How to construct a stock portfolio after the US election?

The second economic crisis in just 12 years, which emerged shortly after the world recovered from the first crisis, pushed monetary policy to the macroeconomic event horizon. Never before have interest rates been brought so close to zero in so many countries, while fiscal deficits spike and debt levels are historically high.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

What will this lead to? Nobody really knows. However, the world is likely to face several exciting and unpredictable years, incl. due to the presidential election in the United States on November 3.

Global equities need substantial earnings growth

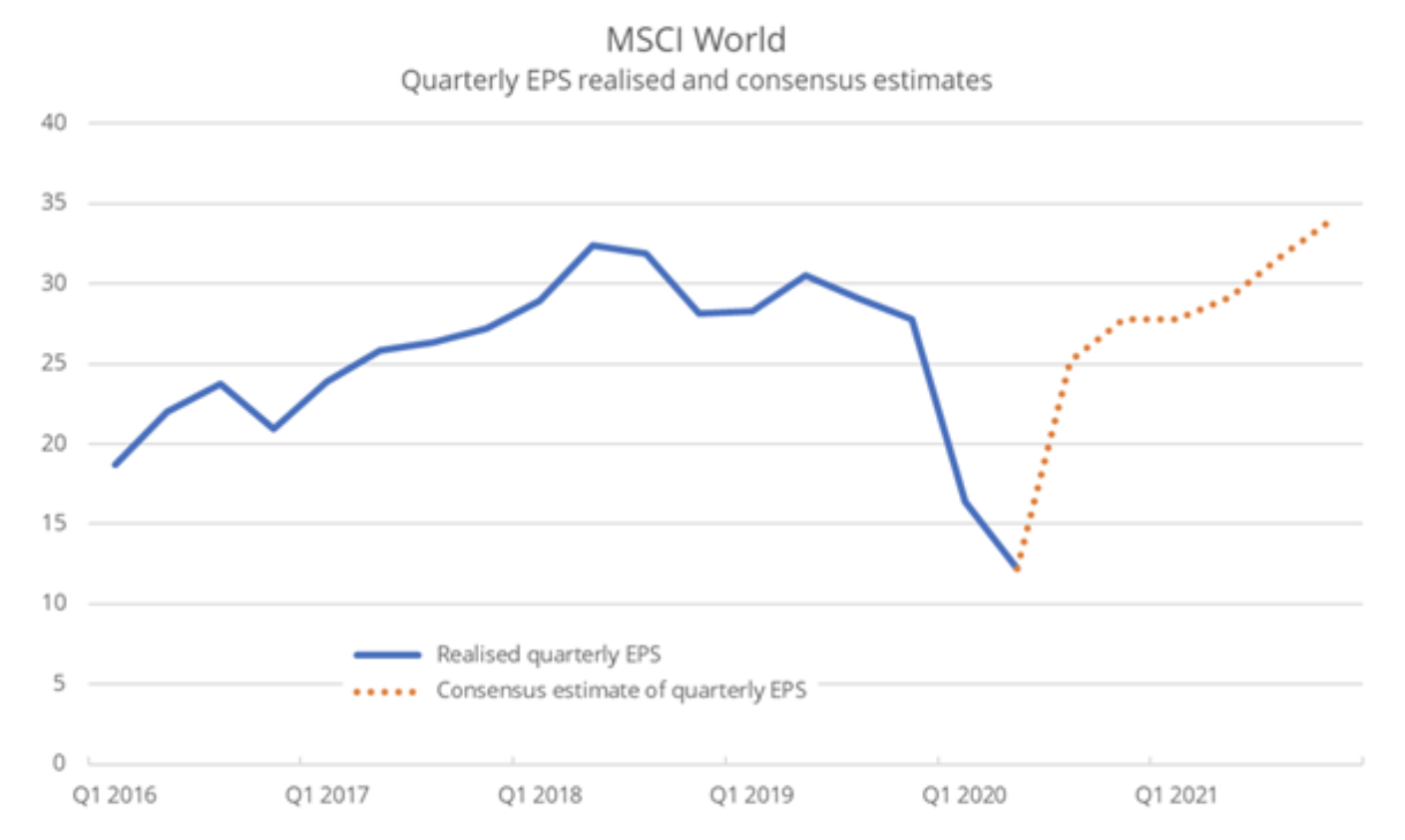

Aggressive policies by central banks and governments in the first half of the year rebounded heavily in stock markets and contributed to the widespread perception that the world could handle the Covid crisis with fewer losses than the 2008 financial crisis. of the first wave of the pandemic, even though the profits of global companies fell by as much as 56% - which brought the P / E ratio to 27,7x at current prices.

