In times of stagflation, commodities can shine

In a recent analysis, the chief economist Saxo Bank outlined the reasons why we revised our 2024 forecast for the U.S. economy from no recession to a milder form of stagflation, termed "slight stagflation," characterized by slow growth coupled with persistent inflation. Historically, during periods of stagflation, certain commodities attract more attention due to several factors, the most important of which are outlined below. We will also take a closer look at how to invest in this sector.

This change results primarily from a significant increase in real interest rates. This makes the cost of funding for the United States almost insurmountable, as evidenced by the recent oUS credit rating downgrade by Fitch.

Moreover, we have witnessed a significant escalation in the cost of consumption, and interest rates covering everything from credit cards and new vehicles to mortgages are now twice the long-term average. There is also a noticeable slowdown in employment and spending data, especially in the area of wages and energy, despite persistent inflation.

This combination of low growth and moderately high inflation points to stagflation, and if this forecast materializes, it will confirm the view that the Federal Reserve - and more broadly, central banks around the world - are fighting a losing battle against persistently high inflation, and further action will hurt economic growth , doing nothing to tame the sticky nature of the price pressure. This leads us to believe that the US Federal Reserve will cut interest rates before reaching the 2% average inflation target, leading to FOMC to raise the target to 3%, which in turn will force an overestimation of future inflation expectations, and thus a reduction in real yields supporting commodities.

Historically, during periods of stagflation, certain commodities attract more attention due to several factors:

- Inflation hedge: Traditional commodities such as gold and silver are seen as a hedge against inflation. As inflation depresses the value of paper currency, tangible assets, particularly precious metals, often retain their value due to rising demand and prices.

- Diversification: In times of stagflation, when standard financial assets such as equities may underperform, investors often try to diversify their assets. Commodities offer a minimally correlated asset class, potentially enhancing portfolio performance.

- Interest Rates: Central banks may be reluctant to raise interest rates in a stagflation environment for fear of further stifling economic growth. Moreover, a weaker dollar could make US currency-denominated goods more affordable to non-dollar buyers, potentially increasing demand and prices.

- Real returns: In a climate where nominal returns on conventional financial assets are being eroded by inflation, tangible assets such as commodities can provide positive real returns. This is especially evident when commodity prices rise due to supply constraints or strong demand.

