"Golden week" in Japan, May weekend and ... trading on Forex

This year, the long weekend in May is really long. And not only in Poland. In Japan, the so-called "Golden week" Golden Week) is a national holiday, which usually runs from 29 April to 3 May. This time the calendar has been arranged in such a way that the days off are not 5, only until 9.

Be sure to read: Everything you need to know about the Central Bank of Japan

The longest break in trade since the Second World War

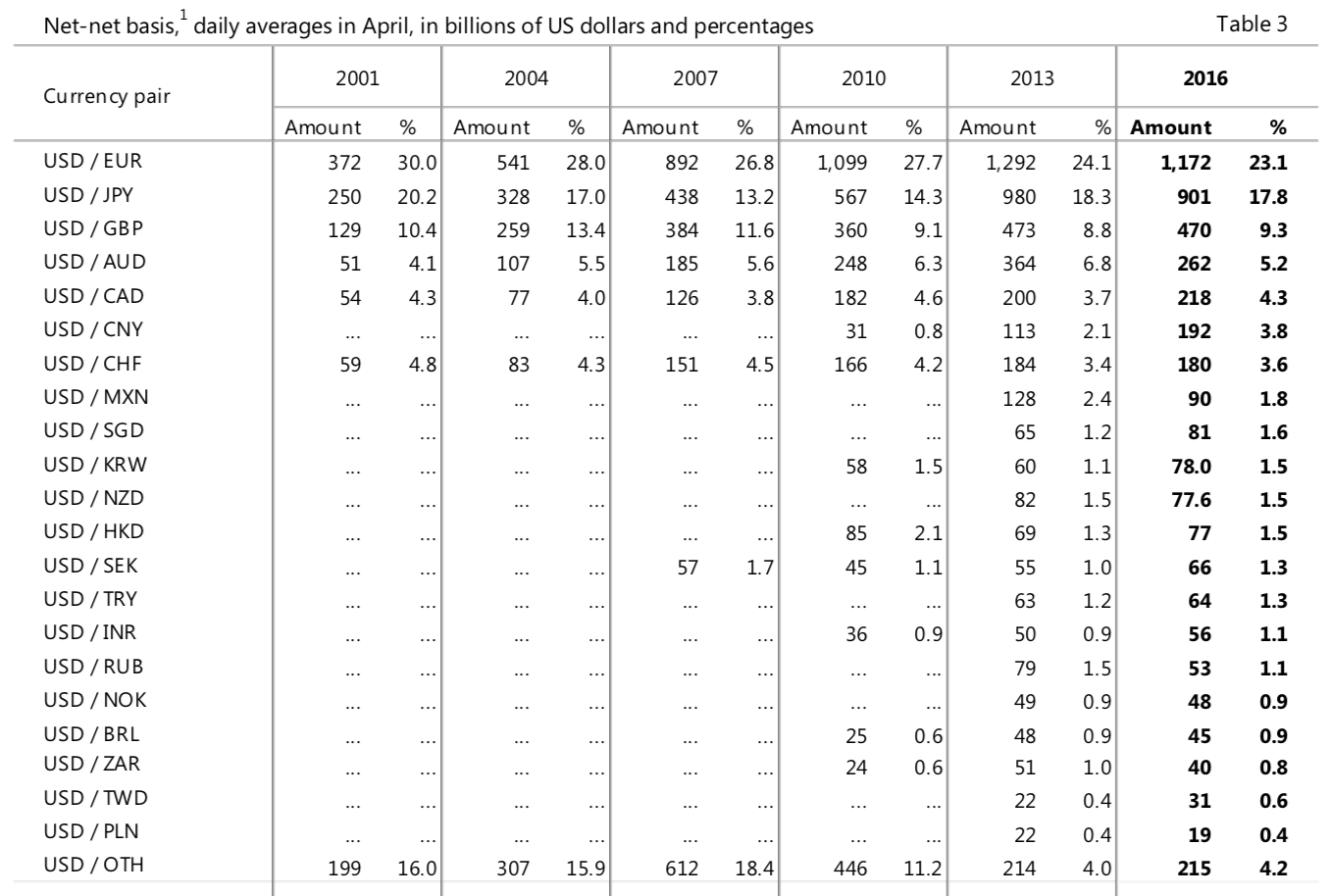

Does the lack of activity on the part of Japanese investors during the holiday period have any impact on the trading of Europeans? Of course. According to the report of the Bank for International Settlements (Bank for International Settlements - BIS) concerning the Forex market for 2016 year, Japan is responsible for 6,1% of global OTC trading. Little? The United States is responsible for 19,5%, and yet it is the largest economy in the world. It is worth noting that this year's "rest" in the form of 9 days without trading sessions in Japan is the longest downtime in approx. 70 years (!).

The study on currency markets and OTC derivatives (OTC market) is carried out by the Swiss bank once every 3 years. The latest report was released in April XUMUMX.

