EUR and JPY, the currencies of countries that may prove to be the safest

There was a massive retreat from the US dollar in QXNUMX as the market ignored the mantra Fed on the need to maintain a "higher reference rate for a longer period of time", which significantly inverted the US yield curve. At the same time, the ECB was catching up with the tightening cycle, the JPY rebounded with momentum after the Bank of Japan started tightening as other central banks began to seek to phase it out, and the Chinese renminbi came back from the brink after a confusing political volte-face. 2023 could prove difficult for currencies if the USD continues to slide further down, but EUR and JPY may perform best.

As 2023 begins, we see the market showing increasing faith in US disinflation. Despite the Fed's "higher rates for a long time" narrative and the fact that at the meeting FOMC in December 2022, the median of this year's dot plot forecast for the Fed funds rate exceeded 5%, the market continues to predict that the Fed will lower expectations by the end of this year. In the first weeks of this year, the market priced in an acceleration in the pace of rate cuts in 2024 after the recent "soft" data turned out to be much worse, including the poor results of the December ISM survey of the services sector, but also after a number of data on inflation was worse than expected. Investors are encouraged to factor in a looser post-peak policy by the Fed, such as two more hikes of 25 basis points over the next few quarters, because annualized inflation over the last few months, minus the traditionally lagged and most important component of the official series CPI data, i.e. the equivalent of the rent payable to the landlord (owner's equivalent rent, OER), is practically back within the Fed's target range of 2%. However, as the subject of this forecast, "Models Broke," we believe disinflationary conditions are unlikely to last long in an underinvested world that is striving to move away from fragile, globalized supply chains and towards a more modern and greener energy system and to arm themselves with new national security imperatives.

Therefore, any slowdown in nominal growth will prove shallow, and growth will pick up again as demand for commodities recovers in China. At the same time, the USD may appreciate sharply from time to time if the market is forced to challenge the expected path of Fed policy next year and if this correction leads to new bearish lows in high-risk assets, in particular US equities. The drivers of the USD's sustained decline are the Fed's liquidity provision and the global return to risk appetite, both of which are equally important. In the last two cycles, major USD sell-offs have only occurred when the Federal Reserve provided significant liquidity after some global crisis. But now the Fed keeps tightening policy! So how did the USD weaken in QXNUMX and early QXNUMX? Largely due to the fall in yields as the market assumes the Fed will change policy, but just as importantly due to other factors counterbalancing the tightening of Fed policy, including the US Treasury Department, which continues to aggressively withdraw funds from the Fed account, thereby increasing system-wide liquidity, and banks shifting reserves and limiting the use of reverse repos offered by the Fed, which can serve as a kind of "quantitative easing warehouse". The last of these factors is unpredictable, but the Treasury Department's liquidity contribution will quickly run out in the coming months and then turn into an actual liquidity problem as the Treasury, sooner or later, recreates funds in its account after the latest bizarre spectacle of congressional resolution of the debt ceiling issue at some point in QXNUMX.

Simultaneous decline in the growth rate of corporate profits and fears recession could see the dollar make a big comeback as a safe-haven currency in the first half of this year, even if it doesn't peak in the cycle. Further down the curve, beyond QXNUMX, when inflation picks up again after possible short-term upside fears and the current misleading fall, the USD may eventually depreciate more as the Federal Reserve needs to provide liquidity to ensure order in the market government bonds, even without a significant - or even any - rate cut. The idea is quantitative easing without a zero interest rate policy – a new paradigm that wins over the current model.

G3 currencies

JPY wins no matter the scenario, EUR stable. It seems that in Q150 and possibly early Q10, any scenario will be favorable for the JPY, even after a significant appreciation against the USD following the impressive strengthening of USD/JPY above XNUMX late last year. In December, there was a surprising change in policy from the Bank of Japan after the country released a significant amount of its reserves to defend the yield curve control band. While President Kuroda failed to make further changes in January, there is a general feeling that Japan is ready to move away from its experimental and extreme monetary policy over the last XNUMX years. The assumption that the Japanese currency will win regardless of the scenario is based on the belief that the JPY may strengthen due to expectations that the Bank of Japan will normalize its policy while other central banks take their foot off the gas; on the other hand, in the absence of a policy change, yield spreads could continue to fall sharply on the back of worse-than-expected global economic performance earlier this year, a traditional source of the JPY's strength. The ideal conditions for further appreciation of the JPY in the near term are both moderate or lower yields this quarter, as well as concerns about growth, which will further increase risk aversion. A surge in energy prices – rather sooner rather than late QXNUMX or later – would dampen the recent JPY rally, unless Japan's central bank postpones the timing of the policy change until after the end of the Kuroda era.

