Weather, interest rates and social anxiety – 2023 on commodity markets

With the end of 2023 approaching, it's time to analyze this year in terms of commodity markets: it has proven to be a varied year, with favorable and unfavorable events, as well as surprises. In addition to concerns about economic growth and demand affecting energy and industrial metals prices, varying weather conditions also played a role, contributing to both the best and worst results.

The year started on an optimistic note with the Chinese economy reopening to the world after months of Covid lockdowns. However, not all was well as markets became increasingly concerned about the economic consequences of further aggressive interest rate increases by central banks in a bid to bring inflation under control. These concerns only began to subside in the last quarter, when markets finally received the signal that the next decision on rates would likely be a rate cut. The war in the Middle East, continued Russian aggression in Ukraine and attacks on ships in the Red Sea combined to create a year in which geopolitical risk increased and with it the world became increasingly fragmented.

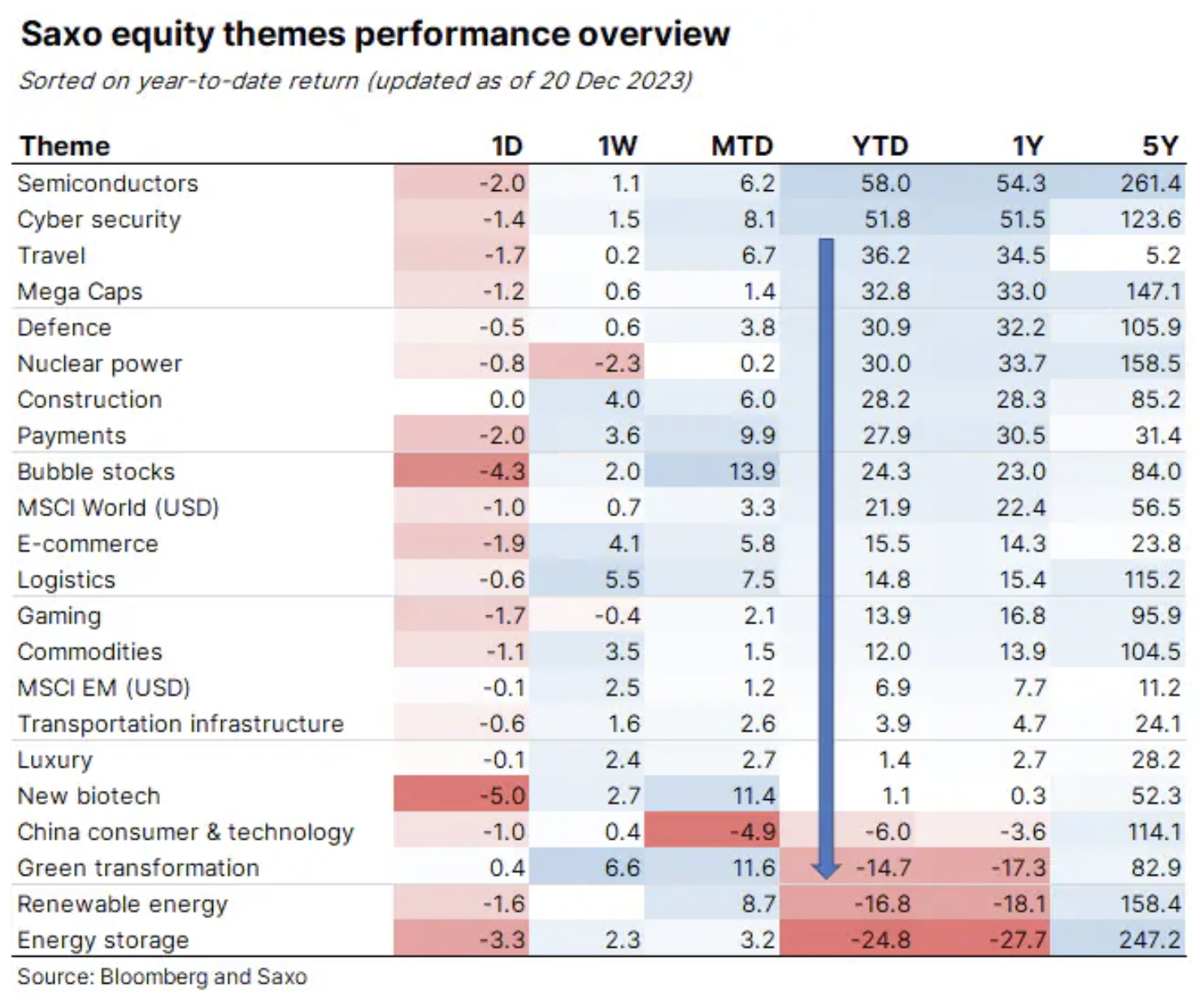

It was also a year in which the green transformation gained momentum, particularly in China, where fuel demand is likely to peak next year. However, this news provided little support to capital-intensive companies engaged in the transition as they came under intense sales pressure in the second half of the year in a context of high valuations caused by a sharp increase in the cost of money combined with rising interest rates and yields. This weakening is clearly reflected in Saxo's thematic baskets, with the worst performance green transformation, renewable energy i energy storage, whereas raw Materials were roughly in the middle of the table with a return of around 12%.

However, we suspect that as financing costs decline next year and further efforts are made to combat climate change, these sectors overlooked by investors may come back into play in 2024. With global energy demand still rising, however, the transition process is, for now, more of a green add-on after demand for gas, oil and coal also reached new record highs.

