Inflation fears beat against the zloty. USDPLN again above 4,70

The zloty is trying to find a balance after yesterday's "inflationary" sell-off. However, a new threat appears on the horizon in the form of more inflation data. Also from the United States.

Stabilization after a strong discount

Wednesday morning brings limited fluctuations of the zloty. Much smaller than the day before. The zloty is trying to find a balance after it depreciated strongly yesterday amid market concerns caused by higher than expected inflation in the US.

Yesterday's wave of zloty weakening, which correlated with the sell-off of all risky assets, was triggered by August data on consumer inflation in the US. Data that turned out to be a big surprise. Unfortunately, a negative one. CPI inflation shaped in August at the level of 8,3 percent. Y / Y and was higher than market forecasts (8,1%). Additionally, the core CPI inflation rose more than expected. This immediately translated into higher expectations for further aggressive hikes by the Fed, triggering an increase in risk aversion in the markets and beating against the zloty.

This is not the end of the inflationary emotions

Today at 14:30 CET data on US producer prices will be released, which may further fuel these emotions, increasing market fears of a continuation of aggressive interest rate hikes by the Fed. Unless, of course, inflation turns out to be higher than expected again.

A decline is expected in August producer inflation (PPI) up to 8,9 percent from 9,8 percent YoY in July and a simultaneous drop in core PPI inflation to 7,1%. from 7,6 percent Higher than expected inflation will once again spoil the costumes, while lower inflation does not have to improve them.

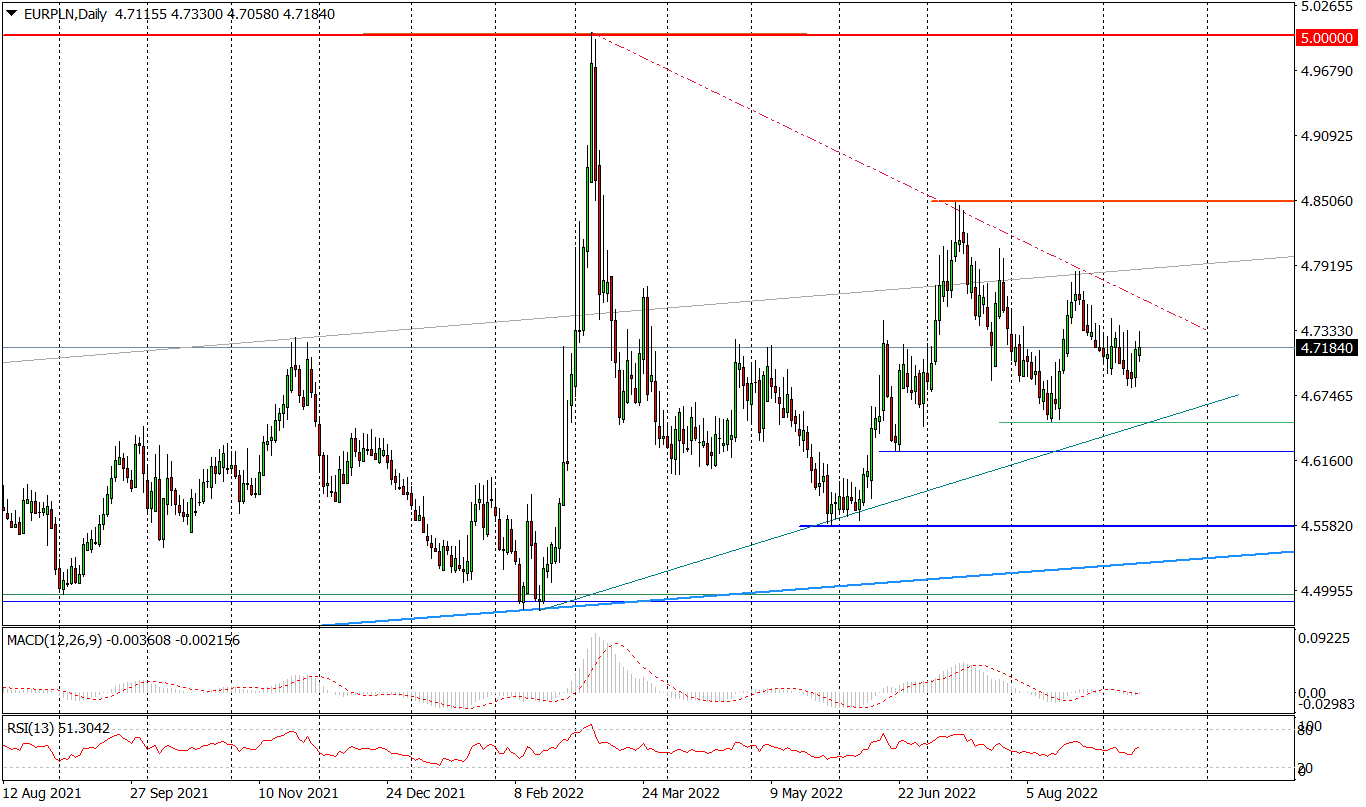

The current situation on the EUR / PLN daily chart, and even more so on the USD / PLN daily chart, suggests a possible continuation of the upward movement. However, in both cases the extent of the increases is quite limited. In the case of the euro, active supply should be expected around PLN 4,76, and in the case of the dollar, the strong resistance zone is between PLN 4,7710 and PLN 4,8225 (it is additionally strengthened by the July peak at 4,8489). This suggests not only a lower probability of strong moves in both pairs in the next few days, but also a relative lack of very large fluctuations in the perspective of 3-6 weeks.

EUR / PLN daily chart. Source: Tickmill

USD / PLN daily chart. Source: Tickmill

Currently, the domestic currency market is mainly influenced by global factors. On the one hand, these are the above-described US macroeconomic data and the impact they have on future Fed decisions. From the second news from the front in Ukraine. This balance of power is unlikely to be disturbed by the Thursday-Friday inflation data in Poland.

Domestic topics will return to the orbit of investors' interests next week, when a whole group of hard data from the Polish economy will be released. However, even then their impact will be temporary, because the American meeting scheduled for September 21 will arouse much greater emotions Federal Reserve.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)