Oil price consolidation on the wave of fear of coronavirus

Last week there was a sense of déjà vu on the markets: some investors behaved similarly to the first quarter, when the Covid-19 pandemic led to a sharp fall in asset prices. Since April, the economic effects of months of isolation have been overshadowed by a strong bull market on global stock exchanges. This week, however, the first scratches appeared on the support of the Fed (liquidity wall), TINA ( there is no alternatives - "there is no other alternative") and FOMA ( fear of missing out - fear of missing something).

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

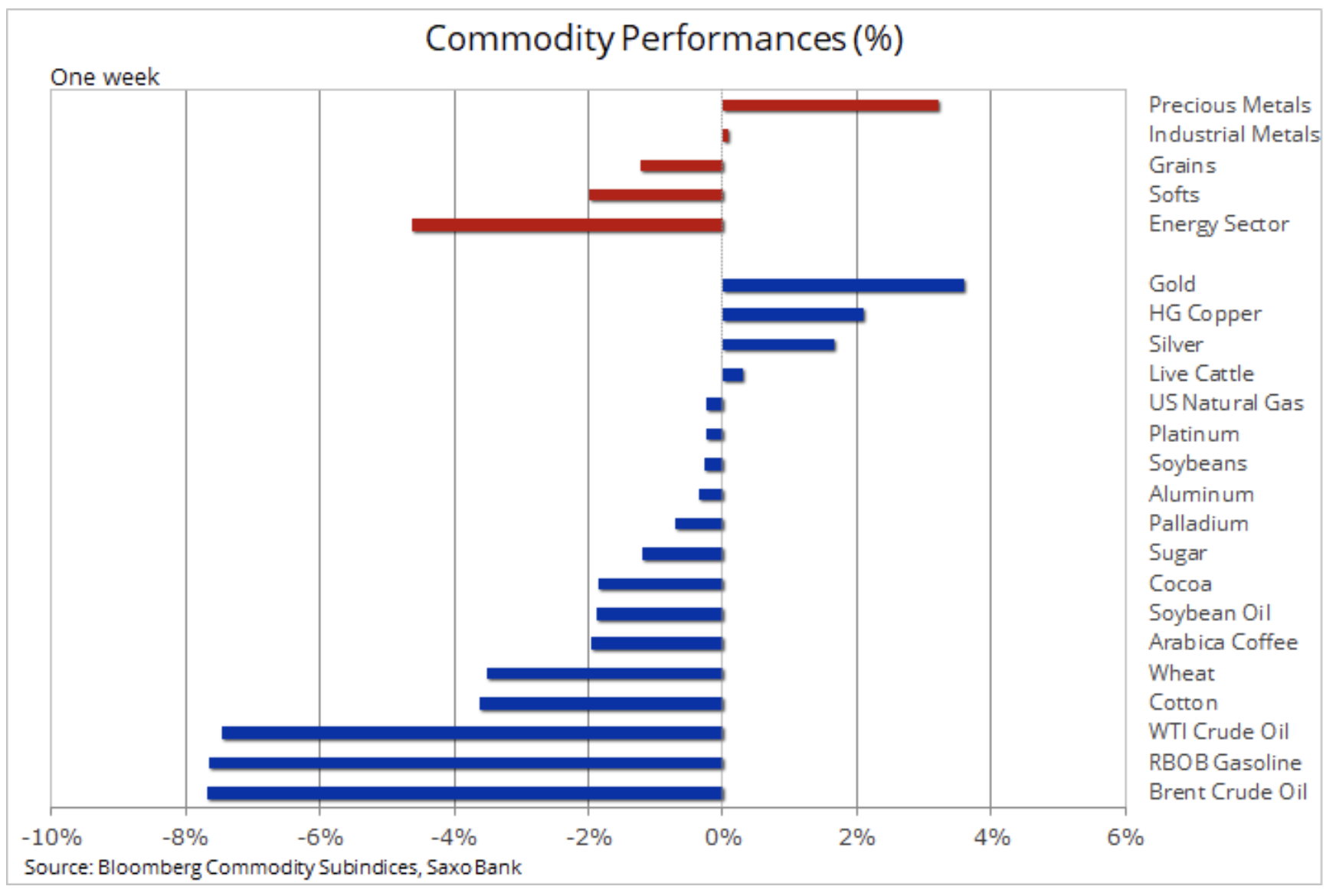

Despite the very gentle American message Federal Reserve risk aversion reigned in the markets - the dollar recovered somewhat, and the S&P 500 index on Thursday recorded its biggest decline since March 6. Treasury bond yields were moving towards record lows, thus supporting gold, while a somewhat speculative boom and oil price rises slowed down after the rate overtook the current fundamentals.

