Consolidation of gold and silver with focus on US interest rates

Last week, gold hit its latest cycle high of $2/oz, just $048 below its 22 high. After gaining 2022% since early March, silver hit an annual high above $31/oz before profits were realized. After such strong gains, both metals need to consolidate, especially given that both gold and silver have a glut of buyers according to relative strength indicators.

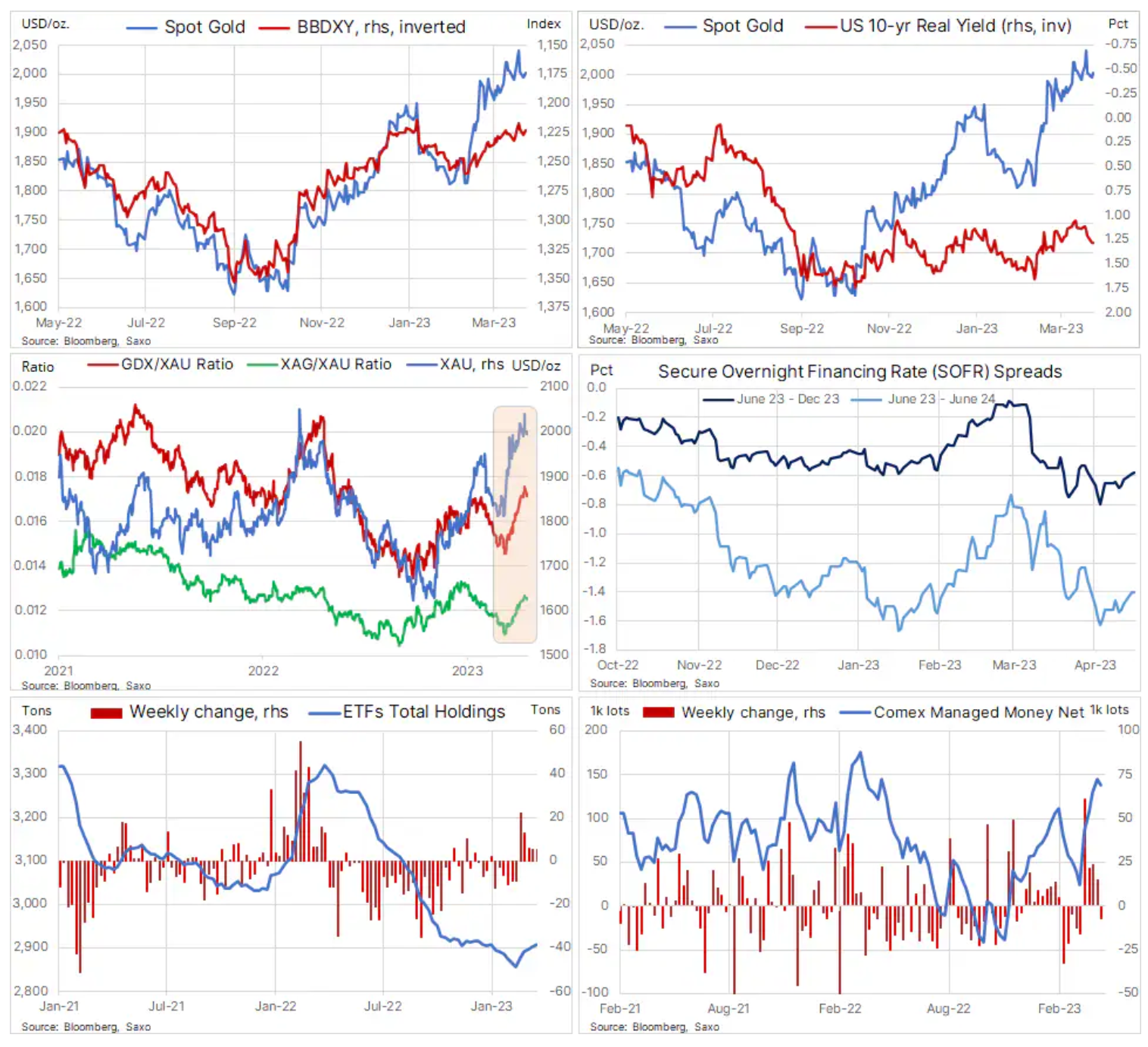

The current correction started on Friday after better-than-expected economic data from the US indicated a further economic recovery, potentially forcing Federal Reserve to maintain higher rates for a longer period of time. Short SOFR futures, like Fed Funds futures, are now priced in for a 25 basis point rate hike next month, and the prospect of additional hikes is gaining momentum. The valuations of the SOFR spread between June 23 and December 23 initially included a rate cut of 80 basis points by the end of the year; it is currently 60 basis points. Coupled with US bond yields rising again and the dollar finding new buyers after last week's sell-off, this has created grounds for a correction.

Despite gold (XAU/USD) managed to stay above its 1-day moving average, now at $989, while support is at the 38,2% retracement of the banking crisis up price line.

What do other factors shaping precious metal prices tell us about the current strengthening?

First, given the recent weakening of the dollar and changes in ten-year real yields, the strength of the gold and silver price rally is evident, with the usual negative correlations with the dollar and yields failing to explain the upward move for both metals. The main factor here was last month's banking crisis, which caused a significant shift in market expectations regarding the direction of the US Fed funds rate - from further hikes to aggressive cuts before the end of this year.

The decline in yields, which is now partially reversed, has contributed to the first sustained increase in demand from financial market participants such as private investors and asset managers. These investors, who had been net sellers of bullion-based exchange-traded funds for the past 11 months, finally saw the right momentum in the gold market and evidence of problems with other investments, and began cautiously placing more money in the metal. However, this important group of investors has not yet committed to gold at a level that would seriously contribute to the strengthening. Between April 2022 and the start of the banking crisis last month, 465 tonnes were traded net, and since then the total position has only increased by 50 tonnes.

Speculative investors on the gold futures market COMEX also reacted to the momentum that emerged last month, ushering in the largest four-week buying wave since mid-2019. During this period, the net long position dynamically increased by 121k. lots or 12,1 million ounces, before taking profits in the week ending April 11 led to a decrease of 7,4 thousand. flights to the level of 137,6 thous. flights, about 38 lots below last year's high, which was reached around the time gold hit a record high of $2.

The recent strengthening of gold is also supported by the current excellent performance of silver (XAU / XAG) and gold mining stocks as evidenced by the reversal and therefore rising indices below, which signal healthy support historically.

While the near-term outlook points to consolidation and risks of lower prices before strengthening again, we maintain an overall positive outlook for investment metals due to the following developments and expectations, among others:

- Further weakening of the dollar as yield differentials narrow.

- Historically (three times in the last 20 years), the confirmation that Fed rates have peaked supported a strong rally in the gold price in the following months and quarters.

- Demand from central banks appears to remain strong as the push for de-dollarization continues to generate demand from a number of central banks. It is not known to what extent, if at all, this demand will prove price sensitive. We suspect that this will be moderate, and higher prices will not necessarily prevent further rollovers.

- We predict that inflation will be much more persistent and market expectations of inflation returning to 2,5% may come true in the short term, but not in the long term, which will force real yields to be revised downwards in favor of gold.

- The multipolar world is raising the geopolitical temperature.

- Low investor involvement will provide support if the above factors eventually lead to the expected breakout.

Silver (XAG/USD)

Silver it remains above $25 and $24,50, an area that provided several highs in January and February. The risk of a deeper correction towards $23,72 will depend on whether markets continue to focus on the risk of higher rates and the slow pace of cuts thereafter.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response