Hyperinflation - the death of money

More and more voices about risk very high inflationwhich can last for more than a few quarters. The most extreme views expect inflation at the level seen several dozen years ago in the Weimar Republic or Poland. In today's text, we will present the operation of the hyperinflation mechanism and show the countries that are currently struggling with very high inflation. Contrary to some texts, a number of factors must happen in order for hyperinflation to occur in the economy. Therefore, in addition to describing the hyperinflation itself, the text will briefly describe the economic situation of the country before the onset of hyperinflation. Hyperinflation is not a common economic phenomenon, but its consequences are devastating for the economy. There is a significant pauperization of people and a significant reduction in economic activity.

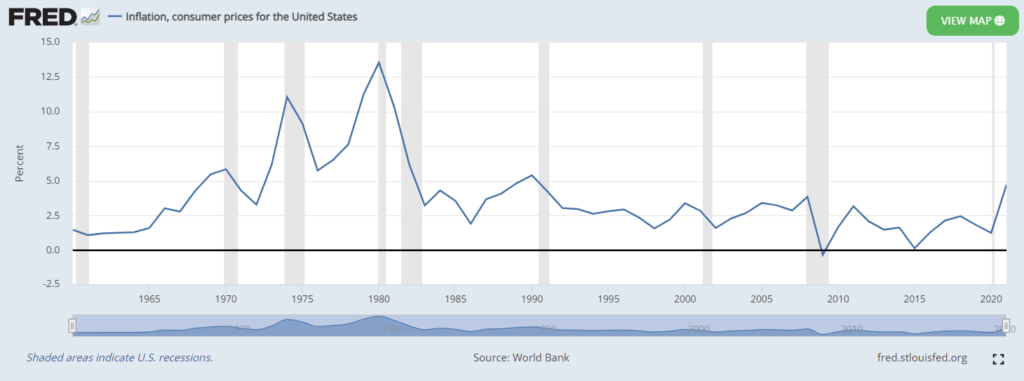

Inflation is not always the enemy

Inflation itself is not always bad. It is simply a price increase in the economy. If inflation is moderate (2,5% - 3,5%) and real wages are positive, then this is a normal macroeconomic environment. Thanks to inflation, budget revenues are rising, it is easier for governments to "get out of debt". In many countries, inflation has remained moderate for several decades. The following data on inflation in the United States:

Inflation in the United States. Source: Federal Reserve

However, sometimes a combination of unfavorable circumstances causes inflation to leave safe regions. Increased inflation is a bigger problem. People with savings on low interest deposits each month are burdened "Inflation tax"because the purchasing value of your savings decreases. Additionally, higher inflation affects the poorest the most, who have to allocate more and more funds to meet their basic needs. Some economists believe that too much inflation can cause the so-called an inflationary spiral.

Inflation spiral

It is a self-propelling mechanism to adjust prices. Higher inflation makes employees expect higher wages, which puts greater pressure on wage growth. Higher salaries mean higher costs of raw materials and production. As a result, traders have to raise prices to keep the margin at the previous level. This in turn means that the final product is more expensive, which raises the inflation rate again. Although it is an academic concept, it has long since hit the mainstream. The president of the USA - Nixon helped in this. It was this president who pushed the concept of a price freeze to fight "the spiral of wages and costs." The price freeze turned out to be a flop, but the spiral phenomenon has already hit the media. Many economists opposed the spiral concept. He was one of them Milton Friedman. The father of monetarism believed that:

"[The spiral] is a manifestation of inflation, but not its source [...] inflation comes from only one source: an increase in the money supply".

Hyperinflation - definition

Periods of increased inflation have occurred in the history of many countries. Sometimes the price spikes lasted only a few quarters, sometimes for several years. Sometimes inflation becomes so large that it significantly changes the way the economy works. If prices in the economy are rising by 50% per month, one can speak of a time of hyperinflation. It is a complete monetary collapse of the state. The rapid loss of value of money causes a problem with trade (how to determine prices for the future, how to finance purchases). In addition, it discourages people from keeping money as security for the future. In such situations, the money literally burns its holder. Hyperinflation also causes people to lose faith in money. Other "more stable" currencies are being accepted, and their rates on the black market are often much higher than the official ones. Rapid depreciation also causes people to stop allocating capital efficiently because they buy quickly “Just not to lose”. Sometimes hyperinflation can cause a return to barter trade (e.g. I get you butter, you give me ham).

