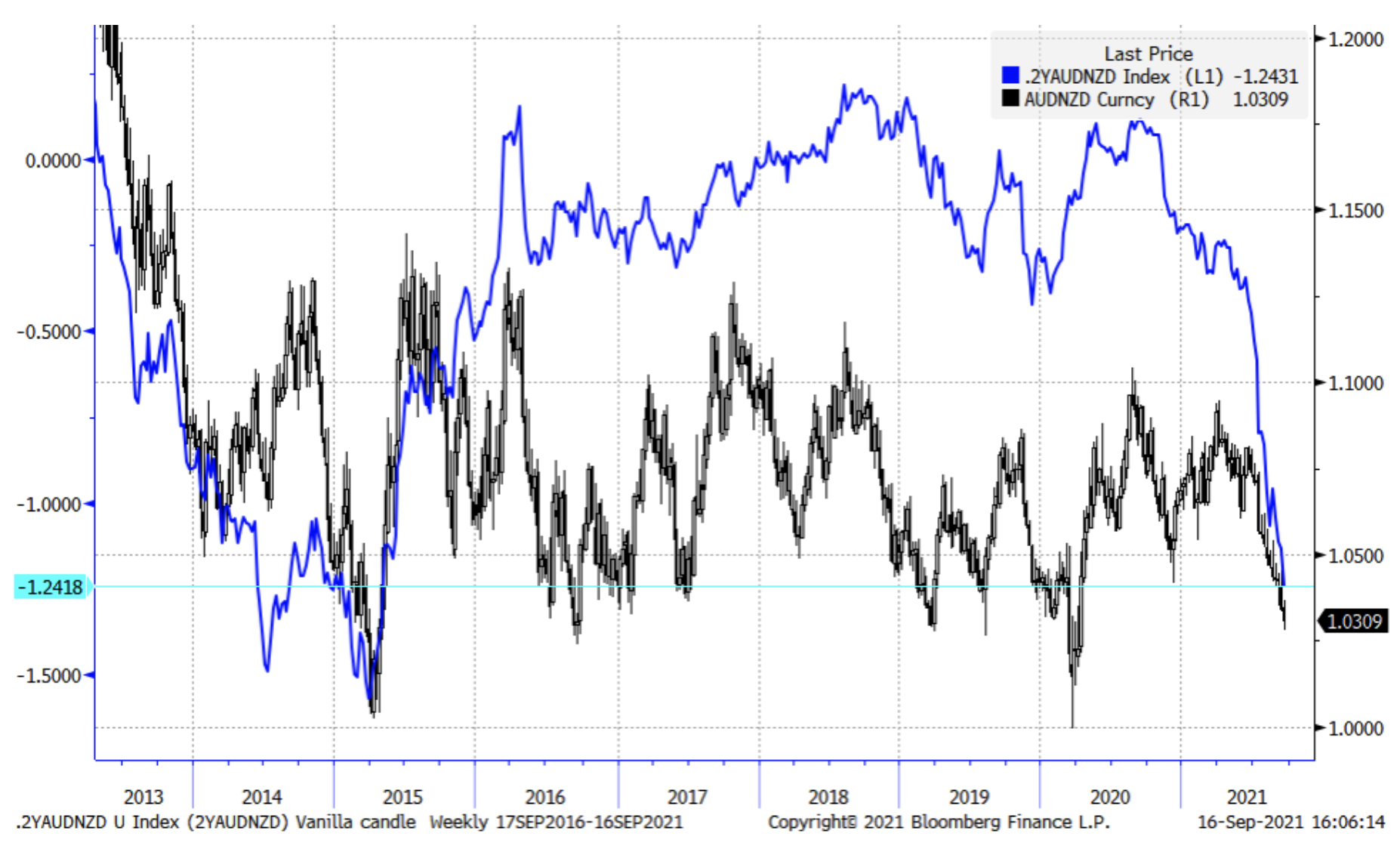

One of the most important topics in the fourth quarter is the relative divergence of political forecasts in the Antipodes, given that Rebuildables is determined to wait until the declared political horizon (2024) with the first rate hike. This position was "backed" by the failure of Australia's zero-tolerance policy, which is why a large part of it Australia it has been put in a lockdown and there has been a shift towards a rapid vaccination policy, which should be completed by the end of this year. At the same time, the RBNZ has shifted away from accommodative policies amid the embarrassingly high inflation and record increases in house prices as a result of a zero-rate policy and quantitative easing at a time when the left-populist government made affordable housing a key policy point. In Q100, Orr's CEO of RBNZ and the company moved away from quantitative easing and started talking about rate hikes, and forecasts for these hikes towards the end of Q2024 saw further highs, although New Zealand's commitment to Covid's zero-tolerance policy did not fully prevent the new infections in the third quarter. Biennial AU-NZ spreads show the largest increase in recent history well below -XNUMXbps and in QXNUMX may return to the average in favor of AUD as the market predicts Australia's QXNUMX forecast to normalize rapidly relative to the rest of the world. We suspect that the current conditions will cause the RBA to withdraw from the guidance assuming no rate hikes until XNUMX, as was the case with the RBNZ.

As we have already noted, the spread of short-term Australian and New Zealand yields in Q2024 widened to near historic highs after the RBNZ departed from quantitative easing and plans rate hikes, while the RBA seems confident it will be able to hold back from hikes until 1,000. We suspect that this divergence has already or will soon be reaching extreme levels, and Australia will make an aggressive opening towards the end of Q1,1500, or at the beginning of QXNUMX at the latest, with the AUD / NZD pair going to a minimum and starting a return to the average in the long-term range of XNUMX-XNUMX. XNUMX. Source: Bloomberg)

CAD: Raw material potential, QXNUMX long positions recommended

