"EXIT" - a mega-trend among central banks for 2021

Moderate market reaction after the meeting Bank of England on monetary policy is worrying. The market expected balance sheet expansion to be limited to some extent - the Bank of England met these expectations, but did not exceed them. The market clearly believes that ultra-low interest rates take into account a possible constraint on the expansion of the balance sheet in the near future, regardless of its scale. He also believes that central banks will announce the curtailment process well in advance to prevent it "Hysterical limiting" similar to the one we observed in 2013.

In our opinion, however, all the conditions are in place for this situation to get out of hand.

About the Author

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

Althea Spinozzi, Marketing Manager, Saxo Bank. She joined the group Saxo Bank in 2017. Althea conducts research on fixed income instruments and works directly with clients to help them select and trade bonds. Due to his expertise in leveraged debt, he focuses particularly on high yield and corporate bonds with an attractive risk-to-return ratio.

# 1. There is no getting away from limiting

The Bank of England's monetary policy meeting was important because it confirmed one of the trends most worried about by the financial market: world central banks are gearing up to reduce an unprecedented amount of stimulus.

In other words, if central banks do not go through this process now, they will do so at a later date. The longer they wait, the more vulnerable the financial market becomes. Indeed, due to the dynamic economic recovery, a tightening of financial conditions may become necessary sooner than anticipated.

It is like a card game: which central bank will be the first to initiate balance sheet constraints, and which will play its card best? Suppose the Bank of England was a bit more aggressive yesterday than the market would like. This could lead to a sell-off of British government bonds that would easily sweep US and European bonds as well. In fact, the aggressive approach of the Bank of England means that the Federal Reserve has lagged behind and should have considered containment sooner than the date communicated to the market. In such a situation, 1,75-year government bond yields could overcome the resistance at 2% and move towards the worrying resistance level of XNUMX%.

Would put it European Central Bank at a disadvantage because of profitability German government bonds they've been going up for months. They are approaching a break above the resistance at -0,15% towards positive values - for the first time since 2019.

This week, the ten-year German government bond yields broke the resistance at -0,20% and went up by as much as 0,16%. If there is a break above this level, they could quickly jump to 0%. German bond yields remain in a narrow upward wedge, while the Relative Strength Index (RSI) is falling, which means that the upward trend is weakening and may reverse. In such a situation, yields could fall to 0,40%.

A similar situation can be seen in the case of futures contracts for German Treasury bonds (Euro Bund). Comment from our technical analysis guru, Kim Cramer:

- Over the past 4-6 weeks, Euro Bund futures have been in an increasingly narrow downtrend that creates a downturn-like pattern. The RSI indicator goes up, however, which means that the divergence between these values is deepening. In other words, the downtrend is easing to near exhaustion levels and a reversal may occur. If it breaks up, there is some resistance at 171,44, but the room for maneuver is as high as 171,91. A close below 169,47 will most likely drop to 168-167,50.

The meeting of the Bank of England dealt a blow to the policy of the ECB, which has been trying to keep the yields of European bonds in check for many weeks. It is high time to realize that there is no escape from limiting balance sheet expansion at the global level, even as part of the ECB's ultra-soft monetary policy.

# 2. Investors have already made their choice

The choice has been made between corporate bond risk and duration, and investors are now awaiting further developments. In this context, investors had to choose between the risk of corporate bonds or the duration of the bonds.

In both cases, the goal was the same: obtaining sufficiently high profitability to protect against an increase in inflation.

Apart from that, however, the approaches differ fundamentally. It is like choosing between sudden and slow death because interest rate risk has a very negative effect on duration, while credit risk can contribute to insolvency.