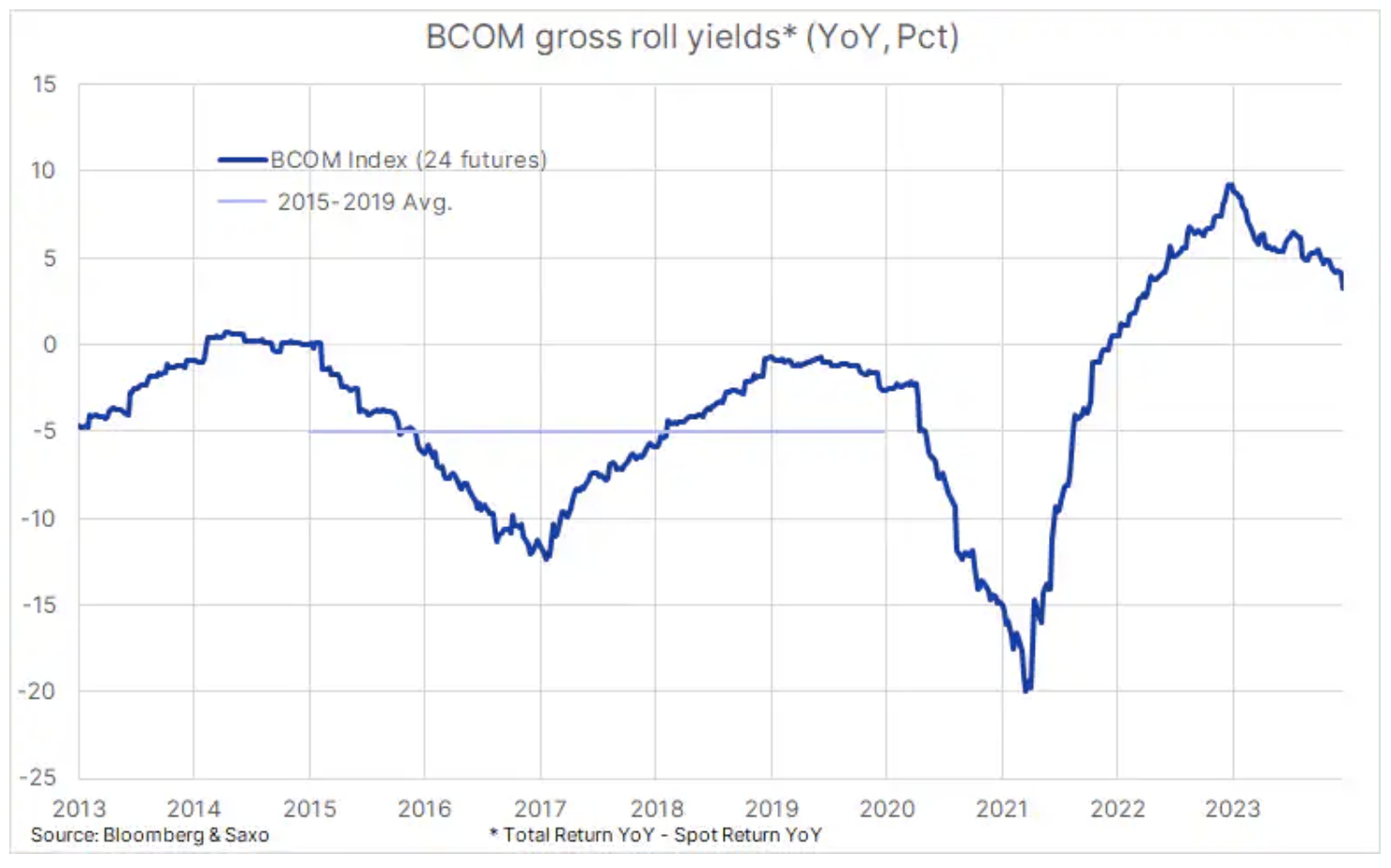

Over the past two years, the Bloomberg Commodity Total Return Index, which tracks the performance of 24 major commodity futures contracts, spread almost evenly between energy, metals and agricultural products, generated a return of 2021% in 27. and in 2022, 16%. Therefore, the assumption that the index will return around 8% this year is quite reasonable given this year's challenges. It should be noted that if American natural gas were excluded from this index, the price of which dropped by as much as 67%, its annual result would remain almost unchanged.

Returns were further supported by the fact that it was another year in which a number of key raw materials were deported - a situation reflecting limited supply in the market, contributing to a positive profit from rolling over expiring futures contracts to lower-priced futures contracts maturing next month. Although the year-over-year rollover yield declined to 3,3% compared to approximately 9,4% during the same period last year, it still provides investors with support that was lacking in pre-pandemic years, when the rollover yield averaged approximately -5%.

