Stock market: year-end considerations and what to expect in 2024

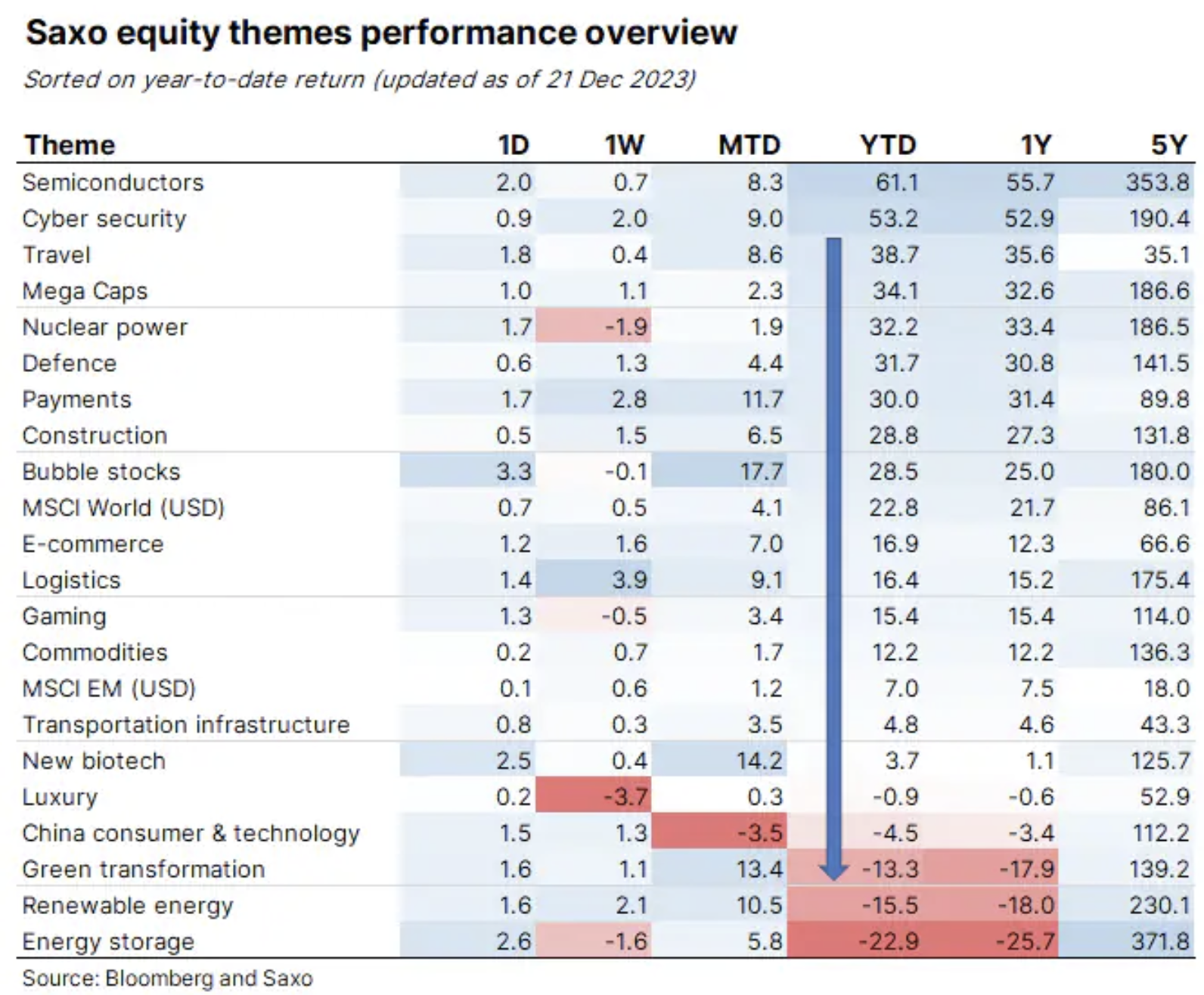

The year 2023 was marked by extremes and divergences. The global economy was resistant to aggressive monetary policy increases, but China faced serious structural growth problems. US stock markets have been pushed to new highs by the tech boom cycle, but green transition stocks have been the biggest losers. The war in Ukraine continued, and a new flashpoint arose in the Middle East. While central bank policies were more or less in sync, Bank of Japan maintained negative interest rates. 2024 will be a year of uncertainty. Investors will wonder if the U.S. economy will tank recessionwhether inflation and wages will prove stable and whether the global economy will accelerate again. The war in Ukraine, the conflict in the Middle East and elections in Taiwan, India, the United States and potentially the United Kingdom will be the main risk factors.