One of the first researchers of this phenomenon was Philip Cagan, who published a book in 1956 "Monetary Dynamics of Hyperinflation" (The Monetary Dynamics of Hyperinflation). It was in this book that he formulated the definition of hyperinflation as a price increase of at least 50% per month. As a rule, episodes of hyperinflation are short-lived as the economic and monetary collapse forces governments to undertake a thorough monetary reform. Based on Cagan's definition of hyperinflation, Peter Bernholz analyzed 29 episodes of hyperinflation. In his opinion most of them were caused by an increase in the money supply to finance budget deficits.

The money supply

According to monetarists, hyperinflation may occur as a result of a significant increase in money supply, which grows much faster than productivity in the economy and the supply of goods and services. Over time, rising prices and rising money supply can, under specific conditions, create an environment for higher inflation. When money starts to lose its value, citizens try to get rid of the money as soon as possible. Another solution is to get rid of the local currency and buy foreign "hard currencies". People's pressure to get rid of money increases the speed of money circulation. This, in turn, supports the rise in prices again. This can lead to the increase in prices being faster than the increase in the money supply. At the same time, if a society begins to lose confidence in its own currency, a self-fulfilling prophecy occurs. Money is losing value, people do not want to keep savings in national currency. At the same time, high inflation makes it difficult to finance new debt, which encourages the government to "monetize the debt."

Sometimes hyperinflation is not the result of a faulty monetary policy, but is the only option to finance war spending. The government of a fighting country must do whatever is necessary to survive the war. At the same time, the basic sources of financing expenses (taxes and debt issuance) are greatly depleted. In that case, increasing the money supply to finance the expenses is the only "easy" option. An example of such a solution was the monetary policy of Nationalist China in 1939-1945.

Of course, a significant increase in the money supply itself does not necessarily lead to hyperinflation, if the economy is under strong deflationary pressure related to, for example, importing cheap goods from low-cost countries or due to an aging population. An example is Japanwhich, despite the expansionary policy of the central bank, has not experienced high inflation in recent decades. Another example is quantitative easing (QE) used by central banks in major economies. Buying debts allowed for the improvement of banks' balance sheets, but did not increase prices in the real economy. On the other hand, the increase in liquidity put pressure on the appreciation of many financial assets.

