How to invest in gaming? Everything about investing in gaming companies [Guide]

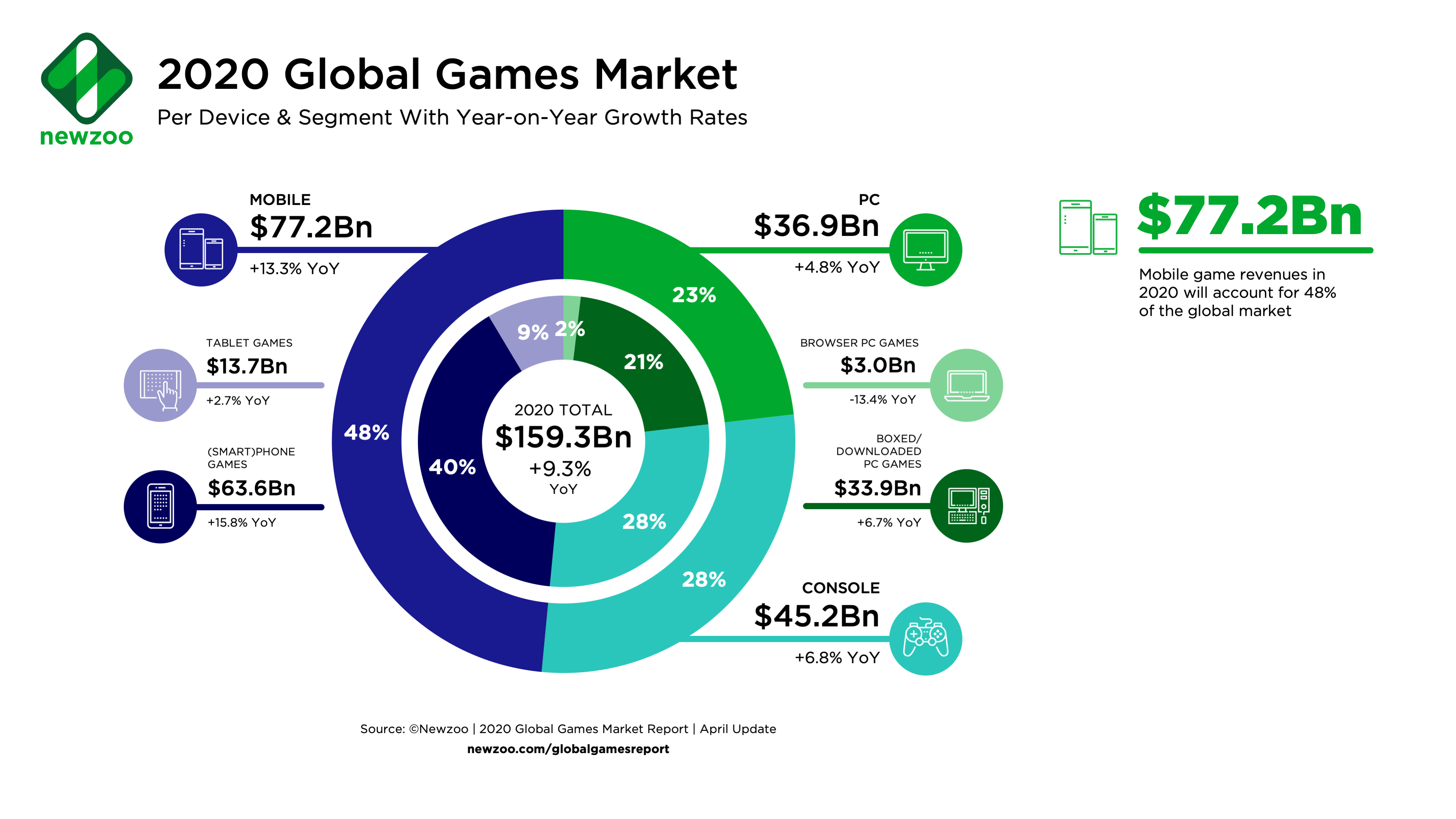

Gaming has grown rapidly in recent years. According to data collected by newzoo, in 2020 the gaming market will grow by 9,3% to $ 159,3 billion. However, a distinction should be made between PC, console and mobile games. Mobile games are the fastest growing gaming market. According newzoo the market will grow by 13,3% annually and will reach the value of $ 77,2 billion. The second largest is the console games market ($ 45,2 billion). The market for PC games is the smallest. The entire gaming market is expected to exceed $ 200 billion in 2023.

