The dynamic rise in profitability hits oil, and gold tests inflation

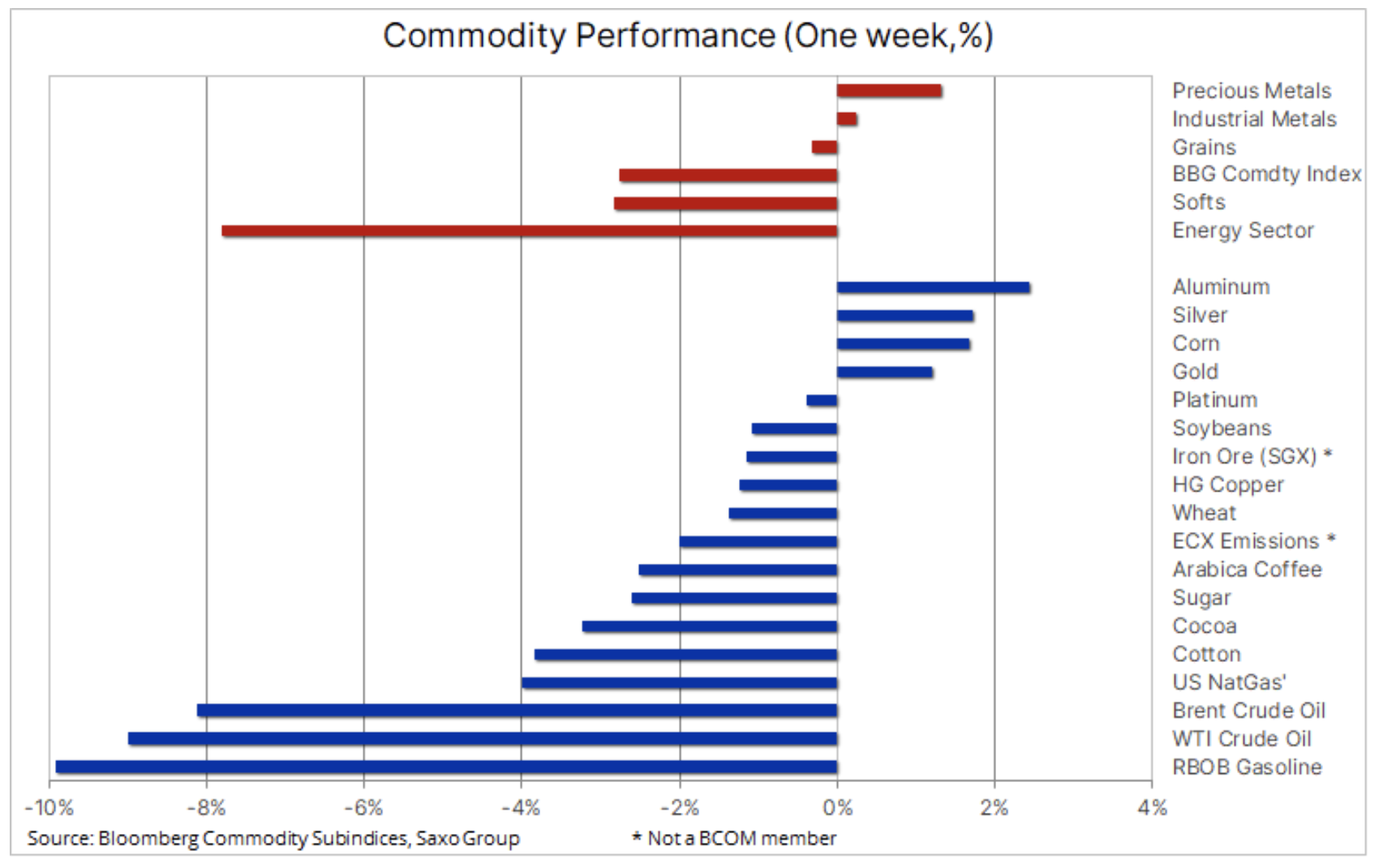

The month-long rally in commodities slowed down and although the strong fundamental forecast for this sector did not change, the continued dynamic rise in US Treasury yields forced a reduction in the overall risk appetite in all markets. After a significant, and as some might say - a long-awaited correction crude oil prices The Bloomberg commodity index fell 3%, posting its biggest weekly loss since last October.