With the start of the Q106 earnings publication season, expectations are high and it is estimated that quarterly profits will increase by as much as 2021%, and then will go up until they reach a new record high in Q2021 19,3. If the enterprise sector manages to lead Until such a rebound, in XNUMX, valuations of the global stock market will assume a profit of XNUMXx. Given the bond alternative, such a valuation is not without foundation.

So what is the probability that corporate profits will go up so much? Published by the New York branch Fed The Weekly Activity Index, which monitors economic growth in the United States in real time, shows a strong V-shaped recovery since late April, even though it was still at -5% in mid-September. Given the current trajectory, the world's largest economy will return to growth before the end of the year.

The number of people who permanently lost their jobs increased sharply from 1,2 million before the Covid pandemic to 3,41 million in August 2020; this level is high, but it is still not comparable to the situation in 2008, when this indicator jumped from 1,49 million to 6,82 million (the size of the labor market at that time was even smaller than today). According to the CPB, the Dutch Economic Policy Analysis Bureau, the global trade volume rebounded by 7,6% MoM in June and the process is still ongoing. This suggests a normalization of the situation, even as global trade is going through its most difficult period since the global financial crisis.

Various data indicate that at this point the probability is tilting towards a rebound in corporate earnings to pre-pandemic levels in the next 18 months, but the subsequent long-term growth rate is a much larger unknown. The two most important factors for investors in the coming decade will be inflation and volatility in both financial markets and the economy. We will deal with this subject in more detail in the next quarterly forecasts.

US elections tend to have little impact on stocks, but the VIX curve suggests otherwise