Source: newzoo

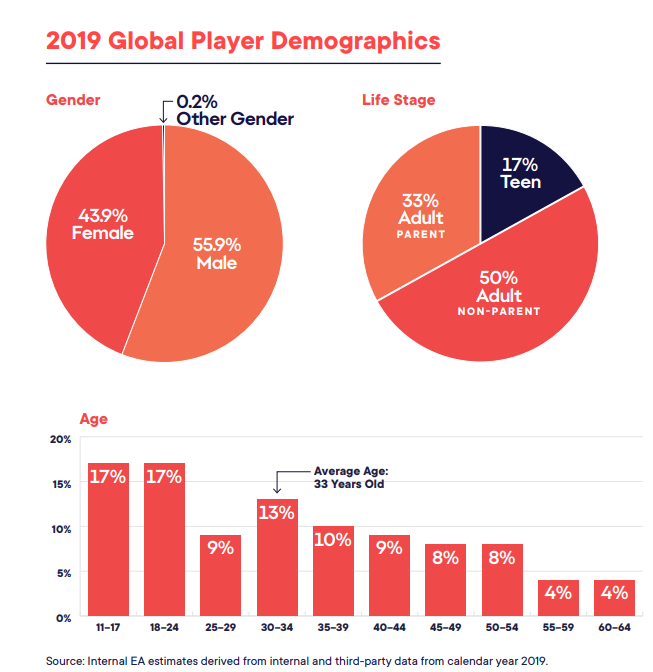

The average age of a player in the United States has been estimated at 35 years. According to estimates made by EA, the age structure is very diversified.

E-sport, an increasingly popular segment, is growing simultaneously with the gaming market. Already, competitions in CS (Counter Strike) attract huge audiences. Football clubs have their own teams playing in FIFA (eg Manchester City, PSG, Legia Warszawa, Wisła Kraków). In the coming years, the e-sport market will develop dynamically. Broadcasts of esports events are made, among others, by Twitch that belongs to Amazona. Some league matches are also broadcast on YouTube.

Investors can also benefit from investing in companies from the gaming and e-sports industry. The stocks of game producers and ETFs related to the gaming industry. The major game producers will be presented below.

Activision Blizzard

Activision Blizzard stock chart, interval W1. Source: xNUMX XTB.

It is one of the largest game developers in the world. It offers such famous titles as Call of Duty, Candy Crush, Overwatch or Diablo. The company was established from the merger of Activision and Vivendi Games in 2007.

Blizzard Entertainment

Vivendi was part of the legendary Blizzard Entertainment studio. This development studio had a reputation for delivering the product "when it's done". Blockbusters such as Diablo, StarCraft and World of Warcraft came out of this studio. Blizzard also has its own online game site called Blizzard Battle.net®. Blizzard also has the Overwatch League ™ which is the world's esports league. Two years ago, Mike Morhaime, who had been Blizzard's boss for 27 years, resigned.

Below are the financial results of the studio:

| Blizzard | 2019 | 2018 | y / y |

| revenues | $ 1 million | $ 2 million | -24,96% |

| Operational profit | $ 464 million | $ 685 million | -32,26% |

| Operating margin | 27,00% | 29,90% | -2,9 pp |

Activision Studio

The history of the company dates back to the end of the seventies. The studio was established in 1979 by former game developers at Atari. Activision was the first independent console game developer. The studio survived the crash on the gaming market in 1983, also known as Atari Shock. The company changed after the acquisition of the studio by Bobby Kotick, which gave the studio a global momentum. Successful acquisitions such as Infinity Ward, which was acquired for $ 5 million in 2003, helped. The development studio created the Call of Duty series. The game is one of Activision Blizzard's "crown jewels". Activision also has an esports leg, which is Call of Duty League ™.

