FTSE Vietnam 30 - How to Invest in Vietnamese Equities [Guide]

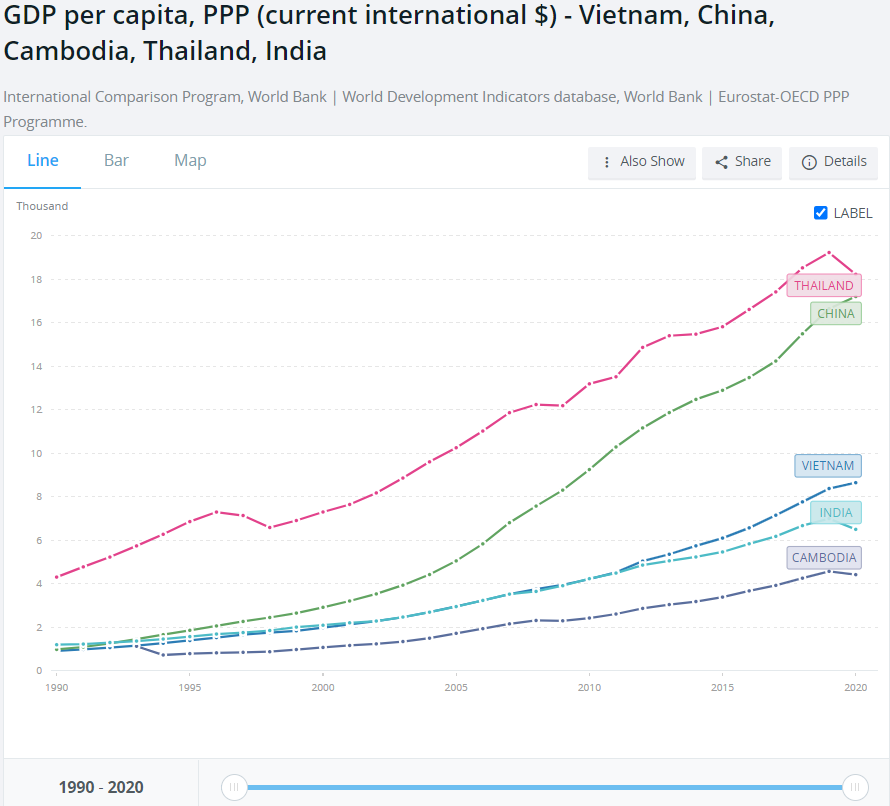

How to invest in Vietnamese stocks? Does it make sense to be interested in the FTSE Vietnam 30 index? It is worth bearing in mind that Vietnam is one of Southeast Asia's most promising economies. The population of this country is over 90 million. Vietnam is also a member of the World Trade Organization and ASEAN (Association of Southeast Asian Nations). The country has been developing dynamically over the last three decades. Thanks to this, the country is located in 23rd place in terms of the size of the economy (after taking into account the purchasing power parity). Construction of modern Vietnam began in the mid-30s. It was then that the plans to build a socialist economy were abandoned. Vietnam has opened up to foreign investments and has started to integrate more into the global supply chain. Thanks to economic reforms, the country's standard of living has improved noticeably. Admittedly, this is not a success at the level of China, but Vietnam has grown faster in the last XNUMX years than countries like Kambodża i Indie.

Source: world Bank

The rise in wealth, combined with a decent demographic situation, make the outlook for Vietnam very positive for the coming decades. According to PwC, in 2050, Vietnam is to be in the top ten countries with the highest GDP (in purchasing power parity). Vietnam is a very open economy. This is indicated by the ratio of trade turnover to GDP. In Vietnam, it is over 200%. For comparison, China has the aforementioned rate at 34,5% and the United States 23,4%. Vietnam is therefore a country very dependent on the condition of international trade. This is helped by the strategic location of Vietnam, which is one of the main places where Western companies relocate their production. The main destination of exports is the United States, which is responsible for over 20% of exports. China is in second place (16,5%).

Thanks to low labor costs and a favorable geographical location (close to the main sea trade routes), the country is an ideal place to locate investments in the manufacturing industry. For example, several dozen percent of Samsung smartphones are manufactured in Vietnam.

Apart from the industrial sector, agriculture is quite well developed. Vietnam is one of the largest producers of rice (6th place in the world), coconut (6th place), tea (6th place in the world), coffee (2nd place) and natural rubber (3rd place).

Capital market

The operation of the modern capital market in Vietnam began at the turn of the 1998th and XNUMXst centuries. In XNUMX, the Vietnamese government passed a law establishing a stock exchange. After two years, the Ho Chi Minh City Stock Exchange was launched, which became the main place for trading Vietnamese securities.