A year of extremes and divergences

It's hard to imagine a crazier twelve months for equities than 2023. It's always difficult to summarize the past year in all its details, but below are some of the key events worth reflecting on.

- The consensus was clearly on the side of recession, but the global economy turned out to be resistant to aggressive increases in monetary policy.

- Monetary policy delays turned out to be historically long this time, most likely due to the extended period in which the economy was in a very low interest rate environment.

- There were great hopes for China, but this year has proven to be a period of many false starts, and the once undefeated country is struggling with serious structural growth problems.

- Rapidly rising interest rates caused a short-lived banking crisis, which was quickly contained and limited to a few of the weakest links. Silicon Valley Bank went bankrupt, a UBS acquired Credit Suisse.

- The market was confident that the central bank would ease in 2023, but instead central banks were adamant and reinforced the "higher for longer" narrative, pushing the US 10-year yield to 5% before aggressively pushing it back down to levels where which the year began.

- Generative AI became the talk of Wall Street, and investors rushed into action when Nvidia posted two gigantic earnings results at levels never seen before in history.

- The cycle of technological hype generative AI pushed US stock markets to new all-time highs in terms of index concentration, with the 'Magnificent Seven' stocks outperforming the S&P 500 by four times.

- There were high hopes for a geopolitical breakthrough in Ukraine that could force Russia to negotiate peace, but instead the conflict has degenerated into a World War I-style war of attrition with no end in sight.

- Worse still, a new flashpoint has ignited in the Middle East with the Hamas attack on Israeli civilians, followed by the brutal invasion of the Gaza Strip by Israeli forces. More recently, the conflict has led to attacks on ships in the Red Sea, forcing freighters from Asia to Europe to reroute and travel around Africa at increased costs.

- Just as technology was the winner in the global stock market, green transition stocks were the biggest loser, fueled by the wind turbine industry crisis and a glut of solar panel stocks.

- Peak COP28 ended with the promise of ushering in an era of declining fossil fuel use. The rapid implementation of energy-saving solutions, especially electric vehicles, is already having a significant impact on oil markets. This trend will be of great importance for Saudi Arabia and Russia in the coming years, leaving its mark on geopolitics.

- While central bank policies were more or less in sync, the Bank of Japan maintained negative interest rates and controlled the 10-year government bond yield curve. Divergent policies with the rest of the world left the JPY absorbing all the pressures, and the financial market wondered when the Bank of Japan would return to the real world.

- The strong US dollar and high interest rates had a negative impact on emerging market stocks, which once again underperformed and were consigned to the dustbin of history, at least for now. Global investors seem less and less interested in emerging markets.

It is worth preparing for surprises in 2024.

As 2023 comes to an end, investors will wonder if 2024 will surprise everyone as well. The consensus increasingly assumes a mild recession in the US economy sometime mid-year. Assuming the consensus is always wrong, this leads to two paths in 2024: 1) a hard landing scenario when high interest rates finally bite, or 2) a reacceleration of growth in the global economy. Economic growth in Europe is not the best, although it is stabilizing in the dynamics of a mild recession, while the US economy remains resilient.

Next year will evolve around the following key themes:

- Will inflation and wages prove more stable than expected, forcing central banks to keep interest rates higher for longer?

- Will the return of the Bank of Japan to normal interest rates trigger deleveraging dynamics as JPY was used as the key currency to finance carry trade transactions?

- General elections in Taiwan (in January), India (in April), the United States (in November) and potentially in the United Kingdom (most recently in December) may surprise markets and increase geopolitical risk.

- Will American technology live up to extreme earnings growth expectations, or will investors get carried away again in 2024?

- Will the world receive another positive surprise from generative artificial intelligence that will once again unleash atavistic spirits?

- Will the global economy fall into recession or accelerate again? China plays a key role here. The most significant risk for the economy is the expected smaller fiscal impulse in Europe and the United States.

- Will the adoption of electric vehicle technology be another year of extreme growth that spells the beginning of the end for oil as we know it? Will this force Saudi Arabia to make rash decisions?

- Will emerging markets return to the financial markets or will they disappoint once again?

- If interest rates continue to fall, could green transition stocks become the biggest winner of 2024?

- Will peace be achieved in the Middle East and will Ukraine get enough support from the EU and the US to avoid losing more territory to Russia as the war drags on into its third year in 2024?

One thing is certain, financial markets and geopolitical events will never cease to surprise us, and investors must be ready for uncertainty as the new year begins.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)