Forex: On average, for the quarter, 40% of Polish traders earned in 2017 year

Polish Forex brokers published their clients' statistics for the fourth quarter of 2017. This time, the reports are at the same time a summary of the whole year of 2017, which was prepared for us by the Chamber of Brokerage Houses. How did native traders fall out? Surprisingly good. Statistically for the quarter, as much as 40% of traders finished with a profit. First things first.

See: Results of Polish traders for the third quarter of 2017

Statistics for the fourth quarter

Currency. Most traders, as much as 37%, reported a profit on currencies at DM Alior Bank. The mForex clients fared the worst again, even closer to the 70% loss threshold. A noticeable decline can be seen in Noble Securities, where 42% of traders achieved profit in Q6, while in the last quarter it was almost XNUMX% less.

CFD for goods. In the main role again DM Alior Bank. It's just that this time their clients have achieved the worst results (as much as 68,3% losing), while in the previous quarter they scored the best (54,% losing). In the first place are traders trading in BossaFX with the value 41,5%.

CFD on indices. Again, Alior Bank. As many as 81% of people finished fourth quarter there with a loss on indices. This is a fatal result, which differs significantly from the rest of the companies, where the earning rate has always exceeded 30%. In the first place TMS Brokers with the value 33,8%, with the advantage of 0,1% over BossaFX.

CFDs on bonds and interest rates. Alior remains the main hero of the fourth quarter. Alternately with negative and positive messages. Profit was recorded by all clients who traded on instruments based on interest rates and bonds. However, you can assume that there were relatively few of them. The worst came Noble Securities (60% losing).

CFD per share. Among the brokers offering trade in share contracts, XTB customers with 35,1% earners scored the best. For the second quarter in a row, the Noble Securities clients fell the worst, again recording the result at 100%. Such a bad result may suggest a small statistical sample in the measurement.

All values presented in the tables are given in percentages.

Forex

| Broker | XTB | BOSSAFX | TMS Brokers | Noble Securities | DM Alior Bank | mForex |

| Profit | 34,3 | 36,8 | 34,3 | 36,3 | 37 | 30,4 |

| Strata | 65,6 | 63,2 | 65,7 | 63,7 | 63 | 69,6 |

CFD for goods

| Broker | XTB | BOSSAFX | TMS Brokers | Noble Securities | DM Alior Bank | mForex |

| Profit | 36,3 | 41,5 | 34 | 37,8 | 31,7 | 35,6 |

| Strata | 63,7 | 58,5 | 66 | 62,2 | 68,3 | 64,4 |

CFD on indices

| Broker | XTB | BOSSAFX | TMS Brokers | Noble Securities | DM Alior Bank | mForex |

| Profit | 32,4 | 33,7 | 33,8 | 30,4 | 19 | 33,3 |

| Strata | 67,6 | 66,3 | 66,2 | 69,6 | 81 | 66,7 |

CFDs on bonds and interest rates

| Broker | XTB | BOSSAFX | TMS Brokers | Noble Securities | DM Alior Bank | mForex |

| Profit | 48,9 | - | 68,3 | 40 | 100 | 38,5 |

| Strata | 51,1 | - | 31,7 | 60 | 0 | 53,9 |

CFD per share

| Broker | XTB | BOSSAFX | TMS Brokers | Noble Securities | DM Alior Bank | mForex |

| Profit | 35,1 | 30,4 | 32,1 | 0 | - | 7,1 |

| Strata | 64,9 | 61,6 | 67,9 | 100 | - | 92,9 |

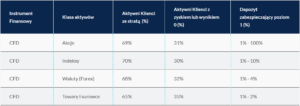

Additional Information

XTB, as the only broker, has expanded the scope of reported information about order execution data and the average spread table. The average execution time of orders was 30 milliseconds (in the previous quarter it was 29 milliseconds). While "Standard lead time", i.e. the maximum time in which 99 was realized% of orders amounted to 188 milliseconds (in the previous quarter they were 173 milliseconds), which is slightly worse than in the third quarter of 2017.

slides:

- Market mode: 74.39% of transactions performed with a price slippage equal to 0, 11.92% with positive and 13.68% with negative;

- Instant mode: 67.87% of transactions made with 0 deviation from the order price, 16.37% with positive deviation and 15.75% with negative deviation;

- Rejection of orders: the percentage of bids for market orders amounted to 1.04%, and the percentage of bids for instant orders 1.74%.

The average spreads table is available HERE.

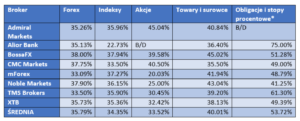

Foreign Forex brokers

Although the obligation to publish quarterly statistics is imposed by the Polish Financial Supervision Authority only on Polish brokerage houses, two foreign brokers - Admiral Markets and CMC Markets. How did Polish traders using the services of these companies fall out? A bit worse. The results are presented in the tables below.

customers CMC Markets it went much worse than in the third quarter. 32% of traders made a profit on currencies, while as much as 3% 39 months earlier. There is also a clear decline in the indices - from 37% to 30%.

W Admiral Markets there was a slight increase among currency traders compared to the third quarter - from 34,61% to 35,24%. Unfortunately, in the case of indices, the trend seen in all brokers is confirmed and over 4% more traders trading in the popular Admiral recorded a loss during this period.

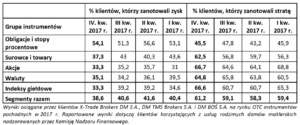

Statistics for the whole year 2017

In its report, IDM compiled all four quarters and showed average results for each of them, without regard to segregation between individual brokers. The study included data from X-Trade Brokers DM, DM TMS Brokers and DM BOŚ.

The data show that the fourth quarter turned out to be definitely the worst for Polish traders, where the average percentage of earners dropped below 40% for the first time. Analyzing the changes over the individual intervals, it can be seen that the weakest result on the indices and shares contributed to this.

In the table below, we find a breakdown by individual instrument classes for the entire year of 2017.

Derivatives for bonds and interest rates turned out to be the best. As many as 53,8% of those who traded on these values recorded a profit. The second in the order are raw materials and goods with the result of 41% earners. Interestingly, the instruments that are most popular among retail traders, ie currencies and stock indices, were the worst. This is probably caused by the largest statistical sample.

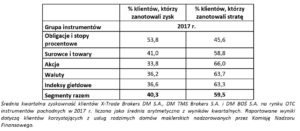

Average result for all brokers

Comparic.pl also prepared a list that includes statistics provided from all Polish brokerage houses, together with the two foreign brokers mentioned above. Applications are consistent. Approx. 40% traders recorded a profit in the 2017 year on a quarterly basis.

The data confirm very good results for the bond market and interest rates as well as goods and raw materials. The worst performers are CFD per share, then indexes. Currency trading was placed in the middle of the statement. Details in the table.

What awaits us in the year 2018

Leverage restrictions planned by government and EU representatives are not yet final. Nevertheless, regulatory changes resulting from the entry into force of the MiFID II Directive force brokers to intensify activities aimed at informing clients about investment risk and offering them "adequate" services in relation to their knowledge and experience. We are curious whether next year, in the next comparison, we will notice a tendency that will indicate that the introduced changes had a positive impact on the percentage of earners.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)