Coronavirus economics: the legitimacy of issuing crowns

The European debt crisis of 2012 led to the creation of the banking union. The 2020 coronavirus crisis may induce the EU to take more far-reaching action and issue Eurobonds, the so-called "Corona bonds" to spread the risk across all Member States. In 2012, several European countries already offered to issue Eurobonds to weather the crisis and limit the appreciation of South European bond spreads. At that time, however, the concept was strongly rejected by Germany. At present, this appears to be an unavoidable policy option allowing Member States to finance healthcare expenditure and economic rescue programs. In recent days, Spain and Italy have called for the issue of "corona bonds", and the European Commission, together with Germany and the Netherlands, have allowed such a possibility provided that it is properly structured. Yesterday, Villeroy from the ECB also expressed support for the joint EU issuance through the structure of the European Stability Mechanism.

Economic prerequisites

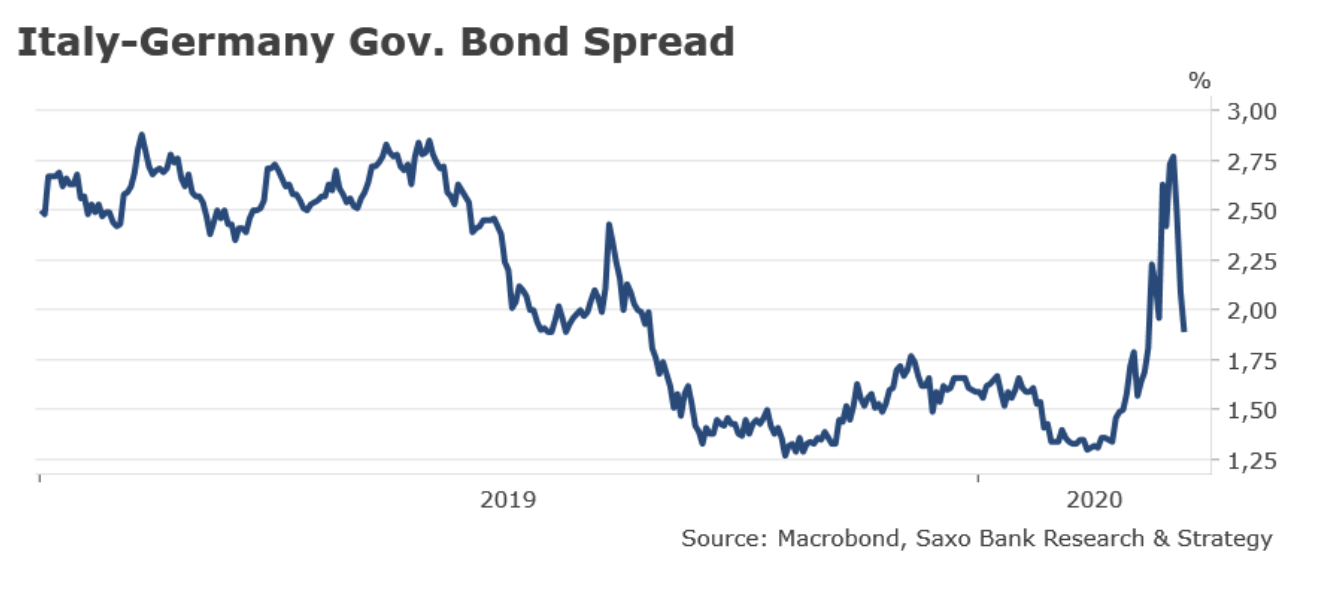

This concept assumes enabling Member States to borrow on reasonable terms even in an emergency. For countries that are able to take out loans with negative real interest rates - such as France or Germany - this is nothing new. However, for Italy or some other Southern European countries navigating the bond market during the crisis can be a greater challenge. As you can see in the chart at the bottom of the page, the difference in yields on Italian and German 19-year government bonds from the outbreak of the COVID-XNUMX pandemic has almost doubled. There are basically two ways to deal with current market voltages.

The first is based on buying assets through EBC. This year's strong increase in Germany's newly issued debt of around EUR 350 billion to some extent solves the lack of quantitative easing, but without moving away from the capital key - and this option is not currently considered - this would mean that the ECB will have to buy even more German debt securities, than I need to buy additional Italian or Spanish bonds. This is certainly not the most effective way to channel funds to countries in need.

The second way involves some form of debt mutualisation. It may consist in the issue of joint eurozone bonds or "crowns", and the appropriate distribution of new funds thus obtained at a low interest rate. An increasing number of Member States support this option.

Preconditions

A condition for broad political support, in particular Germany and the Netherlands, is the appropriate structure of joint EU emissions and the avoidance of moral hazard. We have defined at least three prerequisites:

- Administration via the European Stability Mechanism: Issue of bonds is primarily a market operation and should be carried out and managed through EMS and highly qualified EMS staff.

- Temporary emergency tool: the fund would issue joint bonds only this year or issue them throughout the entire coronavirus crisis.

- selectivity: only countries with high interest rates on loans would have access to loans from the fund.

Many questions remain unanswered, for example, whether countries in need could have unlimited access to new funds, whether the capital key rule would apply and what would be the fees for EMS.

Next steps

We can hear the announcement of this solution this week. The Eurogroup will hold a video conference on March 24 and may then discuss technical aspects of the "crown". This concept can only be approved by EU leaders, which is why the videoconference summit scheduled for March 26 may be crucial.

There is no going back

Previous crises have taught us that when the current rules are broken, there is no going back. COVID-19 is a tragedy in both the human and economic dimensions, but a wider picture of the situation and positive changes that can be the result of this difficult period should be seen. Finally, Europe is showing solidarity with countries in need and is moving away from budget orthodoxy (in particular Germany) and the inefficient 3% deficit rule. After dealing with the crisis, it will be important to start a comprehensive EU-level debate on the level of public debt and ensure that additional debt incurred solely to fight the coronavirus does not burden national accounts. The issue of special Eurobonds for financing infrastructure investments or climate change solutions will also need to be considered.

Christopher Dembik, director of macroeconomic analysis in Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-300x200.jpg?v=1709556924)