How the Fed became the Santa Claus of the real estate market

The real estate market in the context of the crisis and numerous comparisons of the current situation with that of 2008 is still a hot topic. The latest data on sales, building permits and existing properties may have caused some confusion for the observers. On the one hand, the data were getting worse and worse and no one had much hope for their improvement (in the context of a restrictive monetary environment), on the other hand, real housing prices are not experiencing a major crisis. So what's the deal with these properties? Will they face decline? Or maybe another sky-high boom? In this article, let me present you some interesting data and conclusions about the state of this sector from recent quarters.

READ: The Chinese real estate market - everything you need to know about it

Interest rates are not the most important thing

When analyzing the mortgage market in particular, one of the most important factors influencing its shape is: interest rates – nothing groundbreaking. However, if we looked at the real interest rates on loans granted for the purchase of real estate, they are actually not that high. I would even go so far as to say that their level is below normal, which I will show in a moment. Before Fed began to raise interest rates, a person with a monthly housing budget of approximately USD 2000, she could buy a house worth over USD 400. At this point, the same buyer would need to find a home priced at $000 or less. So if loan interest rates are not the main problem, then what is? The answer is sky-high housing prices, which, despite the deterioration of the sector, are still at very high levels in 2023.

Looking through the prism of the last ten years, the mechanism related to the increase in house prices is relatively simple and economically understandable. Low interest rates on loans, high availability of cash, greater (economic) sense in investing rather than saving money, it resulted in an increase in real estate prices. Naturally, there is a real estate market “leveraged asset”, financed in most cases with debt. It is not difficult to see and create a simple correlation in which Lower interest rates are associated with higher property prices. So what went wrong this time? Economic logic would suggest that housing prices should decline in the current period. The answer to this question could be artificially limited supply of real estate, the reasons for which we can look for, for example, going back to the period when the FED maintained a level of rates well below the market.