Hyperinflation in the modern age

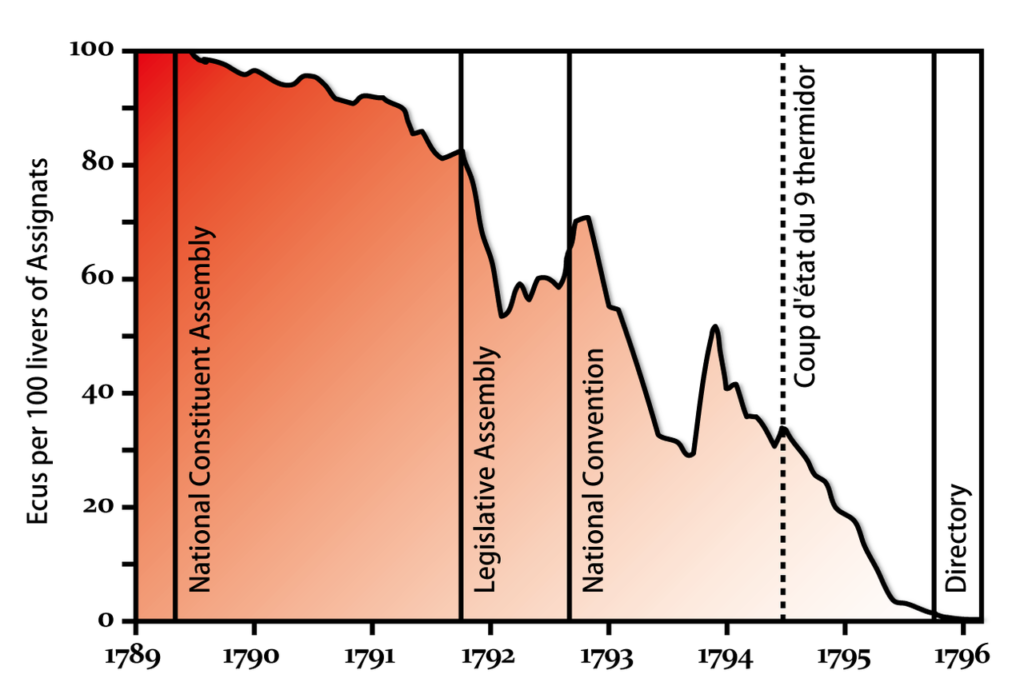

Interestingly, hyperinflation was not only about recent history. An interesting example is the hyperinflation in France at the end of the XNUMXth century. The French government was then struggling with a large budget deficit. He decided to put into circulation paper money (coupons), which were based on land that the government confiscated from the church and part of the aristocracy. The issuance of credits allowed to increase government spending, which accelerated economic development. However, the rapid increase in banknote issuance resulted in an increase in inflation. The solution was another issue of assignments. As the money supply increased, prices increased further after a short-term economic boom. It was blamed on former speculators, foreign buyers and shop owners. There have been situations where the inhabitants of Paris plundered shops because they believed that the increases in product prices were unfair business practices and not the result of incorrect monetary policy. The government tried to fight inflation by introducing decrees on maximum prices. Breaking them could cost you with your life. The small sellers had the choice of either risking their lives to sell goods at market prices or to close the business. Over time, people stopped accepting assignments. As Voltaire said:

"Paper money will eventually return to its true value - zero."

Source: wikipedia.org

Anyone can be affected by hyperinflation

Any country can crash the currency. Having rich deposits of raw materials or past successes in the economic field are no antidotes. To illustrate this, we will present the history of two economies that have had very long periods of hyperinflation. Both of these countries experienced hyperinflation in the XNUMXst century. Thus, it cannot be said that hyperinflation was a problem several decades ago when the level of economic knowledge was much lower than today.

Zimbabwe

R. Mugabe, 1979. Source: wikipedia.org

For decades it was a British colony that was called Rhodesia (before that, Southern Rhodesia). In 1964, the country declared independence, which was not recognized by the United Nations and the Organization of African Unity. The country was then ruled by a privileged white minority who controlled the economy and the most important institutions in the country. For the next 15 years, there was a civil war between Rhodesia (supported by South Africa) and discriminated black majority organizations (African People's Union Zimbabwe and African National Union Zimbabwe). The war ended in 1979 with a compromise that abolished discriminatory laws. The United African National Council won the new elections. In 1980, the political forces centered around Robert Mugabe won the repeated elections.

The initial period of Mugabe's rule was the implementation of reforms supporting economic growth. As a result, large farms belonging mainly to the white minority and small enterprises (mostly managed by black people) continued to thrive. The short period of prosperity was interrupted by another slowdown as a result of the fighting between the Shona and Ndebele tribes. In 1987, the conflict ended, and Zimbabwe changed its regime to the presidential regime. The president was the hero of the liberation struggle - Robert Mugabe.

Wrong steps

Over time, there has been an evolution of governments towards authoritarianism. In order to win the favor of the majority of citizens, Mugabe announced that he intends to confiscate white minority lands and distribute them to those most in need. However, the reform proved to be a failure. There was a transfer of land from the hands of people with extensive experience and capital to people who do not have great skills in the use of modern farming techniques. There was a drastic decline in agricultural and industrial production. Along with it, the level of unemployment and poverty increased. In addition, the white population of Zimbabwe, due to the unfavorable political environment, began mass emigration from the country. This caused an outflow of capital. To make matters worse, the country's international situation has deteriorated. The unfair fight against the opposition and the violation of human rights resulted in the imposition of partial sanctions by the United States and the European Union. However, among the allies there were several dozen countries of the "poor south" - Russia and China. The sanction was caused by the freezing of the assets of persons associated with the Mugabe regime. At the same time, it hindered trade and raising the capital needed to improve the country's economic situation.