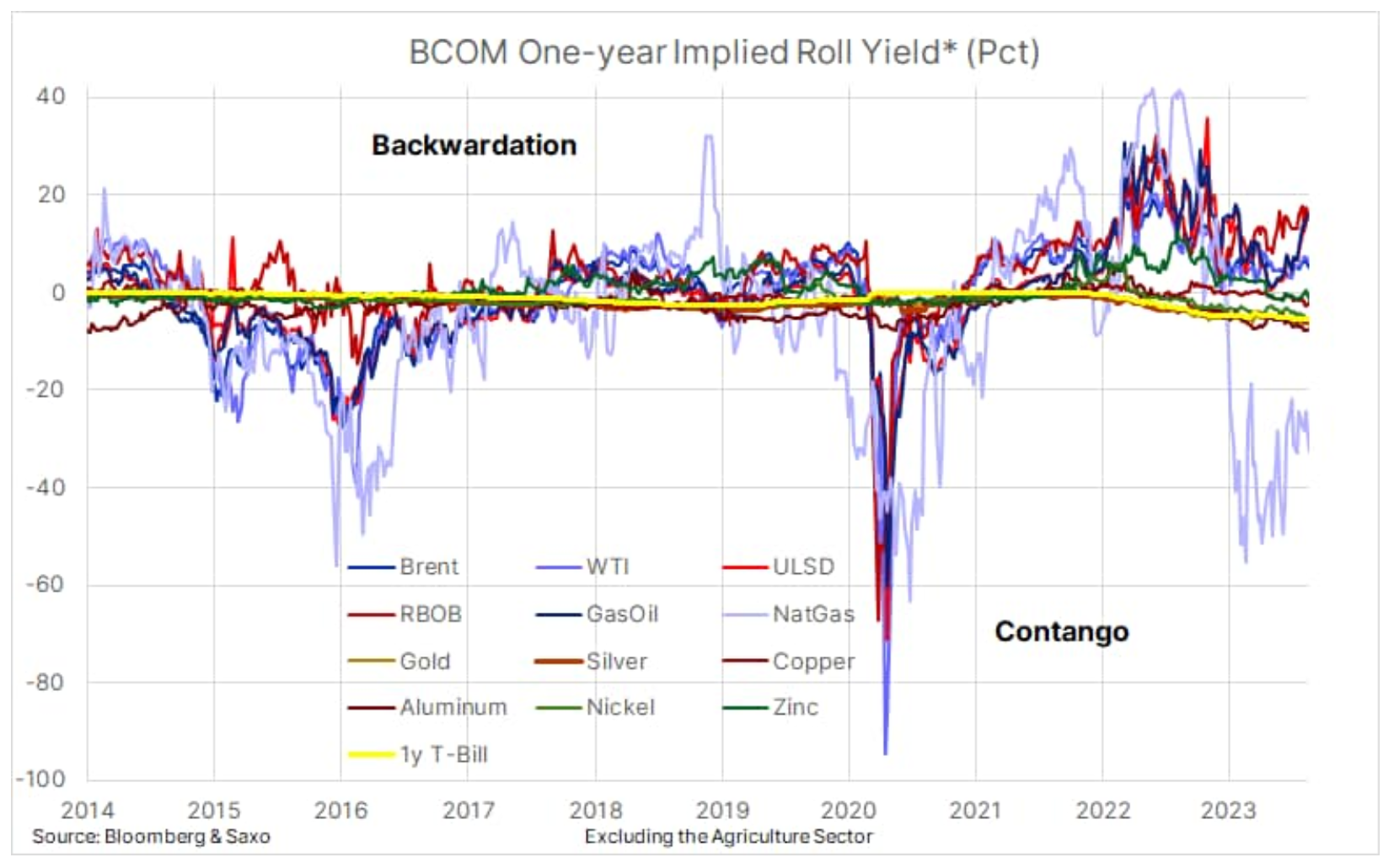

The commodity sector is made up of physical assets, and the price settings of individual commodities depend not only on demand but equally on available supply. Limited supply is often reflected by the shape of the futures price curve, with the immediate delivery price higher than the future price. The tighter the market is, the greater the premium traders and commodity consumers are willing to pay for immediate delivery. A forward curve sloping downwards is called backwardation while its opposite is called contagion.

Backwardation is a well-documented phenomenon in commodity markets. Commodities that exhibit long-term backwardation trends may have tight inventory balances and may experience price increases in response to increased demand, resulting in increased price returns.

A market with plenty of supply under normal conditions always trades contango, as the higher forward price reflects the costs of storage, transportation as well as financing costs. The chart below shows the spread between month 5,3 and month XNUMX for major energy and metals futures. The yellow line represents the reversed annual cost of finance, currently around XNUMX%, and those commodities that are trading above are experiencing some tension. The point is important because it can support prices despite a weakening economic outlook, while providing an additional return for investors.

Certain commodities such as energy, and especially precious metals such as gold and silver, may gain an advantage in a stagflation, while agricultural products may be negatively affected given their dependence on consumer demand, which may weaken in the face of declining incomes and rising costs. The same can be said for industrial metals, but the high costs of financing, employment and environmental protection, as well as the continued demand for metals essential to the green transition, may still add some of them to the group of goods potentially benefiting from stagflation. Therefore, investors who want to invest in commodities during stagflation should, in our opinion, be selective and diversify their portfolio across sectors and regions.

