The commodity bull market is holding back due to concerns about economic growth

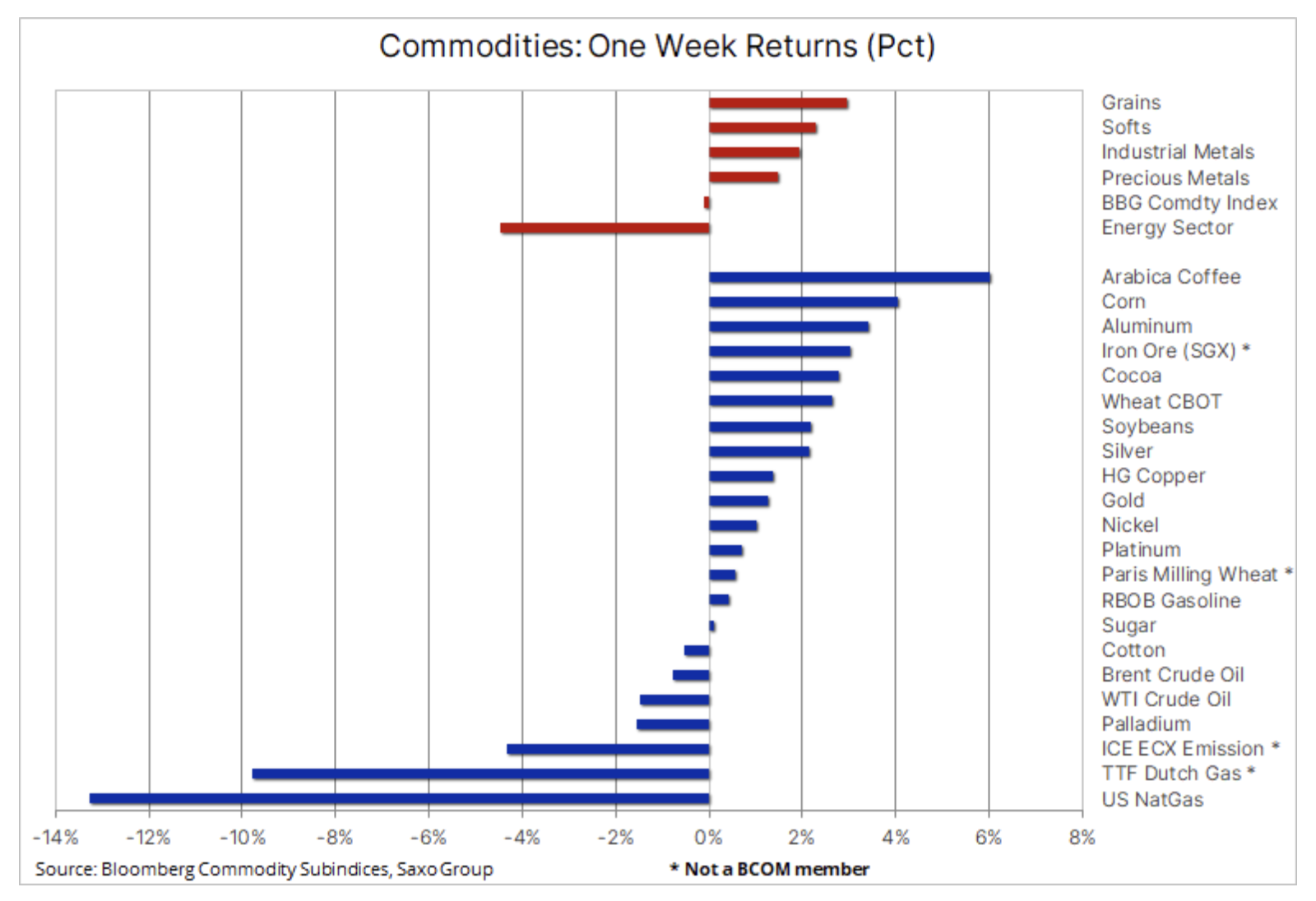

Commodities markets were mixed in the past week: there have been drops and profit-taking after US inflation rose to 7,5%, the fastest annual growth rate in 40 years. The nervous reaction to high inflation, as a result of which government bond yields increased significantly, as well as uncertainty in the stock market, was caused by concerns that an aggressive cycle of interest rate increases would harm economic growth, and hence demand, more than previously anticipated. For now, however, the main problem for commodity markets remains the projected limited supply supporting prices in all sectors, from crude oil and fuels to aluminum and copper, as well as some key crops and coffee.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Declines in the energy sector, caused by the collapse in natural gas prices due to mild weather conditions, and the first weekly fall in oil prices since December, amid the prospect of the resumption of talks on the Iranian nuclear deal, contributed to the first, albeit small, deal in two months. losses of the Bloomberg spot commodity index on a weekly basis. LME Industrial Metals Index hit a new record amidst overall tight supply, primarily for aluminum and copper, and began to depreciate towards the end of the week on the US CPI reading and its potential negative impact on economic growth in the face of further interest rate hikes in the coming months

