Taylor Rule – what does it predict for the coming years?

For many years, people have been working on ways to automatically manage monetary policy. There were many ideas, some more successful than others. Among the very famous patterns is the so-called Taylor Rule. Its purpose was to systematize the conduct of monetary policy by the central bank. The purpose of the special formula was to facilitate the calculation of the optimal level of interest rates. The correlation between the model's calculations and the actual monetary policy of central banks is astonishing. What does Taylor's rule say about the coming years? In this text, we will look at the mentioned principle and give its advantages and disadvantages.

John B. Taylor – one of the most influential economists in the world

JB Taylor was one of the most famous American economists in the 80s and 90s. His fame has not faded in the 2012st century. Suffice it to say that in XNUMX he was on the list “50 most influential people”, which was produced by Bloomberg. He was included in the list in the "Thinkers" category, where he shared, among others, with Paul Krugman and Joseph Stiglitz. A year earlier, the author of Black Swan was classified in the same category: Nassim Taleb. So it's safe to say that Taylor is not a random person. John B. Taylor taught at Stanford University and served as George W. Bush's undersecretary of the treasury. He was therefore a respected person both in the scientific and political world.

Taylor himself was praised by Ben Bernanke for his huge contribution to the development of economics and monetary policy. She was of a similar opinion Janet Yellen. What made Taylor enjoy such a good reputation among political decision-makers, financiers and journalists? The answer is simple: huge scientific achievements. This economist explored the secrets of economics for many years, which resulted in groundbreaking works. He researched, among others: the impact of monetary policy on the theory of rational expectations. He argued that monetary policy can be effective even if people actually act in accordance with the theory of rational expectations.

This outstanding economist created the so-called Taylor contract, which was one of the elements that rebuilt Keynesian economics. As a result, the neo-Keynesian school began to develop more and more, which was based, among others, on: on the theory of rational expectations.

Another strong contribution to the development of economics and monetary policy was the so-called Taylor's rule. In short, the mentioned mathematical structure is intended to help the central bank manage monetary policy in a predictable way. When calculating the optimal interest rate, the formula takes into account both the inflation rate and the level of economic growth. The mentioned rule is mechanical and fits into the trend that prevailed in economics at that time: the so-called mathematization (which Paul Krugman is critical of). Some believe that the rule is used by central banks as one of their tools. Of course, this has not been officially confirmed, but it is an open secret that the Taylor Rule is taken into account when shaping monetary policy.

What is Taylor Rule?

In his research on monetary policy, John B. Taylor discovered that the Fed sets future interest rates without regard to long-term economic prospects. After long research, he developed his model, which was to take into account both the current inflation rate and the pace of economic development.

In the early 90s, Taylor was commissioned to prepare a recommendation for the Fed regarding the shape of short-term interest rate policy. The policy aimed to achieve both a positive short-term goal (i.e. economic stabilization) and a long-term goal (meeting the inflation target). This was important because the Fed's history shows that at times it overheated the economy and at other times it was too restrictive. In the first case, interest rates were kept too low, making credit readily available and stimulating demand. The disadvantage of this policy was the increase in inflation, which sometimes got out of control. In the case of too restrictive policy, inflation was suppressed using too high interest rates. As a result, the long-term inflation target was achieved, but economic growth was below potential.

Taylor believed that the amount of unemployment was an important factor to consider in managing the interest rate. This is because the number of unemployed people is indirectly related to inflation and the size of the output gap. The economist believed that if the principle of full employment in the economy (of course, assuming the natural level of unemployment) is not met, then inflation slightly above the inflation target is also acceptable. On the other hand, when the economy grows beyond its potential, it is worth it “tighten” monetary screw.

The mentioned rule is based on a closed economy model. This means that the issue of the impact of international trade on the domestic economy was not taken into account. After a few years, Taylor's model was modified by Lars E. O. Svensson.

Taylor's rule formula

The formula itself is presented in academic books as follows:

r = p + 0,5y + 0,5(p-2) + 2

Where:

-

- r – nominal federal funds rate;

- p – inflation rate;

- y – percentage deviation between current real GDP and the long-term linear trend of GDP.