While changes in individual commodities contributed to setting the tone, the general direction was taken by movements in the US bond markets for the third consecutive week. Thursday's sharp decline in commodities, stocks and bonds followed a mild FOMC meetingwhich failed to allay market concerns about further yield growth and inflation. Federal Reserve basically it will let the economy and inflation turn red hot. The market was particularly concerned about the comment that the Fed intends to allow the situation in which inflation would exceed 2% for a long time.

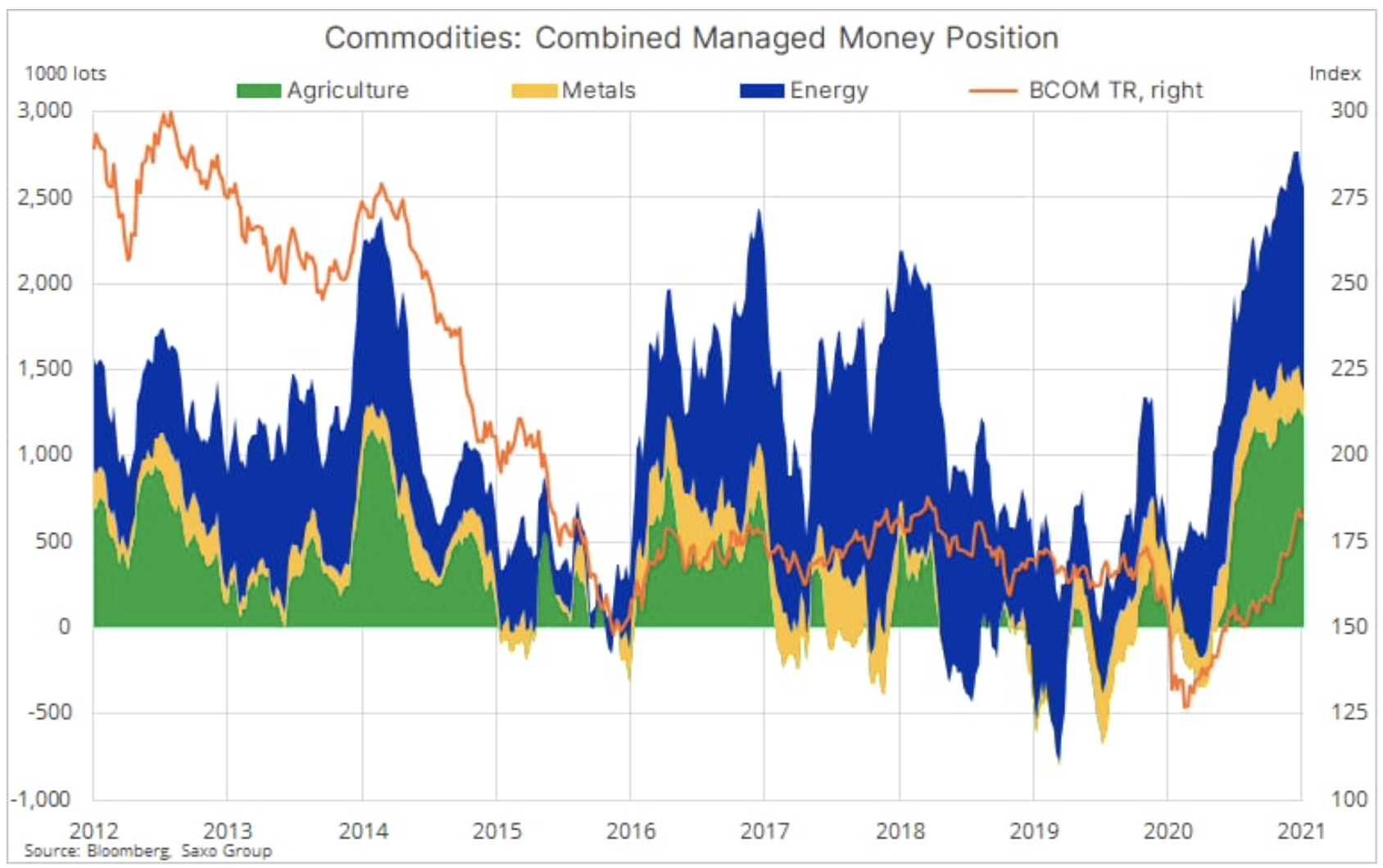

The commodities most exposed to the effects of the new wave of risk aversion are those associated with the largest speculative long positions. Overall, the commodity sector has seen a strong recovery over the past month for reasons discussed at length in previous analyzes. As a result of strong price momentum, cash managers and speculative investors have accumulated a record exposure to commodities over the past nine months, with few exceptions, including with the exception of gold, the net long position has increased to such an extent that any change in the short term fundamental and / or technical forecast would cause a sharp adjustment.

