The commodity boom continues - Weekly Commodity Markets Review

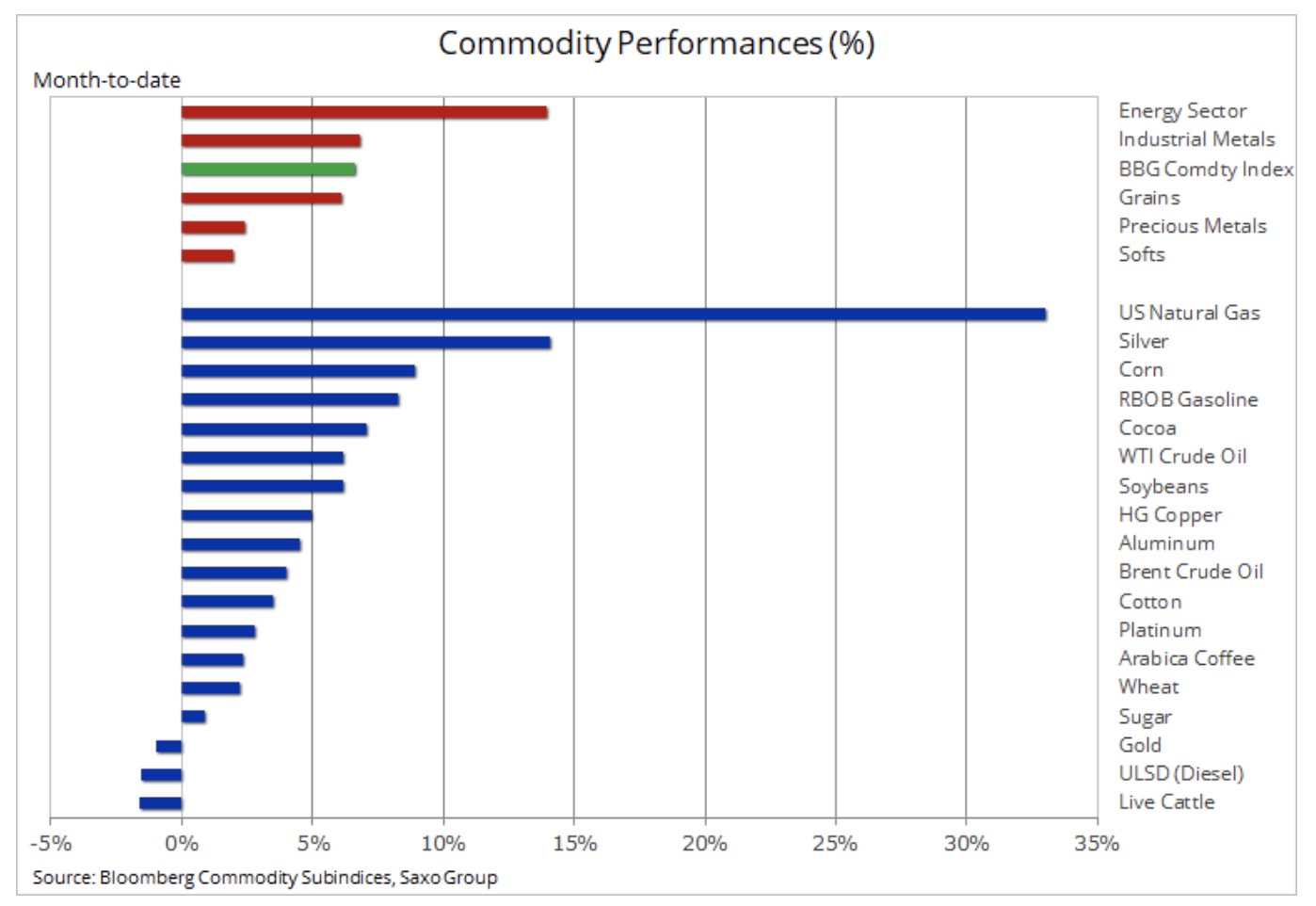

August turned out to be the best month for the Bloomberg commodity index since April 2016. After four consecutive months of gains, the index recovered most of the losses from the February and March pandemics. Drivers of the current boom include an unprecedented amount of central bank stimulus, a definite fall in US and world interest rates, the recent dollar weakness, weather concerns and the demand for inflation hedging investments.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

All major sectors gained on a monthly basis, with natural gas, silver, maize and RBOB gasoline. Gold, which ended July at an almost record level, was one of the few to record a slight loss this month. In the last week of August, the cereals sector, until recently the most sold off by speculative investors, showed solid returns. As a result of unfavorable weather conditions in the US and around the world, yield forecasts have been revised downwards, and the consistent purchases of maize and soybeans by China strengthened the demand side.

Industrial metals also ended the month on a strong note, supported by falling supply in some markets, unprecedented stimulus and zero interest rates in the United States. Added to this is surprising economic data on key consumers such as China and the United States.