Death of the monetary system

Inflation has been a problem in Zimbabwe for a long time. Practically from the beginning of independence, the double-digit level of inflation was not unusual. The government used debt monetization, which increased the money supply in the economy. This translated into a decrease in its value, which resulted in an increase in prices. In 1998, inflation was almost 50%. This meant that the sanctions imposed on the country in 2007–2008 were not the main cause of high inflation. The reason was, among others growth of the monetary base. In 2001, inflation was already three-digit and amounted to 112%. In 2003, the price increase reached 599%. These were not normal economic conditions. High inflation caused the value of savings to decline at an alarming rate. It also discouraged entrepreneurs from making long-term investments, because in an environment of constantly rising inflation it is difficult to estimate the economic viability of a given venture.

At the same time, high inflation caused a significant weakening of the Zimbabwe dollar, which undermined the "value" of the domestic currency. As a result, it was not profitable to keep savings in currencies other than "hard" (dollars, euro). The announcement of the pegged Zimbabwe dollar to the US dollar did not help. It only resulted in two prices: official and "black market". In 2006, officially US $ 1 was worth more than $ 101 zimbabwe (Z $). By the middle of the year, however, the "black market" rate was $ 000 = Z $ 1.

At the same time, high inflation caused a significant weakening of the Zimbabwe dollar, which undermined the "value" of the domestic currency. As a result, it was not profitable to keep savings in currencies other than "hard" (dollars, euro). The announcement of the pegged Zimbabwe dollar to the US dollar did not help. It only resulted in two prices: official and "black market". In 2006, officially US $ 1 was worth more than $ 101 zimbabwe (Z $). By the middle of the year, however, the "black market" rate was $ 000 = Z $ 1.

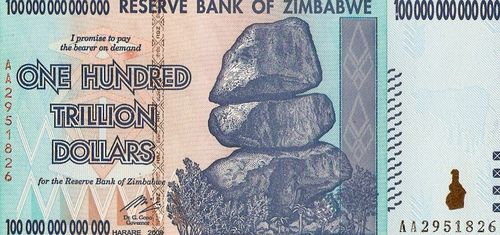

The following years saw the currency denomination ("cutting off" three zeros) and the introduction of new banknotes with higher and higher denominations. For example: On January 18, 2008, the Central Bank of Zimbabwe put into circulation a 10 banknote (worth approximately $ 000). On May 000, the $ 1,93 zimbabwe banknote (worth approximately $ 15) was introduced. There was a problem with ATMs whose systems were not adapted to such high denominations. As a result, many of them did not work. On June 500, 000, another denomination took place. From now on, 000 had a value of 1,93. However, already in January 30, huge denominations such as 2008 began to appear again.

Currency of Zimbabwe source: wikipedia.org

In April 2009, the country switched to the dollarization of the economy. In 2014, 8 legal tender methods were already available: US dollar, South African rand, Botswana pool, British pound, Indian rupee, Japanese yen, Australian dollar and the renminbi (Chinese currency).

The dollarization allowed for a better stabilization of the macroeconomic environment, but it also had its consequences, which include:

- reducing tax transparency (people try to keep money out of the cash system)