Industrial metals

Metals headed by aluminum material i copperand the cereals sector, led by soybeans, rose sharply before their growth was interrupted by Thursday's surprisingly high inflation reading in the United States, which may negatively affect the outlook for demand. Aluminum has hit its highest price in 13 years; the most energy-intensive metal has suffered from supply constraints as China's monetary easing and announcements of infrastructure spending backed demand. Copper, which had been in the range for the last ten months, made another attempt to break out, but was pushed down after the CPI reading.

Soybean i maize have gone up but have not reached their highs as worries about South America's weather continue to support the contraction of supply constraints. The soybean premium to maize has reached its highest level since 2014, and with the approaching sowing season in the United States, farmers may prefer soy to maize, thereby unintentionally supporting the price of maize due to the risk of acreage reduction, which would lead to a decline in production in the United States. the coming season. Worries about the weather in Brazil contributed to a rebound in the market arabica coffeeand the price of futures contracts listed on the New York Stock Exchange has reached a new eleven-year high. The latter move was a reaction to a further decline in the level of inventories monitored by the ICE exchange to 1,03 million bags, the lowest level in 22 years.

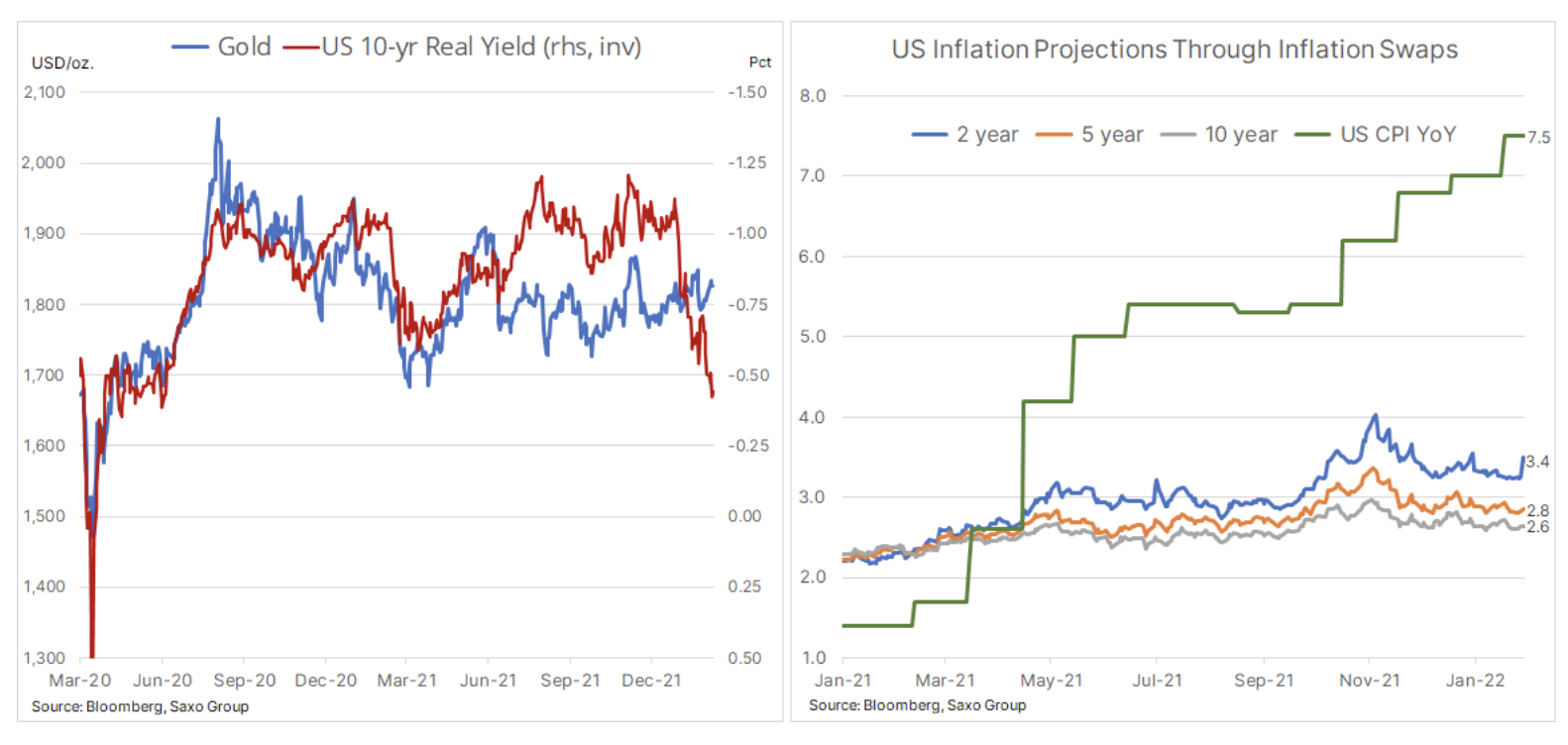

As already mentioned, the January CPI reading in the United States rose to the highest level in 40 years, and these data significantly increased expectations for the upcoming Fed meetings and influenced the risk appetite as it was concluded that the Federal Reserve must keep pace with this development and demonstrate its own credibility. With the seven rate hikes currently priced in over the next 12 months, the latest inflation figures suggest the Fed is lagging so far behind the curve that it must take aggressive action to catch up and regain credibility. With more than a month left to the next FOMC meeting on March 16, some say the Fed may be forced to make a move ahead of this meeting - this would be the first inter-meeting tightening action in recent history .

