EUR/USD is waiting for central banks

Variation on EUR / USD less recently. This may mean that investors have turned on waiting mode for next week's decisions of central banks. Especially the US Federal Reserve (Fed).

Waiting for decisions of central banks…

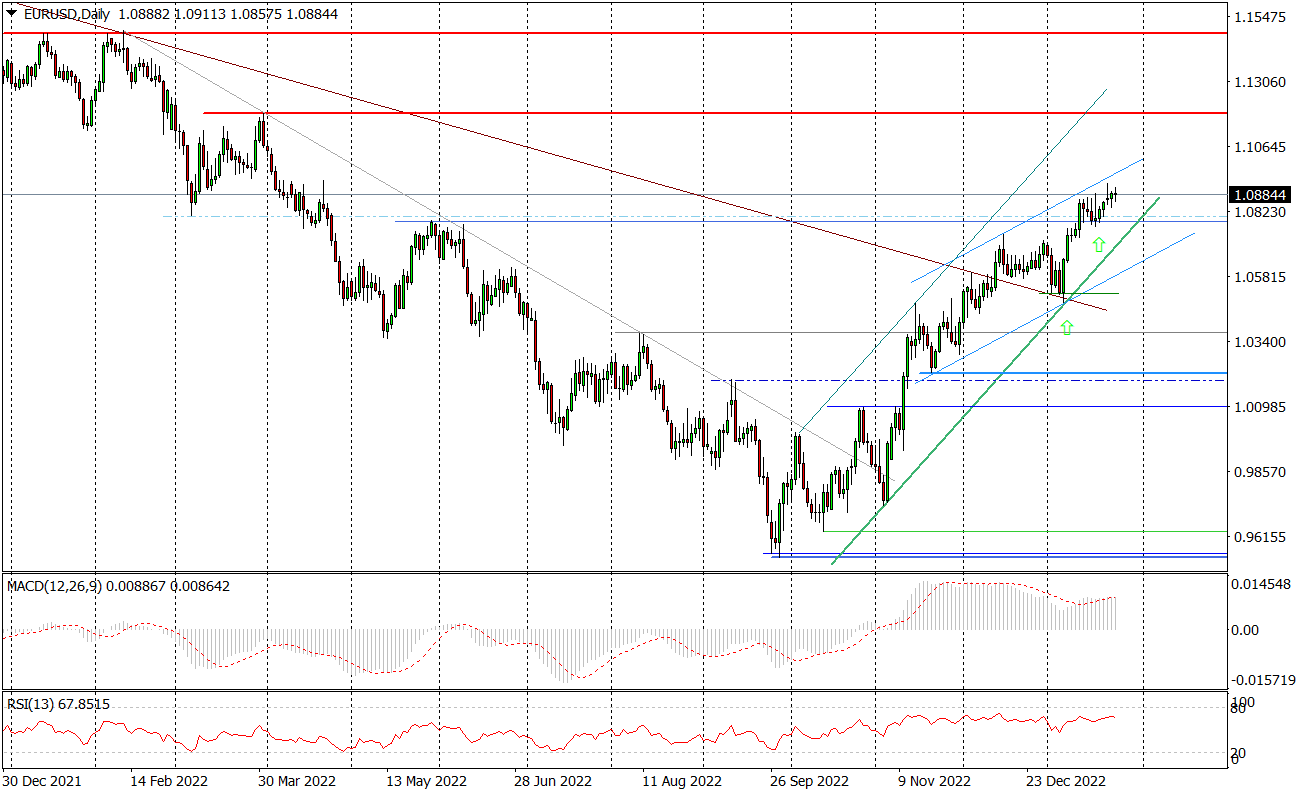

On Wednesday, EUR/USD remained stable, moving in a narrow range of USD 1,0858-1,0911 and for the third day stuck below USD 1,09. The first opportunity to get the eurodollar out of this temporary market stagnation will be the preliminary data on the dynamics of the American GDP in the fourth quarter of 2022, published on Thursday. However, it is more likely that the next meeting will be such an impulse for stronger changes Federal Reserve.

Daily chart EUR / USD. Source: Tickmill

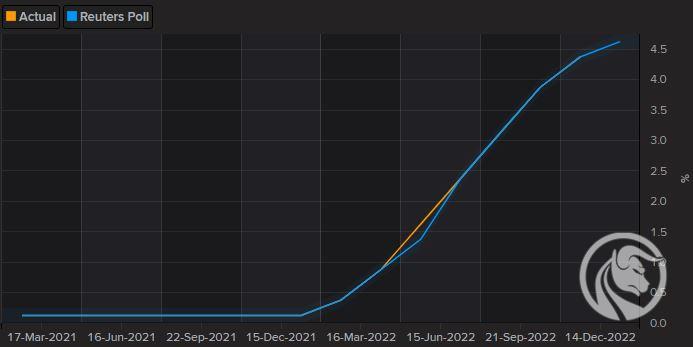

Exactly in a week the Fed will decide what to do with interest rates and monetary policy in the US. Analysts polled by Reuters forecast a 25 basis point hike next Wednesday. This will mean that the fluctuation range for the federal funds rate will increase to 4,50-4,75 percent. from 4,25-4,50 percent. yet. 68 out of 83 surveyed economists believe in such a scenario, while 15 of them assume an increase of 50 basis points.

US interest rates (forecast). Source: Reuters

It is not the end

This will not be the end of interest rate hikes in the US yet. Another increase, also by 25 basis points (to 4,75-5,00%), is expected at the March meeting of the Fed. Only then is a break expected.

Interest rates in February will not only be raised by the Fed, but also European Central Bank (ECB). It will do so a day later, on Thursday, February 2. The market assumes that the rate hike will be 50 basis points. As a result, the deposit rate will increase to 2,50 percent and the refinance rate to 3,00 percent. It promises to be a hot next week for EUR/USD and the entire financial market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)