The spectrum of interest rate cuts by the FED is hanging above EUR / USD

James Bullard, president of the Fed branch of St. Louis, thinks that interest rates in the US had to be cut off at the June meeting. He was the only one who voted for this option, while the other nine decision-makers were in favor of keeping interest rates at the current level, which means leaving the federal funds rate in the 2,25-2,50 range.

Read: The Fed - one of the most influential institutions in the world

FED will lower interest rates?

In Bullard's opinion "Inflation rates have fallen significantly since the end of last year and are now 40 to 50 basis points below the FOMC inflation target of 2%." therefore, the cut of interest rates would now protect against further slowdown of inflation, while at the same time protecting the economy from stunting economic growth.

Bullard's opinion is important for the markets now because they treat it as a kind of leading indicator for future Fed decisions. In this situation it is not surprising that the market is currently waiting for a series of interest rate cuts in the US. The most convincing reason for this are the recent projections of changes in interest rates. Admittedly, the consensus assumes that interest rates will be kept at current levels until the end of the year, but it is a consensus built on a slight advantage. Just one vote. The "dots" show that as many as 7 decision-makers see two cuts in rates this year, and one assumes a 25bp cut. The market concludes that a drop in inflation, as forecast by the Fed itself, or a few worse macroeconomic reports, will quickly convince 1-2 decision-makers to cut cuts and they will become a fact. It is not surprising then that a cut is expected at the meeting on July 30-31 this year. This, in turn, will start a cycle that should bring rates down to at least 1,50-1,75 percent.

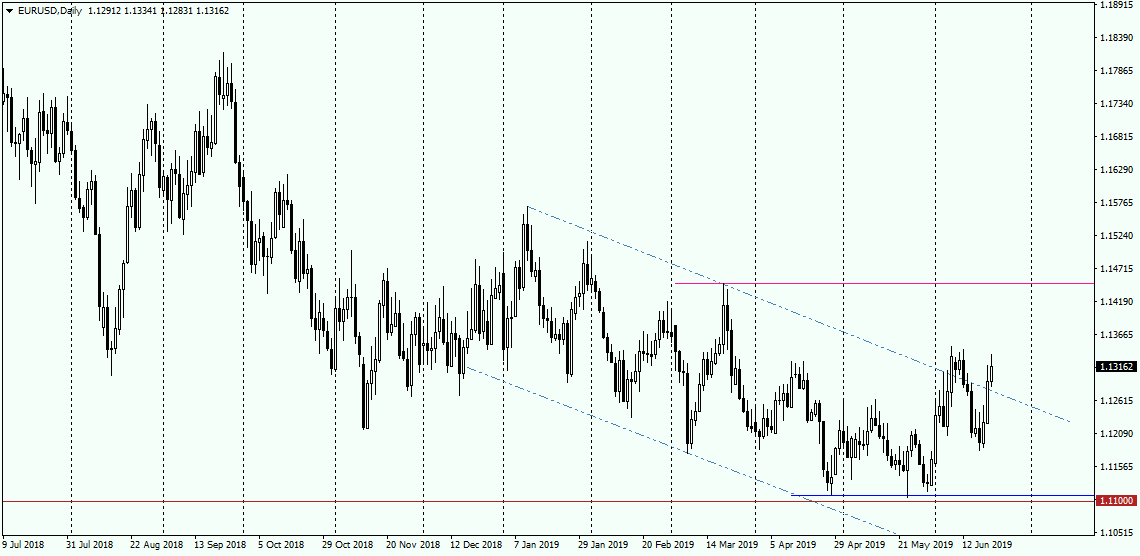

Waiting for interest rate cuts will create supply pressure on the dollar, pushing the exchange rate EUR / USD to higher and higher levels. And despite the fact that even before the Fed meeting, market expectations regarding the scale of money cost cuts seemed exaggerated. Potential goal EUR / USD on holiday is 1,1448 (maximum from March). Why not higher? It should not be forgotten that the risk of loosening monetary policy is also hanging over the common currency, which will certainly limit the scale of growth.

EUR / USD chart, daily interval. Source: MetaTrader 4 Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)