How to invest in the funeral industry? SCI – the leader of eternal business [Guide]

Benjamin Franklin once said that there are two certainties in the world: death i taxes. In the case of taxes, the matter is simple: they are collected by the government or local government. In turn, activities related to the funeral industry, also called "eternal business", is specific to each country. In Poland, cemeteries can only belong to religious associations or municipalities. Funeral services, on the other hand, are privatized. However, this is not the case everywhere. In Great Britain, the United States, Australia, Romania and parts of Germany and Austria cemeteries can be private. In countries where private activity is not suppressed, companies operating on the cemetery market appear like mushrooms after rain. No wonder, this is a business that is less sensitive to economic fluctuations than many other sectors. There will always be a demand for these services. What should distinguish a good company operating in the funeral industry is professionalism and affordable prices.

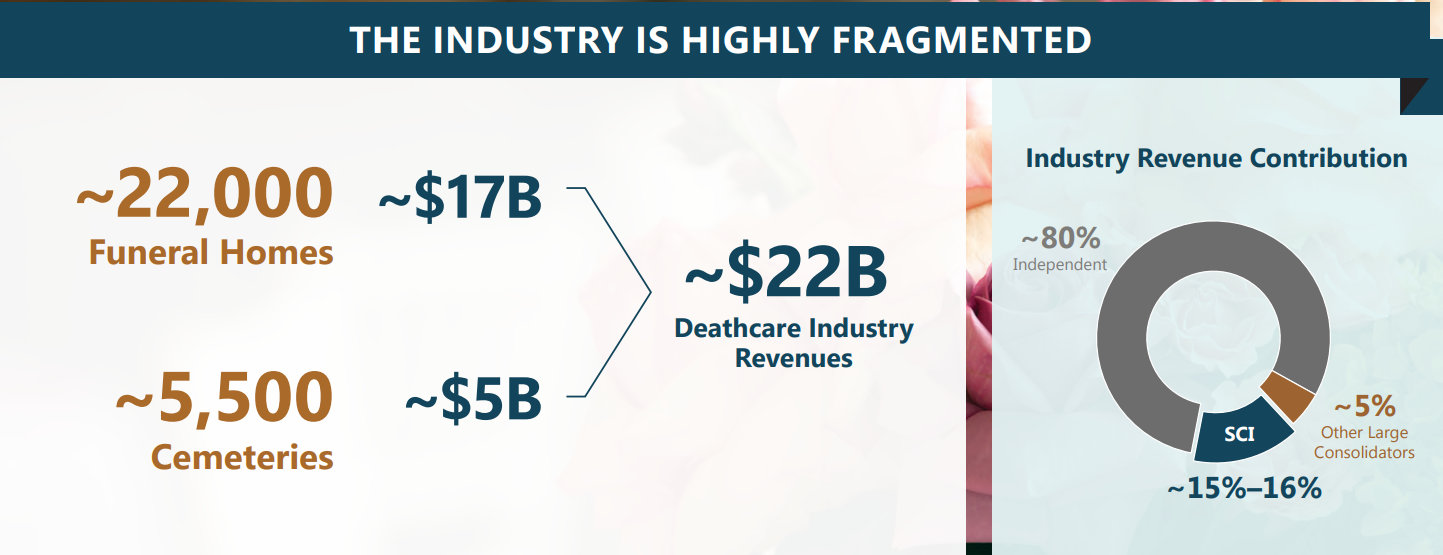

A great example where the funeral market is developing well is the United States. There are many companies there that manage cemeteries and provide funeral services. The size of the funeral market in the USA and Canada has become really large. The entire industry (funeral homes and cemeteries) is estimated at over $22 billion. So this is a large piece of the pie to manage. The North American market itself is highly fragmented. The reason is that the barriers to entry appear to be low. What you need to open a funeral home is a little capital, a few people and a hearse. The stairs start when you scale your business. It is at this point that you need the spirit of an entrepreneur to develop your business. Most companies can't do this. However, there is a company listed on the stock exchange that is slowly consolidating the market of funeral homes and cemeteries. Thanks to solid work for several years, the company has gained several percent of market shares. It is listed on the American stock exchange SCI company, which has become the leader in this market. In this article, we will take a closer look at the industry itself from the perspective of SCI and answer the question: Is it worth it and how to invest in the funeral industry?

SCI company chart, MN interval. Source: xNUMX XTB.

SCI – an accelerating machine on the funeral market

SCI is a leader in the funeral industry in the United States. A dominant position gives competitive advantages over smaller companies. There are economies of scale in this sector. It is easier for the company to negotiate rates with suppliers and has a larger marketing budget. Thanks to this the company can offer its services cheaper and is more recognizable on the national and local markets.

