The boom and fall theory, or what Hayek and Mises teach us about crises

There have been many studies on crises. One could be tempted to say that some of them are only "academic" theory that worked only on data and book tables. Two economists whose studies I want to tell you about today - Friedrich von Hayek i Ludwig von Mises – took a slightly different direction of their research. I invite you to a short article on how central banks changed the face of financial crises.

credit cycle

Our times from boom to bust (from boom to full-blown recession) are a perfect illustration of the credit cycle, which was first presented in all its glory in the XNUMXs. Why then? Because it was the first decade after most countries had created and developed central banks to quite modern levels. As you can guess, the emergence of such a significant market institution caused new, "strange" changes on the stock exchanges. Nineteenth-century-style economics seemed to have less power to explain new phenomena. As you can guess, the old economic models no longer predicted economic cycles well. New patterns had to be found. Two economists took up the topic - Friedrich von Hayek and Ludwig von Mises. They based their model of the business cycle on the following studies, theorems and events:

- Richard Cantillon – when governments inflate the money supply, the effects are unevenly distributed across economic sectors.

- Adam Smith – growing wealth is embedded in the division of labor.

- Carl Menger – he saw money as an organic market creation, not an invention of the state, which means that it should be produced like any other good or service.

- Knut Wicksell – showed that interest rates function as a price mechanism for allocating investment decisions over time, therefore there is a yield curve. The manipulation of the interest rate disturbs the natural allocation of resources.

- Eugen von Boehm-Bawerk (1851-1914) explained that the structure of production consists of more than just consumer and capital goods. Investment decisions contain a forecast of time expectations, and the interest rate is crucial for their coordination.

All right, but why am I listing here a whole collection of subjective claims made by economists? This is because the Hayek and Mises model brought all these pieces of the puzzle together. Similar things were seen somewhat earlier by Jean-Baptiste Say (1767-1832), who saw the adjustment of supply and demand as a law of economics, which means that the market economy is inherently stable. So why the market need a central bank? If you look at the laws regulating the activities of these institutions to a large extent, sooner or later you will come across a statement like this “the central bank is supposed to absorb shocks in the economy” and/ or "take care of market stability".

Who spoils it?

Considering only the first few paragraphs of this text, one can get the impression that the above-mentioned economists could indirectly conclude that the central bank's actions spoil the natural order in the markets. What would his actions entail? To illustrate the whole process in the most simple way, it could be described as follows:

- By lowering the interest rate, the central bank drives the creation of new bank loans, which otherwise would not exist (if there was no institution that sets the level of interest rates). An artificially reduced interest rate acts as a false savings. Savings can be defined as certain “resources: derived from deferred consumption (we can buy, but we do not buy and put away). They serve as the basis for sustainable investments. Artificially low rates signal savings that are not there.

- Low interest rates not only create false savings, but actually disrupt the investment of that money. Capital circulates in a way that it would never have been distributed in the absence of intervention in the rate market. The funds derived from borrowing at low rates create a kind of subsidy for capital products that would not exist if the interest rate remained at its natural, market level.

Inflation = distortion result

Of course, the disturbed allocation of savings in the economy (transfer of savings into investments) does not end there. The distortions result in inflationary processes. The authors of the theory claim that the run-down structure of production and "subsidies" significantly affect the increase in the prices of services and goods in the economy in an "unnatural" way. It can be said that based on interest rates and their impact on the loan, it was based entirely Austrian business cycle theoryof which Hayek and Mises were the authors. According to her, banks granting loans at an "artificial" interest rate (lower than its natural market level) lead to a short-term boom. Thus, they cause an artificial movement in the market of capital goods (e.g. real estate) and investments, which lead to inflationary issuance of money. Here, according to economists, a whole problem arises in the form of, for example, overvaluation of investment projects (e.g. companies) or speculation on financial markets. This situation leads to a recession. A crash, on the other hand, is a kind of market cleansing that leads to the removal of bad investments.