The equation assumes that the federal funds rate is 2% above inflation, which is represented by the sum of p, the inflation rate, and '2' at the end of the formula. Let's imagine a situation in which y = 0 (GDP at its potential) and inflation is 2% (in line with the inflation target). Substituting into the formula we get:

r = 2 + 0,5*0 + 0,5 (2-2) + 2 = 2 + 0 + 0 + 2

It turns out that the interest rate should be 4%, so the real rate should be about 2%.

The following conclusions can be drawn from the formula:

- The interest rate should change by half the difference between current and target inflation. If inflation is 1 percentage point above the inflation target, the interest rate must increase by 0,5 percentage points.

- The interest rate should respond to the difference between current and potential GDP. If actual GDP is 1% higher than potential GDP, the interest rate should increase by 0,5 percentage points.

The assumptions are easy to interpret. If the inflation rate is significantly above the target level, then interest rates should also rise. However, there is a country in the world that has not followed this rule for many years. It was Türkiye, whose monetary policy is described in this article. It used so-called "unorthodox" monetary policy. This ended in high inflation and "fall" value of the Turkish lira.

It is worth remembering that calculating GDP, potential GDP or the inflation rate is not a simple task. This especially applies to the calculation of Gross Domestic Product. Revisions of this indicator are frequent, even though many experts work on its calculation. Since it is difficult to calculate GDP, the indications of the Taylor rule are also not very accurate. Therefore, there may be underestimations or overestimations of the target level of interest rates. It is also worth remembering that the above-mentioned formula does not take into account the operation of the central bank using other tools, such as the level of required reserves or non-standard actions (e.g. quantitative easing).

Open secret - The Taylor Rule is liked by central banks

It is known that monetary policy cannot be reduced to a simple formula. This is because there are a number of external factors that influence the economy. An example may be distant economic problems such as: Asian Crisis or Russian crisis, or disruptions in supply chains. This is why The Taylor Rule is a guide for monetary policy rather than a law.

Currently, central banks from many countries use direct inflation targeting policy (DCI). It provides a clear central bank policy objective that is easily verifiable. Secondly, inflation targeting increases the transparency of monetary policy for both domestic and foreign investors, businesses and ordinary consumers. Additionally, the BCI with its fluctuation range provides considerable flexibility in the application of monetary policy. Thanks to this, during a period of greater economic slowdown, the central bank can agree to a more lenient monetary policy and accept inflation slightly above the inflation target.

Of course, the policy of direct inflation targeting also has its drawbacks. One of the biggest is the problem of delays, because the central bank's policy can only be assessed in hindsight. This is because it takes many months to see the effects of, for example, the first interest rate increases. Another disadvantage of the BCI is that the relationships between individual monetary policy instruments and inflation can be difficult to calculate precisely. It is also worth remembering that monetary policy does not operate in a vacuum and must also take into account the government's fiscal policy.

The Taylor Rule was intended to be a mechanical answer to the question of what the bank's monetary policy should look like based on individual data on inflation and economic growth.. Many central banks apply monetary policy surprisingly consistent with the calculations based on the American economist's formula. This can be seen in the chart below, which shows the relationship between the calculations between the Taylor Rule and the interest rate set by the Fed.

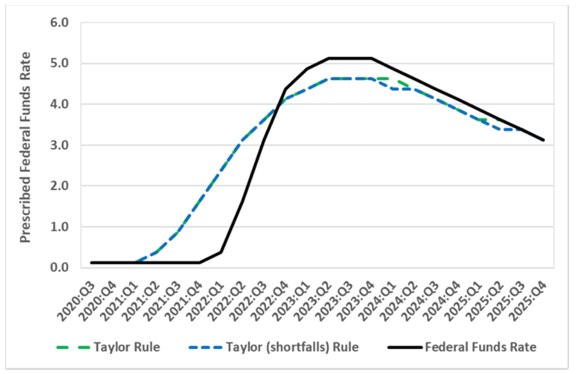

As you can see in the chart below, the FED was late in increasing interest rates, which was partly due to the specificity of 2021-2022. First, 2021 was a time of rebound from the coronavirus. On the other hand, the beginning of 2022 will mark the beginning of the invasion of Ukraine. The Federal Reserve preferred to wait a while before raising interest rates because it did not know how durable the economic recovery would be in 2021. Interestingly, according to the chart, if nothing significant happens, interest rates will fall in the next two years. However, one can only dream about returning to 2020-2021.