READ: NIKKEI, Hang Seng, KOSPI - how to invest in Asian indices?

FTSE Vietnam 30 Index

One of the major indices giving exposure to Vietnamese companies is FTSE Vietnam 30 Index. It groups together the 30 largest companies listed on Ho Chi Minh City Stock Exchange. The index was created in order to be a benchmark for ETFs or derivatives. The weights in the index are limited to 10%. This is to prevent excessive concentration of shares in the index. The index is revised every six months in March and September (on the third Friday of selected months).

The VIET 30 index is dominated by real estate companies, which account for approximately 34% of the index capitalization. Another sector with high exposure is "Food, Beverages and Tobacco", which accounts for around 20% of the index. Below is a summary of selected components of the FTSE Vietnam Index.

VIET 30 index chart (CFD on the FTSE Vietnam 30 index), interval D1. Source: xNUMX XTB.

Masan Group Corp

The company was founded in 1996. It is one of the largest private companies in Vietnam. Masan produces and distributes food and drink in Vietnam. The products sold include: soy sauce, instant noodles, instant coffee, breakfast cereals, processed meat and beer. The brands owned by the company include CHIN-SU, Nam Ngu, Tam Thai Tu, Omachi, Kokomi, Vinacafe, Vinh Hao. In addition, the company also has the WinCommerce sales platform. It is also worth adding that the company also operates in the mining and chemical segment. The company became more widely known among Western investors after the KKR fund took over 10% of the subsidiary Masa Consumer Corp.

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 38 187,6 | 37 354,1 | 77 217,8 | 88 628,8 |

| Operational profit | 6 276,9 | 7 225,7 | 1 195,7 | 11 273,2 |

| Operating margin | 16,44% | 19,34% | 1,55% | 12,72% |

| Net profit | 4 936,5 | 5 557,6 | 1 233,9 | 8 562,9 |

Vietnam Dairy Products JSC

The company was founded in 1993, after 10 years the company made its debut on the Ho Chi Minh Stock Exchange. Vietnam Dairy Products is one of the largest Vietnamese companies operating in the food sector. The companies are involved in the production, marketing, wholesale and retail distribution of dairy products. These include liquid milk, powdered milk, yoghurt, frozen yoghurt, ice cream, cheese. In addition, the company diversifies its product portfolio, including o soy milk, rice milk, bottled coffee and juices. Additionally, Vietnam Dairy Products sells other non-alcoholic beverages.

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 52 561,9 | 56 318,1 | 59 626,3 | 60 919,2 |

| Operational profit | 11 876,5 | 12 797,1 | 13 539,4 | 12 727,6 |

| Operating margin | 22,60% | 22,72% | 22,71% | 20,89% |

| Net profit | 10 227,3 | 10 581,2 | 11 098,9 | 10 532,5 |

Vingroup JSC

The company was founded in 1993 by young Vietnamese in Ukraine. Then, as Technocom, it started operating in the food sector (Mivina brand). In 2000, the company moved its operations to Vietnam. Seven years after returning to Vietnam, the company made its debut on the Vietnamese stock exchange. In 2010, Vingroup sold its business in Ukraine for € 150 million to Nestle. The company operates in the real estate, production and technology sectors. Vingroup deals with, inter alia, production, sale and management of apartments and shops. The company also operates entertainment venues. Vingroup also operates in the automotive segment (36 cars sold in 2021). The company also has subsidiaries operating in the education market. Recently, the company announced that it intends to withdraw from the smartphone and TV market.

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 121 894,4 | 130 036,0 | 110 490,0 | 125 687,9 |

| Operational profit | 13 615,2 | 15 756,4 | 13 167,5 | 2 844,7 |

| Operating margin | 11,17% | 12,12% | 11,92% | 2,26% |

| Net profit | 3 823,7 | 7 545,9 | 5 464,6 | -2 513,9 |

Hoa Phat Group JSC

It is a leading industrial company operating in Vietnam. The company was founded in 1992 and after 15 years it made its debut on the Vietnamese stock exchange. Currently, the company operates in 5 sectors: iron and steel (e.g. hot-rolled steel), steel products (e.g. steel pipes, steel wire), agricultural (e.g. pig breeding, fertilizer production), real estate (e.g. office buildings) and Household appliances and furniture (including office and home furniture). The most important segment is the production of steel, which accounts for approximately 90% of the company's revenues. The company's production capacity exceeds 8 million tonnes of steel per year.