Bernanke - inflationary Nobel Prize winner

This year's Nobel Prize in economics certainly took the followers of the Austrian school of economics by surprise. Former boss got it Federal Reserve, Ben Bernanke, which “magically” repaired the economy after the 2008 crisis without any overt downsides. His term of office lasted from February 1, 2006 to January 31, 2014. Janet Yellen. Contrary to most economists, Bernanke saw the global increase in savings as the main reasons for the anomalies in the US balance of payments. His monetary policy (by the way, successfully continued by Yellen) allowed the United States to keep interest rates at zero for practically 14 years.

If I were to go into the whole structure of the 2008 crisis at this point (let me briefly describe those years), I think that the article would turn into a book. Also, simplifying the model used by Ben Bernanke - low interest rates, in 2008 it was supposed to lead not only to a huge crisis, but above all to a monstrous increase in inflation. However, this did not happen, although in fact this indicator, taking into account the previous levels, slightly increased. How did you get around it? Bernanke paid the banks to keep excess cash in Fedowski vaults. As a result, hot, inflationary money did not reach the market. The problem was seemingly solved, as prices remained at stable levels. As it turned out over time, the solution to one problem did not bring the solution to the other, which was the transfer of money to investments (mainly the technology and housing sectors). At this point we come to the theorems of Hayek and Mises, which spoke of a vicious, distorted investment circle.

READ: The bankruptcy of Lehman Brothers - the story of a spectacular bank collapse

An economic experiment or a new economy?

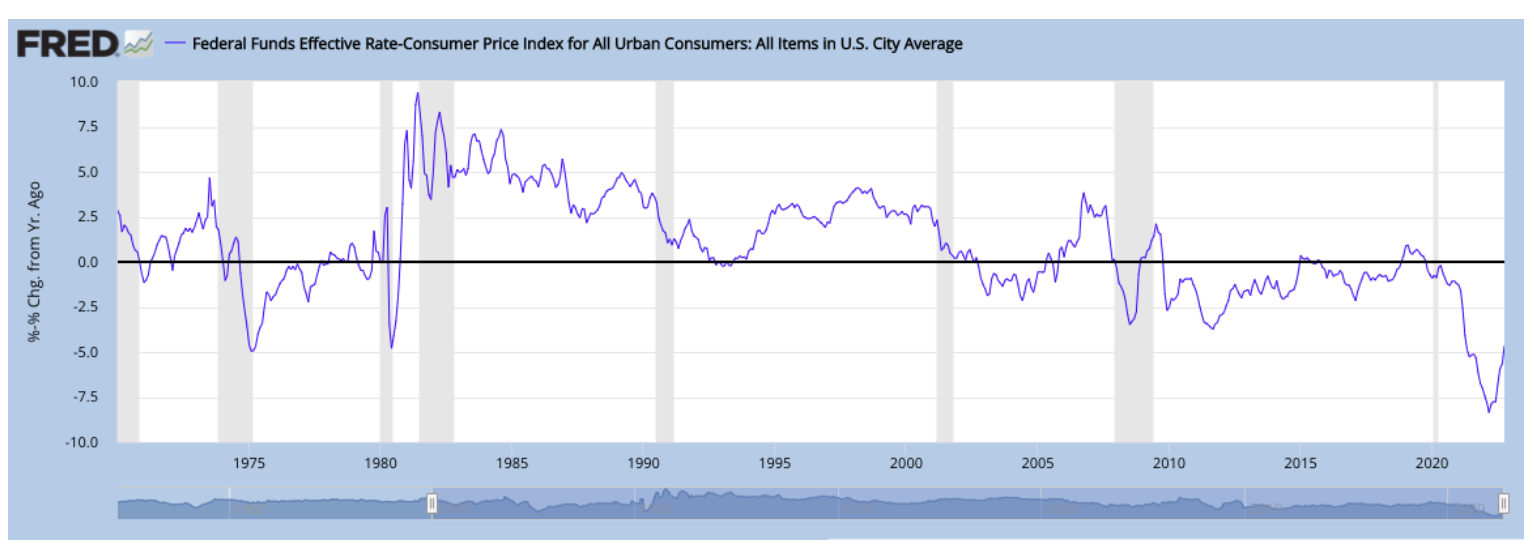

To illustrate the disorder Hayek and Mises talk about in a more graphic way, let's look at the graph below. It shows the federal funds rate adjusted for inflation. The negative levels we see here are the longest period of “disruption” in the United States.