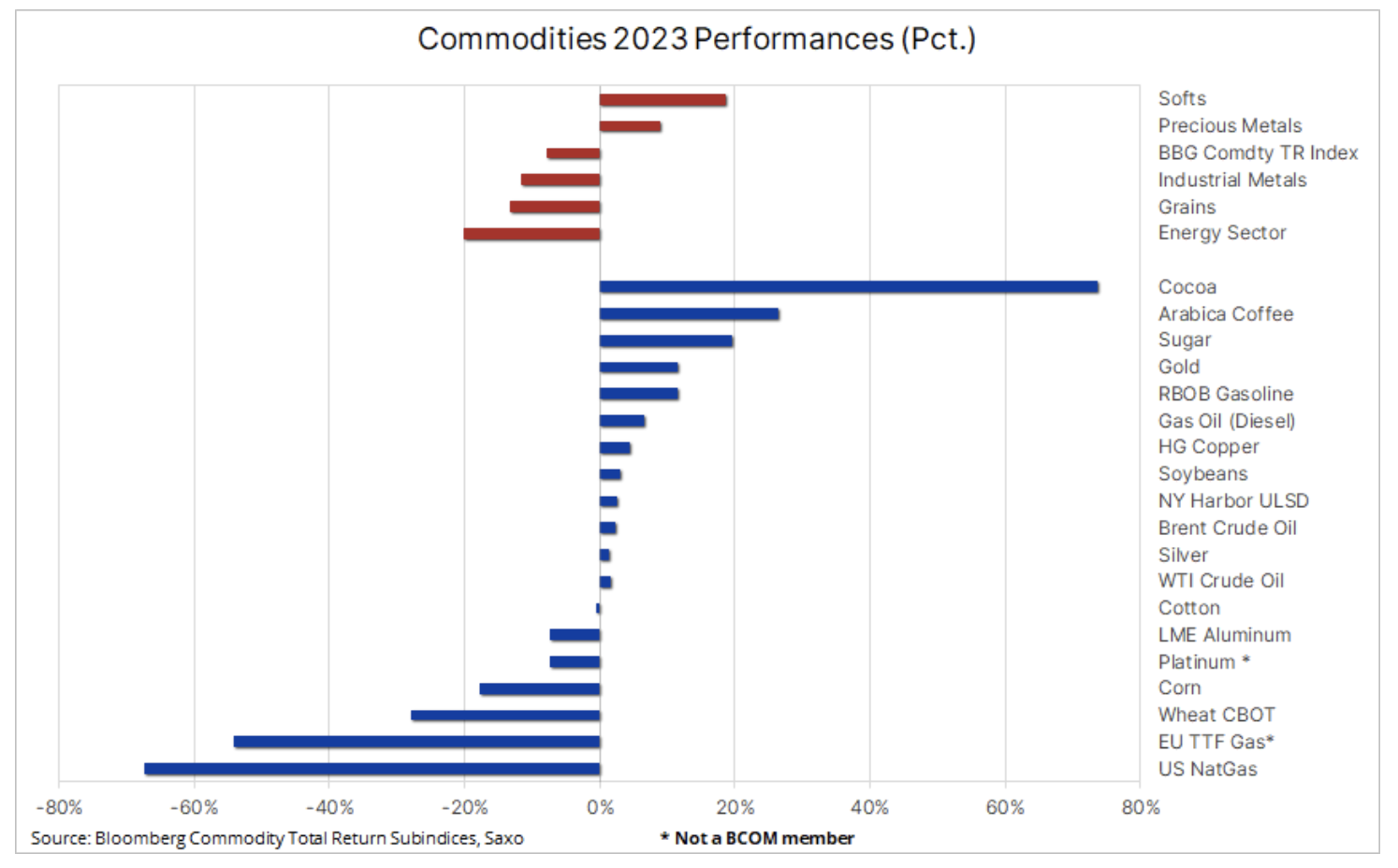

At the beginning of the year, limited supply was visible primarily in the energy sector, where the supply of crude oil and refined products such as gasoline and, above all, diesel oil was very low due to sanctions imposed on Russia and optimism related to demand in China. However, since May, the agricultural sector has come to the fore as the El Niño weather phenomenon, especially in the southern hemisphere, has led to a reduction in supply and a sharp increase in the prices of sugar, cocoa and coffee - the three best-performing raw materials this year - thus more than offsetting the negative impact of lower grain prices following a solid harvest season in the Northern Hemisphere.

In the table below we see what role certain key commodities have played in bringing inflation under control. The Food and Agriculture Organization of the United Nations (FAO) Food Price Index showed a 10,7% year-on-year decline in November, helped by declines in the prices of grains such as wheat and corn, as well as vegetable oils and dairy products. Natural gas - a key source of energy used to generate electricity - has seen significant declines around the world, in particular in the United States, where record production and large inventories and mild weather conditions contributed to a price drop of as much as 67%, but also in Europe, where gas prices have gradually declined after a sharp increase in 2022 as a result of strong renewable energy production, warm temperatures, greater capacity to receive liquefied natural gas (LNG) to replace pipelined gas from Russia, as well as weaker industrial demand .

Gold