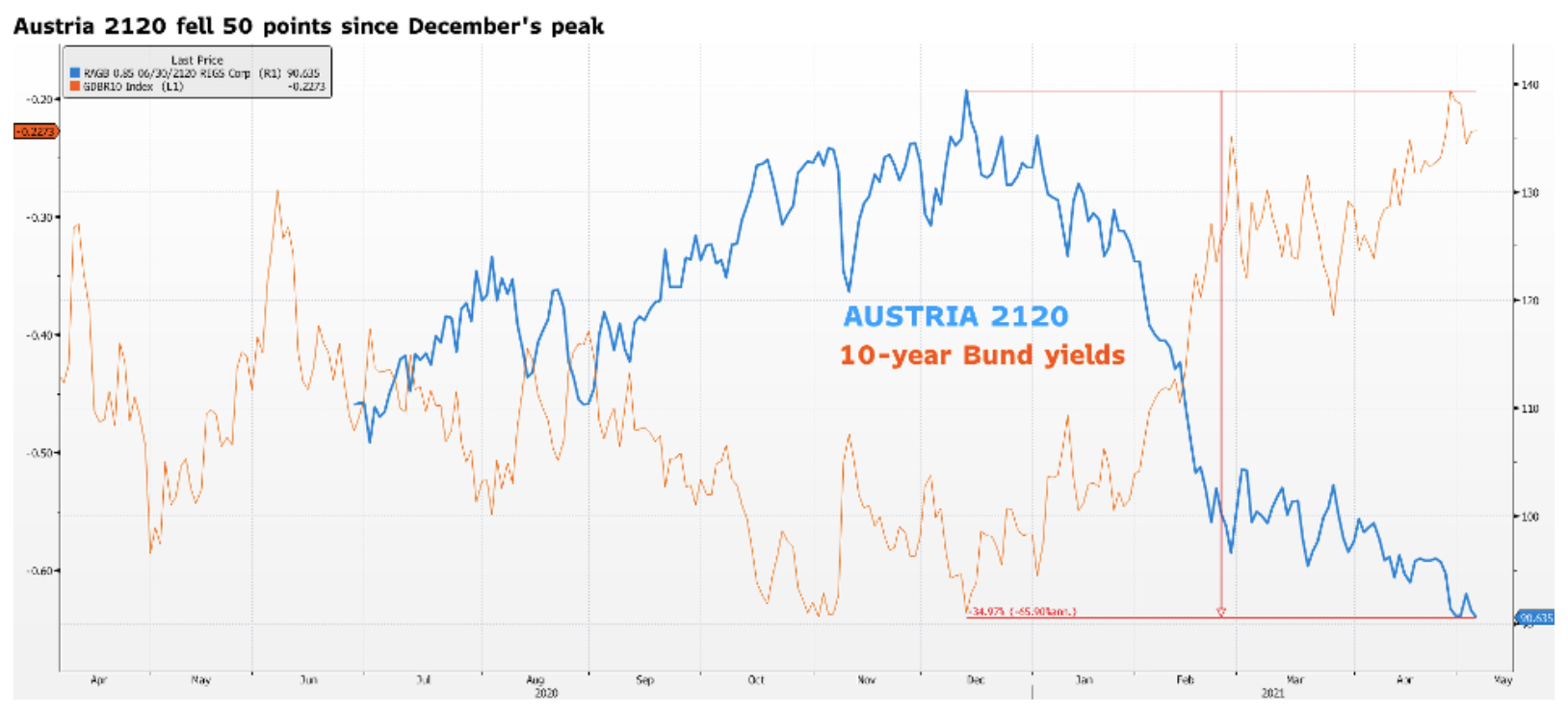

Take Austria 2120 as an example. They were issued in June 2020 with a coupon of 0,85%. A low coupon provides little protection against changes in interest rates. Since December, when German government bond yields began to rise, these bonds have plunged significantly, losing around 50 points in nominal terms and 35% in terms of their price.

The problem is that the rise in German bond yields has only just begun. Rising yields in the United States and the fall elections in Germany point to the only possibility: the yields on German government bonds will turn positive. It will be painful for ultra-long bonds issued in extraordinary circumstances, as accommodative actions of central banks around the world curbed the risk premium. This means that the price of these bonds can easily drop another 20-30 full points, and you should ask yourself how long are we willing to hold this instrument?

Perhaps pension and insurance funds can withstand low valuations for a while, but what will be the fate of smaller investors? While major players have bet on duration, general cargo has opted for high-yield corporate bonds. Neither of these risks is optimal, but I personally know what I prefer. In an environment of rising interest rates, I have no hesitation in avoiding the risk of duration.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)

Leave a Response