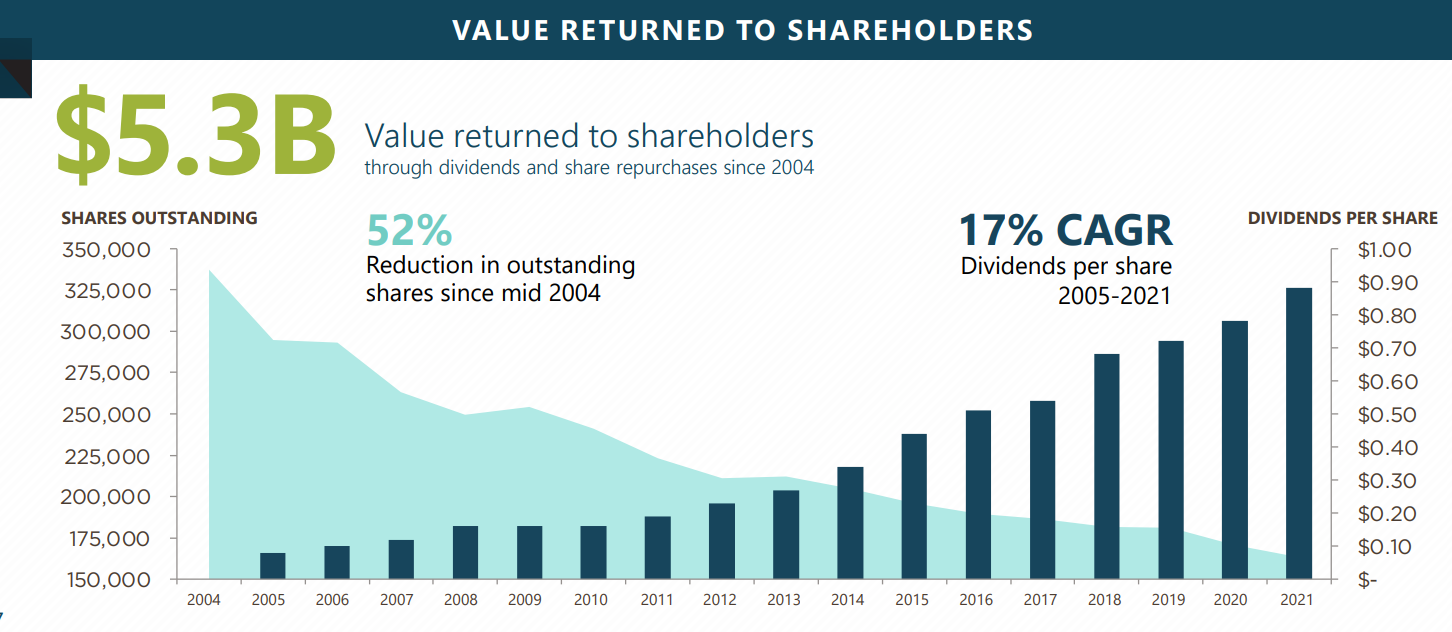

SCI is a consolidator of a fragmented market. By acquiring smaller companies, SCI gains market share faster. Thanks to this, it can also improve the efficiency of the acquired companies (cost synergies). SCI is looking for opportunities that provide an IRR (internal rate of return) of several percent. This means that such investments pay off in less than 10 years. The dynamic development of the business can be seen in the chart below. SCI's earnings per share grew at an average annual rate of 2005% between 2021 and 17. Such a rapid increase in EPS was helped by the reduction of the number of shares, which dropped by 52% over a dozen or so years.

Earnings per share in 2005 – 2021. Source: SCI

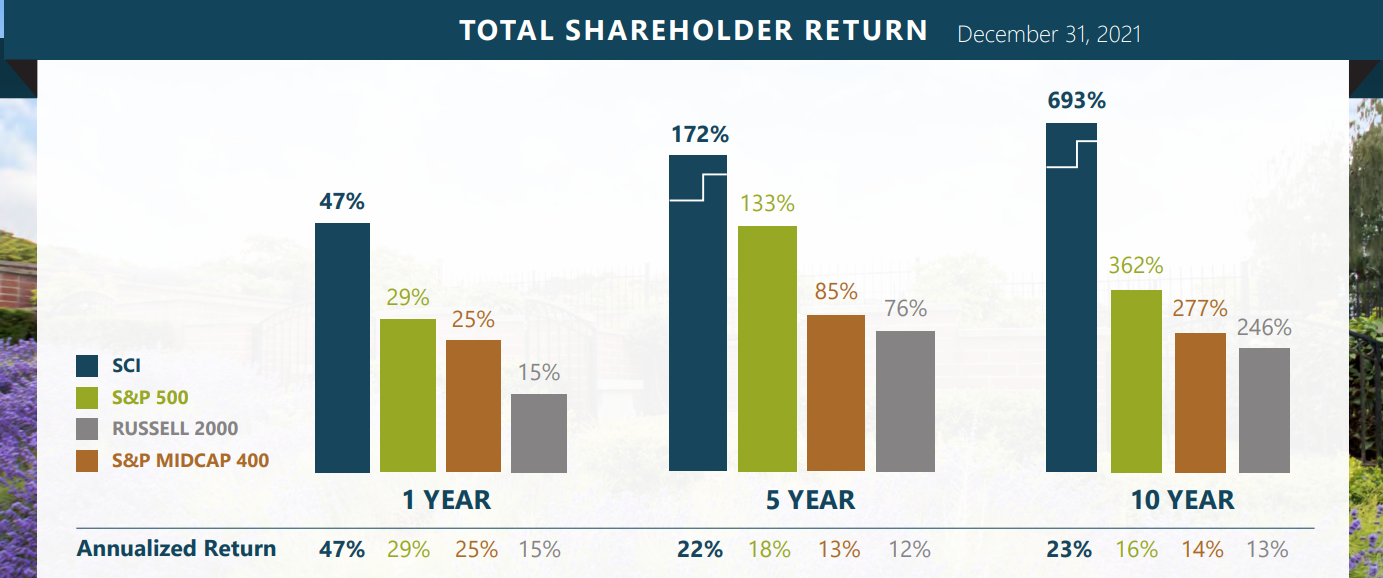

SCI has achieved a high rate of return over the last 10 years. A number of factors helped with this. These include:

- Organic growth,

- Takeovers,

- Improving efficiency,

- Buyback of own shares.

Asset return rates. Source: SCI

The company's capital management is at a high level, because if the company has no idea how to allocate free cash, it buys shares and pays a dividend.

Increasing the scale of the business, purchasing shares and improving profitability are expected to lead to a stable increase in earnings per share. This, in turn, should have an impact on the company's valuation in the long term.