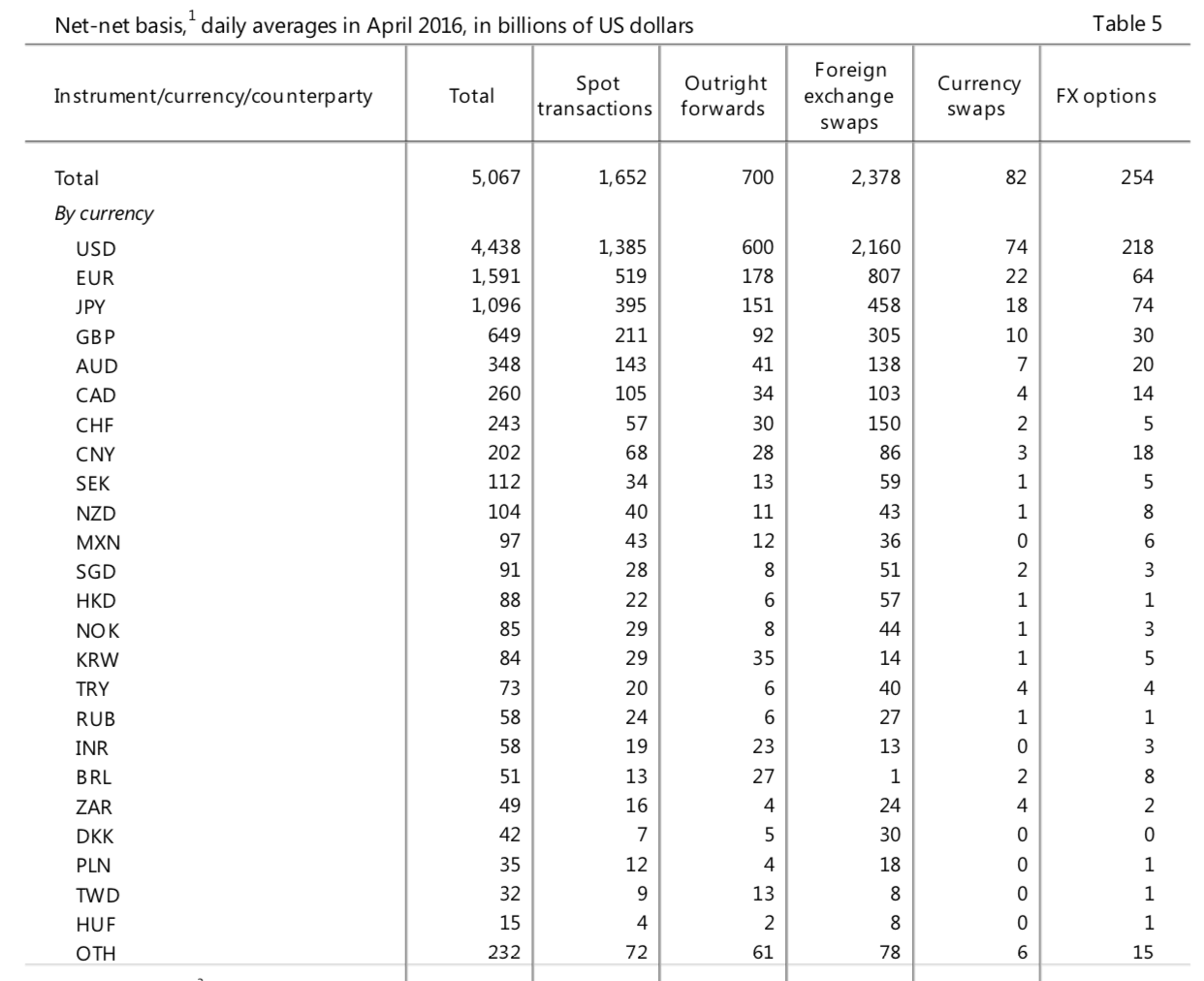

Moving on, the Japanese yen is the third most "popular" currency in the world in terms of daily turnover - clearly behind the leading US dollar and slightly behind the euro.

In addition, the USD / JPY pair is the second most popular instrument in the Forex market, and the market share in the OTC market is 17,8% and almost 2 times more than in the case of GBP / USD. For comparison, USD / PLN is only 0,4%.

Week of limited liquidity

In connection with the stretched national holiday, quite important from the perspective of the market currencies, we can expect limited liquidity, and therefore exchange rate volatility, mainly in Asian hours and in Japanese yen pairs. The decrease in liquidity is an opportunity for manipulation and the occurrence of so-called flash crashes. There is no need to look for examples of such phenomena.

On January 2, 2019, there was a sudden collapse in the pairs with the yen. After 23:00 Polish time, just 30 minutes was enough for the price of USD / JPY to move to -4%, or almost 400.0 pips down - without the publication of macroeconomic data or other logical justification. Coincidence, error, manipulation? Certainly the period "Post-New Year" he favored this phenomenon.

The period of limited liquidity raises an increased probability of price slippage observed, whether wider spreads are observed, as well as the occurrence of price gaps at session opening (mainly after the weekend). In connection with the above risks, it is worth considering limiting the market exposure on selected instruments during the Japanese holiday. Some brokers have already reserved the possibility of reducing leverage at this time (mainly applies professional clients with access to higher leverage) on currency pairs associated with JPY and Asian stock indices.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)