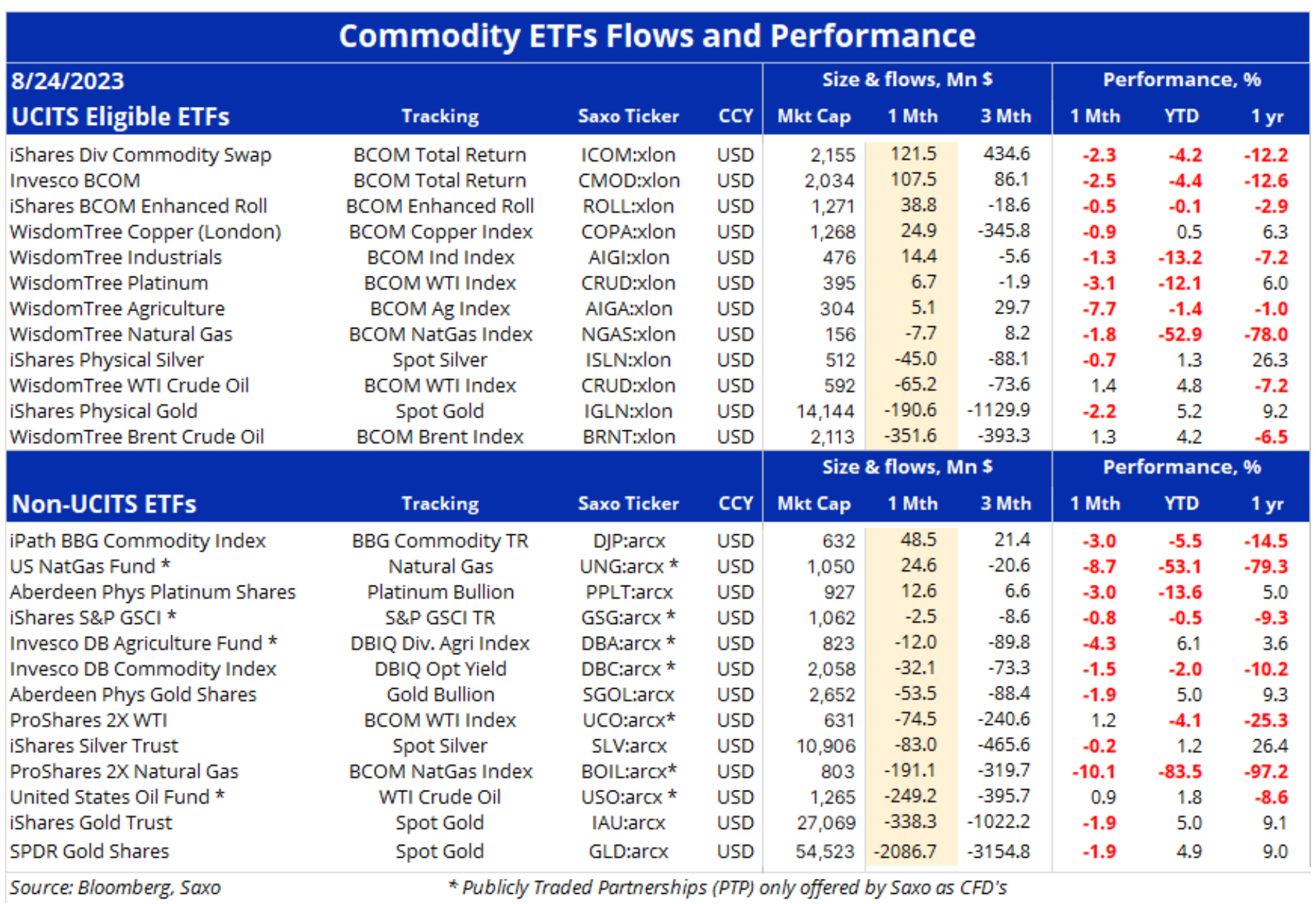

The table above shows some of the world's largest and most actively traded commodity ETFs that track everything from individual commodities and sectors to an entire asset class. There are many ETFs that track commodities, so this list is by no means exhaustive and should be used primarily as a source of information and inspiration.

The first section is ETFs UCITS compliant and based on the EU Directive which provides a regulatory framework for funds managed and domiciled in the EU. The UCITS can be sold and traded by private investors as it adheres to common risk and fund management standards designed to protect investors from inappropriate investments.

The second part of the table mainly shows ETFs listed in the US and therefore incompatible UCITS. This group includes some of the largest ETFs in the world by market capitalization, led by GLD and IAU, two ETFs that track the performance of gold. It is also worth noting that due to the changed taxation rules by the US Internal Revenue Service effective January 1, 2023, Saxo Bank and most non-US banks no longer offer access to PTP cash trading as non-US persons will generally incur an additional 10% withholding tax on gross proceeds from the sale, trade or transfer of US PTP securities.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response