eToro launches LuxuryBrands, a portfolio based on the luxury goods market

eToro, the social investment platform, today announced its launch LuxuryBrands - the latest addition to the Smart Portfolios Thematic Package, offering investors long-term exposure to the luxury goods industry. This is another interesting novelty on the list of ready-made investment portfolios available on eToro. Only two weeks ago, it was introduced to the offer BatteryTech - a product that gives exposure to companies in the battery industry.

LuxuryBrands - exposure to the luxury goods market

The luxury goods market has always resisted fleeting fashions, retaining the necessary value and attracting customers, thereby providing itself with key price power.

"Despite the pandemic-induced cuts in discretionary spending, luxury brands have definitely rebounded and more than retained their value in a world of rising inflation." - He said Dani Brinker, head of investment portfolios at eToro.

“Their timeless nature made them resistant to changes in consumer demand. And after a contraction in 2020, the market grew by 2021 to 13 percent in 15 to a value of € 1,14 trillion.

Ben Laidler, Global Markets Strategist at eToro, comments:

"Luxury stocks performed well during the pandemic, both in terms of 'narrow' luxury such as fashion, leather, beauty, and 'broad' luxury, including cars, alcohol and sportswear. They enjoy strong brands, large profit margins, and non-cyclical growth factors such as exclusivity and status. All this is conducive to high valuations and trends that will continue regardless of market volatility. "

E-commerce strengthens the industry

The accelerated growth of e-commerce has strengthened the position of luxury brands and online stores have become the engine that revitalized the sector. Monobrand online stores now account for almost half (40 percent) consumer points of sale.

“China satisfies a third of the demand for luxury goods, and its zero-covid policy increases exclusivity and prices, which in turn affects the revenues of luxury brands. The growing importance of sustainable development, supply chain integration and multi-brand luxury conglomerates increase market entry barriers for disruptors, and a weak euro additionally cushions high profit margins. As a result, luxury brands will thrive in the post-covid world " - he adds Ben Laidler.

To reflect the diversity of sectors in the industry, LuxuryBrands Smart Portfolio showcases a highly thematically diversified selection of 25 stocks, including brands such as Ferrari, Hermes and Marriott International, parent company of Ritz Carlton and St. Regis. It also offers access to fashion industry parent companies such as LVMHto which they belong Tiffany & Co. and Louis Vuitton; Kering, holding company Gucci, Saint Laurent i Balenciaga; and Richemont Group, which is the owner of a jewelery brand Cartier and a watch manufacturer IWC. A complete list of companies can be found here.

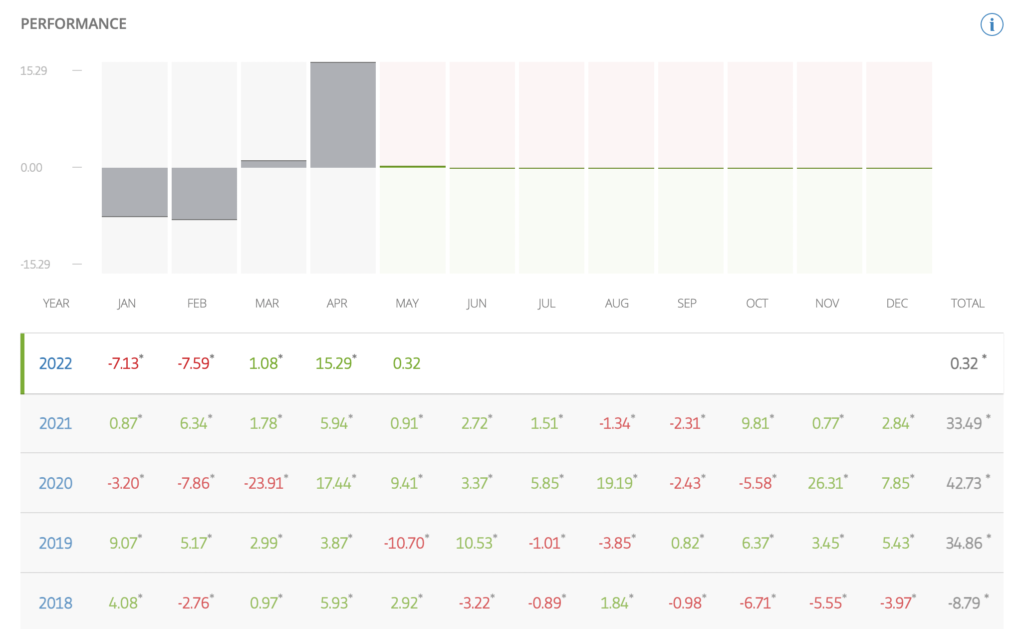

Simulation of historical results of the LuxuryBrands portfolio in 2018-2022. Historical results do not guarantee the achievement of similar results in the future! Source: eToro.

Dani Brinker concludes:

“By placing selected stocks in a ready-made portfolio, we enable our clients to invest in specific areas and gain exposure to the markets while maintaining significant diversification in the automotive, textile and household appliances sectors. By investing in LuxuryBrands, our clients will be able to contribute to one of the most timeless consumer goods segments in the world. "

READ: How to invest in luxury alcohol? [Guide]

What are eToro investment portfolios

EToro Smart Wallets offer investors ready-made, fully allocated exposure to various market paths. By combining several assets within a specific methodology and using a passive investment approach, EToro Smart Wallets they become long-term investment solutions offering diversified exposure with no asset management fees.

The entry threshold is from $ 500. Investors have access to tools and charts to track portfolio performance, while the eToro social channel will keep them updated on developments in the sector. At the moment, this wallet is not available for US users.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

eToro is a multi-asset platform that offers both stock investing and CFD trading.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Past performance is not indicative of future performance. The trading history shown is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading is not synonymous with investment advice. The value of your investment may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and does not make any representations or be responsible for the accuracy or completeness of the content of this publication, which was prepared by our partner using publicly available information about eToro that is not specific to entities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)