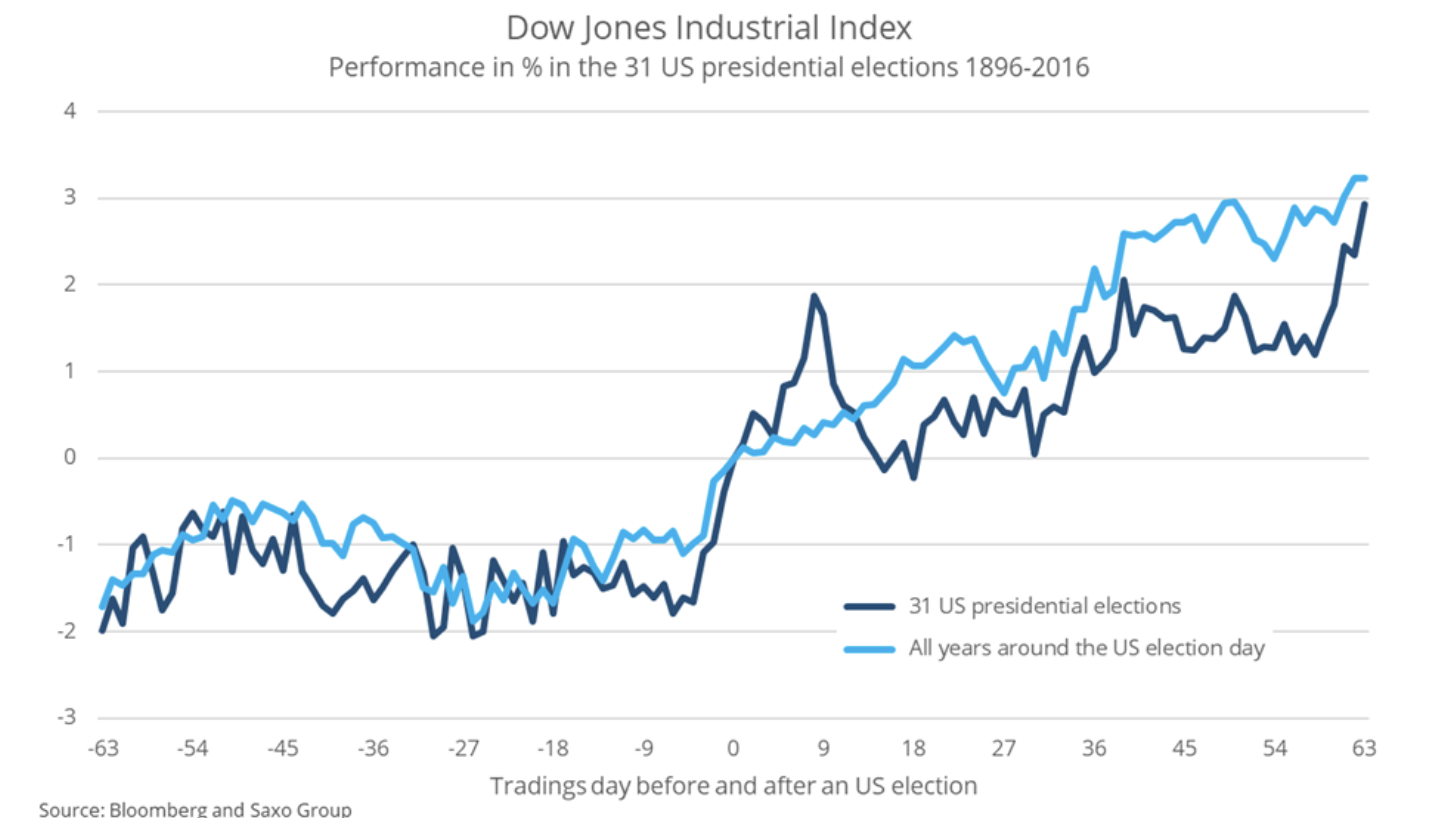

We analyzed all 31 periods of the US presidential election from 1896 to 2016 to determine the stock market performance before and after the election. The US stock market, measured by the Dow Jones industrial index, tends to be flat in the pre-election period, gaining around 3% after the election.

If we measure the performance of the US stock exchange in all years from 1896 to 2016, including the years of the presidential election, we will observe identical trends. The post-election boom in the stock market is therefore probably not a function of the election result or related sentiment, but rather a seasonal effect for the months of November, December and January. However, if we randomly select 29 out of 31 election periods, the "seasonality" effect sometimes does not occur. In other words, the statistical plausibility of this effect depends on the selection of the sample.

We also examined the daily volatility over the 63 business days preceding and following individual elections in the United States. In 31 election periods from 1896 to 2016, we observed an average daily volatility of 0,98% before the elections and 1,01% after the elections. However, this difference is not statistically significant, so we cannot conclude that elections translate into volatility.