Source: econbrowser.com

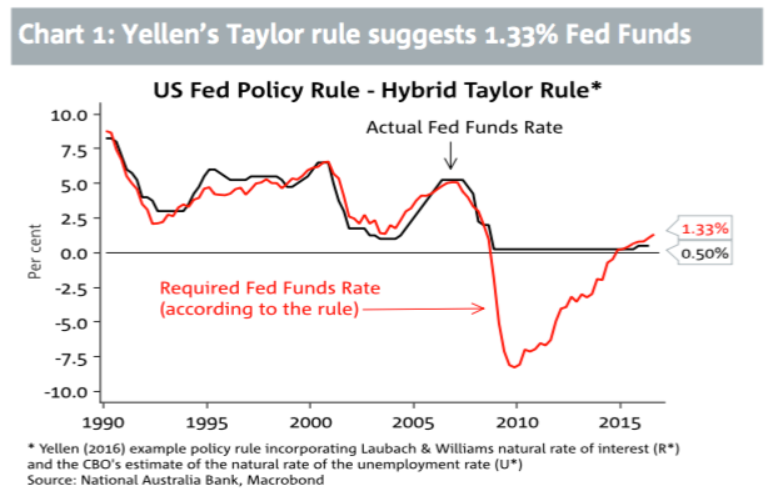

The next chart also proves that the US central bank works in a similar way to the Taylor rule. The periods of easing and tightening monetary policy are similar both in the case of interest rates and the calculations according to the formula. The period 2008-2014 is very interesting. According to the calculations, the interest rate should be much lower and take negative values. It is worth remembering, however, that at the time when rates were around 0%, the FED was implementing a policy of quantitative easing.

Source: NAB

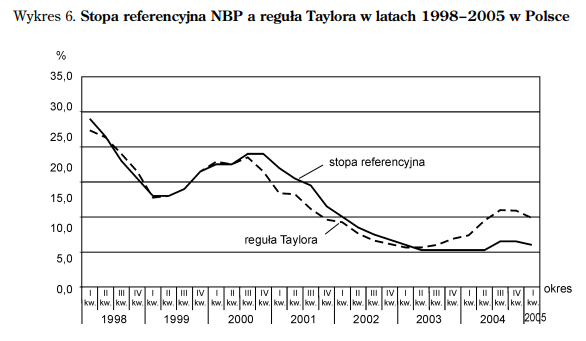

Interestingly, also in Poland the central bank moved to the rhythm of the above-mentioned rule. This can be seen in the study by M. Trzepała from the beginning of the 1998st century. According to the data, the NBP reference rate moved to the rhythm of the rule. This was particularly visible in the years 2002 - 2000. The chart shows that in the years 2001 - 2003, the NBP applied a much more restrictive policy than the theory of the American economist. But in the years 2005 – XNUMX National Bank of Poland took a much more gentle approach to the business cycle.

Source: Malwina Trzepala "Taylor's Rule - application to the Polish economy"

JB Taylor aimed to prepare a recommendation for the FED regarding the shape of short-term interest rate policy in changing economic conditions, so as to achieve both the short-term goal (i.e. economic stabilization) and the long-term goal (inflation target). However, there is no evidence that the Fed directly follows the above-mentioned rule, but everything indicates its high convergence with the policy implemented by the central bank.

Summation

The Taylor rule formula is relatively simple and is designed to calculate the optimal interest rate, taking into account the level of inflation, the inflation target, and actual and potential GDP. Taylor's research was published in 1993 and has become a tool that is often used to help set monetary policy. The monetary policy of central banks often follows the same direction as the above-mentioned rule. But sometimes the actual rate levels differ from the pattern indications. The neutral level of interest rates is when inflation is equal to the target and actual GDP is the same as potential GDP.

According to the assumptions of Taylor's rule Federal Reserve should raise interest rates when inflation exceeds the target or when gross domestic product growth is too high and exceeds potential. If inflation is below target or GDP growth is too slow or below potential, the Fed should lower interest rates.

In relatively calm economic periods, the Taylor rule is a fairly accurate approximation of the optimal levels of interest rates in a given country. However, during the economic crisis it is not very accurate. The recessionary period associated with the Covid-19 pandemic, according to Taylor Rule calculations, should have kept federal funds rates at negative levels. In fact, federal funds rates are capped at zero.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response