Investing in water. Does it make sense? ETF, Stocks [Guide]

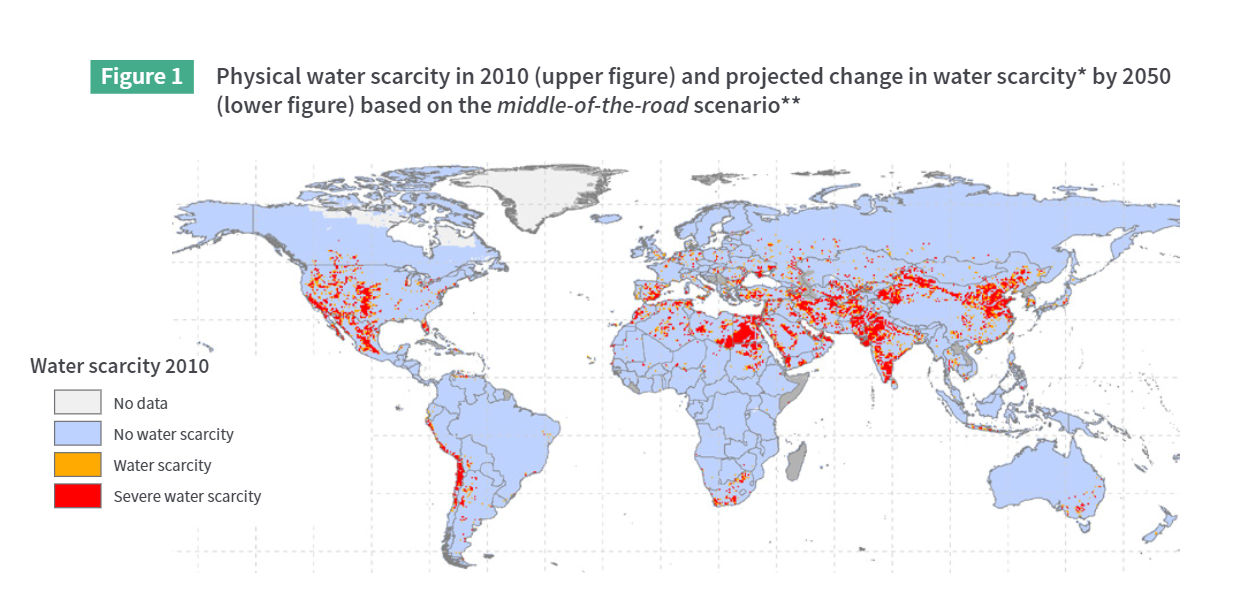

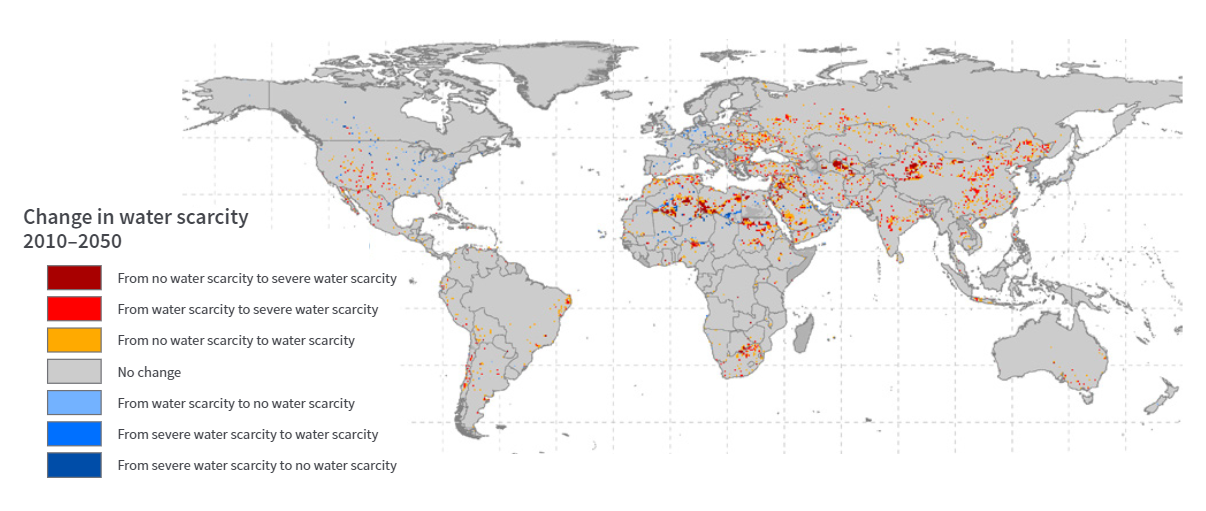

About 70% of our planet's surface is covered by water. However, as much as 97% of it is salt water unsuitable for human consumption. In recent years, more and more studies have appeared that climate change will cause water scarcity in many areas. For this reason, some investors believe that problems with the supply of freshwater will increase prices. That is why some people treat water as a raw material, similar to gold or oil. Despite the dynamic development of the world economy and the sharp increase in living standards, the need for water consumption has not changed over the last millennia.

Rapid industrialization and an increase in agricultural production resulted in an increase in water demand and increased pollution of the sources of this raw material (sewage, fertilizers). More and more parts of the world are reporting periodic water shortages. This applies to countries such as Egypt, India, Israel, Pakistan, Mexico, China (mainly industrial regions) and the United States (including California, Colorado, Las Vegas).

According to data prepared by the United Nations (The UN World Water Development Report 2018), by 2050 water demand will increase by 20-30%. The reason will be, among others enriching the society and growing the population (especially in Africa). In many areas, the sources of available freshwater are expected to deteriorate over the next 30 years. This applies especially to the areas of North Africa, Central Asia, the central states of the USA, India and China. However, in some areas the availability of drinking water is expected to increase. This is true for some regions German, France, Spain, the United States and also some African countries.

Investing in water

