Futures, or a few words about the "future" market part III

Futures are not only the domain of traders who use them to achieve (or increase) profits. These instruments are an important element of security, allowing us to supervise and control the risk we are exposed to (both enterprises and large investors) by using foreign currencies in our everyday operations. Today we will look at forward options that allow you to interestingly hedge your open currency positions.

Term (time) option

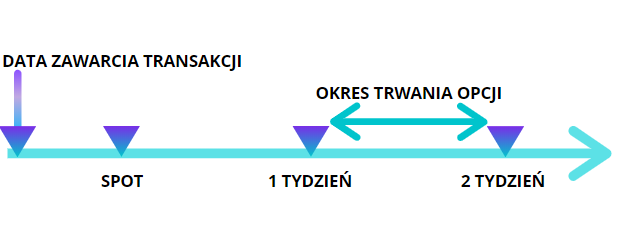

Buying or selling associated with the exchange of one currency for another within a predetermined time in the future is called a forward option. There are at least two additional terms that are used interchangeably. We can call the term option equally well time option and delivery option. These two terms make it easier to understand the definition and working principles of this instrument. In fact, it is not complex, and the basis of its functioning are the swaps we discussed earlier, about which we wrote in TYM article. The forward option is not a currency option. It is a separate instrument.

Indefinite time

The usefulness of forward options is best illustrated by an example. Let's assume that a large investor or foreign trade company expects foreign currency to enter its account. This date, however, is not precisely set, therefore we cannot arrange with the bank, as in the case of forward outrights, we talked about in the second part of this series, for a specific day of exchange (we need to provide a currency that we would not have physically). Hedging such a transaction with a forward would be ineffective. We would absolutely have to deliver our contractual obligation. Here begins the role of futures options, which, in addition to a futures contract, are able to hedge such a risk without having to specify a specific date and a specific time period.

Futures: a bank in a winning position

Of course, there is nothing to hide that due to the unknown delivery date, the bank will set the price for such a transaction with an option on convenient terms. Therefore, the most sensible idea would be to include a term option when several "maturity" dates fall within a specific time period.

The transaction is closed when the client will provide the bank with the full amount for which the contract has been concluded. An option contract, like forward outrights, is a commitment. It happens, however, that the company or investor fails to fulfill its obligation. Then he is forced to close open positions (balances) with a reverse spot transaction (if he bought it he sells if he sold it he buys it). The bank, of course, earns additional cash due to exchange differences other than those on which time option has been included.

Purchase of the term option

The purchase of a futures contract with an option takes place between two participants - the bank and the client interested in concluding such a transaction. For it to occur, three basic issues must be met, which are included in the contract. They are:

- amount of the underlying - we need to define the size of the transaction

- price - at what price we will trade (it is defined as the base price or contract price)

- date - the agreed date on which the contract must be completed. In the case of futures options, these are the time limits in which the foreign currency must be delivered, i.e. the contract fulfilled.

It is worth adding who the buyer is and who sells the contract. The "buyer" contract takes a long position, while the "seller" short one. The actual settlement, as mentioned above, takes place in the future in a strictly defined period of time.

Forward contracts versus extension or earlier implementation

The condition for a possible extension is the necessity of this option. The currency delivery period cannot be extended if the time option expires on a given day. How is this The bank closes the current contract with the option by (most often) spot transactions and a new one is concluded with a new price and a new date of delivery. Any exchange rate differences that arise during this procedure are settled on an ongoing basis between the bank and the client.

Earlier delivery may also be possible. If we want to close this option in full, the procedure is practically the same as for the possibility of extension. It closes with a spot transaction or a forward contract and concludes an unconditional forward contract (forward outright), which sets the date of fulfillment of the obligation.

One of the main advantages of using forward options is some flexibility in determining currency exchange on uncertain dates. In addition, for large tranches of cash, you can set a rate in advance at which the transaction or series of transactions is carried out within the period specified in the contract. The main disadvantage is the high spread between the purchase price and the selling price. Therefore, the longer periods will be in the forward option, the more unattractive they become.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)