This illustrates perfectly how the whole zero interest rate policy becomes somewhat unsustainable when the value of the dollar is falling (through inflation). At some point, the central bank has to reverse the situation. Such a reversal is happening right now. At present, however, investors are rather unconvinced about the intentions of the Fed. After all (just look at the yield curve), current investors are much more likely to indulge in short-term speculation than in long-term investments.

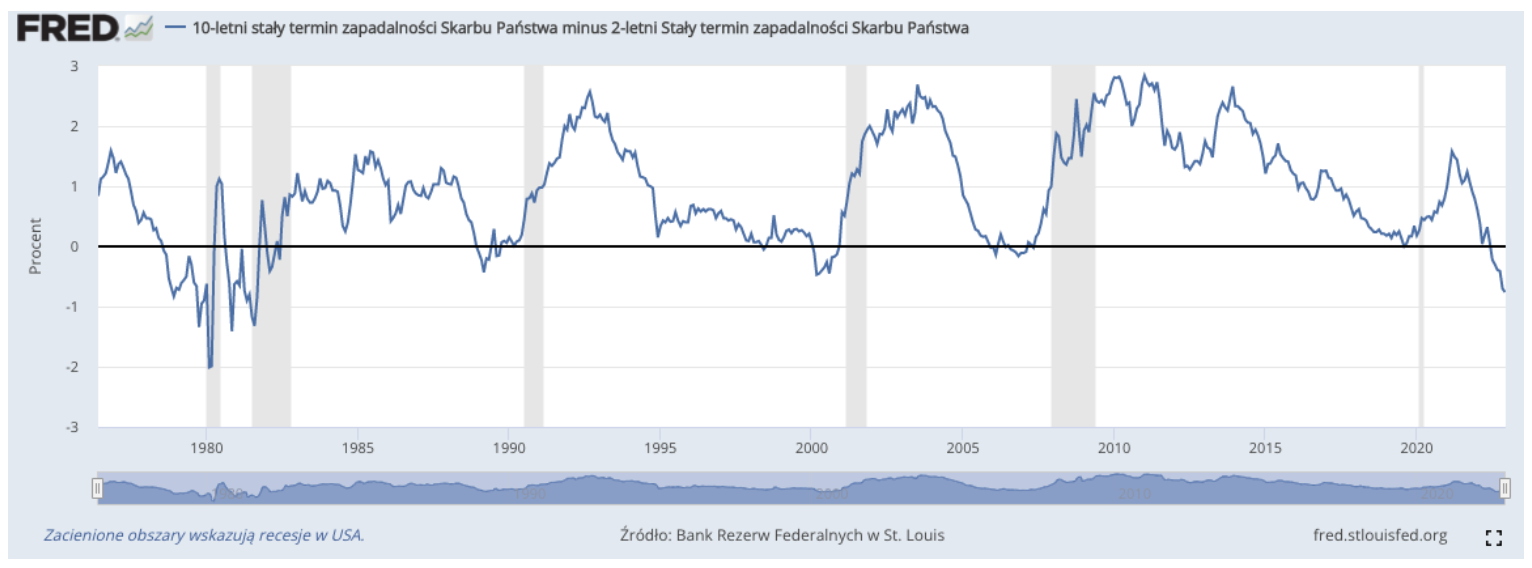

The chart above shows the current state of the yield curve. Shows the 10-year bond yield minus the 2-year bond yield. Consumers and investors are turning away from the long parts of the yield curve to make money in the short term.

There is only one conclusion. Considering the theories drawn from the Austrian school, we are now at a turning point in the cycle. According to Hayek and Mises, the policy of zero interest rates in the US for nearly 14 years has led to distortions in the allocation of capital, the result of which we are now seeing in inflation indicators and the risk of a global recession.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)