Global benchmark for PLN 100? How to realistically compare active and passive investing

The S&P Global agency recently published, as every six months, a report on the effectiveness of actively managed funds. SPIVA, because that's the name of the report, proves again that in the long run only a handful of funds beat their benchmarks.

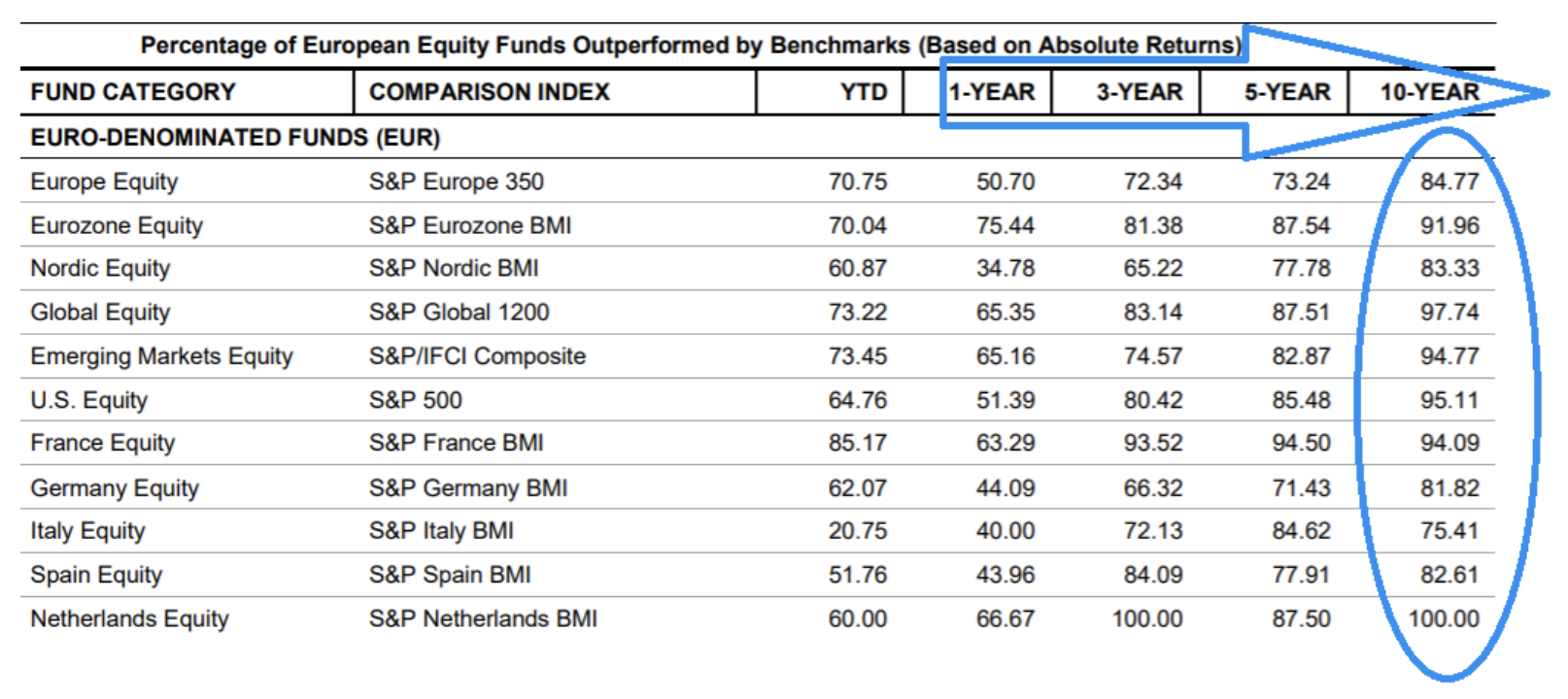

Percentage of actively managed funds losing to the benchmark in the last 10 years. Source: S&P Global

If someone invests in EUR in global equity funds, the fund performance is compared to the S&P Global 1200 index. In the last year, 65,3% of active funds lose against this benchmark. In a 3-year horizon, already 83,1%, in a 5-year horizon - 87,5%, and in a decade - 97,7%. In other words, roughly one fund in fifty has managed to beat it passive investing (based on the index) for the last ten years.

The longer the investing period, the lower the chances of beating the market. Even the legendary one Warren Buffett there have been three years in a row in which he has been losing to with the S&P 500 index (2003, 2004, 2005). Winning against the market is simply a big art. I know people who can do this, but there are literally a few of them. They devote all their time to it, they treat it as a profession, and in addition they have unique personality traits and, what to hide here, a lot of luck.

Reasons for failure? Management costs, emotions, inconsistency, brokerage commissions, strategy change, market timing (when you believe it's a high or low), investment trends. Enough?

If not, add your time to it. The one you spent analyzing charts and numbers. Reading press releases, interviews with CEOs, reports from brokerage houses. It also comes at a price.

See if you are winning with the market. As?

You have to assume with a high degree of probability that you will not win against the market. So let's look for a benchmark so that you can see for yourself on your own wallet.

Therefore, an intelligent investor will bet on the market. What? Diversified. Globally, geographically, in terms of currency, industry, segment. Containing stocks and bonds. Why not local (e.g. only Polish, American, emerging)? Why not limited to technology or raw materials companies? Because then you can fall victim to what I wrote about above - the belief that you can predict which country / sector will be overcome by the market ...

This is where companies offering a diversified, global portfolio of equities and bonds come to the rescue. As finax. What's up in Finax wallets, about which we wrote more a few months ago?

- 7391 - this is the number of company shares in the 6 equity ETFs that make up the Finax portfolios

- 5965 - this is how many bonds are in the 4 bond ETFs that make up the Finax portfolios

- 92 - This is the number of countries from which the issuers of these 10 ETFs come

Which paper has the greatest impact on the value of Finax's equity portfolios? Projects Apple Lossless Audio CODEC (ALAC), i Microsoft. The largest impact is only 2,3% in both cases. Diversification! Do you have a fondness for the country on the Vistula River? We do not. Just like global funds. In total, in the most aggressive portfolios, Polish instruments account for about 2 per mille of assets.

Finax: PLN 100 is enough

How much do you have to invest? At Finax, PLN 100 is enough and you can check whether the time we spend on analyzing charts and numbers is paying off. Such a low amount is possible due to the fact that the robber advisor buys for you and manages fractional parts ETFs. Single ETFs often cost much more. Want to buy one of the ten ETFs from Finax's wallets? This is EUR 1109 (calculations from mid-September 2021).

How much would you have to pay for full ETFs if you wanted to buy them yourself and build a portfolio similar to Finax? This is a one-off expense of EUR 1020 (100% equity portfolio), EUR 2040 (50% equity portfolio) or even EUR 3280 (popular portfolio with 80% shares). In each of these cases, and so, due to rounding, you would have a dozen or so percent of cash in your wallet.

Start with PLN 100. Check if it is worth boxing with the market, or if it is better to join it.

The material was created in cooperation with Finax. Remember that there is a risk involved in investing

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)