With the supply of many key commodities so scarce, the prospect of higher prices is sustained, but the flattening yield curve in the United States is seen as a warning signal that the US economy and several other post-pandemic countries face an economic slowdown as soon as central banks they will start to brake.

In this period of uncertainty, we anticipate continued demand for gold, which managed to make a profit for the second consecutive week despite the prolonged sell-off of US Treasury bonds. Last week, the yield on ten-year bonds exceeded 2%, and real yields reached a new high of the cycle at -0,43%, an increase of almost 0,7% from the beginning of the year. However, the aforementioned flattening of the yield curve suggests that investors expect growth to slow down in the coming rate hike cycle.

In our last gold analysis We highlighted gold's ability to resist gravity in the face of rising US bond yields and the fact that any drops below $ 1 have so far proved short-lived. This support is due to the fact that gold is both a hedge against inflation and a defensive asset in times of increased volatility in the equity and bond markets as the market adjusts to rising interest rates. At the same time, we believe inflation will remain high and rising production costs, wages and rents are some of the factors that may not be reduced by rising interest rates. In this context, gold is increasingly seen as a hedge against the current optimistic market view that central banks will manage to lower inflation.

While asset managers have shown renewed interest in the accumulation of long positions in gold-backed equities, price action has not yet generated increased interest from momentum-driven leveraged cash managers, who have a tendency to buy as they strengthen and sell at a low price. moment of weakness. For this segment to become involved, gold must at a minimum break above the 50% mark from the 2020-2021 correction line of $ 1, which is also the 876 high. On the other hand, an inability to stay above $ 2021 and, above all, $ 1, could signal a deeper correction.

