GlobalConnect, i.e. foreign shares on the WSE. Failure or success? [Guide]

From November 4, 2022, selected foreign shares can be traded on the Warsaw Stock Exchange. For this purpose, the WSE has created a trading platform Global Connect. From June 27, three more foreign companies can be traded on the Warsaw Stock Exchange. They will be Adidas, RWE and BASF. In total, since Tuesday's session, as many as ... 13 companies are available to investors.

In this article you will learn:

- What is GlobalConnect?

- Who brings companies to the platform and provides liquidity?

- What is the full list of companies available for trading on GlobalConnect?

- What are the pros and cons of this product?

- How does this solution compare to other exchanges in Europe?

What is GlobalConnect?

GlobalConnect is an Alternative Trading System (ATS) that allows you to invest in foreign companies that are admitted to trading by the Market Maker. Thanks to the specific structure, companies that will be listed on GlobalConnect will not have to file Prospectus or Information Document. What's more, they will not have to agree to the listing of shares on the Polish stock exchange.

The key element of GlobalConnect is the WAR, i.e. the Introducing Market Maker, which is Santander. It is WAR that is free to choose the companies available on GlobalConnect. It is likely that in a few quarters companies from the US stock exchange will appear. However, it is not known whether the animator will fulfill its promises.

Ultimately, over 100 shares are to be listed on the market or ETFs. Taking into account the current pace of joining companies on GlobalConnect, investors will have to wait a little longer for the promises of the Warsaw Stock Exchange to be fulfilled.

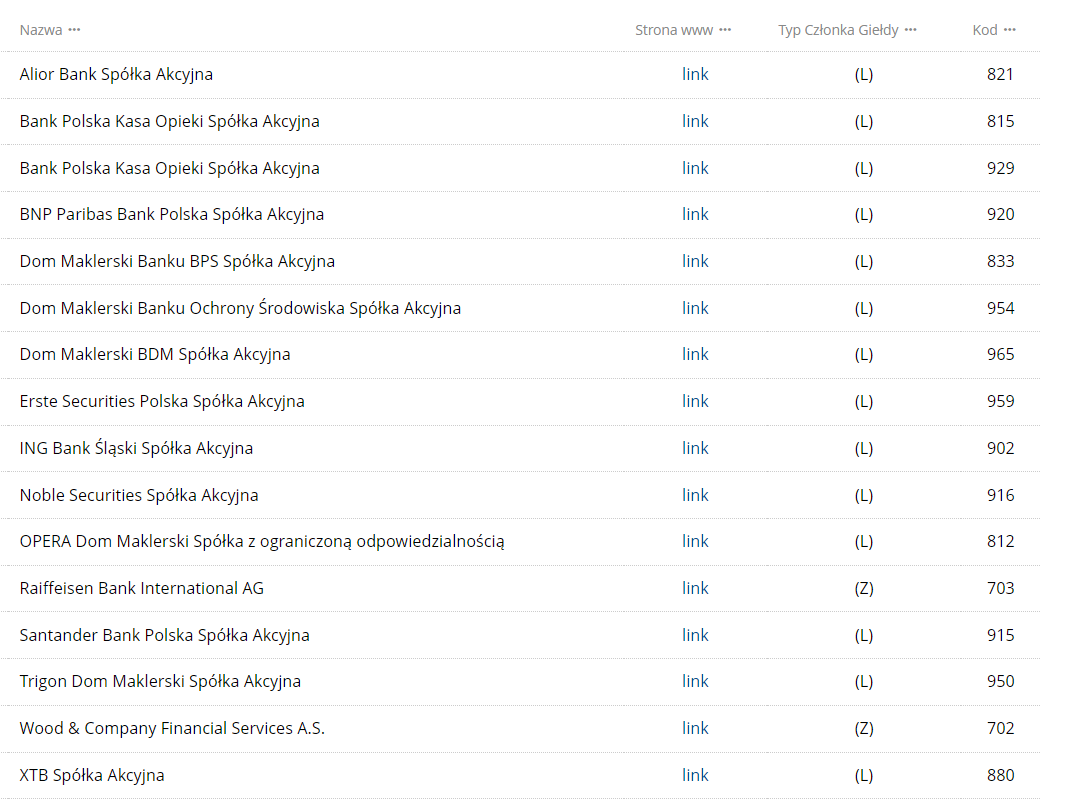

Currently, there are several brokerage houses connected to the market. The full list as of June 26 is available below:

source: WSE

The maximum spread is 5%. The quote is large, but it is worth remembering that in the case of trading in American companies (for now, this is the melody of the future), trading hours on the Polish stock exchange (9-17) do not coincide with the American session in most cases. Even so, a 5% spread is a very large value. If the company is valued at PLN 200. then the maximum spread is PLN 195 - PLN 205.

Why was GlobalConnect created?

The WSE tried to make investing in foreign shares as easy as buying and selling Polish shares listed on the Warsaw Stock Exchange. The WSE is modeled on the solutions of the Vienna Stock Exchange. Vienna Stock Exchange has three market makers, of which one has a dominant market share. There are less than 800 foreign companies and ETFs listed in Vienna.

The WSE said that building the market was a long-term process. This required a legal analysis. This forced the stock exchange to create an ASO and to acquire a market maker. In addition, brokerage offices had to be connected to the new market.

So far, the goal of this platform has not been achieved. The number of instruments available on the ASO is definitely too smallso that it can attract investors who really want to build a diversified portfolio consisting of foreign companies.

What stocks are available on GlobalConnect?

From June 27, 2023 There are 13 companies available on the GlobalConnect market. Of these, one company is listed on the Madrid Stock Exchange, the other on the Lisbon Stock Exchange. The other companies are listed on the Frankfurt am Main stock exchange. As you can see the prefix overall it is strongly exaggerated. It can be said that it is now a market with German characteristics.

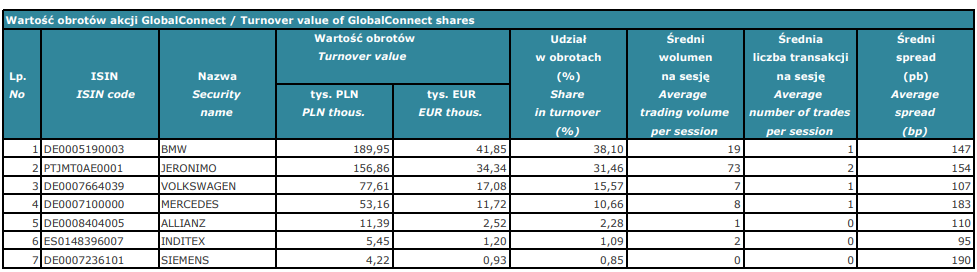

Below is a summary of turnover on foreign companies in May 2023. As you can see, the turnover is dominated by:

- BMW,

- Jeronimo Martins,

- Volkswagen

source: WSE

In the further part of this subchapter, we will briefly introduce the activities of all companies and describe the results of the 3 most popular companies in May 2023. What do the companies available on GlobalConnect do?

- Adidas – manufacturer and seller of sports shoes and clothes. It is one of the largest producers of this type in the world

- RWE – German producer and distributor of electricity

- Bayer – a German company operating on the pharmaceutical and chemical market

- Allianz – one of the largest insurance companies in the world and the largest insurer in Germany

- Bayerische Motoren Werke (BMW) – one of the most famous car manufacturers. The company's products are in the higher price range.

- Industria De Diseno Textil – a Spanish clothing company, owner of, among others, ZARA. One of the largest clothing companies in the world.

- Jeronimo Martins – Portuguese owner of the Biedronka chain, which is the largest retailer in Poland

- Mercedes-Benz Group – German manufacturer of luxury cars.

- Porsche Automobile Holding - the owner of Porsche brand. It is also a German car manufacturer.

- SAP SE – one of the world's largest IT companies. It is an "icon" of the German IT market.

- Siemens – it is a German industrial giant that operates in various industries (from industrial products to medical devices).

- Volkswagen – one of the most popular car manufacturers of such brands as VW, Skoda, Seat.

- Zalando – a German e-commerce company, clothes and shoes are sold on the platform.