Gold, which has strengthened by around 12% year-on-year after a long period of trading within a broad range of USD 330, has performed surprisingly well to some extent due to continued demand from central banks and retail buyers in Asia, which more than offset further selling by investors focused on much higher real yields and rising financing costs of holding positions amid continued increases in short-term interest rates in the United States. It is worth noting, however, that most of the gains were realized in the fourth quarter, when central banks finally signaled that the next decision on rates would likely be to cut them.

Copper

The 12% decline in the Bloomberg Industrial Metals Index was primarily due to low prices of nickel, zinc and aluminum and was only partially offset by increases in tin prices and, above all, copper, which increased by 5% thanks to surprisingly strong demand in China, including in connection with the green transformation, given the numerous applications of this metal in this area. The copper market found support towards the end of the year in the form of numerous short and long-term supply disruptions, and combined with already low inventory levels and potential restocking by industrial users as financing costs ease, further support is likely in 2024 .

Petroleum

Brent crude oil price has remained in a relatively tight range of $27,5 throughout the year compared to the $64 range seen in 2022, when the war in Ukraine led to a sharp rise and then collapse in prices. At the current price of around $80, Brent crude is just a few dollars below the annual average, and you can thank OPEC+ and its attempts to keep prices stable through active supply management for the relatively tight range. There is no doubt, however, that this group would prefer higher prices, but the growing production, among others, in the United States and Iran, combined with weak demand in the fourth quarter, meant that OPEC+ achieved only a partial victory, given its failed attempt to drive up prices while reducing market share.

Hedge funds remain cautious ahead of 2024.