The market in which SCI operates has great potential

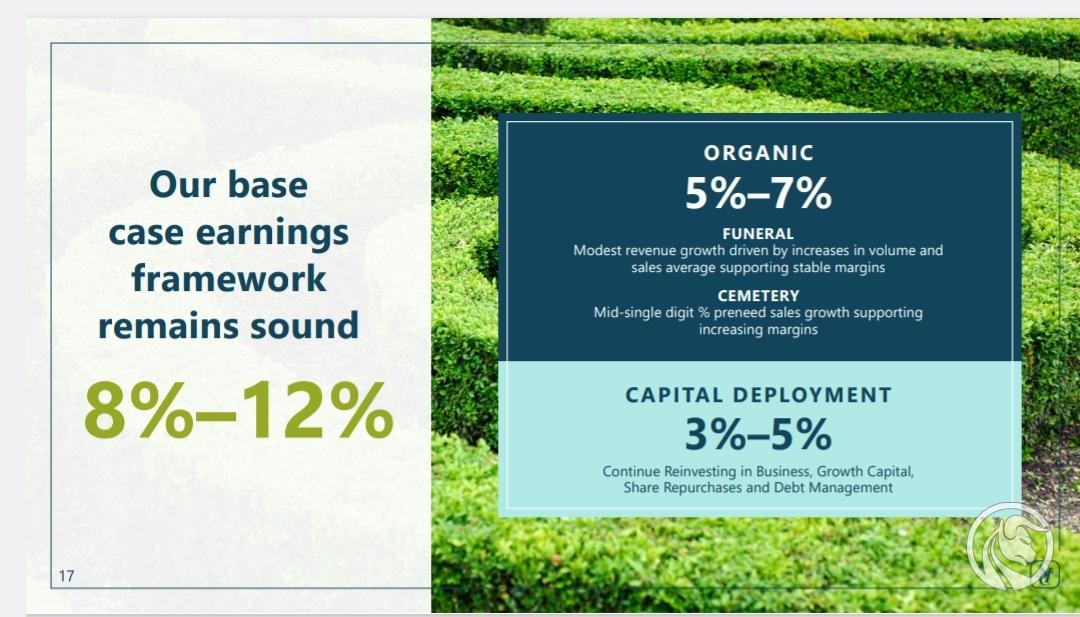

The market itself is a derivative of the population and average age of the society. The older the population, the faster the market growth. You can't fool nature, so the older a person is, the greater the probability of death. The market environment is favorable for SCI. On the one hand, the US population is growing, on the other hand, the US population is aging. This lays the foundations for business growth for many decades to come. The company itself expects to grow by 8% to 12% in the long term, of which organic growth is 5% to 7%. So it is a mature company, but in an industry that is growing.

SCI forecasts. Source: SCI

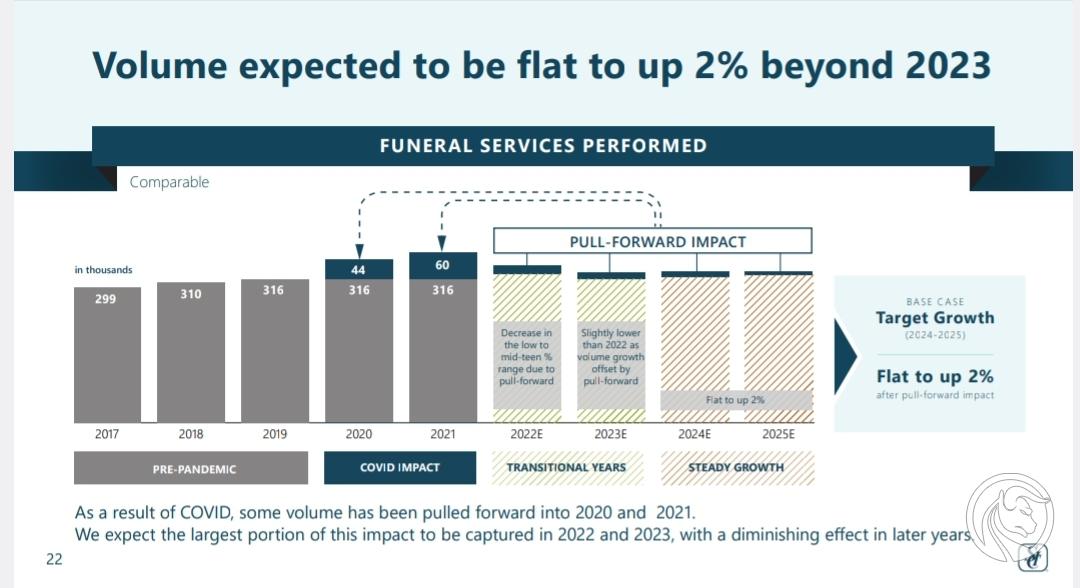

It is also worth taking a look at the impact of COVID-19 on business. 2020 and 2021 are the years of excess deaths in the US. This resulted in an increase in revenues and profits. However, these were mainly elderly people who died prematurely. For this reason these are revenues that the company recognized "promotion". Therefore, the company expects that in the coming years the growth volume of the number of funerals will return to its normal trend.

Excess deaths caused by COVID-19. Source: SCI

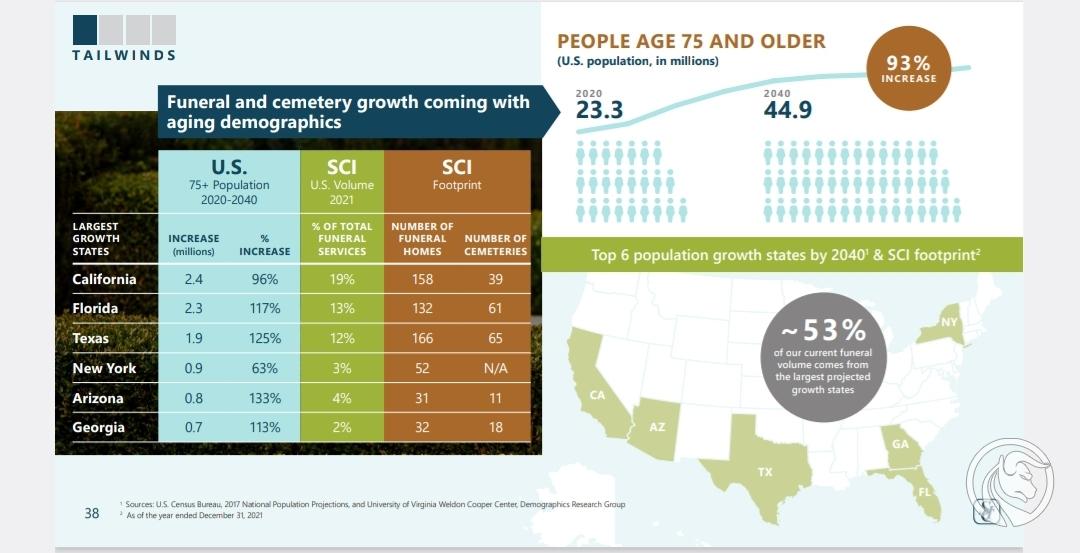

Coming back to the aging of society – According to data from research institutions, by 2040 the number of Americans aged 75 and over will increase by 93% to 44,9 million people. These are potential future customers of the company. Therefore, the demand for funeral services will continue to grow in the USA, but the beneficiaries will be SCI, which is the leader in this industry.

Demographic forecasts. Source: SCI

It is worth comparing the market environment with the company's business model. Some clients purchase services in advance, which helps protect the family from the costs of organizing a funeral. People who have not done so before will be “customers” of SCI in an indirect way, because the family will pay for the service.

