EUR/USD continues to fall: direction $1,05

EUR / USD exchange rate fell to 1,0621, having lost more than four pieces since the beginning of the month and it is the lowest since January 6. This is not the end of the decline. The ongoing correction could bring it down to around $1,05.

Valuation of the dollar and interest rates

Financial markets are becoming more and more familiar with the idea that the American one Fed will raise interest rates at least three times to 3-5,25 percent. 5,50 basis points each time. This is a big change, because not so long ago, at some point, the markets started to price in just one hike and the end of the monetary policy tightening cycle in the US in March. Now it is supposed to be May, and there are already those who see interest rates at 25 percent.

The prospect of extending the hike cycle, and thus also postponing the first rate cuts, supports the dollar against the main currencies. Including the single currency.

Eurodollar situation

EUR/USD, which was at 1,1033 in early February, has now fallen to $1,0621. The drop doesn't seem like much considering interest rate expectations have changed so much in such a short time. This is due to two reasons. Firstly, despite the growing expectations of higher interest rates, the risk of occurrence is decreasing recession. Secondly, at the same time, expectations for larger interest rate hikes are growing ECB.

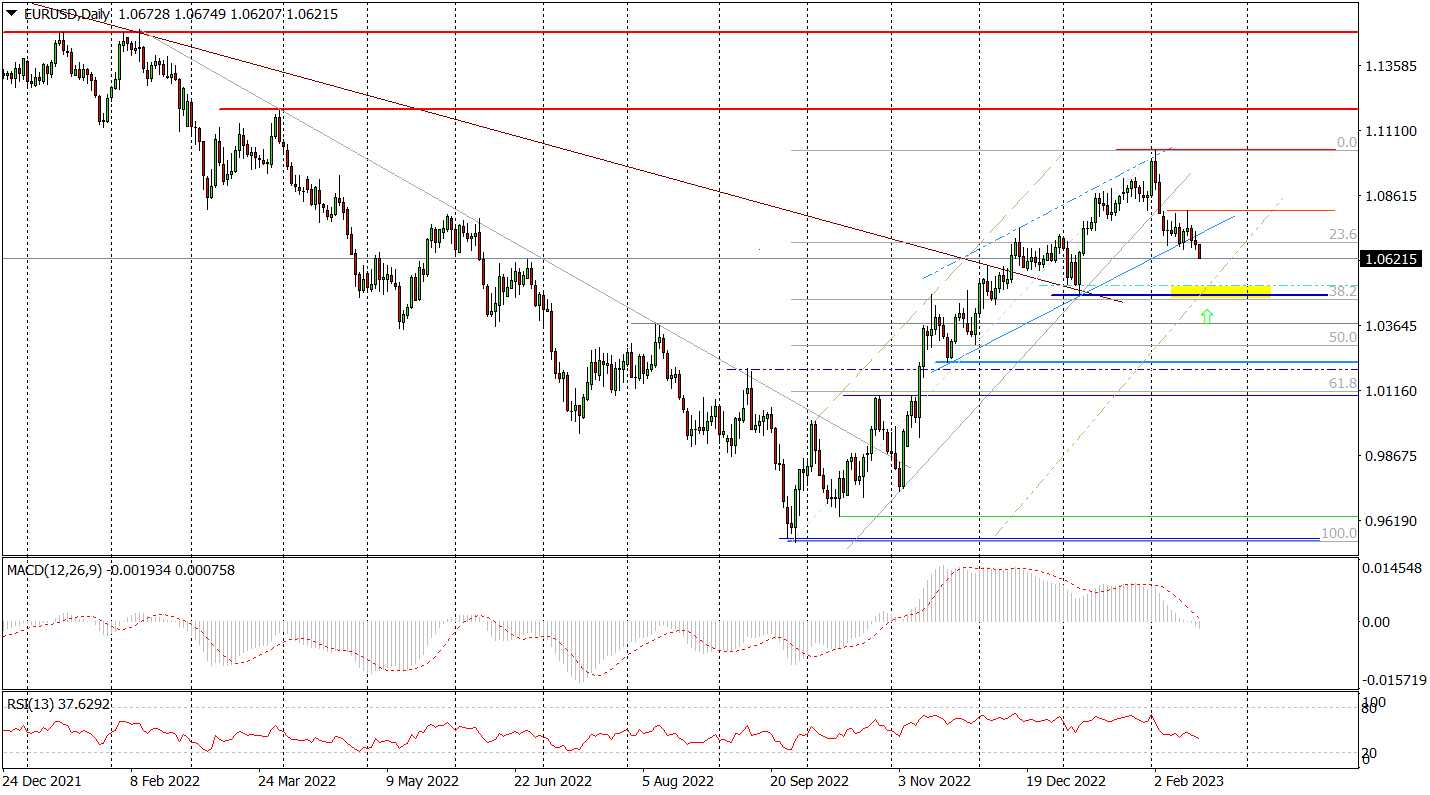

The current situation on the EUR/USD chart suggests further declines. The nearest significant support is the wide zone 1,0460-1,0520, which is formed, among others, by 38,2 percent Fibo abolition of October-January increases and local January low. At the moment, there is nothing to suggest that the supply side will be able to push through it. And this implies that the declines that have been going on since the beginning of February are just a correction of earlier strong increases, which pushed the Eurodollar from 0,9535 in October to the aforementioned level of 1,1033 at the beginning of February.

Daily chart EUR / USD. Source: Tickmill

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)