The elections at the end of Q1,3000 do not appear to have a significant impact on monetary policy as a minority government seems inevitable after the fatal failure of the Trudeau gambit to gain popularity in the polls and an overwhelming victory. In our view, CAD has real potential in terms of its raw material links, even if the long-term impact of problems in the housing market is to be feared. Due to the above-mentioned concerns about the potential for USD appreciation, the value of CAD should be looked for in the USD / CAD pair in the region of XNUMX and above, as the pair experienced an excessive decline in QXNUMX.

NOK and SEK: Interesting twist for NOK more than for SEK

In the third quarter, the SAI moved from strengthening to strengthening as oil prices remained high and natural gas prices soared to unprecedented levels and surpassed oil in Norwegian import revenues. If Russia manages to launch the NordStream2 pipeline in QXNUMX, it could cause natural gas prices to collapse back into historical ranges and slightly lower the forecast for the NOK, even if overall our forecast for this currency remains constructive. We have a similarly positive outlook on SEK and we would focus on a slight decline (SEK is one of the most risk-sensitive currencies) on the assumption that the fiscal and inflation outlook for the European Union will improve significantly next year. SEK often has a high beta against the EUR direction.

Emerging Markets Currencies: CNH is too strong in the context of capital market uncertainty

Be prepared for increased volatility in emerging market currencies after the most favorable recent quarters, driven by falling credit spreads and an overall decline in market volatility. Single commodity narratives can be positive, although recent quarters have shown that politics can disrupt a streak of success. A particularly significant factor of uncertainty is the large-scale shift in policy in China, which overall appears to continue to discourage foreign investment from China. The government is determined to "pick the winners" and discourage the numerous categories of enterprises and areas of activity as factors of inequality and actors of values inconsistent with CCP principles. China has experienced significant surpluses in recent quarters due to pandemic stimulus that has supported its renminbi and enabled it to reach multi-year highs. However, these surpluses may fall on worsening commodity prices (natural gas and oil, I'm talking to you) and high demand for commodities may weaken compared to the demand for services as economies "normalize" and return to pre-pandemic consumption patterns . At the end of QXNUMX, the CNH seems too strong.

All Saxo forecasts are available at this address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)