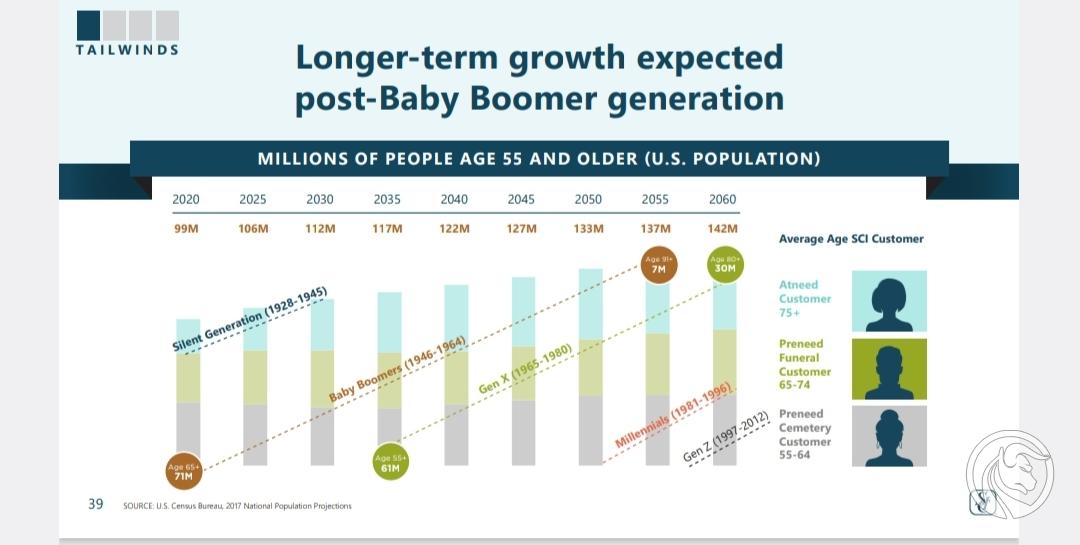

The table below shows that within 35 years (2020 - 2055), 71 million of the 65 million baby boomers who are currently 7 years old will become 2035 million. The remaining people will die and families will need funeral services. According to the company's forecasts, in 61 there will be 65 million people over the age of 2060 in the USA. In 30, the GenX population will decline to XNUMX million people.

The chart also highlights the different types of customers. Gray color potential customers for the so-called funeral places were marked. “preneed cementary” – such people are usually 55-64 years old and want to protect their loved ones from the costs of finding a suitable place. Green are potential customers aged 65-74 who want to pay for funeral services in advance. Color blue these are people over 75 years of age who will die successively in the coming years and have not previously thought about their death. The first two customer groups have the greatest potential for the company because they provide cash flows now. The cash received can be reinvested in your own business (a type of free loan).

Aging generations. Source: SCI

The company's operating activities

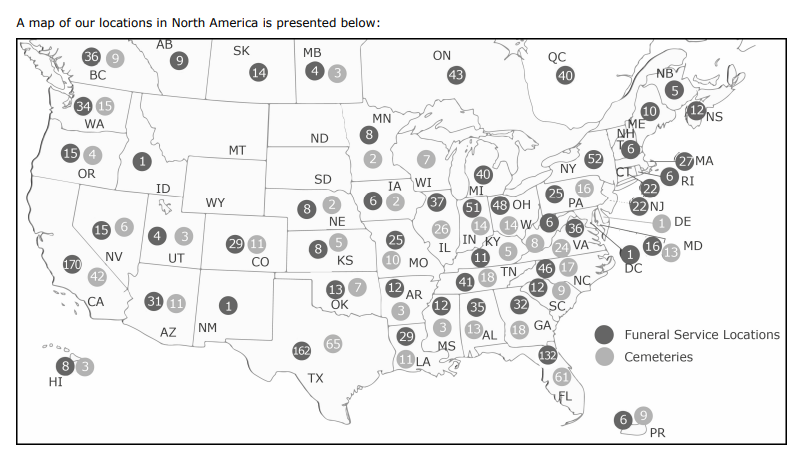

SCI has many funeral homes and cemeteries located in most states in the USA. You can see it on the map below. At the same time, the company still has the potential to expand its network, both through consolidation and building new funeral homes. There are no cemeteries, among others. in states such as Minnesota, North Dakota, South Dakota, New Mexico or Indiana. When it comes to funeral homes, SCI has no exposure, among others: In Wisconsin, Minnesota, South Dakota or North Dakota. In addition, the company may expand its network in more developed states. However, it must be careful not to expose itself to accusations of market monopolization.

Cemeteries and funeral homes at the end of 2022. Source: SCI

Let's look again at the size of the market in which the company operates. The business of funeral homes and cemeteries should be distinguished. The chart below clearly shows that funeral homes constitute the largest part of the funeral market. SCI itself has approximately 15% of the market worth USD 22 billion and is three times larger than its largest competitor. This advantage means that SCI's position seems unthreatened in the coming years.

Funeral market in North America. Source: SCI

SCI has a very good position on the cemetery market. It generates $1,8 billion in revenues (36% of the market value) with approximately 10% of the market share. Therefore SCI has more profitable cemeteries than its competitors. In the case of funeral homes, it is similar, the company generates over 13,5% of the revenues of the entire industry, having just over 6,6% of operating funeral homes.