Let's adjust this for inflation

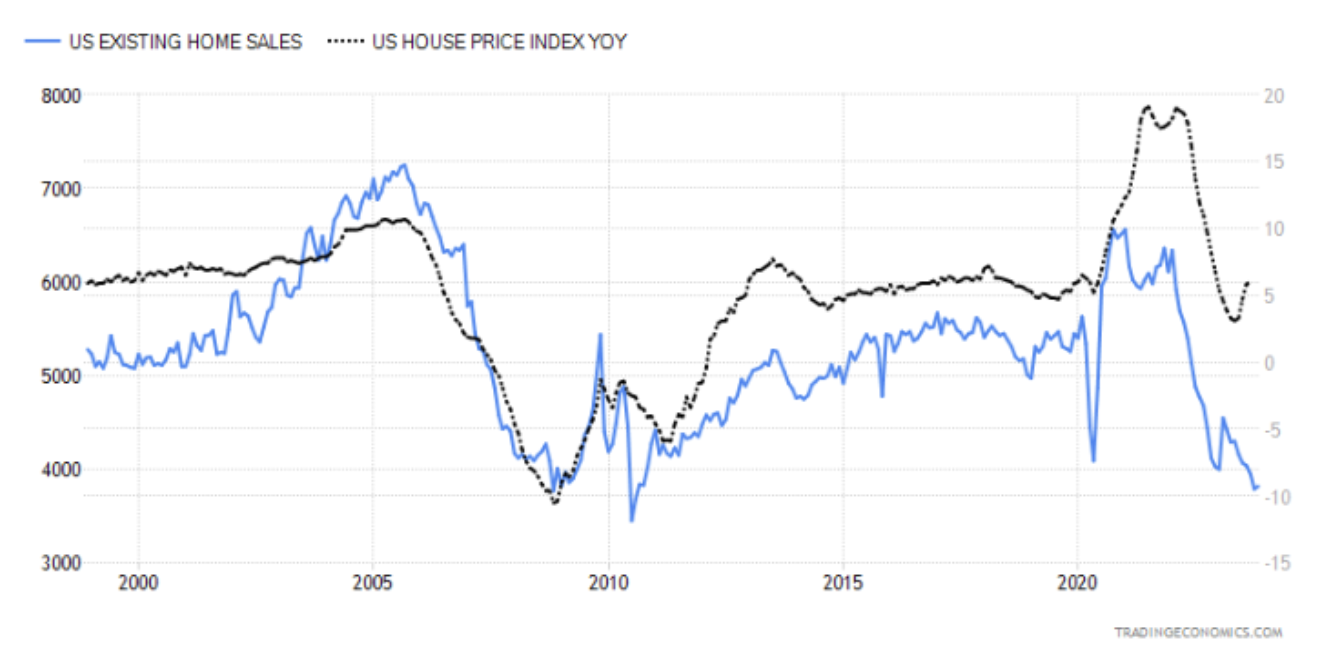

The current level of real estate sales is exactly what we experienced just after the 2007-2009 crisis. I won't surprise anyone by saying that, to a large extent, the previous recession based on MBS bonds did its job, thereby harming the housing market. Below is a chart of current apartments and their prices (the price of apartments is the black line). Please pay attention not only to the divergence of the last part of the chart (this does not prove anything yet), but also to the "unsticking" of prices in the current period of high interest rates.

House sales vs house prices. Source: Tradingeconomics.com

I think that most people who have had at least a little to do with economics are well aware that interest rate cuts take place in “critical” moment. Speaking "critical" I mean one in which inflation is already on a strong downward trend and the economy needs stimulation. In connection with this chart, I would also like to draw your attention to the fact that in the years 1998 - 2007 the housing market did not go below 5 million properties sold...

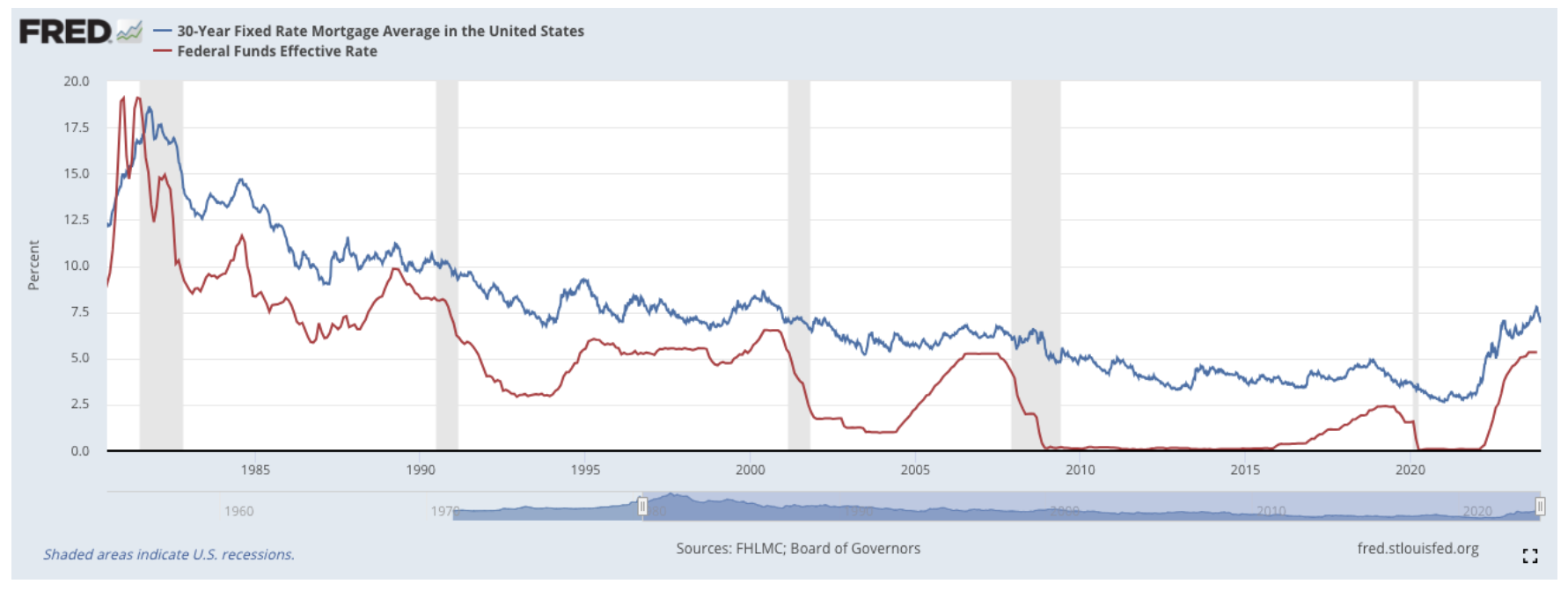

The above-mentioned 30-year mortgage rate does not seem particularly critical compared to real interest rates (red line). It is true that it is worth noting that it is at a higher level than in 2008. What is most important in all calculations taking into account inflation is that it increases not only the cost side, but also the revenue side. If we adjusted the current interest rate on 30-year mortgage loans, it would currently be lower than before Q2011 2,53 - its level reaches approximately XNUMX%. Going further in this direction - real interest rates were negative during the pandemic and the insane level of market stimulation. Excluding this wild period, it is worth noting that mortgage interest rates are currently at their lowest level in 25 years - taking into account, of course, the interest rate adjusted for inflation.

