The commodity boom resumed thanks to the four resources

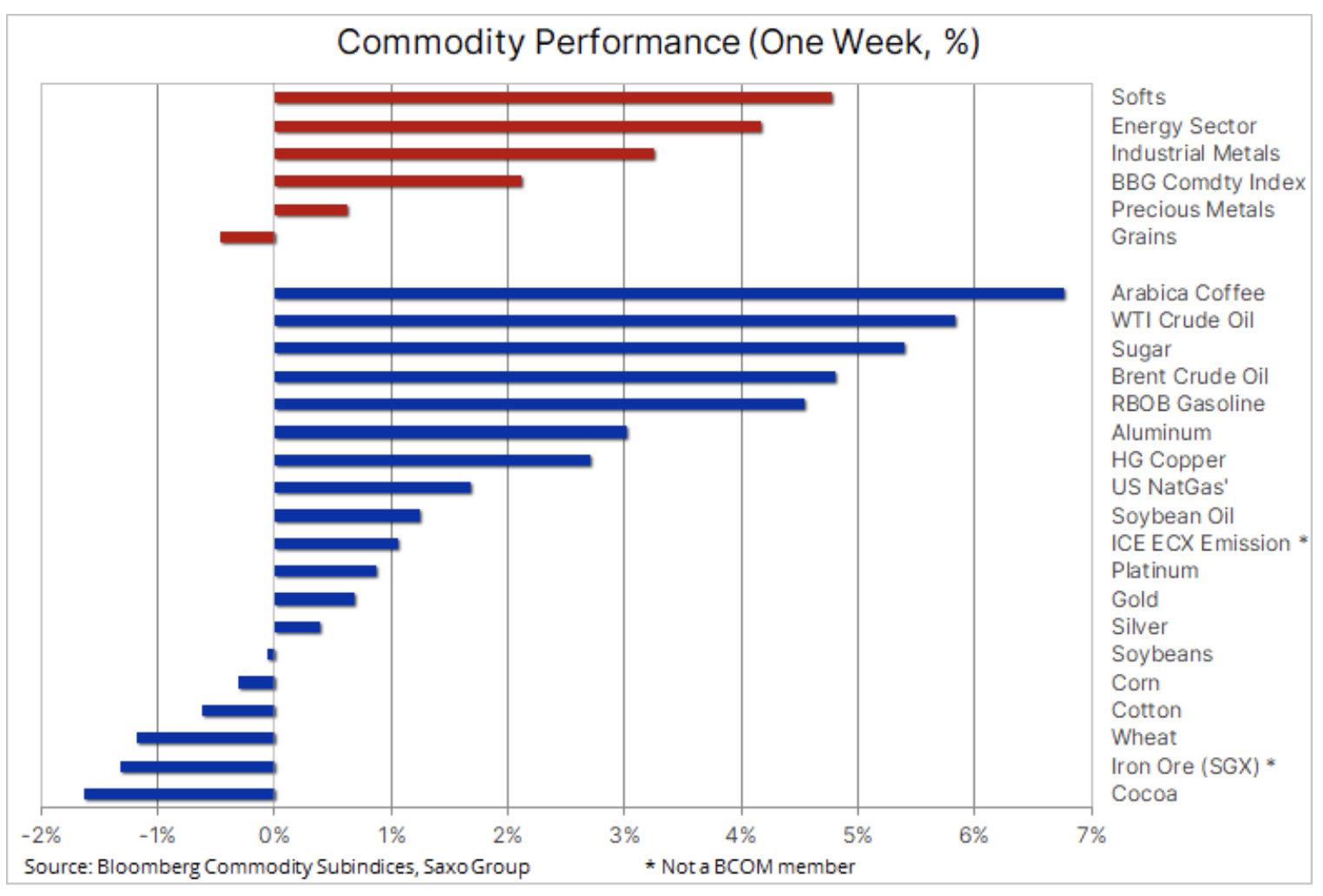

Last week, there was a widespread return to the commodity boom and the Bloomberg commodity index gained 2,1%, recovering more than half of the losses incurred in the May correction. Most sectors have appreciated with an emphasis on growth dependent sectors such as industrial metals and energy. Investors' attention was again drawn to optimism about global growth, intensified efforts to move away from the carbon economy and increased budget spending. One factor was the announcement by the massive-spending President Biden to revive the US economy of $ 6 trillion, and the continued increase in global mobility, ignoring several major coronavirus outbreaks in Asia.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

The aforementioned correction was largely influenced by the Chinese authorities seeking to reduce the involvement of speculative investors in some key markets. Actions to limit speculation and stockpiling so far - and despite a strong rebound before the weekend - have brought tangible results on raw materials that are important for China, such as steel and iron ore. However, in general terms, they are unlikely to have a lasting impact on most of the remaining raw materials, mainly due to the continued pressure to revive demand in developed markets, as a result of which Western consumers may become the marginal buyer, i.e. take over the role reserved for the last several decades for China .

