EURUSD went up after the meeting of the European Central Bank

The EURUSD rate reacted with an increase to the results of the completed ECB meeting. Thus, he made a return from an important support zone, which removes the risk of stronger declines of this pair. It may be a problem for the ECB, because stronger euro stifles inflation, which the bank wants to stimulate.

European Central Bank (ECB) has maintained an ultra-loose monetary policy in the euro area without changing any of its basic elements (interest rates and the value of the asset purchase program) and is optimistic about the future.

In the bank's opinion, this year's GDP decline will be lower than previously expected. As a result, the euro area economy will shrink by 8%, not 8,7%. as the bank forecast in June.

The bank has not adjusted its inflation forecasts for this year, keeping its forecast at 0,3%. He maintained it despite the unexpected deflation in the euro zone in August.

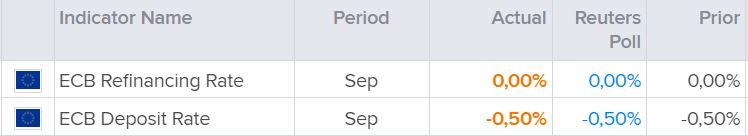

Interest rates in the euro area

The ECB also referred to the euro exchange rate itself, stating that it is closely monitoring it, because the appreciation of the common currency contributes to limiting the inflationary pressure. However, this did not scare investors. Words are not enough to make the euro cheaper. As a result, the EURUSD rate reacted with an increase to the results of the ECB meeting. And no wonder. The market was counting on the ECB to respond more strongly to the changed approach Fed to the inflation target, which, after all, postponed the date of the first interest rate hike in the US. Meanwhile, there was no such response from the ECB. So yes, until the end of 2021, the rates in Euroland will remain record low, but already in 2022 there will be expectations of their growth.

Source: Reuters.com

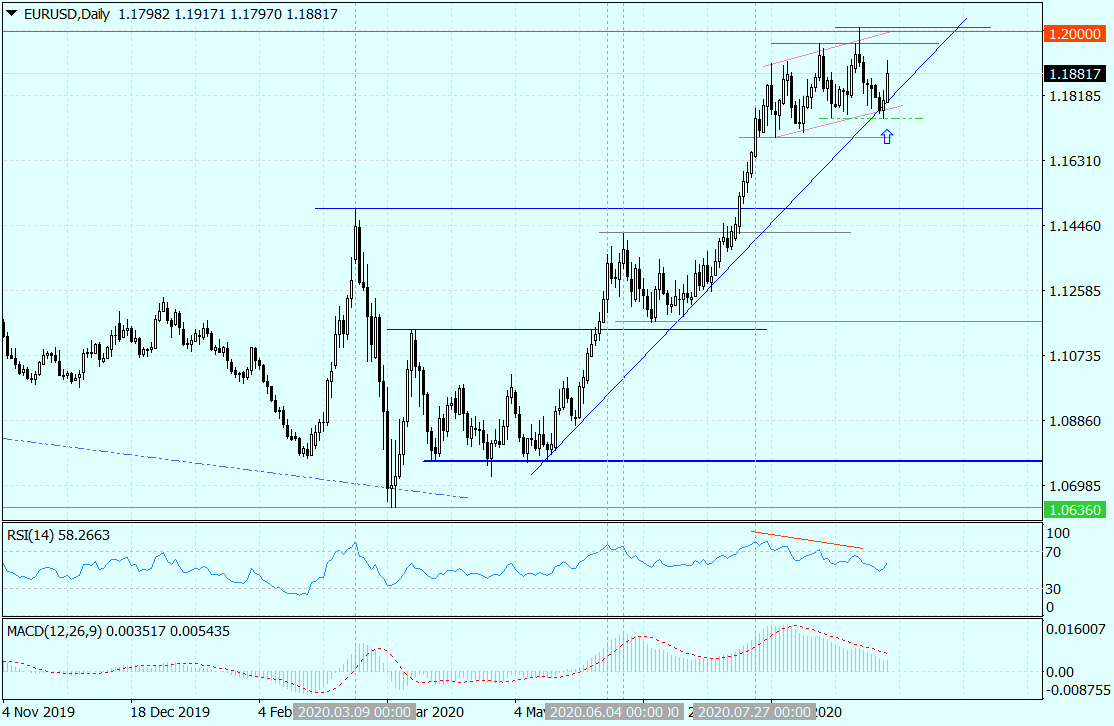

The EURUSD rate reacted with an increase to the results of the ECB meeting, confirming the earlier return from the 1,1754-1,18 support zone, which was creates a 4-month uptrend line. This does not change the balance of power in the medium term and the thesis about the end of the upward trend in the EURUSD remains valid, but at the same time postpones the prospect of a decline in this pair. Moreover, in the next few days another attack on 1,20 is more realistic than a return below 1,18. When it comes to the probability of breaking both of these barriers, the chances of breaking above 1,20 are definitely smaller than for breaking 1,18 and declines towards 1,15.

Diagram EUR / USD, D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)