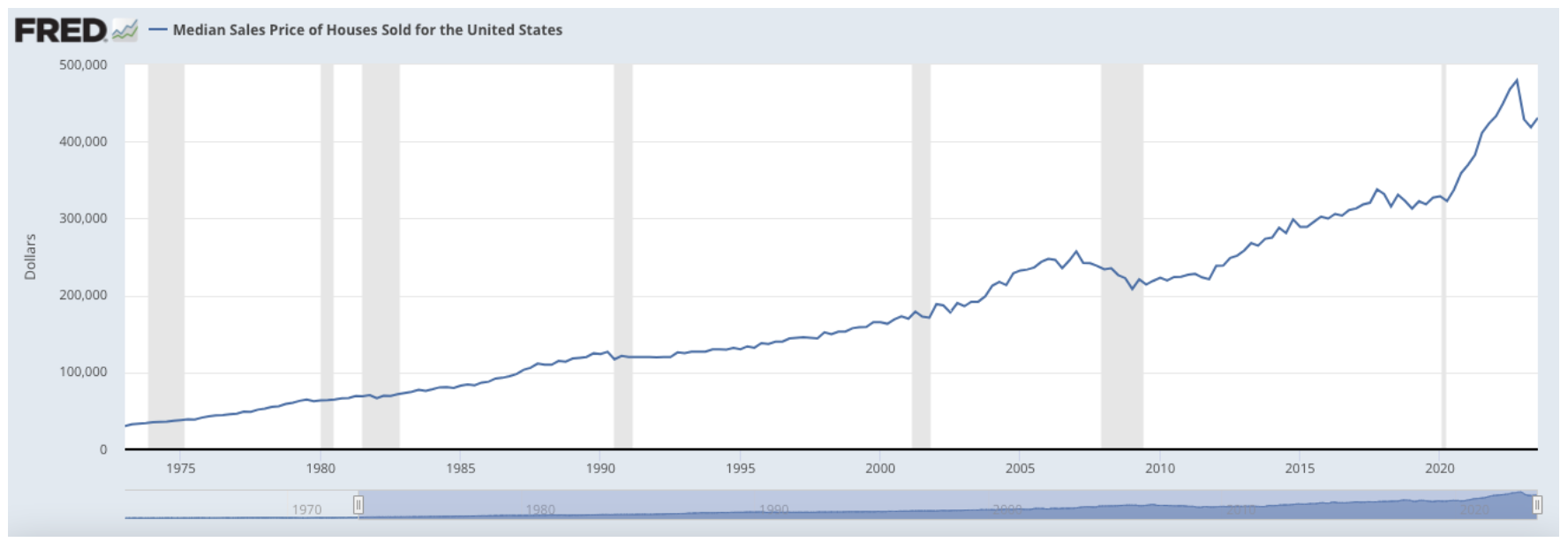

1300% up

Taking into account the period of the last 50 years, real estate prices have increased by almost 1300%. The CPI index itself recorded an increase of approximately 610%. This means that in real terms real estate has increased twice as much (in terms of prices) as inflation-adjusted incomes. The graphic below shows the median sales price of real estate in the Tax Office.