- high interest rates due to lack of capital

- restrictive fiscal policy of the state

- shortage of small denominations to carry out everyday transactions

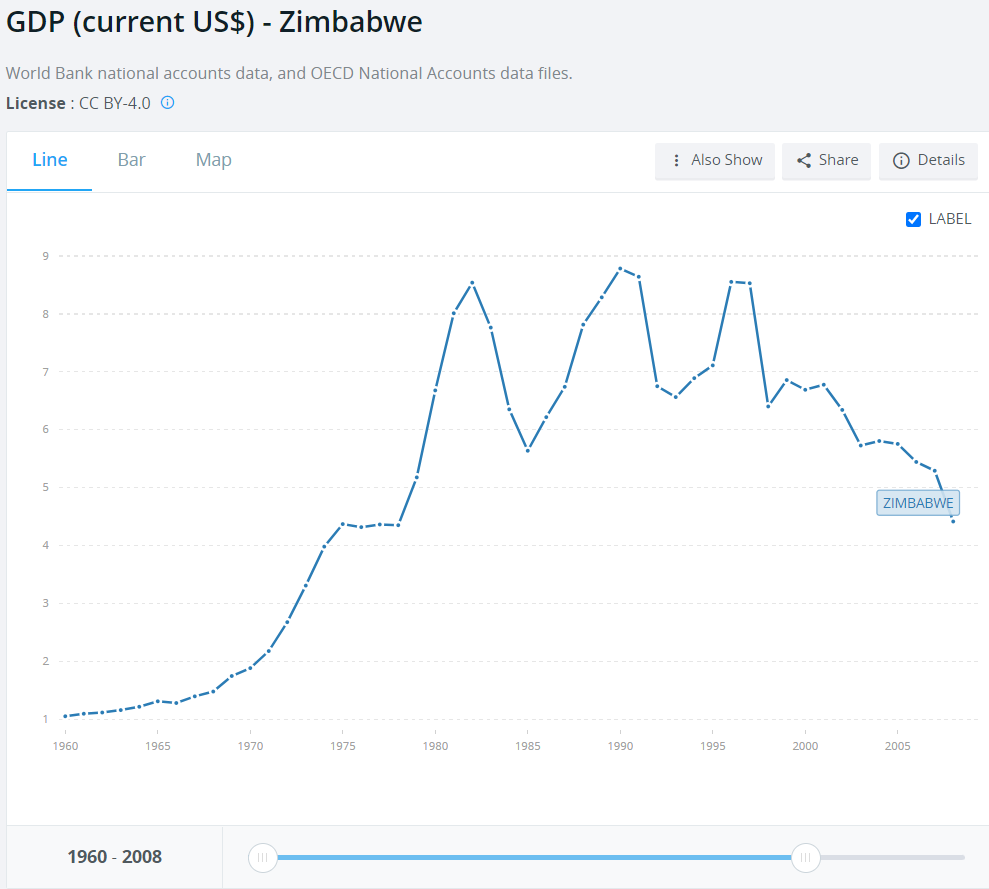

Source: world Bank

At the same time, the problem with tax collection made Zimbabwe look for money by issuing interest-bearing bonds. In 2014, according to some estimates, debt to GDP exceeded GDP twice. High indebtedness caused significant service costs, which should be covered with the inflow of foreign exchange from exports. However, in 2016, due to a trade deficit, Zimbabwe found itself in a situation of an outflow of dollars from the economy. This resulted in the necessity to significantly reduce the payments of foreign currencies from the banking system. The period of dollarization of the economy contributed to the eradication of inflation from the economy. It didn't take long, however. In 2019, there was a departure from the previous policy and a return to its own currency. This caused a return to inflation, which in 2019 amounted to over 250%. A year later, it was over 500%. In 2021, inflation dropped to around 60%. The hyperinflation in Zimbabwe resulted in a drastic decline in GDP. Only the introduction of dollarization of the economy allowed for the economic reconstruction of the country.

Venezuela

Venezuela is a very interesting country example that having "black gold" in amounts unheard of in most countries in the world does not necessarily translate into economic success. Venezuela has one of the largest documented reserves oil in the world. However, years of ill-considered economic policy, corruption and the resolution of social tensions using populist slogans led to an economic catastrophe. One of the symbols of the country's decline is rampant inflation. The hyperinflation that currently prevails in Venezuela means that a significant percentage of the population lives in extreme poverty. However, this macroeconomic situation did not happen by chance. It has taken the rulers many "effort" and years to bring about what is now visible. Interestingly, a dozen or so years ago Venezuela was presented as one of the examples where the "departure" from the liberal economy was successful.

