Investors still active on the market. July volume up 357%

Demand for all assets is still noticeable. They both grow stock, bonds, indices and some commodities. According to reports, currencies, mainly the British pound, the yen and the euro, are very popular. Even though many financial instruments are currently at (or close to) historic highs. This attracts new (often inexperienced) investors who are willing to join the current trends and generate profits with their help. Was it this group that was so active on the market?

1,8 million new individual investors

Exactly this number of bills increased in 2020 on the Moscow Stock Exchange. Such a lot of interest was mainly attracted by shares in which USD 16 billion was invested in the last month. On the stock exchange, an average of 250 thousand. accounts each month. According to MOEX reports, we know that individual investors made at least one transaction in July. In the same month, they pumped into the stock exchange. The stock exchange itself admitted that it was hard to explain such a surge in interest in brokerage accounts. However, taking into account what is currently happening in the world and global markets, it can be said that the demand and the horrendous increases it generated attracted a crowd of new interested parties.

Certainly, the stock exchange in Russia is no exception. Similar situations occur in virtually all world markets, but Moscow stands out from the crowd. The high rates of return that could have been achieved recently in a relatively short time attract. Little is said about prudence and prudence in investing capital in the markets. Therefore, risk aversion is slightly forgotten, thus relegating to the background. We can now only imagine what the potential second coronavirus lockdown will look like in the markets, when the "street" loads into exchanges.

High turnover

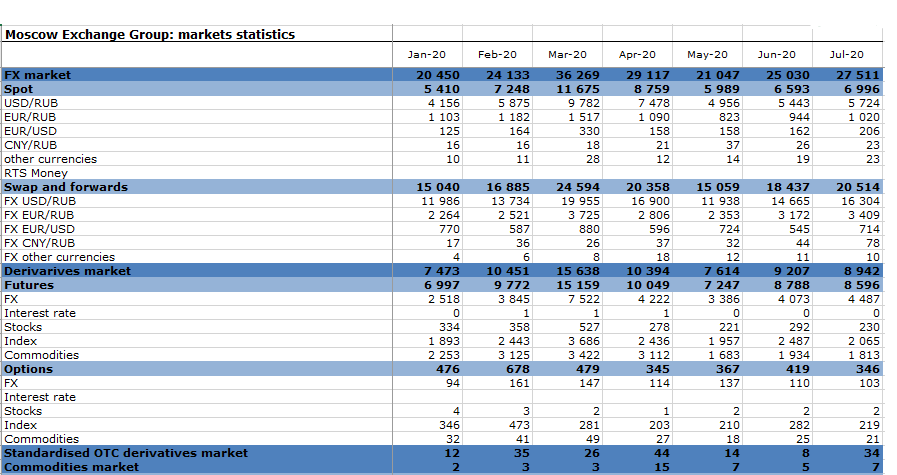

Despite the large influx of new investors, trade on MOEX improved by 10% m / m. July brought a turnover of 27,5 trillion rubles (USD 373 billion) in terms of amounts, while in June it amounted to 25 trillion rubles (USD 348 billion). Taking 2019 (July) as a reference, the turnover on the Moscow Stock Exchange decreased by approx. 7%. Turnover in July 2020 involving spot transactions reached 7 trillion rubles ($ 95 billion), surpassing 6,6 trillion rubles ($ 92 billion) in the previous month. Swap and forward transactions amounted to 20,5 trillion rubles (US $ 278 billion).

Actions deserve a lot of attention MOEX. The stock market started buying shares on smaller platforms, which increased the volume on futures, forwards, currency options and swaps. Striving to expand your “financial” infrastructure will surely contribute to maintaining larger, daily ADVs on MOEX. This will make the OTC market the next place to generate bigger and better results.

Increase by 357% y / y

However, the Dubai stock exchange boasts such a fantastic result. DGCX (Dubai Gold and Commodities Exchange) recorded a surprising increase in forex trading. Volumes on the G6 basket of currencies jumped to 357% higher than in July 2019. The most popular were the Japanese yen (over 700% increase in turnover), the euro and the British pound (both above 260%). such high demand for the yen proves the aversion of some investors to the current stock market risk. A strong yen with such a "demand base" could hurt the US currency in the long term.

DGCX CEO, commenting on the published results, said:

“The steady growth in turnover and product offering reflects our continued success and expanding membership. We are proud to be a stock exchange led by managers who, by introducing innovative contracts, meet the growing needs of our investors, especially in the periods of uncertainty we observe on the market today. "

The reverse is the case at Saxo Bank

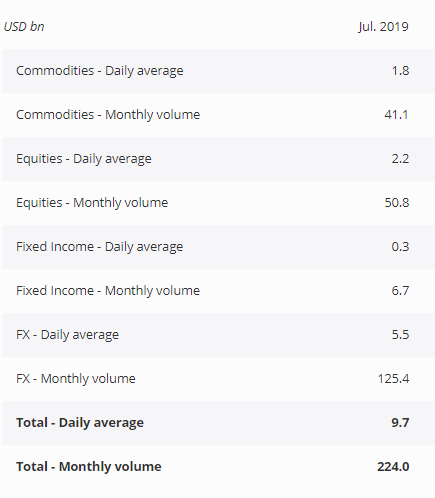

Saxo Bank, as one of the few brokers, showed a decrease in volumes on Forex currency market. It is true that June was a good month, so a slight slump in the turnover is not surprising. We could say the volumes are stabilizing, returning to normal levels. In July, the broker recorded a monthly forex volume of $ 138,6 billion. Comparing it with the previous month, when the total monthly turnover was $ 161,4 billion, the volume is lower by 14,1%.

The situation is slightly different if we take 2019 as the reference point. Although July volumes fell on a monthly basis, they are still 10,5% higher than those of July 2019. We could therefore call what happened in June the “non-seasonal” recovery caused by investors based on COVID-19.

The monthly volume of trading in equities in July was USD 115,4 billion, with an average daily volume of USD 5,2 billion. This represents a decline of 9,1%, compared with $ 127,0 billion in July 2019. When looking at commodities, the total monthly trading volume was $ 48,6 billion in July, with a daily average of $ 2,2 billion. The results he published Saxo Bank they are very similar to those recorded, for example, by the Tokyo stock exchange.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Volume Spread Analysis: Frequently Asked Questions and Answers [FAQ] vs faq](https://forexclub.pl/wp-content/uploads/2023/06/vsa-faq-300x200.jpg?v=1685689430)

![The use of volume on the forex market in practice - Rafał Glinicki [Video] Volume utilization in the forex market](https://forexclub.pl/wp-content/uploads/2023/06/Wykorzystanie-wolumenu-na-rynku-forex-300x200.jpg?v=1685602297)

![Rafał Glinicki – The use of volume on the forex market in practice [Webinar] Rafał Glinicki Using volume in the forex market webinar](https://forexclub.pl/wp-content/uploads/2023/05/rafal-glinicki-Wykorzystanie-wolumenu-na-rynku-forex-webinar-300x200.jpg?v=1684850257)