IronFX with its own stock exchange cryptocurrency and a token

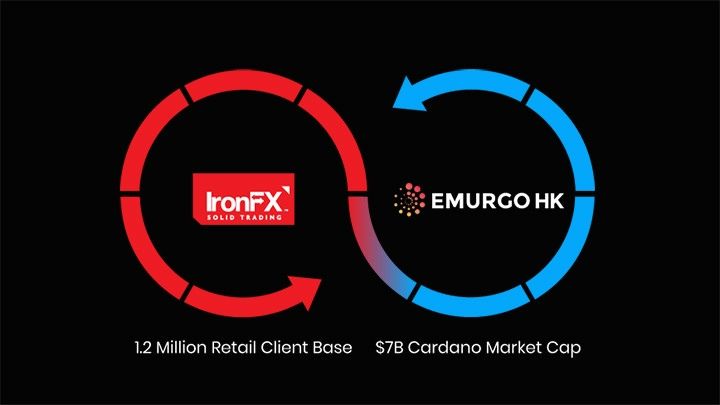

IronFX, a Cyprus Forex / CFD broker, announced plans to launch its own cryptocurrency exchange. The Emurgo company, one of the members of the Cardano Foundation, is to help him. In addition to the stock exchange, it also wants to issue its own virtual coin - IRX.

Fashion for your own "cryptocurrency"

The plans to create your own virtual coin, both by large corporations and entire countries, are heard every day. Less often, such plans concern a larger undertaking, which is the creation of the entire stock exchange. The Cypriot broker wants to act immediately and create an IronX Exchange on which he will offer exchange of cryptocurrency instruments as well as national currencies. He also wants to be fully regulated.

IronX is also to allow its users to transfer assets / transactions to them in the form of tokens from another cryptoclicky exchange. This action is to encourage traders trading in virtual coins as well as traditional currencies and CFDs to work with IronX. The start of the Beta exchange is planned for October 2018.

IRX - this is what the token should have, issued by the Cypriot broker, which is to be based on the Ethereum platform. The presale has already started, and 200 million tokens for $ 0,33 apiece have been offered. In total, as many as 500 million virtual moments are to appear in circulation, which should allow the stock exchange to raise capital of $ 50 million.

IronFX - Withdrawal Issues

"Iron broker" until 4 years ago it was one of the largest retail Forex / CFD brokers in the world. The loud success of the company was developed in just 4 years (from 2010) as a result of effective (sometimes quite aggressive) marketing activities. The most popular among customers were bonus promotions, which provided for receiving up to 100% of the value of the deposit "for free". This attracted a lot of investors from around the world, and IronFX boasted a quarterly turnover of $ 770 billion in 2014.

The spell was broken at the beginning of 2015. It was then that the first serious problems with withdrawing funds to clients appeared. The Market Maker model, leverage of 1: 500, poor risk assessment, calculation errors and "too smart" traders who used the broker's promotions without inhibitions finally took revenge and caused liquidity problems. Initially, according to the information provided, withdrawals were to be withheld only from traders who abused the bonus promotions. As a consequence, those who had never used them and also encountered problems with recovering their funds backfired.

The reactivation of the activity took place only after two years from the beginning of problems with payments, about which we have informed in this article. Even after such a time and resumption of marketing activities, some of the investors still did not recover the funds in Ironie, all the time getting a casual answer, or even missing.

Will IronFX still be able to rebuild its reputation and attract retailers to its new offer?

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)