The ECB changes the inflation target, but EUR / USD looks at something else

European Central Bank (ECB) revised its strategy and set the inflation target at 2%, departing from the earlier one "Below, but close to 2%". The bank continues to treat interest rates like the main tool of monetary policyand other tools will only be used in exceptional circumstances. The ECB will start to include climate protection in its policy. The Bank further recognized that while HICP inflation is an appropriate measure of inflation, it will also include housing costs over time.

Eurodollar is recovering from losses

The change in the inflation target, which could suggest the bankers' agreement to temporarily exceed it, and thus in theory postpones the tightening of the monetary policy, was calmly accepted by the currency market. The EUR / USD exchange rate, which has been rising since the morning, correcting the recent drops to 3-month lows, remains close to the daily highs. It seems that this factor will not affect the eurodollar for now. Investors pay more attention to the falling yields of US bonds or the corrective sentiment on the stock markets.

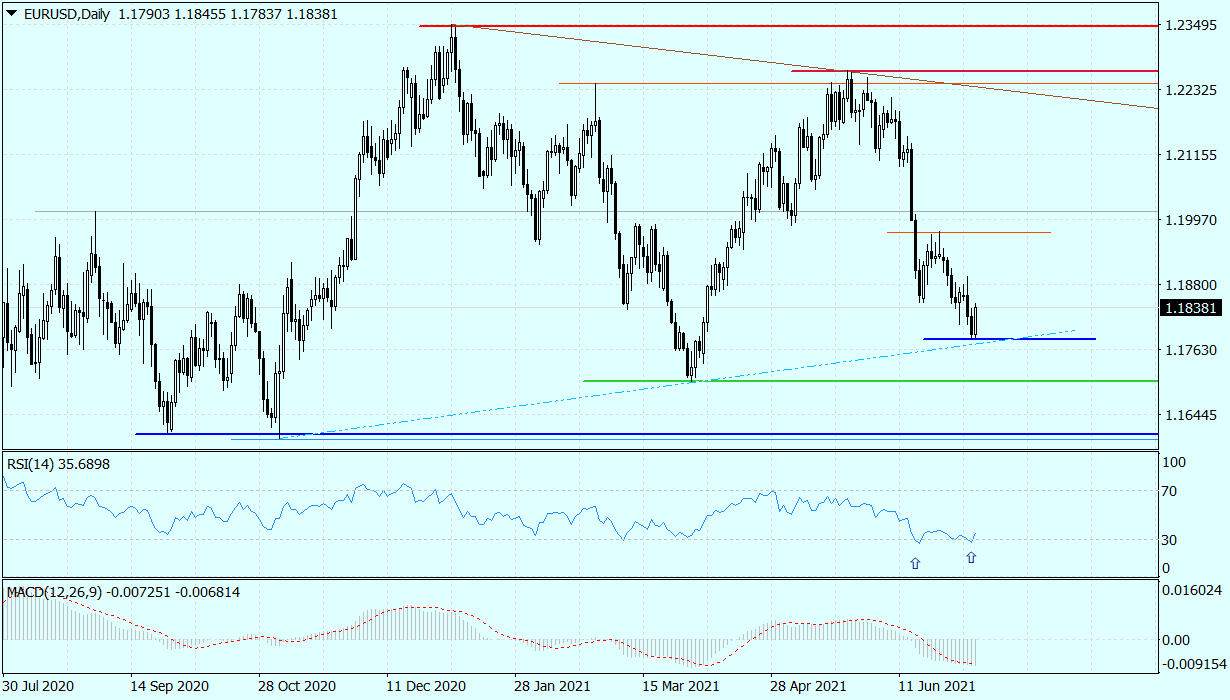

Daily chart EUR / USD. Source: Tickmill

The situation on the EUR / USD daily chart indicates a significant oversold as the main source of the observed upward correction, which increased the quotation above 1,18. However, something else is also visible there. Namely, the upward divergence of the chart with the RSI indicator. It may even be an introduction to a trend change and an end to the last wave of declines.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)