Golden years

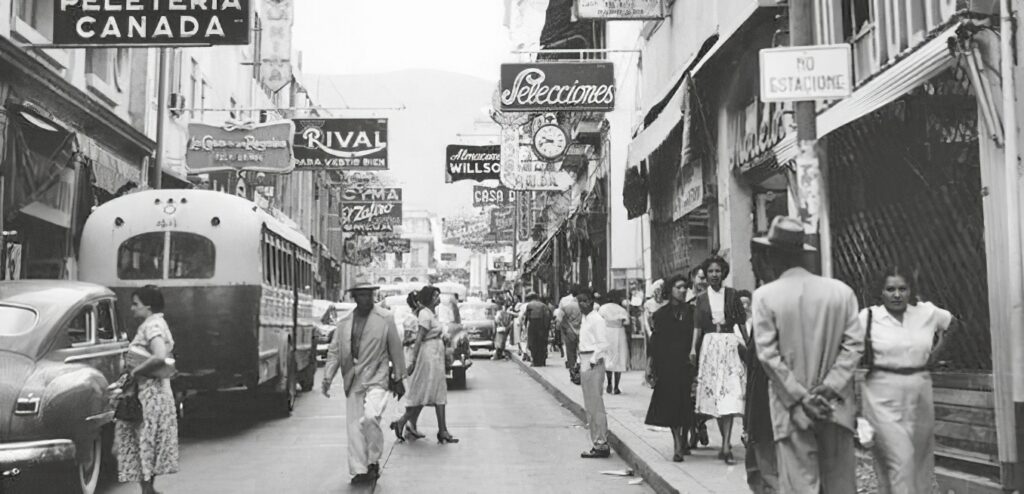

A turning point in the economic history of Venezuela was the discovery of large oil fields near Maracaibo in 1922. American mining companies became interested in investing in Venezuela very quickly. In 1943, Standard Oil of New Jersey approved a 50-50 oil profit split. Oil profits resulted in a very rapid economic growth of the country. Venezuela has become the country with the highest income in the region. Thanks to this, economic migrants from all over Latin America began to come to the country. It was one of the richest countries in the world. You can even say that Venezuela was the "Qatar and Dubai" of the 50s. It was here that a lot of luxury goods were sold, and music and sports stars came to the country. Initially, money was also spent on infrastructure projects. Motorway networks and office buildings in the largest cities were developed. At the same time, social inequalities grew. People lived very prosperously in the cities, while poverty and illiteracy were spreading in the provinces.

Esquina de Gradillas a Sociedad, 1950. Source: wikipedia.org

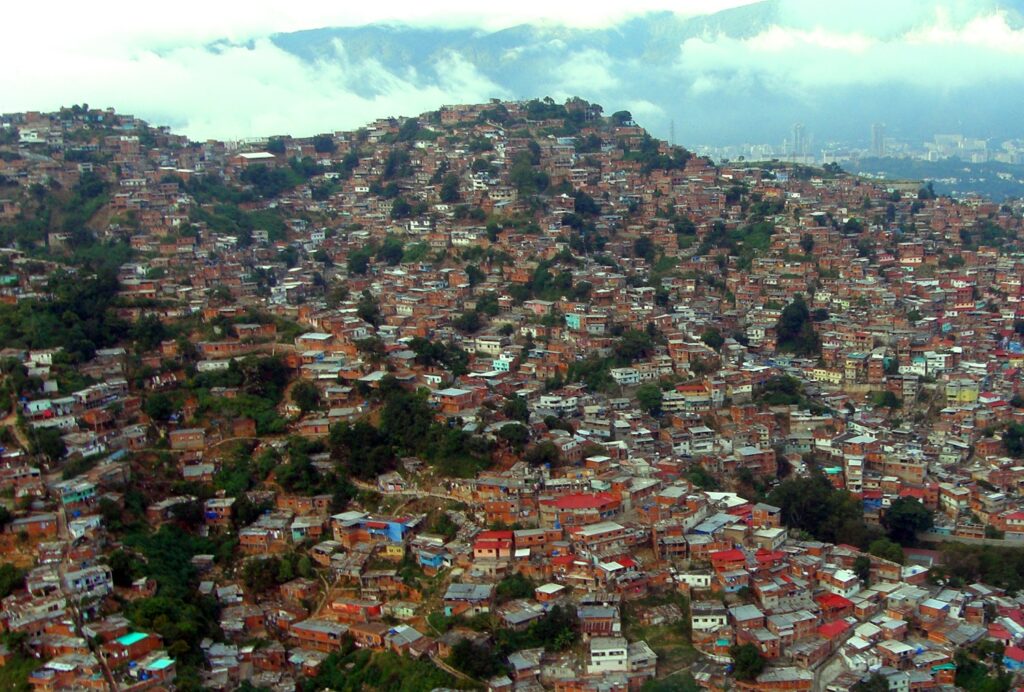

Easy money caused the country to put off needed reforms. Governments were rather concerned policy "Hot tap water" and reducing dissatisfaction through social transfers. As a result, the level of education and health care were raised, and food subsidy programs were expanded. However, increasing inequality remained a problem. It was during this period that poor districts around the largest cities were developed - Neighborhoods.