Activities of the SCI company. Source: SCI

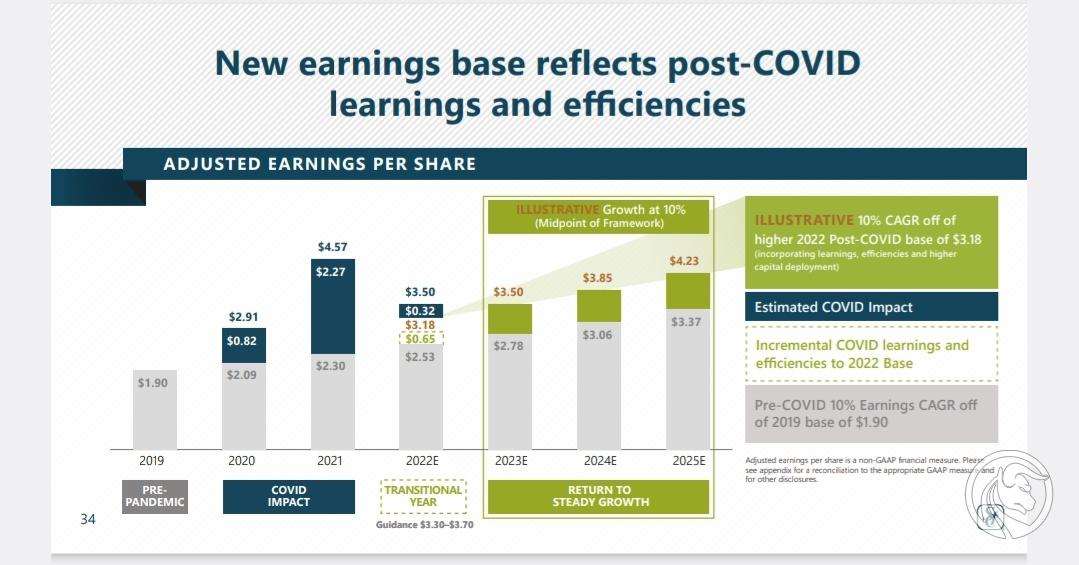

Demographic factors, COVID-19 and improved efficiency have significantly changed the business in which the company operates. The impact of the coronavirus on earnings per share is marked in dark blue in the chart below. It was a harvest season for the company, as EPS doubled from forecasts. The current period is a return to normality. Profits decreased, but the company, thanks to the experience of the 2020-2021 period, believes that it can increase its efficiency. The current profit forecasts in 2025 are much higher than similar forecasts made by the company in 2019.

Company forecasts. Source: SCI

SCI is also aware that due to cultural differences, there are different needs for funeral services. This can be seen in the chart below. The company strives to create products and services “tailor-made”.

One threat to the business is the popularity of cremation. This means that the average expense for organizing a funeral is lower. There is no need for beautiful coffins or expensive suits during cremation. SCI tries to convince clients to choose more expensive burial places, such as private tombs or nice-looking niches for ashes.

The cremation trend has an impact on the results. Source: SCI

Business growth model: acquisitions and grassroots work

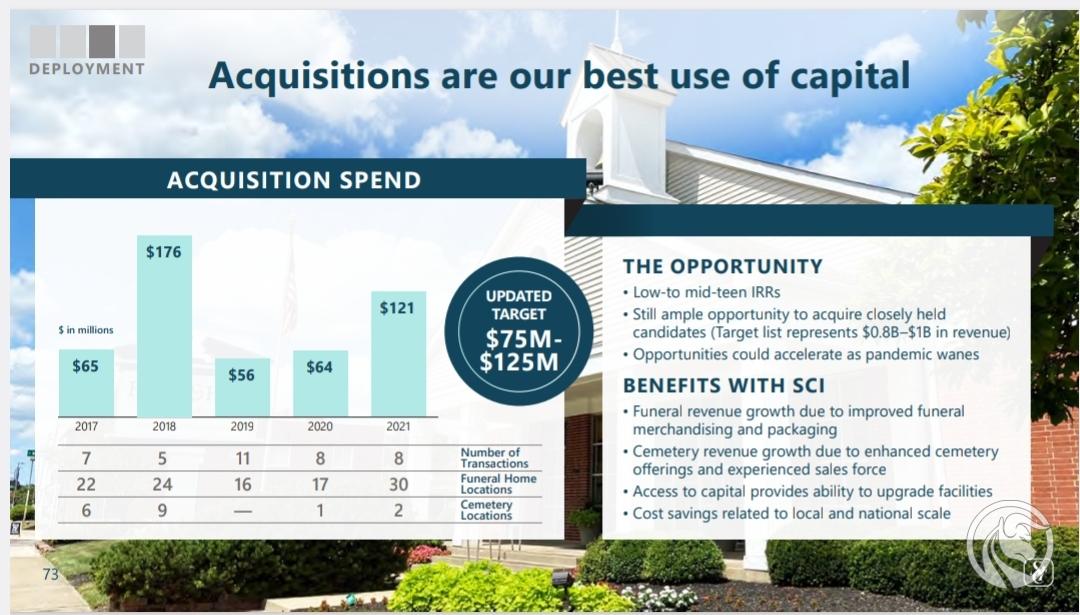

It is also worth taking a closer look at the business growth model. SCI is trying to consolidate the market through acquisitions of smaller players. Between 2017 and 2021, the company spent $480 million on acquisitions. In 2022 alone, the company spent over $100 million on 15 funeral homes and 3 funeral homes with cemeteries.

In addition, the company is trying to grow the business organically, spending in 2017 - 2021 on new cemeteries and funeral homes.

Funeral industry – SCI acquisitions. Source: SCI

SCI shares information about investment objectives. He is looking for companies that will provide a return on investment of several percent per year. The current list of candidates generates total revenues ranging from $0,9 - $1 billion. Thanks to revenue and cost synergies, SCI can improve the profitability of acquired companies.

What companies is SCI looking for? Source: SCI

For organic business, the company is targeting 10-15 new funeral homes per year. Of course, the company tries to generate a rate of return of at least several percent per year. SCI selects selected locations in terms of the assumed potential for services and the closest competition.

Funeral industry: Construction of new funeral homes and cemeteries. Source: SCI

It is worth remembering that SCI has a lot of already paid contracts that have not yet been performed (so-called backlog). It is currently several billion dollars (part in the form of insurance and part in the form of a Trust), which can be invested in further business development. This can be compared to an insurance company's float. SCI knows how much of this cash will be needed in the future (based on mortality statistics), because may treat some of the funds as free capital needed for further business growth.

Backlog of several billion dollars. Source: SCI

The company itself is aware of this the funeral market is growing slowly. For this reason, he expects the funeral home segment to grow revenues by 3-5% in an optimistic scenario. Of course, SCI assumes that it will improve its operating margin as a result of improved efficiency.