The most popular companies from GlobalConnect

BMW

The capitalization of the company as of June 26 was €71,9 billion. The company was established in 1916. Its headquarters are in Munich. BMW stands for Bayerische Motoren Werke. The main activity of the company is the production and sale of cars, spare parts and car accessories. The brands belonging to the company are BMW, Rolls-Royce and MINI. The company also sells motorcycles under the BMW ark. Financial services (financing customer purchases, insurance) are a secondary activity. A secondary segment is fleet management services, which operates under the Alphabet brand.

| million € | 2019 | 2020 | 2021 | 2022 |

| revenues | 104 210 | 98 990 | 111 239 | 142 610 |

| Operational profit | 7 568 | 4 760 | 13 454 | 14 209 |

| Operating margin | 7,26% | 4,81% | 12,09% | 9,96% |

| Net profit | 4 915 | 3 775 | 12 382 | 16 327 |

Source: own study

BMW stock chart, D1 interval. Source: TradingView

Jeronimo Martins

The company's capitalization is around €16 billion. In Poland, the company is known for its chain of Biedronka stores. In addition, Jeronimo Martins runs a chain of Hebe drugstores on the Vistula River. In Colombia, the company runs a chain of grocery stores under the name Ara. In turn, in Portugal, the largest source of revenue are Pingo Doce supermarkets and the so-called "cash and carry stores" operating under the Recheio brand. It is also worth mentioning that the company also has side activities such as the Pongo Doce restaurant chain and Bem-Estar pharmacies. The Jeronymo cafe chain and the Hussel chain of sweet shops also have a slight impact on revenues. The company's headquarters is in Lisbon.

| million € | 2019 | 2020 | 2021 | 2022 |

| revenues | 18 638 | 19 293 | 20 889 | 25 385 |

| Operational profit | 721 | 668 | 820 | 1 004 |

| Operating margin | 3,87% | 3,46% | 3,93% | 3,96% |

| Net profit | 390 | 312 | 463 | 590 |

Source: own study

Jeronimo Martins stock chart, D1 interval. Source: TradingView

Volkswagen

The company's capitalization is €68 billion. The company was founded in 1937 in Wolfsburg. Volkswagen AG manufactures and sells cars in every major country or region. The company divides its business into four segments: passenger cars, LCVs, commercial vehicles and Power Engineering (production of diesel engines or turbomachiners (e.g. turbines). Volkswagen has a strong portfolio of brands. These include Volkswagen, Skoda, Seat, Audi, Lamborghini, Bentley, Ducati, Scania, MAN. The Volkswagen company belongs to the Porsche Automobil holding.

| million € | 2019 | 2020 | 2021 | 2022 |

| revenues | 252 633 | 222 884 | 250 199 | 279 232 |

| Operational profit | 16 019 | 10 057 | 15 952 | 18 220 |

| Operating margin | 6,34% | 4,51% | 6,38% | 6,53% |

| Net profit | 13 346 | 8 334 | 14 843 | 14 867 |

Source: own study

Volkswagen stock chart, D1 interval. Source: TradingView

Advantages of using GlobalConnect

- An investor can invest in selected foreign companies via a “Polish” brokerage account.

- It is possible to trade foreign shares during the session on the Warsaw Stock Exchange.

- Companies are quoted in Polish zlotys, so there are no currency conversion costs.

- The investor may receive benefits from the shares held (e.g. dividends).

- By using the offer of brokers registered in Poland, the investor will receive T-8c.

- Transactions are secured by a guaranteed clearing system.

- The settlement cycle is the same as on the WSE (T+2).

- Transactions are settled by the National Depository for Securities (KDPW).

Disadvantages of using GlobalConnect

- High spread, which significantly increases the real cost of executing the transaction.

- Very poor stock offer.

- No foreign ETFs.

- Problems with trading spin-off shares (separation of a new company from the structures of the "old" company).

- The problem in the case of taking over a company listed on GlobalConnect and paying for the transaction in shares.

- The problem may be the settlement of dividends received from foreign companies.

What is the solution of the Warsaw Stock Exchange compared to the Viennese market?