Barrios. Source: unicef.org

The oil crisis of the 70s put Venezuela's problems on hold again. Due to the sharp rise in prices, the river of money flowed into the country. Over time, the rulers looked more and more greedily at the private mining sector. As a result, on January 1, 1976, foreign assets were nationalized, creating the state-owned PDVSA (Petróleos de Venezuela). The Eldorado in the crude oil market ended in the 80s with the decline in crude oil.

Economic problems and neoliberal reforms

The drop in oil prices has led to a significant reduction in the government budget. At the same time, loose fiscal and monetary policy contributed to an increase in the level of inflation and debt in the 80s. In 1989, inflation peaked at over 80%. In turn, public debt increased from 8% of GDP in 1975 to 90% of GDP in 1989. The deterioration of the macroeconomic situation resulted in social protests. As a result, Carlos Andres Perez took power. He began the deregulation of many branches of the economy and began to introduce more liberal labor law. Economic growth ensued, but inflation soon returned to levels above 50% per annum. The period of economic liberalization highlighted Venezuela's structural problems. However, people did not want to sacrifice the next decade of their lives to "heal" the economy. The corruption scandals did not improve the public mood. A big problem with the Venezuelan economy was unemployment and a huge mass of socially excluded, poor citizens. A riot called Caracaso broke out, which resulted in clashes with the police and acts of vandalism (e.g., plundering shops). The "left side" of the political scene began to gain advantage. Her face was Hugo Chavez, who was "the protector of the poorest".

Bolivarian Revolution

By becoming the president of Venezuela, Hugo Chavez started a real revolution in Venezuela. He started with catchy topics such as the fight against corruption, injustice and the poverty of Venezuelans. Chavismo (the president's political movement) advocated nationalizing the economy, expanding social benefits and reversing liberal economic reforms. In international politics, he was a supporter of anti-Americanism.

The strikes of 2002-2003 and the military's attempt to overthrow the President of Venezuela forced Chavez to focus on extinguishing negative sentiment in society. At the same time, he purged PDVSA employees, which resulted in a decline in the company's operational efficiency. Extensive social projects were financed thanks to high oil prices. The story from the 60s and 70s was repeated. The profits from the sale of oil were overeated to gain public support. Reforms were postponed as the economic situation seemed very good. Expenditure on ambitious social projects was wasted. Corruption and crime have risen. In addition to loose fiscal policy, the money supply continued to grow significantly. As a result, inflation was most often at double-digit levels. Moreover, Chavez used the oil profits for political projects. An example is the financing of Cuba, buying Argentina bonds. Already at the end of Chavez's reign, inflation was very high, but thanks to his charisma, social unrest was moderate.

The era of Maduro

Political chaos

Nicolas Maduro. Source: wikipedia.org

Chavez did not see the effects of his economic policy. He died in 2013 and he was succeeded by Nicolas Maduro, anointed as heir. The Bolivarian Revolution continued, but the oil market began to worsen. The shale revolution in the United States, combined with the increased oil supply in Arab countries, caused a significant drop in the price of "black gold". There were budget problems which were solved by increasing the money supply. Entrepreneurs ("the bourgeoisie") were blamed for the rise in inflation. Decrees on maximum prices began to be introduced. Political and social tensions began to rise. Maduro did not have the charisma of Hugo Chavez. The increase in riots caused the Venezuelan government to introduce "colectivos", which were designed to stifle the protests in 2014. In 2015, the parliamentary elections were won by the opposition, which meant that the "chavists" began to lose support. Two years later, social protests broke out again. In 2017, the constitution was created to replace the previous parliament dominated by the opposition. The elections to the Constituent Assembly were boycotted by the opposition. As a result, the United States began introducing sanctions against Venezuela, including freezing of funds in the subsidiary PDVSA - Citgo. In 2018, Maduro won the elections, also thanks to the help of the courts, which prevented numerous opposition candidates from running (under the guise of, for example, formal shortcomings).

