I Can't Trade - How I Select Forex Signals

How do I choose Forex signals - Social trading in practice!

I hope you all spent nice and peaceful Easter. Unfortunately, the holidays are over and you have to get back to work. In today's article, I will discuss how I choose signal providers. If you are interested in investing in social trading, maybe it will help you choose the right manager.

Forex Signals - Rule # 1

First, the most important thing - never invest money that you cannot afford to lose. No matter the signal seems confident, it has a low equity draw and a strong performance so far. Despite a marked lull in recent years, Forex market it is still incredibly dynamic and "something" can happen at any moment. It doesn't matter if the system you want to copy is a scalper during the Asian session, the trend follower or it uses sophisticated techniques of managing open positions - as a result of certain events, each system can reset your account at once. In recent years, such events have been, for example, the earthquake in Japan, the release of Frank's course, Brexit, GBP Flash Crash, etc. In today's politically tense times, one spark has the ability to cause a massive explosion in the market, and only luck will depend on whether you make a lot of money or lose everything :).

Forex Signals - Rule # 2

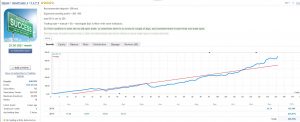

If, after the previous paragraph, you want to continue investing through social trading, let's move on to ourselves signals. What is the ideal investment strategy in my opinion? It's easy:

- On the market for at least several years,

- Stable profit with a low slippage,

- The manager uses Stop Loss.

compromises

Unfortunately, I have not found such a strategy so far. In most cases, I have to settle for two of the three features listed above.

In this project I divided the signals into two categories:

- Theoretically safer

- Agressive

Those safer to those that have been on the market for at least a year, at which time the capital subsidence did not exceed 40-50% and annual profits are higher than DD. I can include such systems as Calm, TrippleX, Kauri, Click, EA PAMM, New York City Capital or Delta. I wrote "theoretically safe" because:

- New York City Capital recorded a large capital slippage, changed the strategy and now with the expiration of the subscription I turned it off, waiting for a return to form

- Kauri and Delta from the moment I started to invest are in the red. I am counting on the improvement so I hold it, but we must also expect further deterioration.

- Secure trend ride and Small to big also matched these parameters, and they did not finish well.

Forex signals from the "Aggressive" category they are usually those that are either shorter on the market or have more equity capital (more risk), while bringing high profits. These signals include Tourbillon Precision, HotSpotForex, JimmyChen Aggresive Strategy and SAFE.

Secure systems usually have larger deposits (over 2 thousand usd or 8 thousand) and a lower siphon. Aggressive systems have lower deposits (usually around 1 thousand USD) and a higher leverage. In the near future I will have to consider balancing the capital between individual systems, but for that I need more time to get to know the strategies.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)