How would Marine Le Pen's election victory affect the markets?

Emmanuel Macron is 19 times more likely to win in the Sunday elections than his opponent. So there's a slim chance Marine Le Pen will repeat Donald Trump's 2016 polling shock and Britain's Brexit referendum. However, if Le Pen wins, the global stock exchanges, in the current situation, may react strongly to it.

About the author

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Pawel Majtkowski - analyst eToro on the Polish market, which shares its weekly commentary on the latest stock market information. Paweł is a recognized expert on financial markets with extensive experience as an analyst in financial institutions. He is also one of the most cited experts in the field of economy and financial markets in Poland. He graduated from law studies at the University of Warsaw. He is also the author of many publications in the field of investing, personal finance and economy.

Macron has an advantage - but a small one

Recent polls indicate that support for Emmanuel Macron fluctuates between 55-57,5 percent. His rival Marine Le Pen can count on 42,5-45 percent. votes. Some of the polls were carried out after Wednesday's debate between the candidates. This 3-hour exchange of views was, in the opinion of experts, to help the undecided to choose their own candidate and thus decide about the election result. However, it did not happen - Emmanuel Macron won the debate, but not in a decisive manner, which did not bring him any significant increases in the poll. Marine Le Pen fared worse than Macron, but much better than in the corresponding debate in 2017, which allowed her to defend her possession. It remains unknown how the undecided will behave on Sunday and how 22 percent will be distributed among individual candidates. votes cast in the first round for Jean-Luc Melanchon (forecasts indicate that Macron will receive half, 1/4 Le Pen and 1/4 voters will not vote).

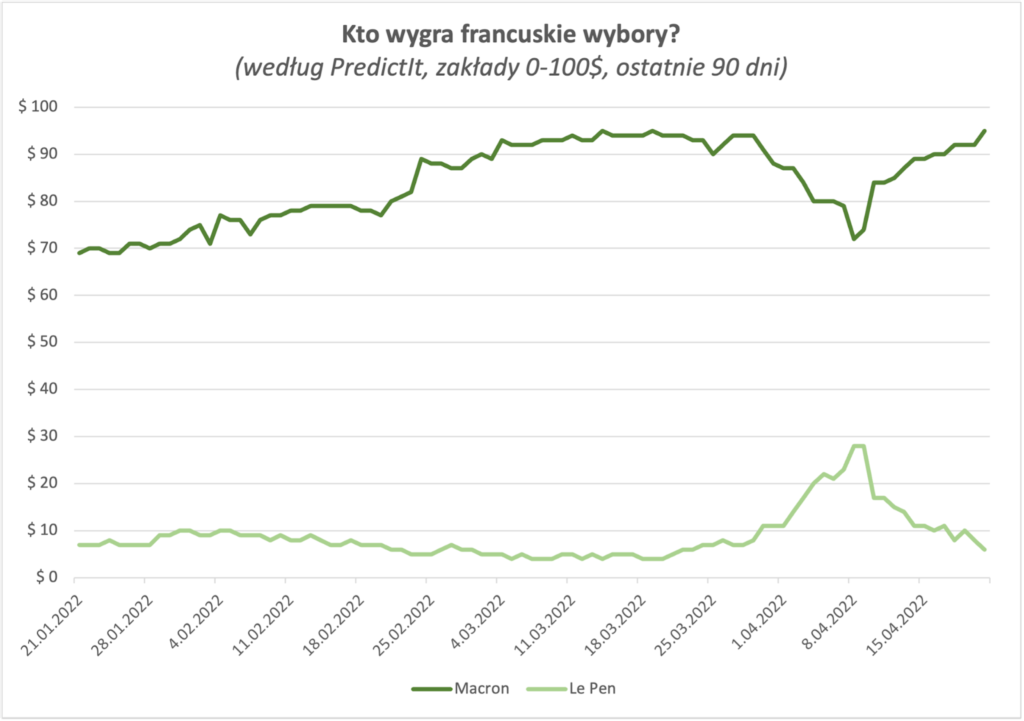

Both polls and data from the website PredictIt (hosted by Victoria University of Wellington) indicate that Macron's victory seems most likely. According to PredictIt, Le Pen's chances of winning are 19 times smaller. However, experiences with the election of President Donald Trump in 2016 and the results of the referendum on Brexit, showed that these less likely scenarios should not be excluded as well.

What if Marie Le Pen wins?

If Marine Le Pen won the elections in France, it would pose a serious threat to the functioning of France in the European Union and NATO. It would also be a serious challenge for the functioning of the entire EU. Especially in a situation where France and Germany have in recent years constituted the main axis of shaping European policy. The victory of the extreme-right candidate would also have an impact on the current situation related to the conflict in Ukraine, as Le Pen opposes the introduction of the currently discussed embargo on Russian oil and gas.

It is worth noting that The unexpected election of Donald Trump as president of the USA in 2016 was positively received by the stock exchanges. He expected what the markets usually expect from Republican candidates - lowering taxes, improving the budget situation and favoring business. Within one month of the election day (November 8, 2016) S & P500 increased by 5 percent. In the current environment, increased uncertainty and market volatility, should Marine Le Pen win, the global market would likely react strongly negatively. Recently, we have observed many symptoms of asymmetry in the response to incoming data, positive data provoke significantly less reaction than negative data. This could also be the case in this situation.

Of course, it remains most vulnerable to the effects of Sunday's elections Paris Stock Exchangealthough due to the fact that France is the second economy of the EU and a permanent member of the UN Security Council, the effects will also affect the European and world economy. The French market is dominated by stocks of luxury goods companies such as LVMH, Hermes and Kering. Industrial companies such as Schneider, Airbus and Vinci, and defense companies such as Thales, are in second place. Basic consumer goods companies such as L'Oreal and banks such as BNP Paribas are also well represented. As in the rest of Europe, the valuations of French companies are lower than in the US (12x P / Z), with a decent 10%. increase in profits. Most of the income of French companies comes from outside France, which makes the weak euro an important support for their competitiveness.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)