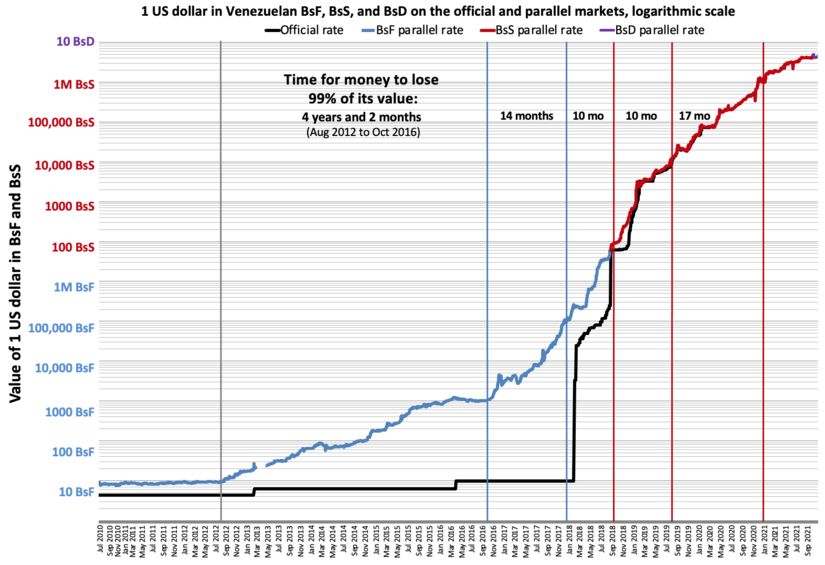

Venezuelan inflation

The unstable political situation, incorrect economic policy and loose monetary policy caused a significant decrease in the value of Venezuela's currency - the bolivar fuerte. The loss of value is so great that many Venezuelans call their currency bolivar muerto (dead bolivar). In August 2014, $ 1 was valued at around 100 Bolivars, a few years later the dollar was valued at 300 Bolivars. The country's economy is also shrinking. In 000, GDP was $ 2021 billion. In turn, in 44,9, Venezuela's GDP was $ 2014 billion. As a result of investment negligence and the dismissal of experienced employees, the production of crude oil, which is the main source of exports, is declining.

Inflation is hard to imagine. In 2016, it was "only" 270%. However, already in 2018 exceeded 130%. Despite the slowdown in inflation, in 2021 it amounted to over 2000%. Every now and then a new currency reform is created. In 2019, the fuerte bolivar was replaced with a soberano bolivar (sovereign bolivar). The reform consisted in "cutting off" 5 zeros. In 2021, another denomination took place, this time “truncated” 6 zeros. The rapid depreciation of the bolivar causes that currency to no longer be used as a store of value. For this reason, more serious transactions are made by pricing in dollars or euros.

Price controls have created an economy of scarcity. People wait in lines at the store to buy goods at a lower price than the market price. However, if it is not possible to officially buy the products they need, Venezuelan citizens buy them on the black market. Of course, the price of such products is much higher than the "official" price.

The economic problems have not been resolved. Hyperinflation has caused the poverty of Venezuelans to rise significantly. Many of them leave the country in the hope of improving their fortunes. Colombia is one of the main directions of emigration. It is a kind of history chuckle, because even 70 years ago, Colombians moved to Venezuela in order to improve their financial situation.

Venezuela is an example of a country that, despite its great natural resources and favorable twists of fate (e.g. the oil crisis), did not take advantage of its opportunities. Due to corruption and a flawed economic policy, the country has fallen into the extreme case of the "Dutch disease". Oil profits made the import of finished products cheap. As a result, its own industry collapsed, and underinvested it became less and less competitive. As oil profits plummeted, currency and economic problems ensued.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)