More and more investment companies point out that investing in water and companies related to the water market can be an interesting capital investment in the long term. An example is the Harvard investment fund, which purchased land with access to groundwater for part of its capital. However, it is not necessary to purchase plots of land to benefit from the appreciation of water prices. There are specials ETFs and non-public funds that allocate funds to the water extraction and filtering market.

There are also specially created indices that mimic the behavior of companies related to the water market. One of the most important indexes is:

- S&P Global Water Index.

According to data prepared by S&P Dow Jones Indices, over the past 10 years, the average annual return on the index has been 11,35% (after dividends are included). The index includes companies producing solutions (tools, materials) for other companies related to the water industry. Another group of companies are public utility and infrastructure companies related to the water market (e.g. treatment plants, water treatment). Another criterion is capitalization, which must be at least $ 250 million. By contrast, capitalization after deducting the free float ratio (float adjusted capitalization) is to be a minimum of $ 100 million. The index consists of 50 companies with an average cap of $ 5,57 billion. IN American companies dominate the S&P Global Water Index (50,3%) and British (13,1%). Other significant companies are companies listed in France (8,9%) and Switzerland (7,2%). The largest components of the index are companies such as Xylem Inc., American Water Works and Veolia.

ETF related to the water market

There are many ETFs that are related to the water market. The most famous of them are presented below.

iShares Global Water UCITS ETF (IH20)

It is an ETF fund whose benchmark is the S&P Global Water Index. Assets under management totaled over $ 5 billion as of March 2021, 1,8. The annual management fee is 0,65%. The index is dominated mainly by American (49,1%), British (13,4%), French (9,0%) and Swiss (7,6%) companies. The most important ETF companies are Xylem (9,3%), American Water Works (7,8%) and Veolia (5,4%). ETF is listed on many exchanges (including LSE, Deutsche Boerse, Borsa Italiana, SIX Swiss Exchange).

