eToro creates a BitcoinWorldWide wallet, based on the cryptocurrency market

eToro, a broker famous for social investments (so-called social trading), is launching today BitcoinWorldWide, thematic investment portfolio based on companies supporting and adapting bitcoin. Although this portfolio includes some exposure to Bitcoin, its main element are companies working to support the further acceptance of cryptocurrencies in everyday life.

Thematic investment portfolios in eToro

eToro is developing dynamically. The result of this the stock market debut is plannedand the company is initially valued at $ 10 billion. The broker constantly tries to fit into market trends and react quickly to the needs of users. It was similar when it was introduced to the offer a portfolio based on the crude oil market - #OilWorldWide - at the end of April 2020, after negative prices on futures contracts for this raw material were recorded. At the end of May, however, it appeared portfolio based on a basket of Chinese technology companies - #ChinaTech. Now, cryptocurrencies and companies that invest in them (incl. Tesla), hence the idea for the construction of the BitcoinWorldWide wallet.

“As bitcoin enters the mainstream of life, this cryptocurrency is increasingly in the spotlight” - says Dani Brinker, eToro's director of portfolio investments. - "Bitcoin's new records of value regularly make headlines, but the most important change associated with the world's largest cryptocurrency is not the price, but the companies building their business around it. From mining operations to chipmakers and service providers that support use, payment, monetization and governance, bitcoin is more than you might think. "

Bitcoin has been in operation since 2009 and currently boasts a market capitalization of more than $ 1 trillion. Over the past decade, the first and most famous cryptocurrency has gone through many stages of adoption - from an unknown technology to a well-known name that attracts institutional investors and generates headlines in the media. The previous year was another hugely significant bitcoin development when payment companies, including Square and PayPal, announced their Bitcoin payment service plans, which allowed millions of users around the world to make easy transactions using this cryptocurrency. Now, just 12 years after Bitcoin's launch, you can use it to pay at HomeDepot, buy a Tesla or Whopper or (in some countries) KFC, buy games from the Xbox Store, and pay your AT&T phone bill.

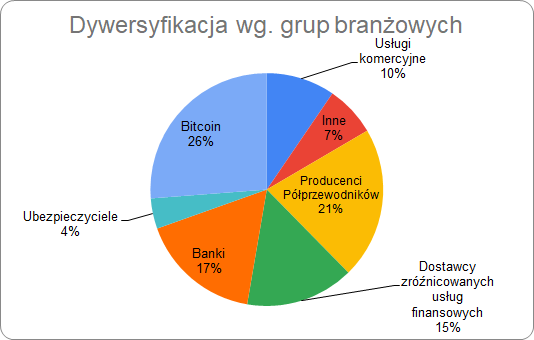

The portfolio includes companies such as Paypal, chip manufacturer Nvidia, manufacturer of crypto mining equipment Canaan i giełda kryptowalut Coinbaseas well as a small amount of allocated bitcoins. eToro believes that the bitcoin value chain includes companies operating in the cryptocurrency mining, payments, exchanges, trusts and insurance industries, semiconductor manufacturers, as well as the asset itself, bitcoin. eToro has deliberately excluded organizations that make money from bitcoin, but lack business units related to its activities. E.g MicroStrategy will not appear in this portfoliobecause the bitcoins owned by the company are the only element that connects it with this cryptocurrency.

"Our goal is to provide retail investors with an easy way to get exposure to companies that provide the service or product needed to further deploy bitcoin." Explains Dani Brinker. - "This is a broader approach to investing in bitcoin that offers a diversified investment that is not correlated to bitcoin itself, but retains exposure to the growth potential of the cryptocurrency sector.".

BitcoinWorldWide is one of over forty CopyPortfolios themed available on the eToro social investment platform. Platform users can invest in BitcoinWorldWide from as little as $ 1 with no management fees. Other costs still apply, including spread and conversion fees (for people who don't make a dollar deposit).

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)