Funeral home segment. Source: SCI

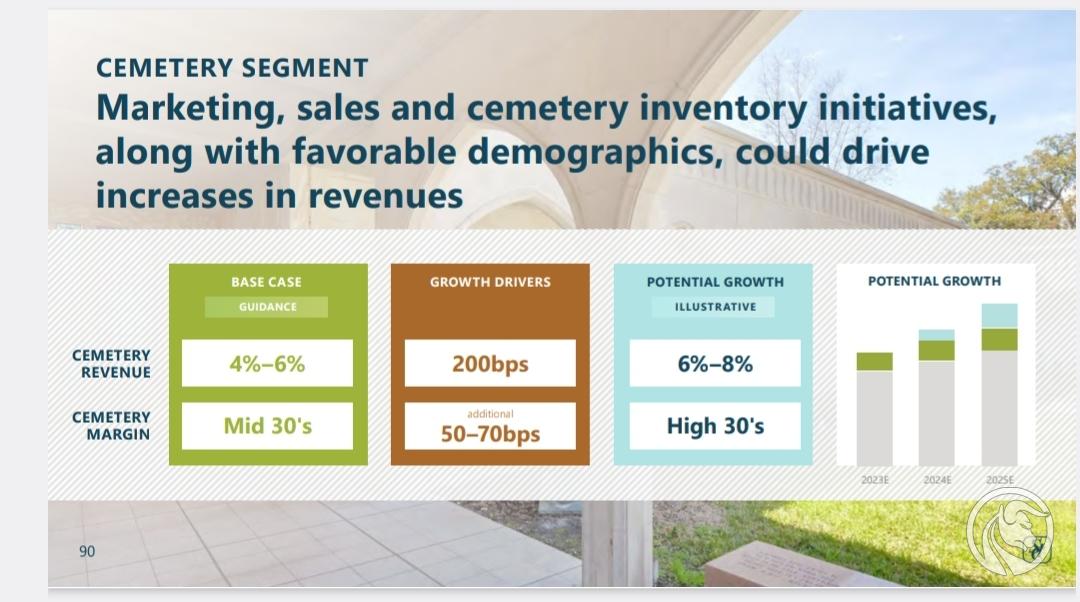

In the case of the cemetery segment, revenue growth is expected to amount to 6-8% y/y in the optimistic scenario. SCI also expects margin improvement of 50 to 70 basis points.

Forecasts for the cemetery segment. Source: SCI

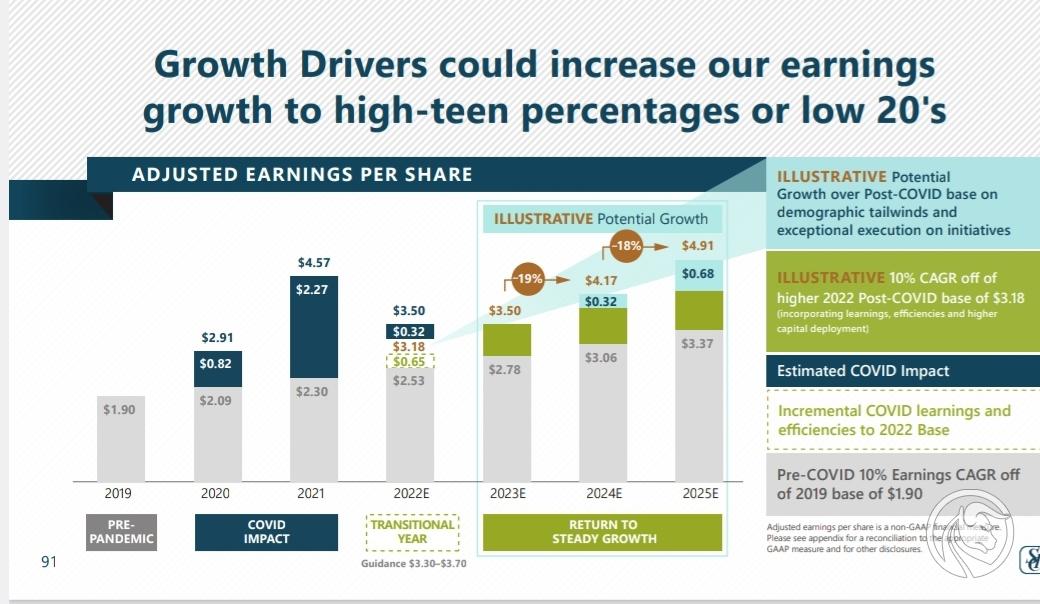

Summarizing, the company expects an increase in earnings per share ranging from a dozen to even 20%. This is a fast growth for such a stagnant market. The question remains whether the company will be able to scale this business in the long term.

SCI revenue growth forecasts. Source: SCI

The company's financial results

At the very beginning, it should be added that the cemetery and funeral home segments have completely different dynamics. This means that it is better to look at results segmentally rather than as a whole.

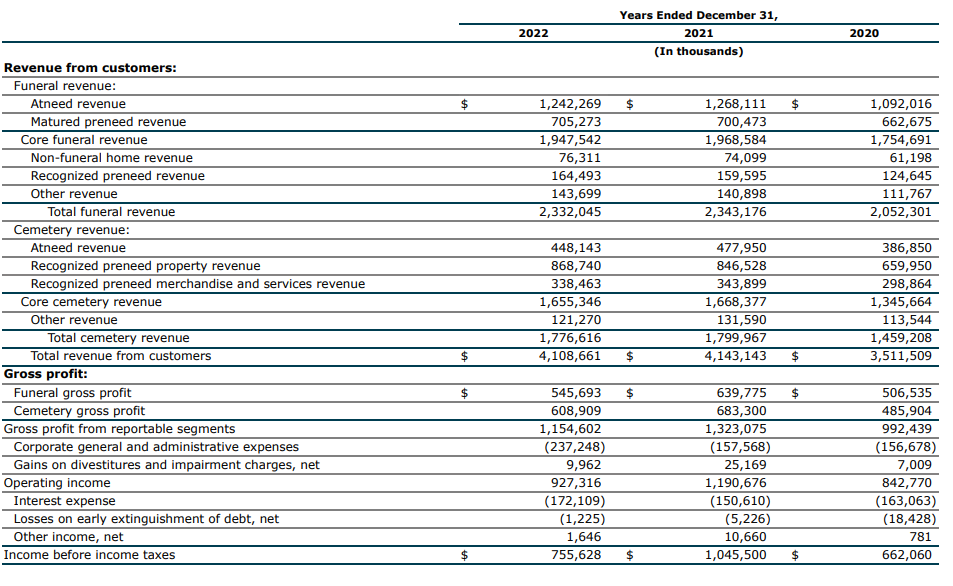

The revenues of the cemetery segment in 2022 decreased by $23,4 million, i.e. by 1,3% y/y. Ultimately, sales amounted to $1 million last year. The declines would have been greater if not for the increase in the number of cemeteries, which increased sales by $776,6 million. Comparable revenues decreased in 15,9 by 2022%, i.e. by $2,2 million. Only recognized revenues from previously paid cemetery services had a positive impact on sales. This type of revenue increased by $39,1 million y/y to $24 million.