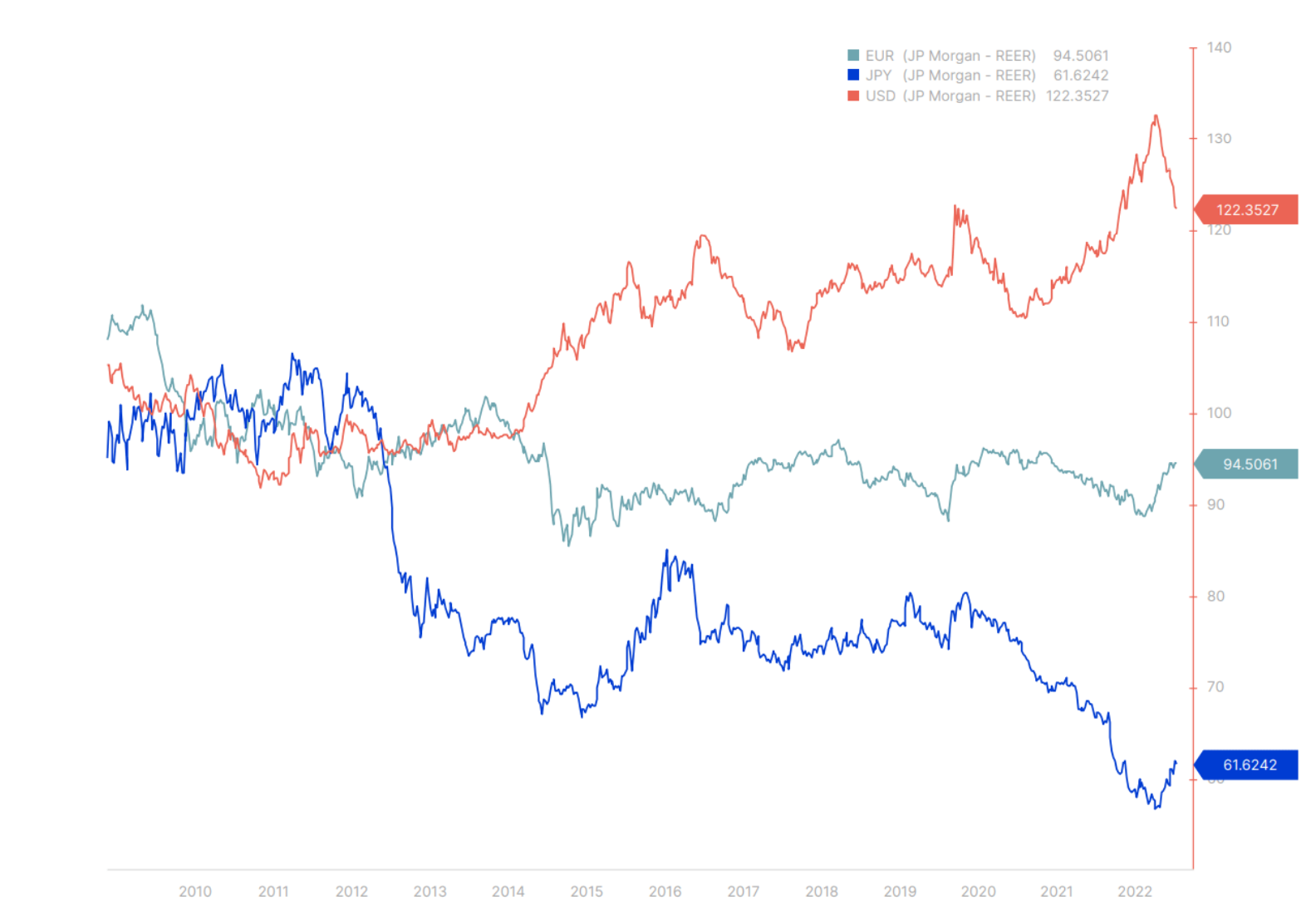

Chart of G3 currency rates (USD, EUR and JPY) from QXNUMX forecast.