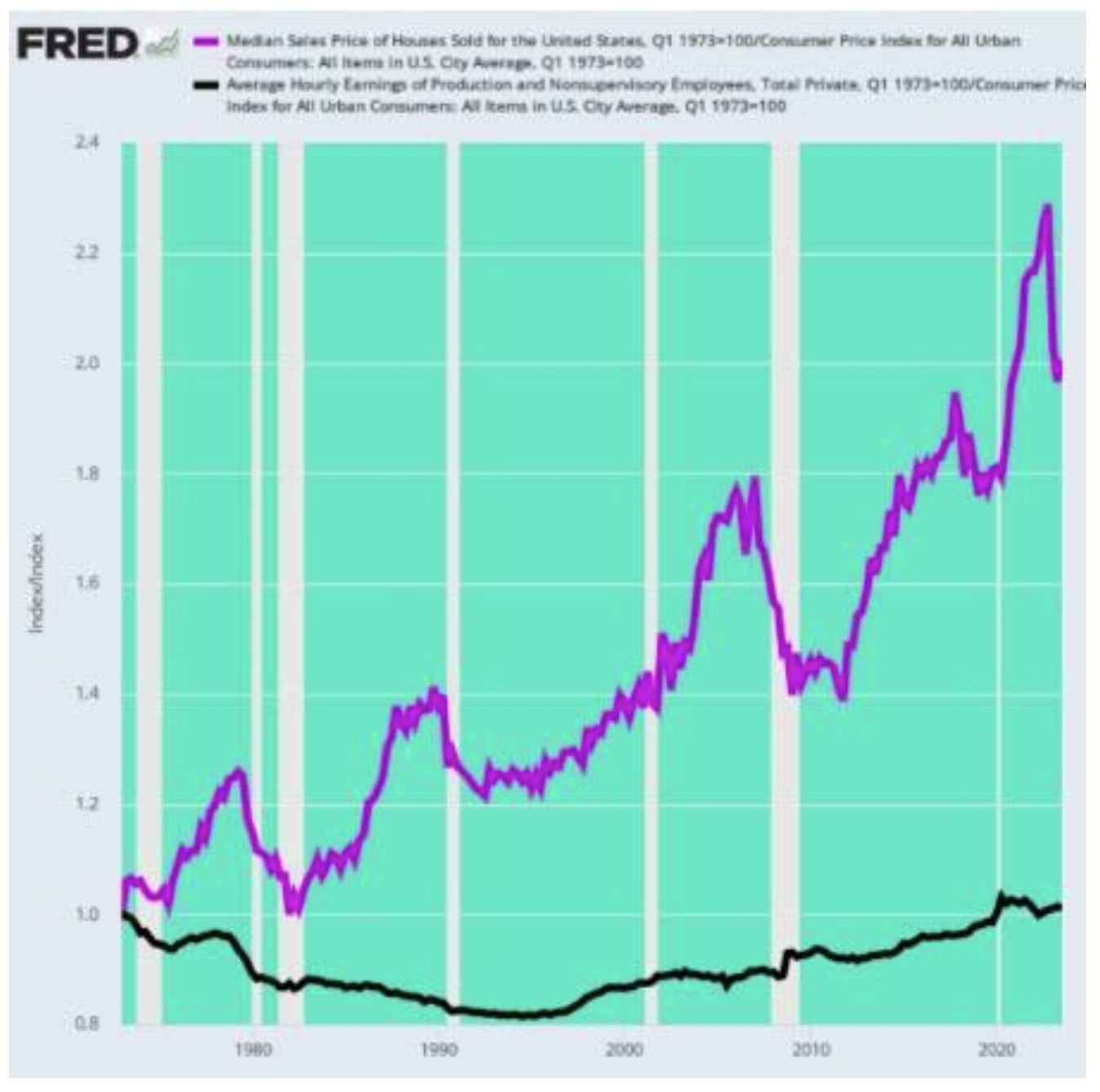

One question probably comes to mind for some of you - did wages really grow so slowly that they couldn't keep up with the skyrocketing real estate market prices? Recently, the Zero Hedge portal attempted to calculate how real wages (hourly wage adjusted for inflation) and median prices adjusted for inflation look in relation to each other.

source: zerohedge.com

Application? Looking at the chart above, over the last five decades, the average inflation-adjusted wage (black line) has increased by just 1%. What is very important, we are referring here to the entire 50-year period, not an annual growth of 1%. Meanwhile, the inflation-adjusted median home price (purple line) increased by 100%. Real house price increases have outpaced real wage increases by 100 times. In practice, this means that a potential housing "crisis" will be related to the natural lack of availability of real estate, which results from their abstract prices. Therefore, in the current loan installments, the interest rate is actually less of a problem than an element of the sky-high price increase. Believe me, there are definitely more paradoxical combinations of various data from this sector. These, however, are the most important in the entire debate on the real estate market.

One of the most alarming things about mortgage loans is the fact that 95,2% all outstanding liabilities are loans with fixed interest rates. Therefore, based on interest rate data, it can be assumed that almost 70% of this total 95,2% of the pool are liabilities bearing interest at 4%. The only conclusion that comes to my mind is the desire to artificially "suppress" loan interest rates in order to increase the pace of construction of new apartments. It is hard to imagine the functioning of the development industry without an inflow of fresh mortgage capital. In this context, it is very puzzling what will happen to the real estate market during the next interest rate cuts. The distortion at the moment is so large that despite high rates and low supply, prices are going up.