IShares Global Water UCITS ETF Chart, Interval W1. Source: xNUMX XTB.

Lyxor World Water (DR) UCITS ETF

It is an ETF created by one of the largest European ETF providers. Lyxor World Water has assets under management of £ 704m. The average annual management fee is 0,6%. The ETF benchmark is the World Water Total Return Index. The largest share is held by American (51,9%), British (13,5), Japanese (13,5%) and Swiss (11,4%) companies. The most important ETF companies are Geberit (11,4%), American Water Works (8,8%) and Xylem (7,5%).

Invesco Water Resources ETF

It is an ETF that invests in companies related to the "water" sector. Invesco Water Resources ETF has over $ 1,4 billion under management. The average annual management fee is 0,6%. The benchmark is the Nasdaq OMX Us Water Index. The ETF consists mainly of American companies (98,5%). The most important ETF companies are Waters (8,2%), Roper Technologies (7,8%), American Water Works (7,7%) and Danaher (7,6%).

Invesco S&P Global Water Index ETF

It is an ETF investing in companies related to the water industry (including water treatment). The Invesco S&P Global Water Index ETF has over $ 800 million under management. The average annual management fee is 0,59%. The benchmark is the S&P Global Water Index. The ETF consists mainly of American (50,3%), British (13,7%) and French (8,3%) companies. The most important components of the index are Xylem (9,6%), American Waters Corporation (8,9%) and Veolia (5,0%).

Companies related to the water market

For investors who prefer to actively invest in this market segment, it is necessary to select the appropriate companies. Selected companies from this sector will be briefly described below.