Petroleum

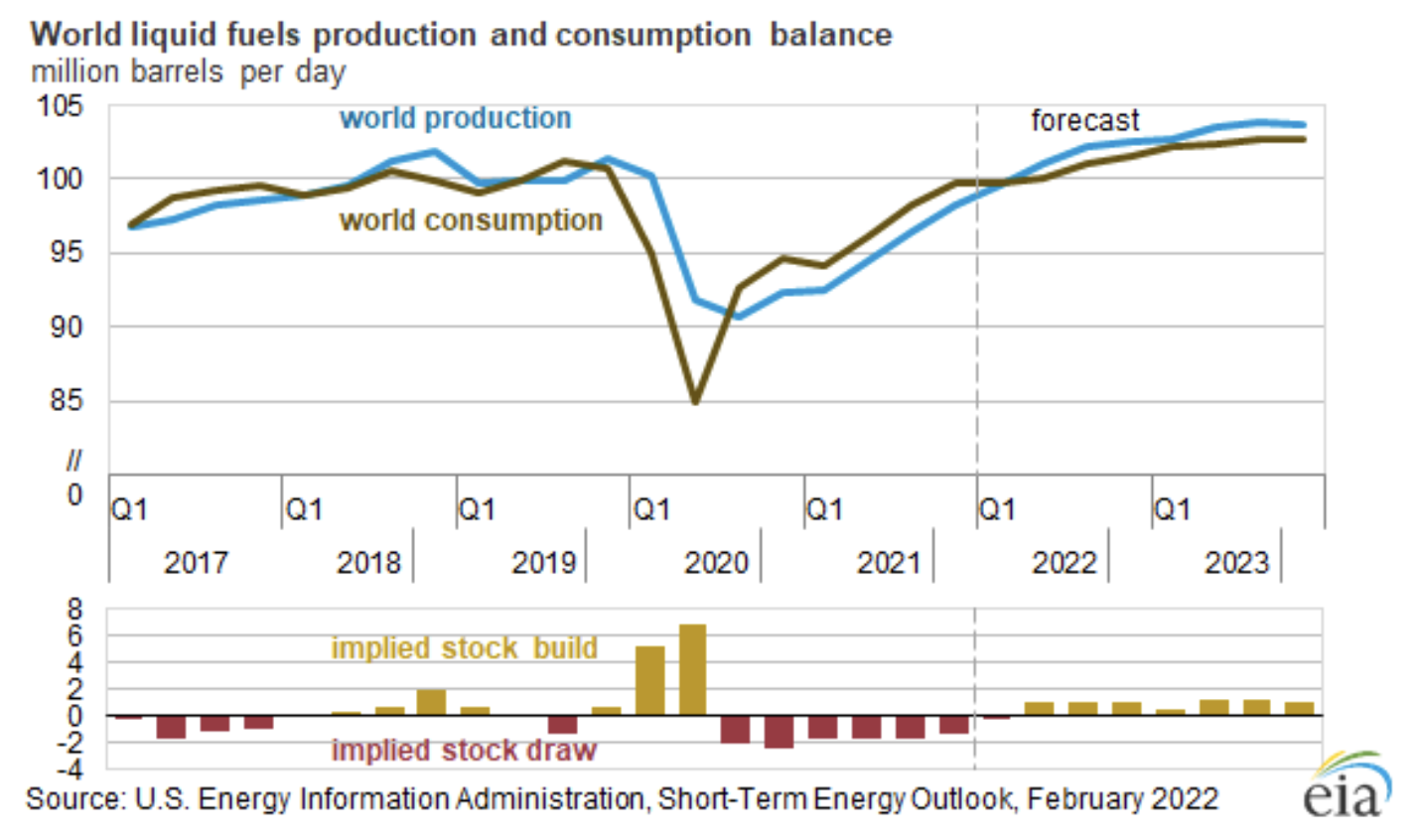

Clothing it was heading for the first decline in eight weeks, with the prospect of an agreement with Iran paving the way for additional production and exports in the spotlight. This would provide an injection in the form of additional barrels, which according to the most recent the IEA report on the oil market it is missing out on the "chronic" struggle of OPEC + to revive production. Struggling with underinvestment and disruptions, 23 OPEC + production failed to meet agreed production targets in January (the result was 900k barrels / day lower), and the IEA predicts this will continue to worsen, exacerbating the current market decline. Moreover, in the opinion of the IEA, the extremely high gas prices in Europe in the last quarter of 2021 contributed to an increase in the demand for crude oil on this continent by 250-300 thousand tonnes. barrels a day.

With Saudi Arabia, as one of the few producers with significant production reserves, reluctant to increase supplies, the market is increasingly focused on Iran and resuming efforts towards the nuclear deal. According to the IEA, the deal could mean an additional 1,3 million barrels per day, which would significantly stabilize the market before rising production from outside OPEC, primarily from the United States, contributed to a decline in world oil prices.

However, global oil demand is not expected to peak in the near term, putting even more pressure on available production reserves, which are shrinking every month, thus increasing the risk of even higher prices. This confirms our long-term positive opinion on the oil market, as it faces many years of potential underinvestment - major players are redirecting some of their already reduced capital expenditures to low-carbon energy production.

In the short term, however, Brent oil, showing a strong upward trend since early December, is increasingly in need of consolidation, and in the event of further concerns about economic growth and an no less important deal with Iran, the price could drop to $ 83 or even $ 80 without affecting the long-term outlook. growth. For now, the price has stabilized in the four-dollar range between $ 90 and $ 94.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response