As president, so dollar. Overview of the most important short-term factors.

Currency market recently, he has indeed focused on the strong euro and the abstractly cheap pound. The US currency slightly receded into the background. Or Federal ReserveNeither the global mood was able to restore his "appreciation" power. On the one hand, the USD is one of the most overvalued currencies, on the other hand, the market situation is long enough to lean towards the American currency, at least in the short term. The stock markets in the United States are having their "best" time. The indices, despite several corrections, are still hovering around historical highs. Appetite grows as you eat, as evidenced by the valuations of the largest US companies. Most stocks look like huge speculative bubbles that will flood the stock exchanges red under the influence of significant, poor information. The current president has to be admitted that he favors high prices on the stock market. With its possible departure, will the increases in indices also go away and the dollar will strengthen?

Secret weapon

While recent polls are not in favor of Donald Trump, they are not the result of real elections. Contrary to appearances, the current head of the White House has a few proverbial aces up his sleeve that he can use just before the elections. One is the trade war with China that is still unfinished and now extinguished. However, these are only speculations, but not without reason the Chinese thread begins to intertwine between the words of politicians in the US. A trade war is a tool to show the strength and tenacity of Trump's policy, although when looking at the real benefits, it's hard to find any that would realistically improve the (long-term) image of the current president. Nevertheless, its re-escalation, even for campaign purposes. at least in the short term, it would support the USD performance. Of course, it all depends on the importance of any statements and their geopolitical relevance. If these are only common announcements without coverage, and the imitation of confusion, there is a chance that a large part of investors, who have long been bored with this topic, will not take any market action. It will be an image flop rather than a real help in the campaign.

Between a rock and a hard place

After all, Donald Trump faces a difficult choice. Maintaining good market sentiment is related to the lack of external conflicts between the US (i.e., de facto, with China). Any turmoil in the international arena would reduce the recent gains. The indices, along with leading companies, are the showpiece of his entire term. A confirmation that the markets developed intensively in a healthy and strong economy. But is it enough to improve the polls? Or will Trump decide to take the baton over the trade war again at the cost of a correction? Or maybe it will decide to use the issues related to the TikTok application for this?

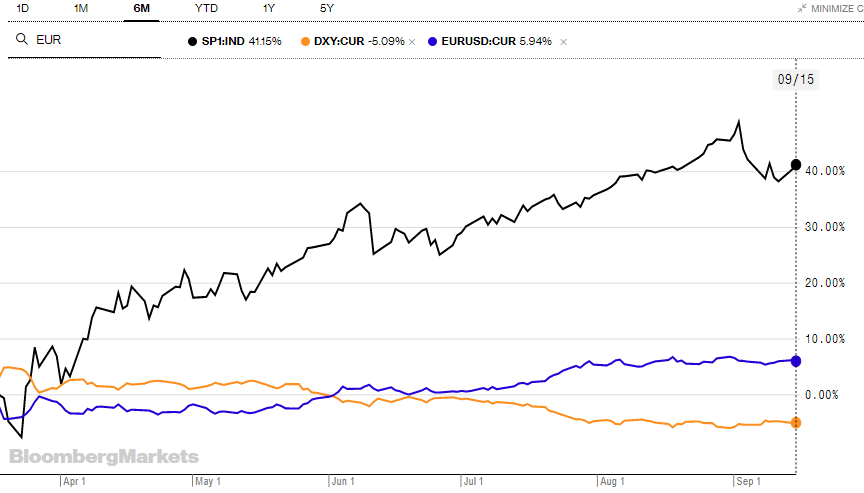

A correction in indices and an increase in uncertainty in world trade, at least in the short term, would allow the USD to strengthen. We have presented three instruments in the chart above: futures contracts S & P500 (black), dollar index (orange), and EUR / USD (blue). In addition to the strong and understandable correlation between the USD Index and the currency pair, the noticeable depreciation of the USD due to strongly inflated equity markets deserves more attention. It is true that the rates are moving within certain limits and certainly EUR / USD is not yet (and probably will not be in the near future) at its upper limits. However, this does not change the fact that the capital has departed quite far from the safe havens and does not intend to return there for the time being. However, a strong correction on companies may change this.

A meeting of the Fed may significantly change a lot. Admittedly, the extremely loose policy and no idea of the Federal Reserve to further weaken the dollar may have a positive impact on its performance. Reaction to the meeting may be different, especially that the market has already priced-in most of the announcements. Therefore, the lack of "freshness" and the repeatability of Powell may bring a correction similar to the one in June, where despite dovish announcements we had to deal with solid declines.

The exhibition looks interesting Commercial Hedgerson the dollar index. Usually, during periods of equilibrium, when Hedgers positions are close to Large Traders, there is an impulse.

Source: https://finviz.com

Commercial Hedgers shedding shorts may indicate a short-term chance for USD to strengthen as CH starts buying more short positions on the USD index futures.

Source: https://finviz.com

The large Commercial Hedgers short display is also in gold. Periods of high involvement of this group of investors in shorts usually end with the execution of these contracts and the metal price breaking. The correlation between the dollar and gold is known for a long time. Even though both assets belong to the group of Safe havens, however, are negatively correlated with each other. The fall in gold prices on the market has a positive effect on the value of the US currency. Combined with geopolitical instability and tensions in the international arena, the chances of a US dollar appreciation (in the short term) are significantly increasing even before the elections.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)