Consolidation of the zloty awaiting US data

The zloty remains stable awaiting the US inflation data to be released in the afternoon. It is possible that this report will end the stabilization of EUR / PLN above PLN 4,70, and USD / PLN at PLN 4,60.

The zloty is slightly losing

The first half of Wednesday's trade on the domestic currency market is marked by a slight weakening of the zloty, which, however, is still consolidating at the levels from the last days, and at the same time awaits new impulses that will slightly revive this market. And today such an impulse will appear. It will be published in the afternoon of July consumer inflation data in Usa. Data that is not only the event of the day on the financial markets, but also of the week, and even the entire month.

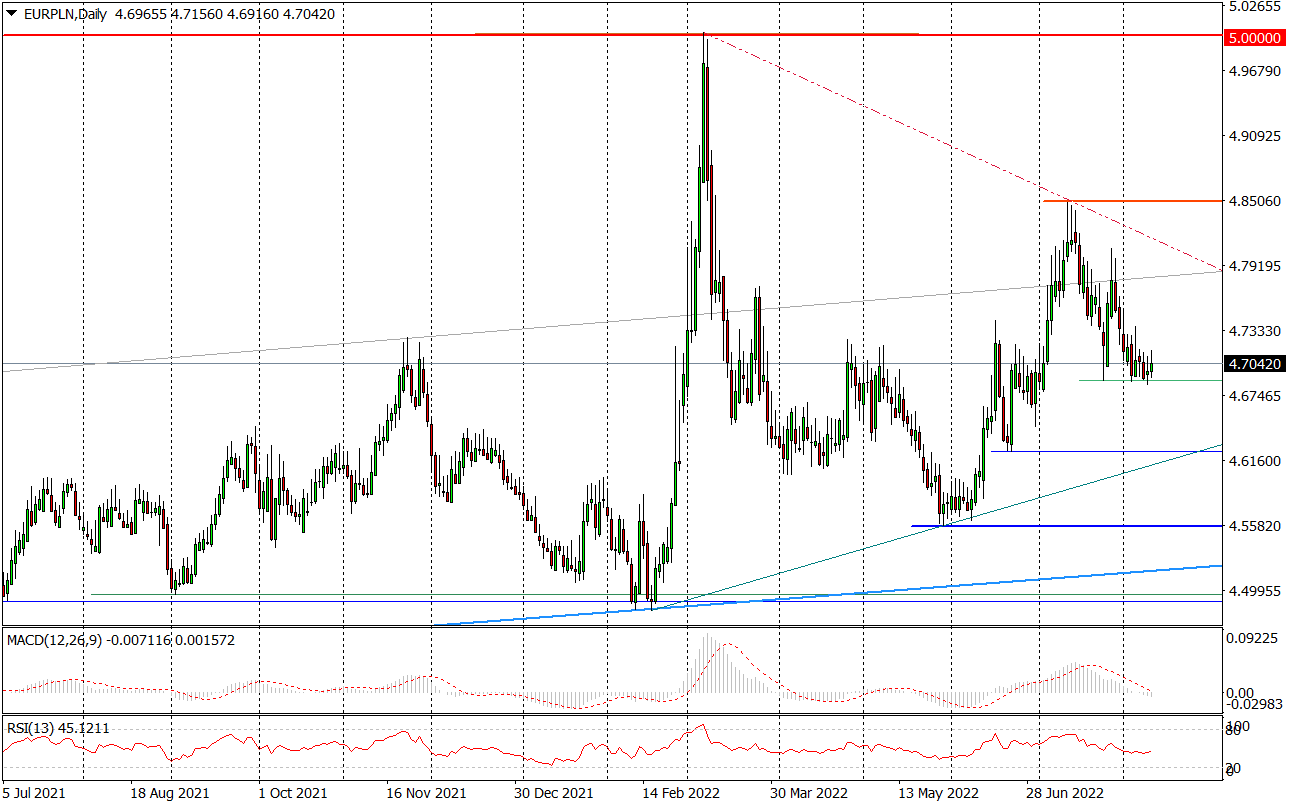

In the morning, the euro had to be paid 4,7042 zlotys, which is slightly more than yesterday, but similarly to the last days, when the decline of the EUR / PLN slowed down around the level of PLN 4,70. The USD / PLN quotations fluctuated in the range between 4,5957 and the daily maximum at PLN 4,6207.

EUR / PLN daily chart. Source: Tickmill

The market is waiting for data from the US

The situation in both Polish pairs may change at 14:30 pm. Then the latest data on inflation in the US will be released. They will constitute an important point of reference for expectations regarding the scale of further interest rate hikes by the American Fed, being at the same time a direct impulse for the dollar and an indirect impulse for the zloty.

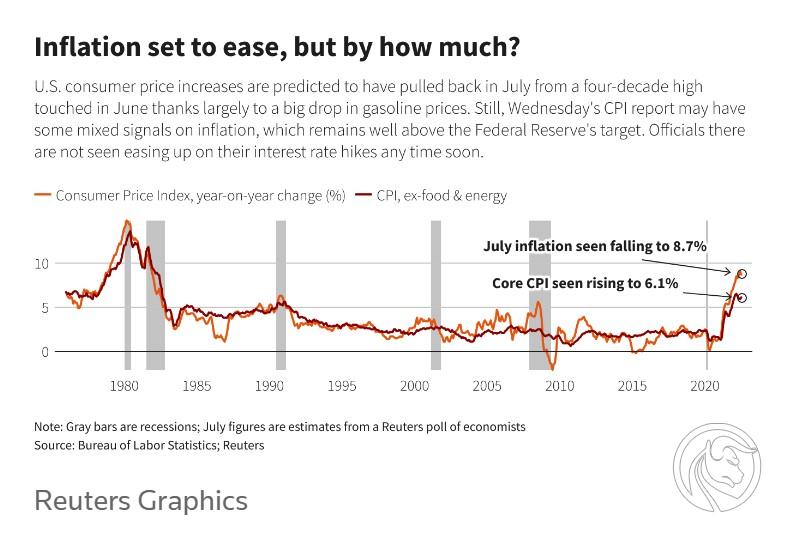

Economists forecast that consumer inflation (CPI) fell to 8,7% in July. Y / y from 9,1% in June, with a simultaneous increase in core inflation to 6,1 percent. from 5,9 percent

Source: Reuters

Higher than expected inflation will practically determine a rate hike in the US in September by 75 basis points (bp). This should translate into a strengthening of the dollar, while acting as a stimulus for the zloty weakening.

Lower than expected inflation would be quite a surprise and would provoke a reverse reaction of the currency market. Probably much stronger than in the case of higher inflation. In such a situation, the dollar would weaken against the basket of currencies, expectations for rate hikes in the US would decline, risk appetite in global markets would increase, and the zloty would benefit from all this. And quite clearly. In such a situation, it would be realistic for the EUR / PLN to break the support at the level of PLN 4,70, and for the USD / PLN to break a similar demand barrier, located at PLN 4,60. In both cases, it would herald a decline in both of these pairs by about 5 PLN in the following days.

Currently, the zloty is mainly influenced by global factors. And that won't change until the end of the week. Hence, the domestic inflation and balance of payments data to be released on Friday will probably be ignored. Domestic topics will come back only next week, when data on Polish GDP growth in QXNUMX and July data on core and producer inflation, industrial production as well as wages and employment in companies will be released.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)