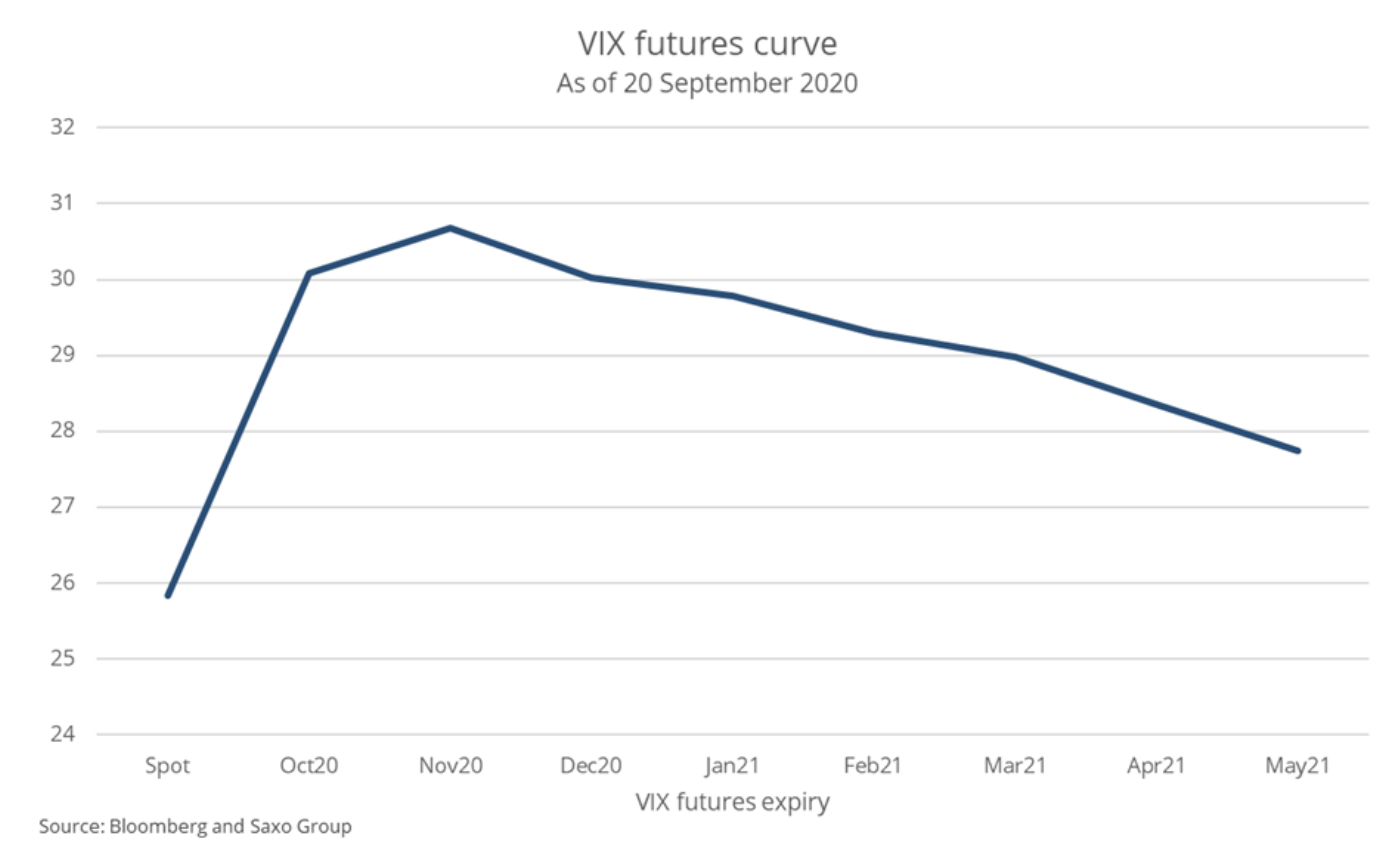

The daily volatility of 1,01% after the US election corresponds to about 16% per annum and is therefore much lower than the current implied volatility as measured by the VIX futures index curve. The 30-day future implied volatility for the year exceeded 1916 in October, November and December. Only for the 1932, 2008 and XNUMX elections was the realized volatility higher, which suggests that the current valuation of the VIX does not take into account a real risk scenario in the tail of the decomposition. If the election result is contested, or if Biden wins, it may well be that the volatility before the election was in fact very cheap.

US stock market during Trump's tenure and the impact of Biden's possible tax increase on profits