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 55 836,4 | 63 658,2 | 90 118,5 | 149 679,8 |

| Operational profit | 10 072,1 | 9 030,9 | 15 292,3 | 37 008,4 |

| Operating margin | 18,04% | 14,19% | 16,97% | 24,73% |

| Net profit | 8 573,0 | 6 871,4 | 12 743,6 | 32 054,5 |

Vietjet Aviation JSC

It is the first private airline established in Vietnam. The company states that it is the largest airline in domestic flights. The share on this market was 2021% in 41. Vietnam Airlines is in the next position with a 35% share. Currently, Vietjet has a fleet of 76 aircraft with an average age exceeding 3,4 years. The outbreak of the COVID-19 pandemic caused a significant decrease in flights. In 2021, VietJet carried 5,3 million (domestic) passengers. For comparison, in 2019 the company transported 25 million passengers (including 17,5 million domestic passengers). The decrease in the number of passengers transported affected the company's revenues, which forced a reduction.

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 53 577,2 | 50 602,9 | 18 220,3 | 12 998,4 |

| Operational profit | 5 808,9 | 3 847,6 | -2 017,6 | 177,6 |

| Operating margin | 10,84% | 7,60% | -11,07% | 1,37% |

| Net profit | 5 335,1 | 3 807,3 | 68,7 | 100,2 |

Saigon Securities

The current name of the company is SSI Securities Corporation. The company was founded in 1999 as the first private brokerage house in Vietnam. The company currently employs 1200 people in 12 offices. Currently, SSI has an 11% share in the brokerage market with over 300 brokerage accounts. In addition to retail activities, the company also operates on the institutional market (brokerage services) and has an investment banking department. In investment banking, the company advised, for example, on divestment in Vietnam Dairy Products (worth $ 000 million) and advising on the IPO of Vincom Retail (worth $ 400 million). Additionally, SSI has an asset management department (open-ended, closed-end funds, ETFs). It is also worth adding that SSI Asset Management was the first Vietnamese company with a license to invest outside Vietnam (742).

| Billion VND | 2018 | 2019 | 2020 | 2021 |

| revenues | 3 672,8 | 3 234,9 | 4 366,8 | 7 443,1 |

| Operational profit | 1 567,0 | 1 098,6 | 1 552,4 | 3 252,3 |

| Operating margin | 42,66% | 33,96% | 35,55% | 43,70% |

| Net profit | 1 304,9 | 909,2 | 1 257,4 | 2 695,9 |

How to invest in Vietnamese stocks

CFDs

An interesting and accessible option for retail traders is to speculate on contracts for differences (CFD). VIET 30 index it is very rarely found in the offers of Forex brokers, but it is offered by, for example, the Polish Brokerage House X-Trade Brokers SA. The leverage on this CFD is 1:10.

| Broker |  |

| End | Poland |

| FTSE VIET 30 symbol | VIET 30 |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

| Min. Lot value | price * 20 USD |

| Commission | - |

| Platform | xStation |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETFs and stocks

One option, though relatively inconvenient to gain exposure to most of the Vietnamese market, is to buy selected stocks of companies. If the investor does not want to choose individual companies by himself, only buy "Basket of Vietnamese stocks" it has the opportunity to take advantage of ETFs. One of them is FTSE Vietnam Swap UCITS ETF. This ETF is designed to mimic the FTSE Vietnam 30 index. It is worth noting that the ETF does not replicate the structure of the index directly (by purchasing shares) but through swap contracts with HSBC Bank. When investing in this type of fund, remember that the ETF does not have shares in its portfolio, and the rate of return depends on the financial condition of HSBC Bank (the other party to the swap transaction). In addition, the use of synthetic replication raises management costs, which in this ETF amount to 0,85%. The fund currently has approximately € 320 million in assets under management.

FTSE Vietnam Swap UCITS ETF Interval W1. Source: xNUMX XTB.

Brokers offering stocks and ETFs

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![FTSE Vietnam 30 - How to Invest in Vietnamese Equities [Guide] ftse vietnam 30 index - viet 30](https://forexclub.pl/wp-content/uploads/2022/04/ftse-vietnam-30-index-viet-30.jpg?v=1649830339)

![FTSE Vietnam 30 - How to Invest in Vietnamese Equities [Guide] nzdusd](https://forexclub.pl/wp-content/uploads/2018/10/nzdusd-102x65.jpg)

![FTSE Vietnam 30 - How to Invest in Vietnamese Equities [Guide] crude oil, brent](https://forexclub.pl/wp-content/uploads/2021/09/ropa-naftowa-najdrozsza-102x65.jpg?v=1632736728)

Leave a Response