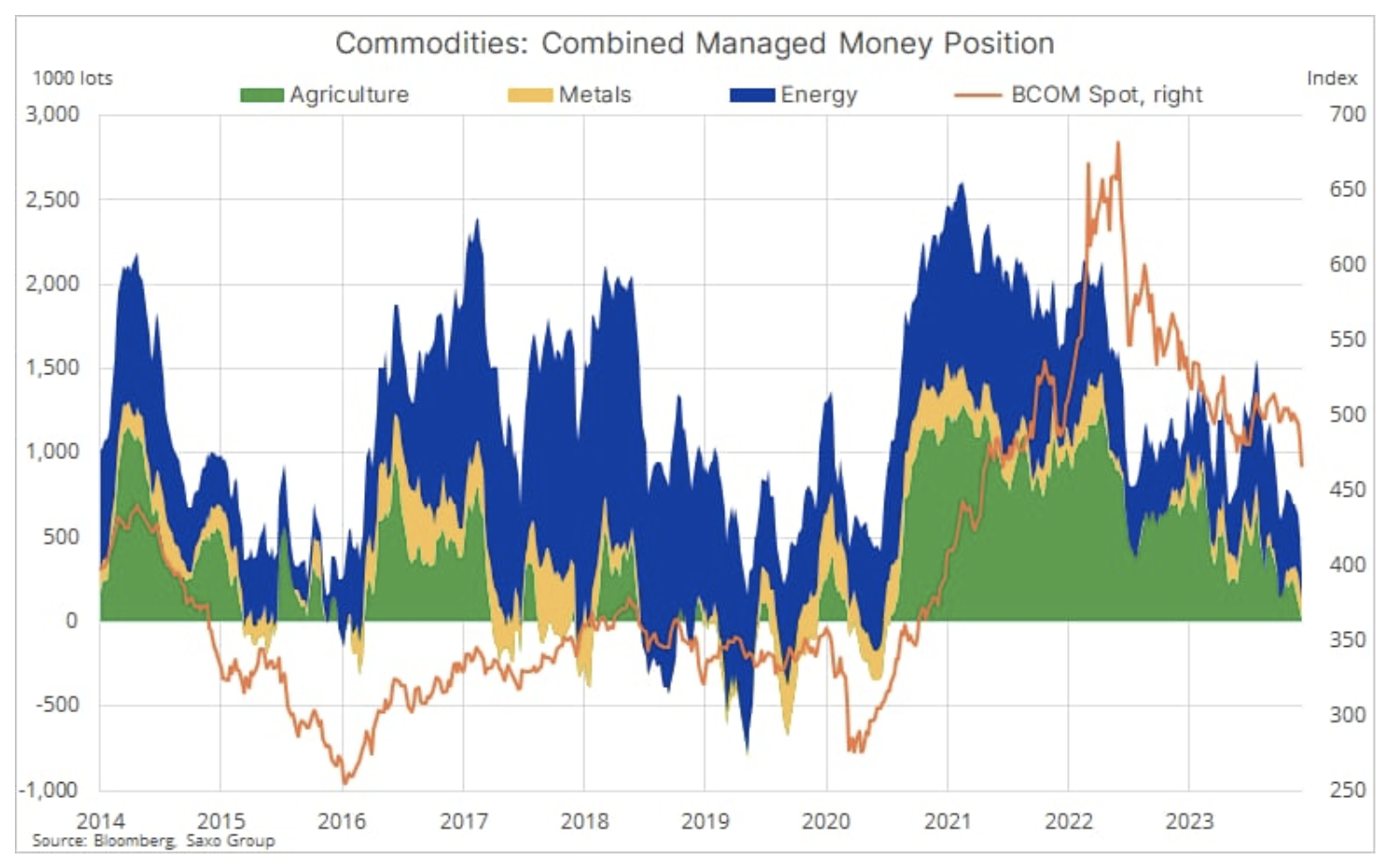

Since October, selling by hedge funds and trend-following funds (CTAs) has pushed the net long position in 24 major commodity futures contracts to levels last seen during the most turbulent period of the pandemic in early 2020, when the global meltdown occurred. demand for raw materials, primarily fuels.

In the context of these developments, we see an asset class that has been declining in popularity and has struggled in 2023 as a result of concerns about economic growth in China and around the world and a sharp increase in financing costs, prompting the industry to reduce excess inventories. We also see a sector that, under favorable circumstances, could see a strong recovery in 2024 when technical and/or fundamental outlooks become more favorable, leading to a new wave of short buying and covering. Factors that could trigger such a change may include interest rate cuts, which lower financing costs and therefore contango, as a result, there will be replenishment of inventories in the industrial sector, tight control of oil supply by OPEC, as well as signs of reduction in the supply of key raw materials, offsetting the risk of economic slowdown in the world's largest economies.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response