ECB will lower interest rates at today's meeting?

If Mario Draghi and European Central Bank (ECB) was supposed to take into account the latest data from Germany, today the decision to cut interest rates in the Euroland should take place. However, even without this, it is a real scenario despite appearances. Therefore, it is better to prepare for a possible surprise.

The ECB meeting is the event of Thursday in the financial markets. The decision will traditionally be announced at 13: 45, and 14: 30 will start a press conference after the meeting.

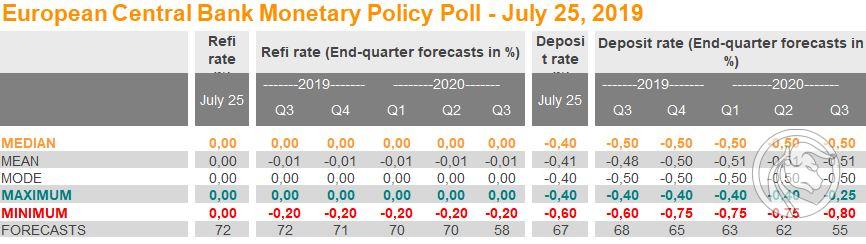

The market expects that at the July meeting the ECB will not change interest rates, but will announce a cut in September, while expressing its readiness to resume the asset purchase program in the uncertain future.

According to a Reuters survey, in September a cut in the deposit rate is forecasted for 10 basis points to -0,50 percent. The resumption of the QE program is also expected. Only that it was only in 2020 year. The chances of the ECB returning to asset purchases later this year see only 40 percent. surveyed economists and analysts.

Germany is exempting

If the ECB had only to take into account the latest data from Germany in its decisions, then it would undoubtedly be cutting interest rates now. The July decline in the PMI index for German industry to the lowest level since 7 years and also 7. another month of this index after the recession (below 50 points), or the lowest since more than 6 years reading the IFO index for Germany, that's what they suggest.

However, even without this rate cut at today's meeting is real. No one doubts that the situation in the Euroland in recent months has not only improved, but even worsens (see data from Germany). First of all. Second, the interest rate cut of 10 pb does not really change much. It affects the mood more than the real sphere. Thus, combining this decision with the element of surprise would have an additional positive effect on the mood and would prepare the ground for other activities. And thirdly, in the past, the ECB has surprised the markets several times, ahead of market expectations. Why would not he do this today?

How will the possible rate cut at the July meeting affect the EUR / USD exchange rate? Here the matter is obvious. The rate cut + the element of surprise would have to hit the single currency. In this situation one should take into account the attack on the strong 1,11-1,1111 support zone, from which in the April-May period Eurodolar was already turning back 3. It is likely that this demand barrier would be broken and the euro could be tested around 1,1050.

Chart EUR / USD, D1 interval. Source: MetaTrader 4 Tickmill

Any fall below 1,11, however, will not mean a new wave of stronger EUR / USD sales. It can not be forgotten that the Fed will cut rates in a week. And this will not be a one-off action, but the beginning of a mini-cycle. Therefore, in the medium and long term, the dollar will be losing to the euro, and not vice versa.

And what will happen when the ECB will do everything what analysts expect today? Well, such actions, despite the fact that easing monetary policy, are already in prices. It would be rational, therefore, to see an upturn in EUR / USD and the start of the game for next week's interest rate cuts by the Fed.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)