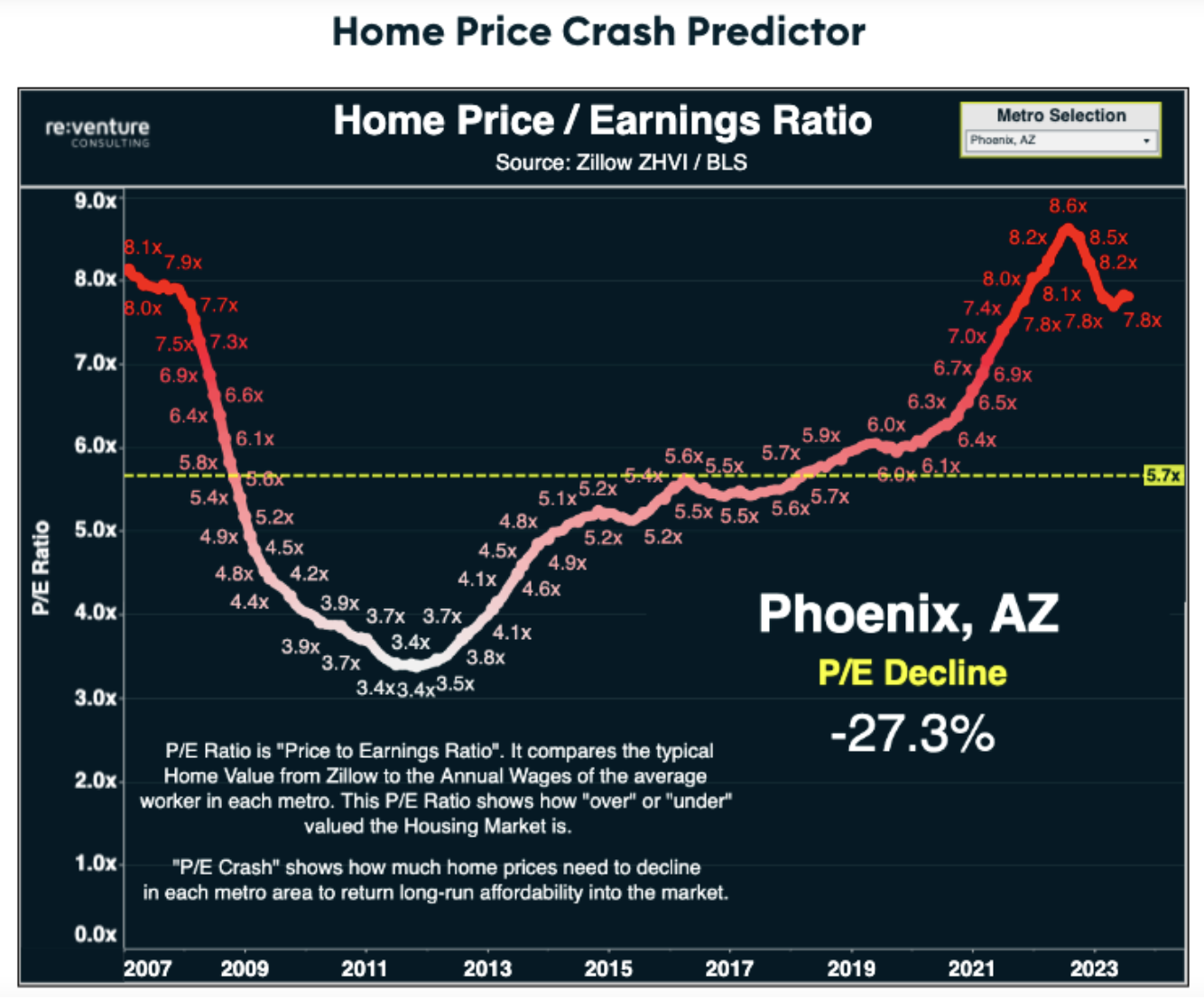

However, there is a huge stimulus ahead of us, which in the event of a recovery due to even lower mortgage interest rates, may push real estate prices even higher. The Fed, whether intentionally or not, became a saint Santa Claus for this sector, contributing through its stimulating actions to create enormous distortions. The next “round” of potential stimulus (printing + low interest rates) could be a tipping point for the real estate sector. While it may seem that we managed to land softly without serious economic damage, perhaps this element in future, significant changes in monetary policy will become the nail in the next coffin of the real estate crisis. Finally, let me leave you with a very telling graphic from re:venture consulting.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response