In a previous forecast, we noted that the USD and JPY "jaws widening dangerously!". From then on, they expanded even more until the final - if somewhat timid - turn in the other direction. Let's note how modest the strengthening of JPY has been so far. For the rest of 2023, the two currencies will continue to converge, with the EUR behaving somewhat calmer, though remaining strong against the US dollar and other currencies.

In the case of the EUR, we have the ECB belatedly joining the widespread tightening of interest rates only in December, and signaling further decisive tightening, emboldened by the fall in natural gas and energy prices due to the mild winter (even if these prices are above historical intervals). For Europe, the fiscal outlook is more robust than for almost the rest of the world, and with the expected return of Chinese demand, downside risks remain very low. Long-term energy and power issues are a concern in the longer term, but supply concerns this winter are of little concern. Strongly positive bond yields in Europe, even if real yields remain negative, could help to keep domestic investors engaged. EUR may prove to be a relatively stable ship in rough seas this year. Sterling, meanwhile, would benefit most from a very soft landing elsewhere and from stable global markets. It is uncertain whether this will happen - Sterling faces the same balance sheet problems as the "minor G10 currencies" discussed below, although it is difficult to understand the risk to the British currency when it is already heavily overvalued, even after Truss' traumatic tenure last fall.

Minor currencies from the G10 group

All of the smaller G10 countries are small open economies where housing markets were largely unaffected or suffered only temporarily during the global financial crisis of 2008-2009. These countries' currencies experienced horrendous volatility at the time, some due to over-enthusiastic carry trades (AUD, NZD and NOK), others due to pro-cyclical appreciation linked to commodity prices (CAD and SEK), and sometimes both, with the exception of SEK. Forced to stifle interest rates in a competitive devaluation after the global financial crisis, housing markets in these economies went white-hot, getting a real turbo boost during the 2020-2021 pandemic. Now, with long-term lending rates rising rapidly, the likes of which these economies have not seen in decades, housing markets are set for a further major correction that has already begun. Real estate is a notoriously illiquid asset and it will take time to absorb the effects of rate hikes. However, this will have a huge impact on both the activity of the construction sector and on private balance sheets, and possibly on consumer sentiment in general in these economies, in particular for those housing markets that are extremely sensitive to changes in variable-rate mortgages, including Australia, Sweden and Canada. While our long-term outlook for commodities is very constructive to say the least, with some strengthening in the next growth cycle offsetting the impact on commodity giants like Australia and Canada, massive private sector debt in all of these economies could significantly offset their growth potential. Risk in Sweden can become systemic and require significant intervention. This could have been the reason for the significant weakening of the SEK at the end of QXNUMX and beginning of QXNUMX.

China and emerging markets

In the case of the CNY, a lot has already been factored into valuations after the currency's big comeback from the brink with the significant political shift discussed in Redmond's QXNUMX China outlook. The coming quarter may turn out to be less significant in terms of currency as investors have already closed favorable deals and China will want to prevent the CNY from strengthening too much to keep its exports competitive even as it moves up the value chain. Other EM currencies could face a turbulent start to the year amid global growth concerns after a strong performance since late last year, when the market managed to pull the dollar down and interest rates fell, providing a solid performance for local currency-denominated EM bonds . In the coming quarter, however, it is worth considering value purchases focused on commodity currencies (BRL, IDR, ZAR and others).

About the Author

John Hardy director of currency markets strategy, Saxo Bank. Joined the group Saxo Bank in 2002 It focuses on providing strategies and analyzes on the currency market in line with macroeconomic fundamentals and technical changes. Hardy won several awards for his work and was recognized as the most effective 12-month forecaster in 2015 among over 30 regular associates of FX Week. His currency market column is often cited and he is a regular guest and commentator on television, including CNBC and Bloomberg.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)