Crude oil, and most importantly fuel products, surged just before Hurricane Laura hit the Texas and Louisiana coast last Thursday. However, after the hurricane nearly missed the region's key energy infrastructure, there was an immediate price correction. Given that two more storms are currently approaching from the Atlantic, the long-awaited correction in oil prices is unlikely to be expected.

President Powell revealed the results of a long-term policy review Fed. He stated that the Fed is currently operating under a "flexible and targeting average inflation" regime - which came as no surprise - and the lack of explicit levels or opinions about the willingness to implement the yield curve control policy confirmed that both the Fed's statement and conclusions were as expected and did not contain any new information. Perhaps Powell did not want to confuse the financial markets in which he is already buzzing, especially the Nasdaq technology index, which is breaking new records.

Precious metals

With reference to gold i silver, this comment did not affect our positive forecast. A greater tolerance to inflation as the Fed strives for an average inflation of 2% could keep interest rates low for the next five years. In the short term, the absence of any mention of yield curve control led to an increase in nominal US 1-year bond yields, potentially reducing the attractiveness of precious metals. However, the real profitability and above the break-even point will be of key importance. As long as real yields remain around –XNUMX%, while inflation expectations (break-even points) continue to go up, gold should deal with the potentially more upward yield curve.

In the short term, the greatest risk to gold would be the emergence of an effective and widely available vaccine while adjusting stock prices to liquidate gold positions in order to raise funds quickly.

After finding support at $ 1 / oz two weeks ago, gold still appears to be in the range; the key level to be overcome in order to attract new technical buyers and thus attempt to resume the bull market is $ 900 / oz.

Petroleum

Crude oil continues to trend sideways after another wave of hurricane fears as the market briefly tested the high end of the current range. Both oil and gasoline prices peaked in five years as market attention briefly turned away from the impact of the pandemic on demand in the context of OPEC + output constraints, focusing on production in the Gulf of Mexico. At the end of the week, the sector was able to breathe a sigh of relief as the hurricane by a hair missed key energy assets, in particular the world's largest refinery cluster.

In the near future, one has to take into account several weeks of disruptions in the import and export of crude oil, fuel and natural gas, as well as production and refining activities. These disruptions will be discussed in detail in the Weekly Oil Report (Weekly Petroleum Status Report), published every Wednesday by the US Energy Information Administration (EIA).

WTI oil had difficulty attracting buyers as the stoppage of production in the Gulf of Mexico was more than offset by a fall in demand from refineries and a slowdown in exports. This indicates, and in our opinion even confirms that crude oil may have a problem with continuing the boom, at least in the short term. While demand for fuel in the United States continues to grow, the pandemic is gathering pace in Asia and Europe. While the resumption of entire economies is unlikely to be expected, the impact of the pandemic on fuel demand is clearly felt. At the same time, OPEC + is trying to dispose of more than 2 million barrels a day from countries that have not yet reached their agreed production targets.

A drop below USD 43 / b could increase the risk of liquidating long positions, which would bring the price down to around USD 41 / b or even USD 38,5 / b, which is the July 30 minimum. As we mentioned, the potential threat of two Atlantic hurricanes could reduce the downside risk at this stage. Meanwhile, Brent crude oil has to break out of an ever narrower range, with the lower bound now being a 43,75-day moving average of $ 45,80 / b and the upper two-day moving average of $ XNUMX / b.

How to invest in raw materials?

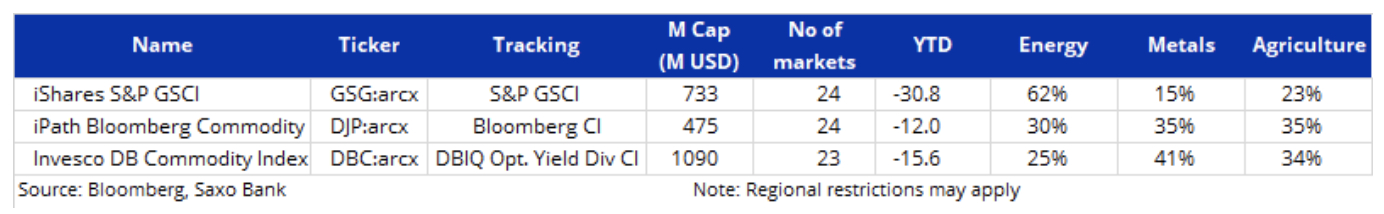

Investments can be made with publicly traded funds (ETFs). There are many possibilities here, and if the goal is to gain broad exposure to raw materials for the reasons mentioned above, we have a number of different funds at our disposal. However, you should first familiarize yourself with the types of exposures these funds offer per commodity and sector.

WHAT ARE ETFs

The three most important funds that provide broad exposure to raw materials and sectors are outlined below. With this year's good streak for metals and a decline in energy commodity prices, the two ETFs with the lowest energy exposure and the highest exposure to metals recorded relatively the best results. However, it should be remembered that the selection of the optimal fund may be conditioned by local constraints.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response