Petroleum

Crude oil, which in recent weeks has shown more and more clearly to reach its short-term price potential, fell the hardest since October following a double blow from the International Energy Agency and the FOMC on Wednesday. In the last month oil market report The IEA has questioned some of the reasons behind the recent sharp appreciation of Brent crude oil to USD 70 / barrel. In particular, the risk of another supercycle and future shortages have been questioned.

The IEA not only predicted the high level of crude oil inventories despite the continued reduction of the huge overhang accumulated in Q2020 8, but also emphasized significant production reserves, currently in the order of 5,5 million barrels per day, at the disposal of OPEC + members. Given that the recovery in fuel demand remains weak, in particular due to problems with vaccination in many regions of the world, especially in Europe, forecasts for global demand growth of around 2021 million barrels per day in XNUMX may turn out to be too optimistic.

Therefore, it is obvious that the 80% boom since the beginning of November, when information about the first vaccine appeared, was mainly due to the fact that OPEC + limited production. As a result, the price was exposed to any negative news related to the demand. The collapse was initiated by a drop in the price of Brent crude oil below $ 66,50, and from then on, there was an almost straight-line peak to $ 61,5. While these new levels more accurately reflect the current oil market situation, there is still a risk that speculative investors have not yet managed to fully correct their positions.

On the other hand, after such a fierce fight to support prices last year, OPEC + members are unlikely to remain passive in the event of further declines. In such a situation, verbal intervention can be expected as the first line of defense, and if that does not help, the current production limitations are prolonged or even scaled up. OPEC + has a number of tools at its disposal, and the organization has already shown its readiness to use them under the leadership of Saudi Arabia.

Technically, Brent crude broke the November uptrend, but so far has found support at the 61,50-day simple moving average of $ XNUMX, and a weekly close above that level would increase risk appetite and potentially signal a rebound in the coming days.

Gold

Gold received a preliminary impulse after the FOMC confirmed a mild stance and maintained the forecast assuming unchanged interest rates until 2024. de facto very accommodative green light for venture capital and dollar bears, the market was concerned about the still pending issue of a possible "political error" by the Fed, ie perceiving the rise in long-term US bond yields as completely harmless.

Moreover, the market recognized that the Federal Reserve would allow the economy and inflation to become red hot, with inflation being able to reach and exceed 2% for a longer period. Despite the initial solidarity decline with the rest of the asset classes, gold began to attract more and more buyers as it sought to restore faith in reflation that had been declining over the past few months. The relation of gold to real yields on ten-year US bonds can be seen as a sign of success. On March 8, when real yield was -0,6%, gold was testing the support at $ 1, which is about $ 680 below its current level.

While other commodities, such as crude oil and grains, were exposed to a reduction risk due to their high position, gold has already lost its attractiveness to investors. Due to the lack of momentum in recent months, hedge funds have reduced their net long position in COMEX gold futures contracts to an almost two-year low of 42. Lots (4,2 million ounces), down 85% from the last high in February 2020.

Bloomberg estimates that the total position in gold-backed equities over the past 30 days has been steadily declining to its nine-month low of 3 tonnes, down 144% from its peak last year. year. However, one region is breaking out of this trend - China, where according to the World Council, the gold position in equities increased by 9 tons in February to a record 8 tons after investors experienced turmoil in the Chinese stock market.

For now, gold remains in no man's land, although its technical forecast has slightly improved. For this to change and to attract new demand, in particular from leveraged accounts, the price of gold must return to $ 1 / oz; until then, we maintain a neutral short-term outlook and, at the same time, believe in gold's medium-term potential to strengthen again towards USD 765 / oz.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)