| Activision | 2019 | 2018 | y / y |

| revenues | $ 2 million | $ 2 million | -9,72% |

| Operational profit | $ 850 million | $ 1 million | -15,92% |

| Operating margin | 38,30% | 41,13% | -2,83 pp |

King Digital Entertainment

It is one of the largest development studios for creating mobile games. The main type of games are F2P or "free-to-play". The most popular game is Candy Crush, which was created in 2012. The studio was bought by Activision Blizzard in 2016 for $ 5,9 billion.

| King | 2019 | 2018 | y / y |

| revenues | $ 2 million | $ 2 million | -2,63% |

| Operational profit | $ 740 million | $ 750 million | -1,33% |

| Operating margin | 36,44% | 35,95% | +0,49 pp |

Electronic Arts (EA)

EA stock chart, interval W1. Source: xNUMX XTB.

It is one of the largest digital entertainment enterprises. The company is best known for a series of sports games such as FIFA® (soccer) or Madden NFL® (American football) or NHL® (hockey). However, the company has a much wider portfolio of games. Among them can be found Star Wars, Battlefield, The Sims or Need for Speed.

In addition to games, the company also has a "live service" that offers additional content. This segment generated approximately 51% of revenues in 2019. The most famous is Ultimate Team. FIFA Ultimate Team (FUT) is an example. The player can create his own team. It can be upgraded by completing tasks for which FUT coins are awarded for which you can buy "player packs" or disposable cards. Micropayments are also possible.

The company also has a portfolio of mobile games, including: FIFA, Need for Speed, Simcity and Real Racing.

The company sells its products both through the digital channel (77,9%) and through physical sale (packaged goods). The company's overall revenues in the fiscal year 2020 increased by 12% y / y, reaching the level of $ 5,5 billion.

| EA Sports | 2020FY | 2019FY | y / y |

| Downloaded games | $ 809 million | $ 680 million | + 18,97 % |

| Live services | $ 2 million | $ 2 216 ml | + 26,94 % |

| Mobile | $ 692 million | $ 814 million | -14,99% |

| Digital sales together | $ 4 million | $ 3 million | + 16,28 % |

| Physical sale | $ 1 million | $ 1 million | -1,37% |

Take-Two Interactive

Take Two stock chart, interval W1. Source: xNUMX XTB.