The gross margin on sales of the cemetery segment was 2022% in 34,1. The company experienced a margin decline of 3,9 percentage points. The decrease in margin was caused by lower current sales (being a higher-margin service). Another reason was the increase in employee costs and the costs of maintaining cemeteries.

The funeral segment generated $2022 billion in revenue in 2,332. This meant a decrease of $11,2 million, or 0,5%. The decline would have been greater if not for the increase in the number of branches, which improved results by $43,5 million. It is worth noting that comparable sales decreased 4,6% y/y. Another interesting conclusion that can be drawn from the report is the increase in revenue for funeral services, which increased by 2% y/y. The reasons for the price increase were, among others, adding additional services to more funerals (including catering, flowers) and increasing the price list of services. SCI sees a further increase in the number of cremations, which in 2022 reached 61,1% of burials. This meant an increase of 1,9 percentage points.

It is also worth looking at the gross margin on sales, which decreased by 2022%, i.e. by $14,7 million, in 94,1. Looking only at comparable operations, gross profit on sales decreased by 15,7% y/y, or $101,2 million. This meant that the margin for the follow-on business fell from 27,6% to 23,7%. The reason for the decline in the margin was the increase in energy costs (especially needed for cremation) and the increase in salary costs. In a difficult macroeconomic environment, SCI had difficulty raising prices for its products.

Therefore, it is clear that the company had problems with growth in 2022, which was caused by many factors. One of them was the return of the market to “normality” after a period of excess deaths caused by COVID-19. There has also been a continuation of customers moving to cheaper services, such as cremation. There is also pressure on the margin, especially visible in the funeral segment, where the increase in costs makes it difficult to maintain the margin at the previous level. The more profitable cemetery business is also struggling and has also seen a decline in gross margin.

Revenue segments. Source: SCI

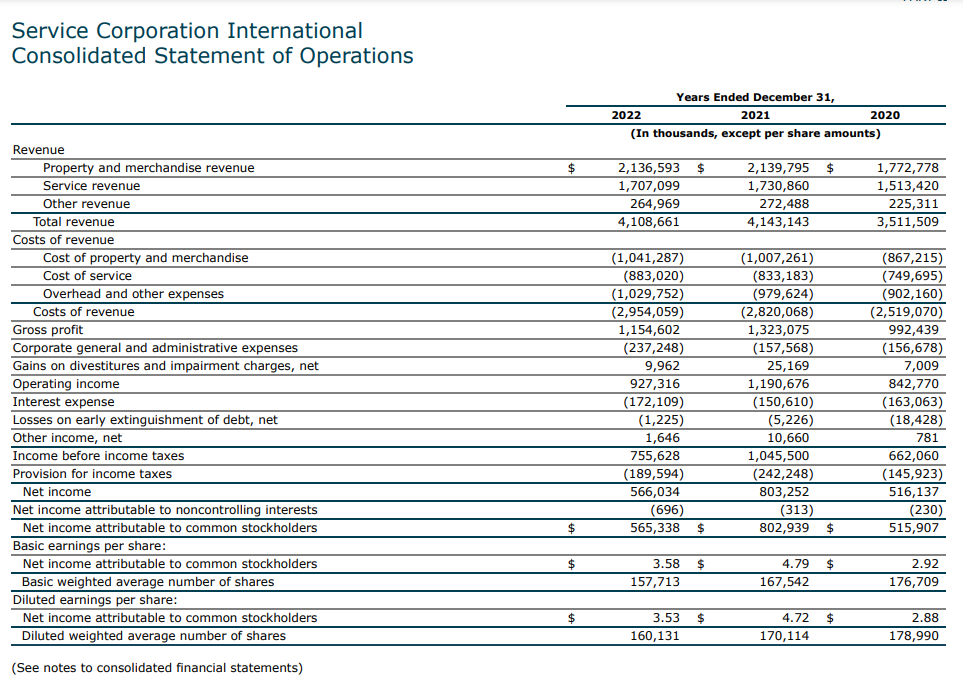

It is also worth taking a look at the consolidated income statement. The company generated $927 million in operating profit. This meant a decrease of 22,1% y/y, i.e. by $263,4 million. The reason was a decline in the gross margin on sales and an increase in administrative costs (an increase of approximately $80 million y/y). There is also a visible increase in interest costs by $21,5 million y/y.

Profit and loss account. Source: SCI

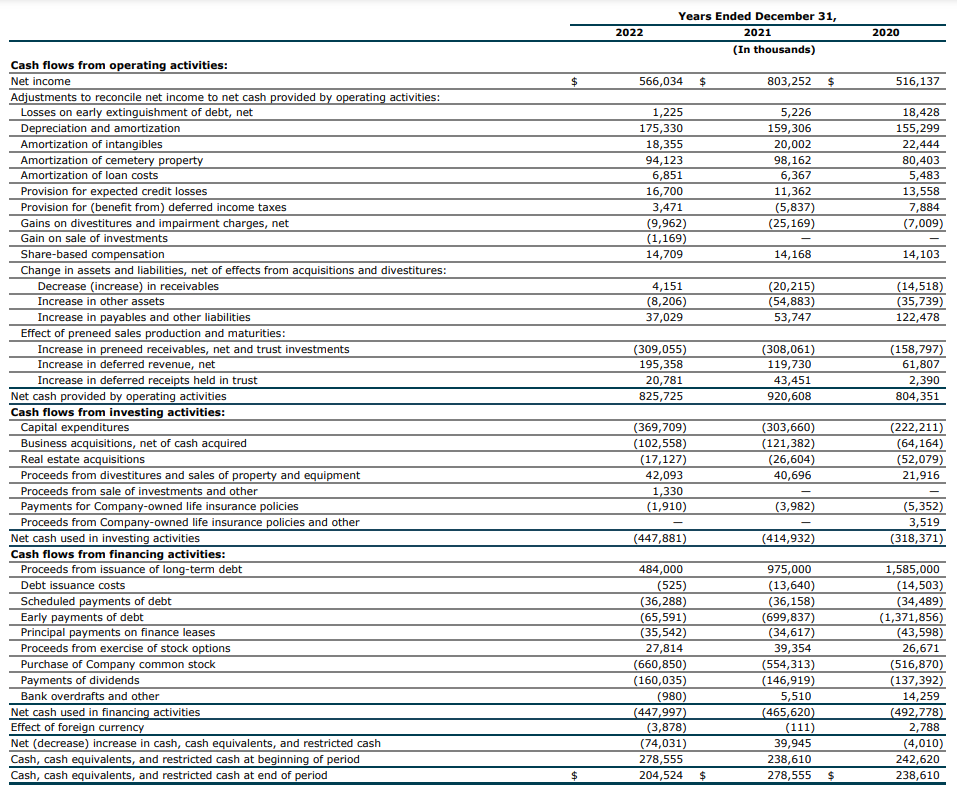

The company is a cash generating machine. In 2022, SCI had positive operating cash flow of $825,7 million. It is worth noting, however, that $195 million is the positive impact of deferred revenues (sales of funeral services and cemeteries "in advance").