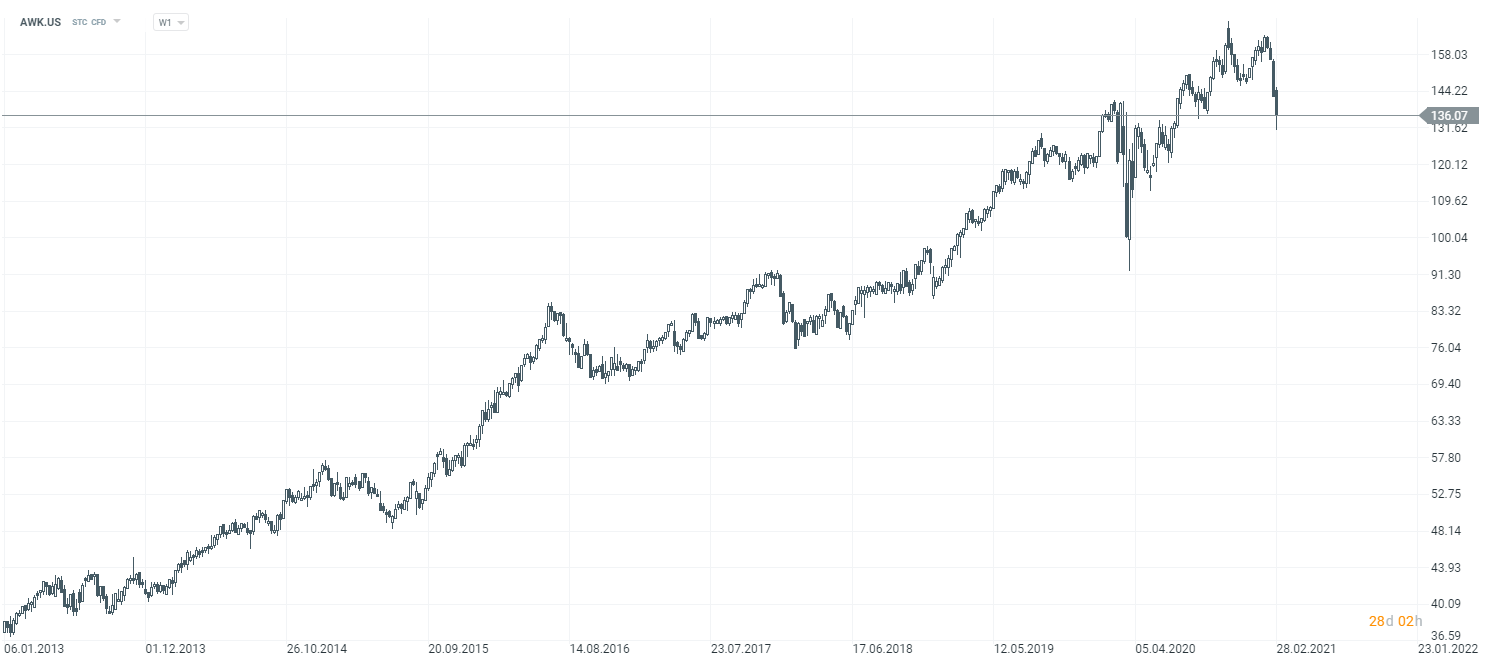

American Waterworks Corporation

The company is a drinking water supplier and offers waste management. AWK was founded in 1886 and has been listed on the stock exchange since 2008. Before the IPO, the company belonged to the German concern RWE. American Waters Corporation employs over 7 people. The company provides its services to 000 million people in 15 states. However, as much as 46% of revenues were generated in 87,7 states (New Jersey Pennsylvania, Missouri, Illinois, California, Indiana and West Virginia).

| American Waters Co. | 2018 | 2019 | 2020 |

| revenues | $ 3 million | $ 3 million | $ 3 million |

| Operational profit | $ 1 million | $ 1 million | $ 1 million |

| Operating margin | 33,11% | 33,35% | 33,04% |

| Net profit | $ 567 million | $ 621 million | $ 709 million |

Source: own study

American Waters Works Cooperation chart, interval W1. Source: xNUMX XTB.

Veolia Environnement SA

Veolia is a very diversified company. It is a French company operating in the water, sewage, energy and waste management sectors. The company operates on all continents and provides drinking water to over 98 million people. In turn, waste management services are offered to over 42 million people. Veolia employs over 300 people in 000 countries. The company is listed on the Paris Stock Exchange.

| Veolia Environment | 2018 | 2019 | 2020 |

| revenues | $ 25 million | $ 27 million | $ 26 million |

| Operational profit | $ 1 million | $ 1 million | $ 809 million |

| Operating margin | 5,63% | 5,73% | 3,11% |

| Net profit | $ 373 million | $ 619 million | $ 89 million |

Source: own study

Veolia Environnement chart, interval W1. Source: xNUMX XTB.