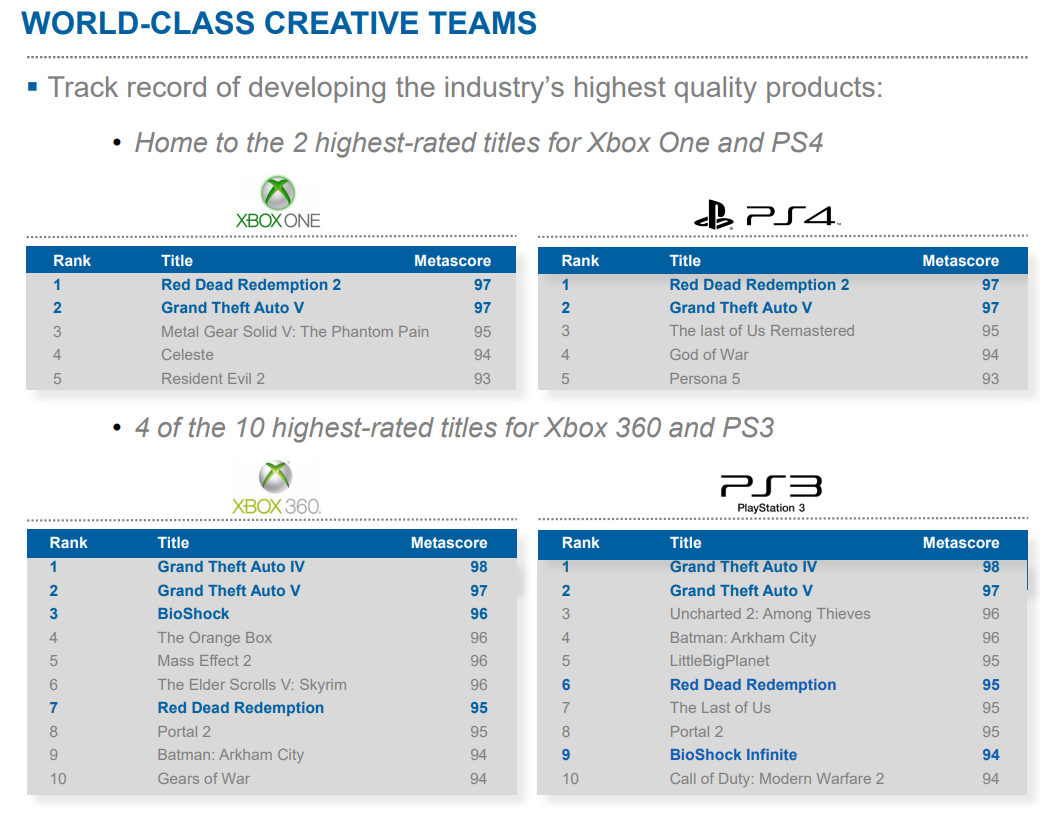

The company was founded in 1993, and after 4 years it made its debut on the NASDAQ. In 1998 there was a milestone in the company's development. BMG Interactive was acquired, which was the publisher of the controversial game Grand Theft Auto (GTA). These were the foundations for the founding of Rockstar Games, the publisher of GTA games, Max Payne and Red Dead Redeption. The studio does not release games serially. It focuses on quality, which means that you have to wait up to several years for the next series of games. The strategy has brought many successes as evidenced by the high ratings of the games:

Source: https://ir.take2games.com/

High quality also translates into good sales of titles. An example is the game GTA V, which has sold 120 million copies. The entire GTA series has achieved sales of more than 315 million copies. In turn, Red Dead Redemption 2019, released in 2, sold 2020 million copies by the end of January 29.

Take-two also owns 2K Games studio, which publishes games such as the NBA 2K series, Civilization and Mafia. Take-Two also has a partnership with the NBA. Thanks to this, NBA 2017K Leaugue was created in 2. These are fully professional esports competitions in which players receive remuneration. 70 players signed up for the first edition, 000 of which were accepted.

The company also has a segment of mobile games. His portfolio includes F2P (free-to-play) games such as Dragon City or Monster Legents.

| Take-Two | 2020FY | 2019FY | y / y |

| Console | $ 2 million | $ 2 million | + 3,35 % |

| PC and others | $ 780 million | 434 ml $ | + 79,72 % |

| Together | $ 3 million | $ 2 million | + 15,78 % |

Ubisoft

It is a French gaming company founded in 1986. He is the publisher and developer of a series of famous games. The company made its debut on the Paris Stock Exchange in 1996. In 2000, Ubisoft acquired Red Storm Entertainment studio, which publishes the Tom Clancy series of games. A year later Blue Byte Software - producer of The Settlers® game joined the portfolio. In 2004, Ubisoft started publishing Far Cry games. In 2007, Assassin's Creed debuted, which is one of the most famous game series in the world.

Ubisoft has a wide portfolio of games, but its strategy focuses mainly on the development of Assassin's Creed, Tom Clancy's, Far Cry, and Watch Dogs. The company has 18 employees, twice the number of Activision Blizzard. However, the games published by Ubisoft generate less income per employee than American competitors. The company generated revenues of € 000 billion in the financial year 2020. Of which 1,6% from the digital segment (games, DLC).

WIG - GAMES

In Poland, the fashion for gaming companies began in 2010 - 2011, when the first successes began to be achieved by studies CD Projekt (The Witcher 2) and CI Games (Sniper Ghost Warrior). In the following years, more and more companies from the gaming industry began to appear on the market. On the wave of popularity of the sector, the WSE introduced the WIG.GAMES index, which has been published since March 18, 2019. The base value of the index was established as at December 28, 2018. Its value was set at 10 points. The share of one company was limited to 000%. At the end of the session on December 40, 11, the index was worth 2020 points. Composition of the index as of December 29:

| Company | Index shares |

| CD Project SA | 33,639% |

| Ten Square Games S.A. | 32,608% |

| 11 bit studios S.A | 18,609% |

| PlayWay SA | 12,590% |

| CI Games S.A | 2,554% |

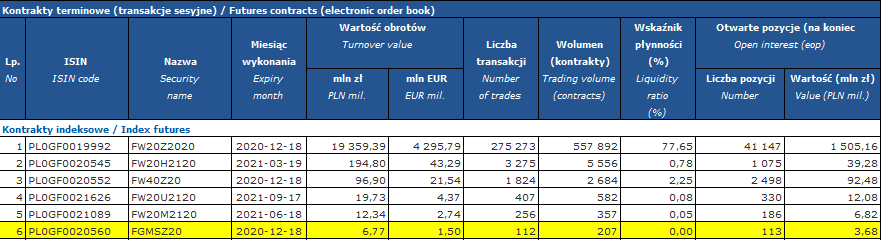

The WSE also offers futures contracts on the WIG.GAMES index. 1 point is worth PLN 1. This means that the nominal value of the contract is close to PLN 30.

In November, the December series of the WIG.GAMES contract (FGMSZ20) was the 6th most popular contract on the WSE. In November, trading in contracts amounted to PLN 6,77 million (207 contracts).

ETFs for the gaming market

Investing in individual gaming companies runs the risk of choosing the wrong company. An interesting alternative is investing in ETFs that give you exposure to the gaming market.

VanEck Vectors Video Gaming and eSports ETF (ESPO)

-

- Issuer: VanEck

- Annual fees: 0,55%

It is one of the most popular ETFs related to the gaming and esports market. The benchmark for the ETF is the MVIS® Global Video Gaming and eSports index. The ETF was established in October 2018. As of December 11, the ETF had $ 681 million in assets under management. The Annual Management Fee (TER) is 0,55% per annum. The ETF consists of 25 companies. Asian companies have the largest shares: Tencent (8,21%) and Sea Ltd. (7,41%). Both companies are not pure play. They generate most of their income from other activities. However, keep in mind that Tencent is the largest game publisher and producer in China. Sea Ltd, in turn, has a gaming and esports subsidiary (Garena). The ETF also includes such publishers and game producers as: Activision Blizzard, Electronic Arts ora Take-Two.

Global X Video Games & Esports ETF (HERO)

-

- Issuer: Global X

- Annual fees: 0,50%

The ETF benchmark is the Solactive Video Games & Esports Index. The ETF was established in October 2019. As of December 10, 2020, there were $ 513 million in assets under management. The Annual Management Fee (TER) is 0,50% per annum. The ETF consists of 40 companies. The ETF is dominated by American and Asian companies.

The 3 largest components of the ETF are Sea Ltd (8,43%), Bilibili (6,46%) and Nintendo (6,21%). The top 10 largest companies include, among others Activision Blizzard, Electronic Arts and Take-Two.

How to invest in companies from the gaming industry?

Investments can be made in the growing gaming market with the help of companies that publish and produce games. At the same time, you can also invest in companies related to the e-dispute market or producers of gaming equipment. However, if you invest in single stocks or CFDs, the risk of choosing a wrong company increases. A simpler solution is to invest in an index grouping companies from this industry or in ETFs available on the market. The largest ETFs include Global X Video Games & Esports ETF (HERO) and VanEck Vectors Video Gaming and eSports ETF (ESPO).

ETF brokers

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

397 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in gaming? Everything about investing in gaming companies [Guide] how to invest in gaming](https://forexclub.pl/wp-content/uploads/2020/12/jak-inwestowac-w-gaming.jpg?v=1607892983)

![The gaming industry is a long-term win [Market report] gaming industry](https://forexclub.pl/wp-content/uploads/2021/03/branza-gier-gaming-300x200.jpg?v=1614772221)

![Is this the end of the boom on gaming companies? [Download e-book] gaming companies](https://forexclub.pl/wp-content/uploads/2018/10/spolki-gamingowe-300x200.jpeg)

![How to invest in gaming? Everything about investing in gaming companies [Guide] forex tickmill competition November 2020](https://forexclub.pl/wp-content/uploads/2020/12/konkurs-forex-tickmill-listopad-2020-102x65.jpg?v=1607892354)

![How to invest in gaming? Everything about investing in gaming companies [Guide] fc cryptocurrencies](https://forexclub.pl/wp-content/uploads/2020/12/fca-kryptowaluty-102x65.jpg?v=1608113630)