SCI is trying to increase the scale of its operations. For this reason, capital expenditure (CAPEX) increases. In 2022, these expenses amounted to $369,7 million, a year earlier it was approximately $304 million, and in 2020 it was $222 million. Over the last three years, the company has spent slightly less than $3 million on acquisitions.

The company generates large FCF, which is used for share purchases and dividend payments. In 2022, SCI spent $661 million on share buybacks and transferred $160 million in the form of dividends.

SCI cash flow statement. Source: SCI

Risks associated with investing in the company

One of the biggest risks facing the company is: customer cultural changes. Already in 2015 the number of cremations exceeded the number of traditional funerals. In 2030, cremation will have 70% of the market share. Cremations are a more economical version of a funeral because they do not require so many decorations, flowers or expensive coffins. On the other hand, cremation takes up less space in the cemetery, which gives cemetery owners the opportunity to use the space more efficiently. Cremation in the US costs an average of $6,7. $, while a traditional funeral costs approximately $7,6 thousand. Increasing revenues from one burial in such an environment will be a significant challenge for the company.

Another risk is that SCI operates in an industry that is sensitive to the business cycle. Even though funeral homes are considered a perpetual business, they also experience a decline in consumer spending during economic downturns. Families simply prefer to reduce funeral expenses during economic downturns. This was the case in the years 2007 - 2010, when the company's revenues decreased by 4% and the operating margin decreased from 15% to 13%.

It is also worth remembering that the high interest rate environment in the case of SCI translates into higher debt servicing costs. In addition, higher costs of loans and credits also affect consumers who are also looking for savings. The last annual report included information that the company actively purchases bonds from the market if it guarantees it attractive rate of return.

The company's strengths

SCI operates in an industry that changes very slowly. As a result, the company's economies of scale constitute a strong moat, which protects it from less competition. It is worth remembering capital barriers, because opening a new funeral home is difficult due to the limited number of clients (it is difficult to convince someone to die faster : )). SCI consolidates the fragmented market, which further increases the company's competitiveness on local markets.

The funeral business has no problems achieving profitability even during periods recession. Of course, during an economic slowdown, revenues may decline slightly, but most likely not by more than a few percent. Even in such a situation, a business can generate several percent of operating margin.

SCI manages capital well because it does not grow by force, but seeks investments with an IRR of several percent. The company has a list of companies it wants to take over and is waiting for the right moment to make the acquisition. The capital surplus is returned to shareholders in the form of dividends or share repurchase. The purchase itself causes the number of shares to fall, which increases earnings per share.

Weaknesses of the company and the entire industry

Due to its operation in a mature industry, SCI is unable to grow its revenues at a rate of several percent per year in the long term.

Another downside is that the current trend in the funeral market is towards less lavish ceremonies. Simplicity and cremation of bodies are increasingly winning. This reduces the company's revenues, which makes it more difficult to sell additional, more expensive services.

SCI needs to spend heavily on CAPEX or acquisitions to scale up. So this is not an example of an asset-light business. Higher capital expenditure causes the company to generate less free cash flow. This in turn reduces the size of stock buybacks and dividends.

The company is still local and operates exclusively in North America. However, SCI cannot scale both segments in all countries. For example, in Poland, the cemetery segment is legally blocked for private players, leaving only the funeral home business.

End customers use the service once, during their own burial, which results in one-time revenue. Of course, SCI tries to convince the family to use additional services or encourages them to purchase, for example, a family tomb in advance.

How to invest in the funeral industry?

Brokers offering shares

How to invest in the funeral industry? Purchasing shares seems to be the most effective form due to the fact that there is no ETF or index that would include the entire basket of companies from this segment. An increasing number of forex brokers have a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 21 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

3 - shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

323 - ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | 0% commission* |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

PLN 0 / EUR 0 / USD 0 | 100 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

EToro platform |

*Zero commission means no brokerage/transaction fee was charged during the activity. However, they may still incur general fees, such as currency conversion fees for deposits and effects in non-USD currencies, fees for fees, and (if applicable) inactivity fees. Market spread also applies, although this is not a "fee" charged by eToro.

76% of retail investor accounts lose money when trading CFDs with this provider. Consider whether you can afford the high risk of losing your money.

Funeral Industry: SCI Business Summary

SCI is a leader in the funeral services market in the United States and Canada. Thanks to economies of scale and capital resources, it takes on less competition. This allows you to increase market shares. In addition, the company is growing by opening its own funeral homes in yet unpenetrated markets.

The company regularly shares its profits with shareholders. In accordance with company policy 30% to 40% of after-tax profits are paid out as dividends. SCI raises its dividend regularly and pays it quarterly. Back in 2005, the quarterly dividend was $0,25 per share. In 2022, the quarterly dividend is $0,27. Therefore, it is a company that can easily be classified as one of the so-called dividend growth. It is thanks to a sound capital management policy that SCI has generated over 250% profit over the last 10 years.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in the funeral industry? SCI – the leader of eternal business [Guide] how to invest in the funeral industry](https://forexclub.pl/wp-content/uploads/2023/10/jak-inwestowac-w-branze-pogrzebowa.jpg?v=1698748292)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to invest in the funeral industry? SCI – the leader of eternal business [Guide] Salaries in Poland](https://forexclub.pl/wp-content/uploads/2022/10/wynagrodzenia-w-polsce-102x65.jpg?v=1666259094)

![How to invest in the funeral industry? SCI – the leader of eternal business [Guide] crypto retirement October 2023](https://forexclub.pl/wp-content/uploads/2023/11/kryptoemerytura-pazdziernik-2023-102x65.jpg?v=1698847402)