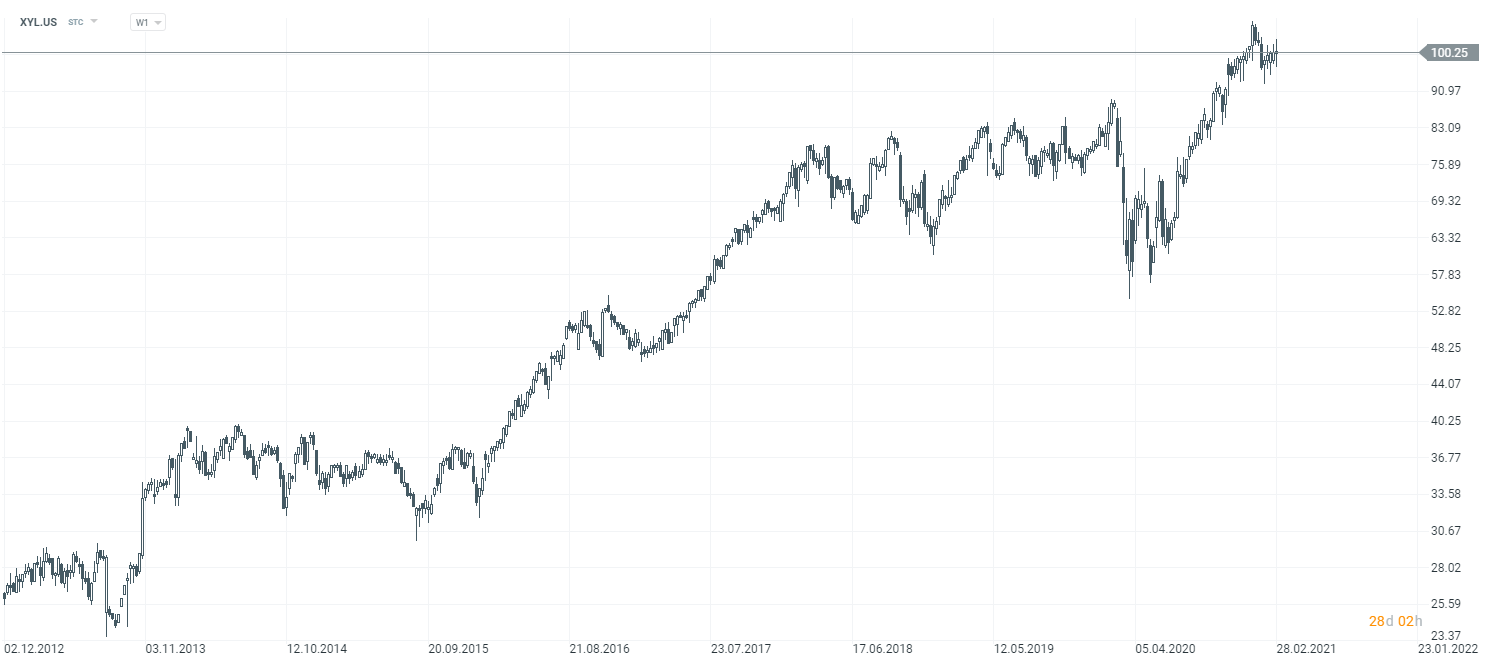

xylem

The company manufactures equipment used in the water sector. Xylem products are used in many sectors. For example, agriculture uses pumps needed to create irrigation systems. In turn, the water treatment industry uses monitoring and control devices as well as filtration systems. The company employs over 16 employees. Xylem sells its products in around 700 countries around the world.

| Xylem Inc. | 2018 | 2019 | 2020 |

| revenues | $ 5 million | $ 5 million | $ 4 million |

| Operational profit | $ 676 million | $ 697 million | $ 500 million |

| Operating margin | 12,98% | 13,27% | 10,25% |

| Net profit | $ 549 million | $ 401 million | $ 254 million |

Source: own study

Xylem Inc. chart, interval W1. Source: xNUMX XTB.

Summation

Despite the increasing demand for water, it should be remembered that companies operating in this industry are highly regulated in some countries. Companies supplying drinking water to the end customer have the advantage of being a "natural local monopoly", which reduces the need to advertise their services. Another advantage of investing in companies related to the water market is meeting the basic needs of the population.

Over the next several decades, the demand for water will increase as the population grows and global consumption increases. Both individual companies and ETFs can be invested in the water sector. You can invest in these financial instruments through brokers such as XTB and Saxo Bank.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Investing in water. Does it make sense? ETF, Stocks [Guide] investing in water](https://forexclub.pl/wp-content/uploads/2021/03/inwestowanie-w-wode.png)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![Investing in water. Does it make sense? ETF, Stocks [Guide] costesting prime xbt](https://forexclub.pl/wp-content/uploads/2021/03/covesting-prime-xbt-102x65.png)

![Investing in water. Does it make sense? ETF, Stocks [Guide] coinquista liquidity problems](https://forexclub.pl/wp-content/uploads/2021/03/coinquista-problemy-z-plynnooscia-102x65.png)