Reports on vaccines and reductions in ETF lead to the risk of a correction in gold prices

Gold continues to lose momentum in response to recent reports on vaccines and their potential efficacy against Covid-19. In fact, we are now seeing emerging-market currencies as well as stock indices pull back from the latest series of gains amid fears of tougher restrictions being introduced to contain a resurgent coronavirus pandemic.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

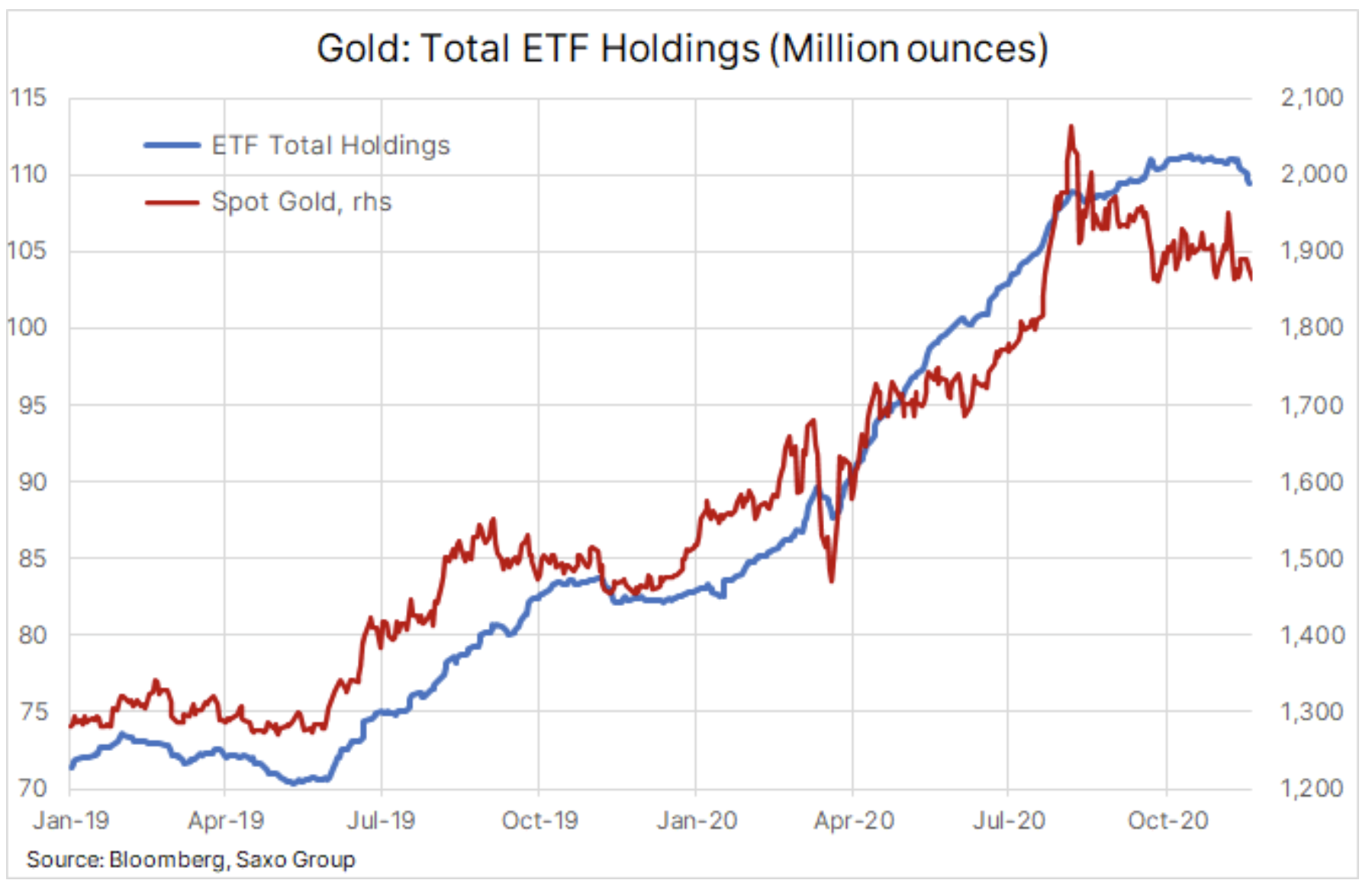

Despite this, gold remains on the defensive, and the loss of momentum attracts sales from stock exchange funds. Yesterday, total resources fell by 322 thousand. ounces and from time Pfizer / BioNTech announcement on November 9 cumulative reserves fell by 1,7 million ounces to 109,4 million, the lowest in 2-1 / 2 months.

While these changes may further increase the risk of a deeper correction, it is worth remembering that flows ETF they tend to be lagging behind rather than driving price action. As we highlighted in previous comments, the vaccine may neutralize the virus, but it won't do to the mountain of debt that has been amassed this year. Central banks are expected to maintain ultra-loose monetary conditions, which may inadvertently lead to the risk of higher inflation due to flawed policies of not reacting sooner to possible recovery.

In addition to the risk of rising inflation providing medium-term support for gold, another key factor affecting commodities in general, and precious metals in particular, remains the inverse correlation with the dollar. Big bank analysts predict the dollar could fall by 20% if a widely available vaccine leads to an economic recovery in 2021. You can read about it, among others in today's Financial Times, in an article titled "The vaccine could plunge the dollar in 2021." ("Vaccine arrival expected to trigger dollar slump in 2021").

However, the short-term forecast remains in question due to the deteriorating technical outlook and the aforementioned withdrawal of funds from stock exchange funds. As you can see in the chart below, there have been warnings for the stock market as a result of recent price action, and a break below $ 1850 / oz carries the risk of a deeper correction towards $ 1837 / oz, a 38,2% shift from the March-August rally and even dropped to the 200-day moving average of $ 1790 / oz.

While short-term technical traders and algorithmic trading can sell with the current weakness, traders with a long-term perspective can - in our opinion - take advantage of the opportunity to accumulate at lower levels.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)