The WSE did not hide that its solutions were modeled on the Vienna Stock Exchange. Vienna offered brokerage houses access to foreign shares more than 4 years earlier than the WSE. It is therefore not surprising that the offer of the Vienna Stock Exchange is much richer for the time being. Currently, members of the Vienna Stock Exchange can buy or sell almost 800 instruments (stocks and ETFs) from over 20 countries. In the case of the WSE, access to foreign shares is very limited. These are 13 companies from Europe (Germany, Spain, Portugal).

Summation

GlobalConnect was created to facilitate access to foreign shares for Polish investors. However, it should be noted that the achievements so far are quite small. Of the 13 companies available to Polish investors, as many as 11 are listed in Frankfurt. For now, the platform does not allow trading in shares of American companies. It is possible that more companies will appear in the coming quarters. The offer also lacks foreign ETFs. Another problem of the market are high spreads and low investor interest. This is not surprising as trading conditions and a small number of instruments discourage trading. At the moment, it cannot be said that the road to 100 instruments listed on the ASO is fast. It is therefore difficult to talk about the success of GlobalConnect.

FAQ

When can I trade on shares available on GlobalConnect?

On the GlobalConnect market, orders can be placed between 9:05 and 17:05 CET.

What currency are companies quoted in?

An investor may purchase shares of companies available on GlobalConnect in PLN. Thanks to this, you will avoid currency conversion costs.

Is there no exposure to currency risk when purchasing shares on GlobalConnect?

By purchasing shares on GlobalConnect, the investor is exposed to exchange rate risk. This is due to the fact that the shares are only quoted in PLN. This means that the price of the German share shown on the order book is a derivative of: the share price in EUR, the EUR/PLN exchange rate and the market maker spread.

Is it possible to transfer securities of foreign companies between brokers?

Yes, this type of transaction is possible using FoP (Free of Payment). The fee for this transaction will be in accordance with the KDPW price list.

If another security is separated from the shares (i.e. spin-off), will the shares be traded on GlobalConnect?

Unfortunately, this will only be possible when a new share (new ISIN) is made available for trading on the platform by WAR.

Can I take advantage of lower tax rates on foreign dividends under a double tax treaty?

It all depends on how this case is solved by the brokerage house. If the brokerage house allows you to provide documents to avoid double taxation, the investor will be able to take advantage of preferential tax rates.

What currency will the dividend be paid in?

KDPW allows you to receive dividends in such currencies as: USD, EUR, GBP, HUF, CZK.

How are transactions settled on GlobalCONnect?

Transactions are settled in the same way as ordinary transactions on the Warsaw Stock Exchange.

Will the trading days be in accordance with the foreign or Polish calendar of holidays?

Trading on the GlobalConnect market is conducted on the same terms as trading in Polish shares. Therefore, free on the German or American market does not mean that you will not be able to trade shares in Poland.

Is buying shares on GlobalConnect different from buying CFDs or fractional shares?

Yes. Buying shares on GlobalConnect means that you are the owner of the shares and you are entitled to dividend and participation in the General Meeting of Shareholders. On the other hand, the purchase of CFDs or fractional shares is not the same as the physical purchase of shares.

Who can invest on GlobalConnect?

All investors whose brokerage houses are connected to this ASO can invest in this market.

Brokers offering access to foreign stocks

How to invest in foreign markets? It cannot be denied that, at the moment, the WSE's GlobalConnect offer is so modest that it practically does not allow for the effective construction of a portfolio based on foreign securities. However, an increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| Country | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![GlobalConnect, i.e. foreign shares on the WSE. Failure or success? [Guide] globalconnect gpw](https://forexclub.pl/wp-content/uploads/2023/06/globalconnect-gpw.jpg?v=1687937809)

![GlobalConnect, i.e. foreign shares on the WSE. Failure or success? [Guide] an increase in inflation](https://forexclub.pl/wp-content/uploads/2021/11/wzrost-inflacji-102x65.jpg?v=1636704252)

![GlobalConnect, i.e. foreign shares on the WSE. Failure or success? [Guide] exchange rate eurosd, eurodollar](https://forexclub.pl/wp-content/uploads/2022/10/eurusd-eurodolar-102x65.jpg?v=1666786536)