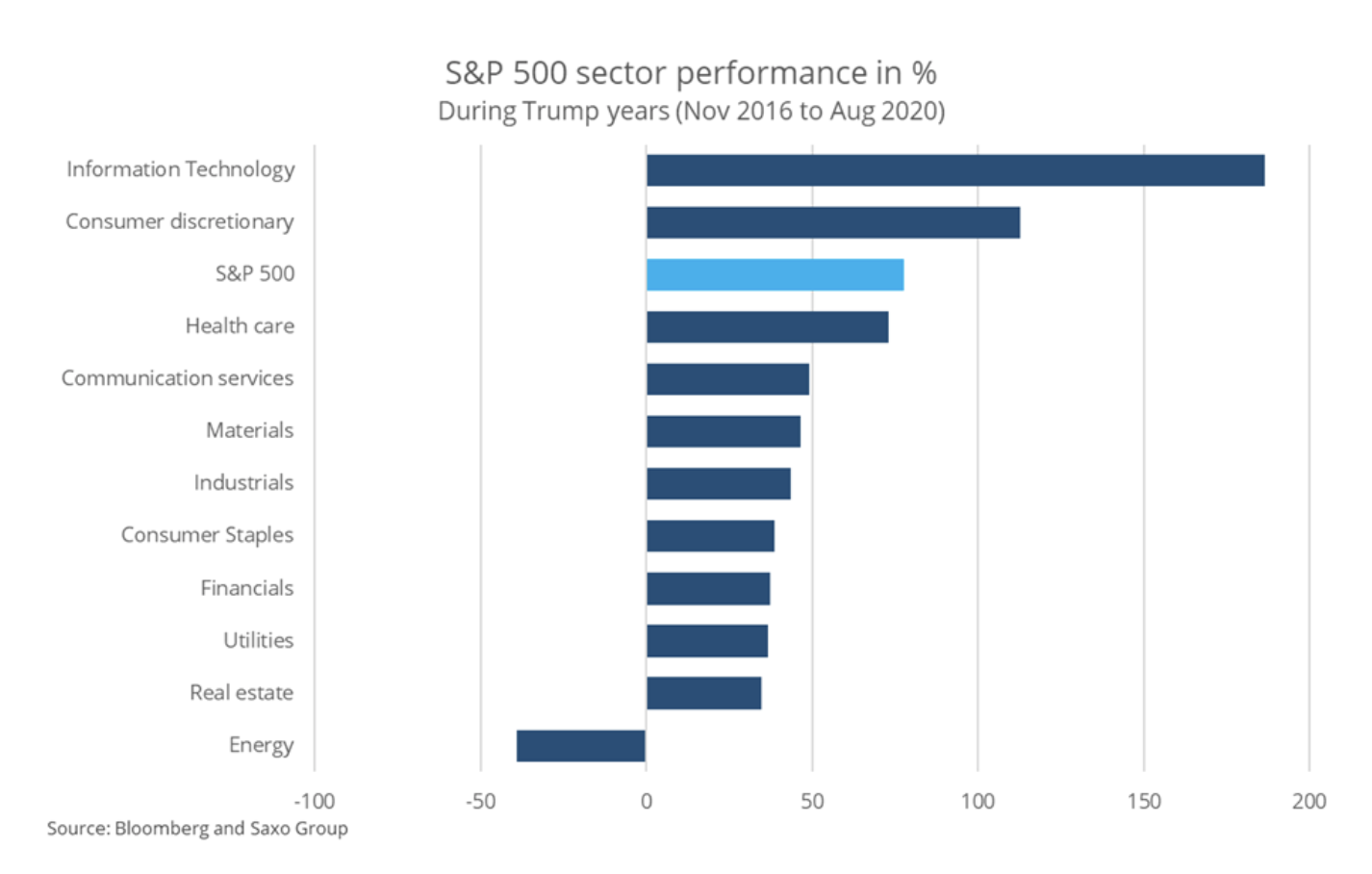

In 2016, Wall Street analysts made a mistake in arguing that Trump's victory would be bad for stocks. During Trump's four-year tenure, the US stock market performed fairly well despite mounting tensions between the US and China, which raised concerns about global supply chains among US companies.

Most of the profits came from three sectors: information technology, luxury consumer goods, and healthcare. Along with telecommunications services (which expanded to include social media in September 2018), these sectors benefited most from Trump's 2017 corporate tax reform. The worst performers were traditional industries such as energy, finance and real estate, which were predicted to be in great shape during the Trump presidency. In fact, the energy sector is the only one that has seen negative gains during Trump's tenure.

Trump's tax reform is also critical to understanding why re-election would be the best outcome for the stock market. Market participants have grown accustomed to Trump's personality, and the corporate sector has benefited in many ways from Trump's policies of lower taxes and less strict government oversight. For companies and investors, the Trump administration can even mean somewhat predictable relations with China.

On the other hand, Biden's victory could negatively affect stocks, as Biden proposes to raise statutory corporate income tax from 21% to 28% and foreign intangible income (GILTI - Global Intangible Low-Tax Income) from 10,5% up to 21%. In addition, Biden wants to raise the minimum corporate income tax rate to 15%, and impose a payroll and social security tax on the highest earners. In total, it is estimated that such tax changes would burden the earnings of S&P 500 companies by 9% - and ignore secondary effects such as a shift in investor sentiment that could put valuations at risk.

The two tax changes with the greatest potential impact are the increase in statutory income tax and GILTI. In particular, telecommunications services, healthcare and information technology would be negatively affected, as companies in these sectors are generally the least taxed and make a significant use of intangible assets. Due to the fact that these industries are the driving force of the stock market, it can be suspected that in the event of changes introduced by Biden, the dynamics may be reversed. There is still an unanswered question as to whether Biden will dare to introduce these changes in times of economic downturn.

Election scenarios

Below we present our forecasts of the market consequences in the event of a Biden or Trump win. Overall, which one wins may not make much difference in the long run. More important is whether the Democratic Party manages to get the full advantage. Even so, in some sectors, the winner may be associated with better results. Here are our predictions - they may change after presidential debates, when the market shows a viable choice between Trump and Biden.

Impact on post-election actions in the United States

1. WON BIDENA

- Significant increase in green energy

- Decrease oil i gas

- Significant loss of technology (GILTI, taxes)

- The infrastructure will go up a lot

- Finance may suffer

- Marijuana Shares Will Go Up

2. TRUMPA WON

- Strong oil and gas growth

- On running a small cap company

- Infrastructure stocks will go up

- Caused by the bull market relief S & P 500, Nasdaq 100

- Possible discount of Chinese technologies

- Possible sell-off in the healthcare sector

3. CONTESTING THE RESULT

- Overall stock discount

- Higher volatility

- Lower valuation multipliers

- Worst performance - high beta stocks

All Saxo Bank forecasts for download pod TYM address.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)