The fact that the US Federal Reserve believes that the road to recovery will be very long, and the World Bank has determined that we will be dealing with the largest global recession since World War II, and above all the risk of a second wave in the United States and some other countries , confirmed that the famous V-shaped recovery will be very difficult.

Oil prices

The forecast for the demand for key raw materials, primarily energy, is still negatively affected by the uncontrolled Covid-19 pandemic. While the situation in Europe, except Great Britain, as well as in China it has improved, globally it continues to deteriorate, and the number of new cases of infection is record-breaking - primarily in the Americas and in South Asia. There is increasing evidence of the possibility of a second wave in some US states and this has essentially contributed to recent market changes, especially given that most of the countries in which the second wave occurred, including the United States, are unlikely to implement further isolation activities for fear for economic effects.

As a result, oil prices have fallen sharply, recording their first weekly decline since April. The risk of a second wave slowing the recovery of global demand is associated with numerous challenges, primarily for the group of producers with OPEC +, who have recently reached an agreement on extending production cuts for another month. These cuts are currently translating into production reserves, which can be used after reviving demand and reducing global inventories. For some time this group will be able to control supply, but not demand, and insufficient recovery of demand may shake cooperation due to the risk of cheating on quotas.

HOW TO BUY CRUDE OIL [GUIDE]

The US continues to feel the effects of the price war triggered at the worst possible moment - in March - by Saudi Arabia, and the millions of additional barrels of imported oil from that country have pushed commercial stocks to record highs. Although these developments will slow down in the coming weeks, the positive impact on prices will not materialize for some time to come due to the increased levels of gasoline and, above all, distillate stocks, and the slow pace of recovery in demand. Added to this is the risk that some shale oil producers may start increasing production as long as forward contract prices remain at the current level.

Both WTI oil and Brent oil failed to fill the gap caused by the market crash in early March after Saudi Arabia launched a short-lived price war. Market behavior following the agreement of OPEC + members to extend production restrictions by 9,7 million barrels per day to the end of July signals the beginning of the long-awaited correction / consolidation.

Hedge funds have been intensively buying WTI crude oil since the beginning of March, and in the week ending June 2, their long net position reached 380 million barrels, which is the largest upward position in WTI oil since August 2018. Although our long-term positive forecast has not changed, the coming months may prove slightly more difficult due to subsequent outbreaks of Covid-19 in the United States contributing to the reduction of the speculative position.

Precious metals

The inability of gold, after a gentle FOMC message, to overcome resistance above USD 1 / oz contributed to profit taking before new concerns about the stock exchange and Covid-750 provided new support. Although there were no new initiatives such as the yield curve control, FOMC presented a positive forecast for gold. Official interest rates are expected to remain unchanged until 19, while further bond purchases will provide extensive monetary policy support.

HOW TO BUY GOLD [GUIDE]

We are reiterating a positive forecast for silver and, above all, for gold after the current reduction in the silver premium. The main reasons why we predict that there will be minimal traffic to USD 2020 / oz in 1, and further record highs will be recorded in the coming years are as follows:

- Gold used as collateral against central monetization of financial markets

- Unprecedented government incentives and the political need to raise inflation to support debt levels

- The inevitable introduction of yield curve controls in the United States, forcing a fall in real yields

- Increase in global savings in the context of simultaneous negative real interest rates and unsustainable high stock market valuation

- Increased geopolitical tensions over shifting blame for Covid-19 pandemic before US elections in November

- Weaker US dollar

Base metals

HG copper surpassed only gold; this metal reached 2,71 USD / lb, the highest level since January, and then slightly fell on the wave of concerns about coronavirus. The recent break above USD 2,50 / lb, a key level of support transformed into a resistance level, eventually resulted in hedge funds joining Chinese speculators and starting buying this metal. In addition to the latest accumulation of long speculative positions, the boom from the minimum level in March was the result of an increase in demand from the Chinese industrial sector, supply disruptions in South America due to coronavirus, and recently also a gradual decline in inventory levels monitored by stock exchanges in both London and London. and in China.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)