Growing physical demand in times of inelastic supply, particularly in the context of industrial metals, where new mining projects can be deployed over the years, coupled with some demand from speculative and hedging investors, are the main reasons for the market mentions of the continuation supercycle in commodity markets.

The recovery in demand, combined with limited supply, continues to attract investors' attention - not only for physical goods, but also as a hedge against a longer run of inflation. Governments with massive fiscal spending and central banks releasing the brakes to maintain loose monetary policy conditions remain a strong combination, as a result of which inflation may not be transitory in the least.

Chart: The Invesco DB Commodity Index, which gained 27% year-over-day with the DBC ticker, is an exchange-traded fund with a market capitalization of $ 2,5 billion. It follows the DBIQ (Optimum Yield Diversified Commodity Index) diversified commodity index with 14 different futures, broken down into energy (60%), metals (19%) and agricultural products (21%).

Gold

Gold it hit its highest price in four months and then apparently entered a long-awaited phase of consolidation. At the end of the week, the metal slightly depreciated after it almost reached the next key resistance level ($ 1, a 923% retracement from the correction line from August to March and a level that could signal a further move towards a record high) at the end of the week. the maximum from August, i.e. USD 61,8).

The main theme in the markets that fueled risk appetite was the sheer tsunami of liquidity continued to be generated by the Fed. These measures contributed to the recent dollar weakening and at the same time kept bonds in check despite continued concerns over inflation. In the short term, however, the precious metals markets need to consolidate their recent strong gains, with the first warning in this regard being the relatively weak performance of silver and platinum versus gold last week. XAUXAG's coverage peaked in a month, while the platinum discount rose to $ 710 from the recent minimum of $ 500.

From a technical perspective, a break below $ 1 could mark a move towards $ 890, followed by a two-hundred-day moving average, currently at $ 1. Key factors will be the upward movement of the dollar and bond yields as usual, as well as the extent of the necessary further calibration of funds following the long-term trend to accommodate recent changes in the technical forecast.

Copper

Copper

Copper has recovered more than half of its losses in the recent 9% correction due to supply concerns and after the market acknowledged that China's efforts to curb speculation and stockpiling will primarily focus on the environmentally polluting steel industry. The threat of strikes by individual groups of the Chilean BHP company, operating the world's largest copper mine, contributed to a further improvement in sentiment. This was due to, inter alia, the prospect of a strong, growing demand for the so-called "Green metals" such as nickel, aluminum, platinum and, above all, copper. After a slight correction to the low in a month ($ 4,44 per lb), copper HG recovered with a break above $ 4,72 that could potentially signal a return to the May 10 high of $ 4,88 and above.

Petroleum

Futures contracts for oil found new buyers thanks to an increase in demand, mainly in the United States, counterbalancing concerns about the possibility of increasing supplies from Iran. WTI crude oil came to the fore of the boom, reaching the two-year high at the close, while Brent crude oil again approached the region of USD 70, i.e. the upper limit of the current range. The market focuses on the OPEC + meeting scheduled for this week, where it is expected that the group, despite uncertainty about future Iranian production, will confirm the 0,8mbbl / day hike already agreed in July. Until there is more certainty about the outcome of the negotiations between Washington and Tehran, and the global revival in fuel demand is more synchronized, the potential for growth above the March high of $ 71,40 appears limited.

Coffee

Prices arabica coffee on a weekly basis, they rose 7% to their highest level in four and a half years above $ 1,6 per pound. The recent spike in prices has been linked to supply concerns from major producers - Brazil, where drought continues to hit production projections, and Colombia, where political protests since late April have pushed supplies to a halt. In the short term, these events are of key importance and, given the potential for cooling in Brazil increasing the risk of frost in higher growing areas, the forecast suggests further support.

Maize

Maize gained the most in two years, recovering further losses from the recent weakness culminating in an overall correction of 18%. This followed the release of weekly export data that showed the second-largest sales volume since 1990. After falling to its lowest level in a month last Wednesday ($ 6,03), the July contract went up by the exchange-authorized limit to the level of $ 6,6450, entailing both wheat and soybeans in particular. Sales were primarily influenced by another huge order from China as a reminder that the country, despite seeking to reduce speculation and hoarding stocks, will continue to drain global supplies to build up the world's largest cattle population.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

Leave a Response